10 stock market crashes from history, explained

This story originally appeared on Stacker and was produced and distributed in partnership with Stacker Studio.

10 stock market crashes from history, explained

Beginning with the start of the 20th century and through to the coronavirus, here are 10 stock market crashes that shook investors, economies, and sometimes the world. To better understand them, Diversyfund compiled a list of 10 stock market crashes throughout history, analyzed their causes and effects, using information from economic news reports and research.

The best known might still be the 1929 stock market crash, which preceded the Great Depression of the 1930s. The Dow Jones Industrial Average did not fully recover for 25 years.

Exactly what leads to a crash is sometimes disputed. After the United States housing bubble burst in 2008, for example, The New York Times columnist Paul Krugman and former Federal Reserve Chairman Ben Bernanke disagreed over why the Great Recession became so serious. Then President Barack Obama and Arizona Sen. John McCain gave competing versions of its causes, with the president pointing to the deregulation of the financial system, and his Republican presidential challenger citing lending by Fannie Mae and Freddie Mac.

Crashes can result in regulatory changes, which occurred when the Panic of 1907 led to the creation of the U.S. Federal Reserve System, or demonstrate the full effects of something like globalization, as the 1987 Black Monday Crash did.

To learn more, read on about these 10 stock market crashes and the stories behind each of them.

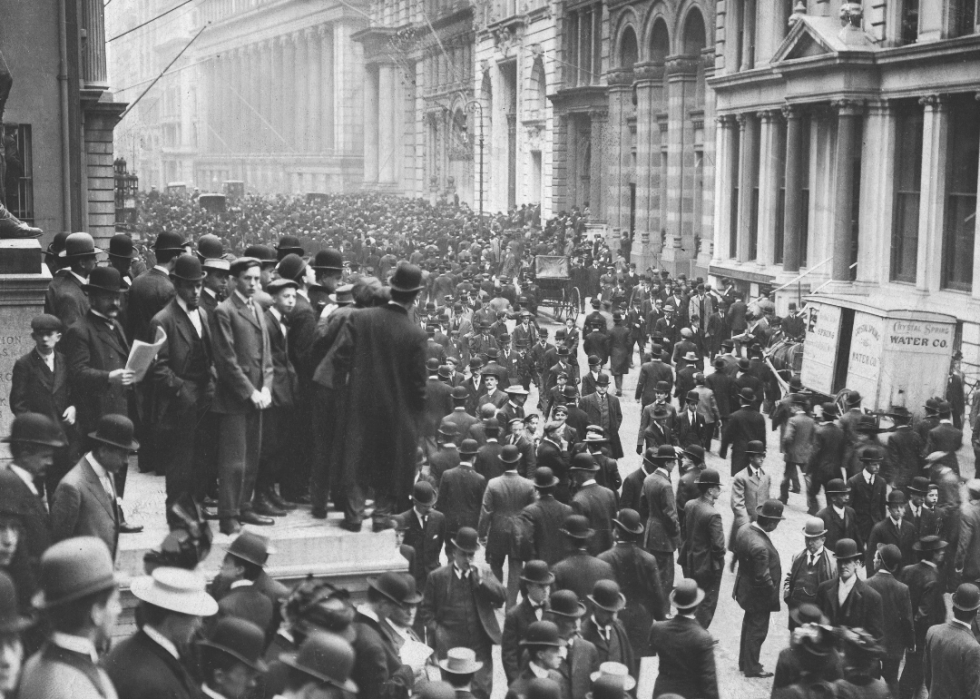

1907: Panic of 1907

The first 20th century financial crisis to extend across the world, the Panic of 1907, prompted the creation of the U.S. Federal Reserve System. The crisis began in New York City trust companies, which competed with banks, but were outside the control of the New York Clearing House. Two speculators, F. Augustus Heinze and Charles W. Morse, failed to corner the stock of United Copper, a copper mining company, and sparked the panic. A run on banks associated with the men was calmed by the clearing house, but not one on the trust companies. Eventually the legendary banker J.P. Morgan and others rescued the banks and the stock market.

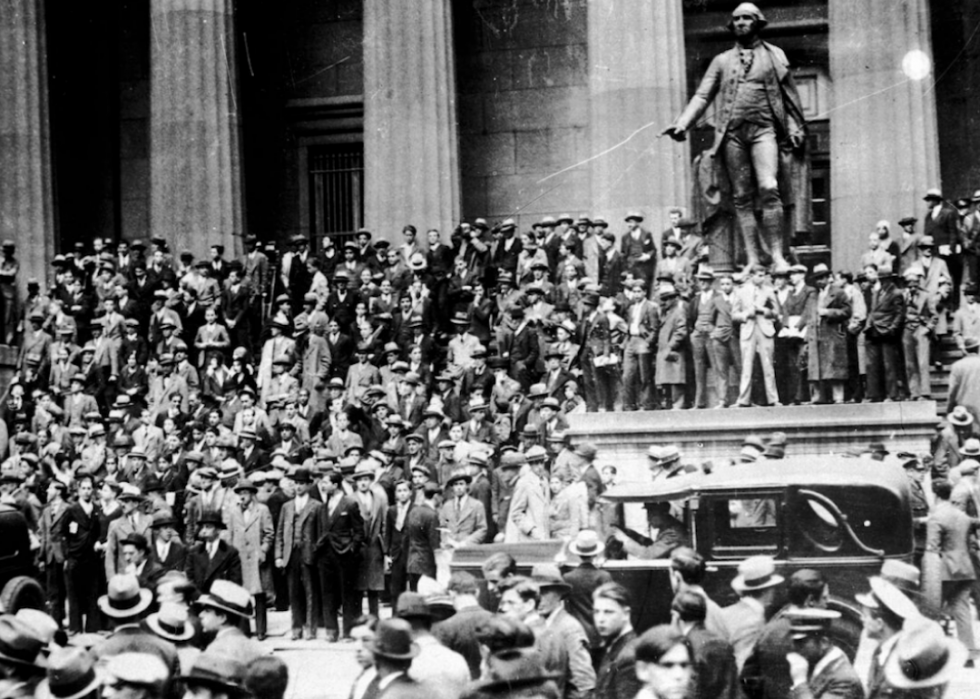

1929: Stock market crash

In the five years before what is probably the best-known crash, the Dow Jones Industrial Average grew six times in value, from 63 to 381. Then on Black Monday, Oct. 28, 1929, it plummeted by nearly 13% and kept falling—down 12% the next day, Black Tuesday, and on through the summer of 1932. It did not regain its value before the crash until November of 1954. The boom had been spurred by everyday people buying stock with borrowed money, and the stocks serving as collateral for the loans. The crash was followed by the Great Depression of the 1930s.

1987: Black Monday crash

Another Black Monday took place on Monday, Oct. 19, 1987, when the Dow Jones Industrial Average plummeted 22.6%. The fall came after the federal government announced a larger than expected trade deficit. The largest since the Great Depression, the drop had been preceded by an increase of 44% in the value of the Dow Jones in the first half of the year. The sudden drop set stock exchanges across the globe tumbling, showing how connected modern economies had become through globalization. Afterward, regulators pointed to an increase in international investors and the use of options and derivatives among the reasons for the crash.

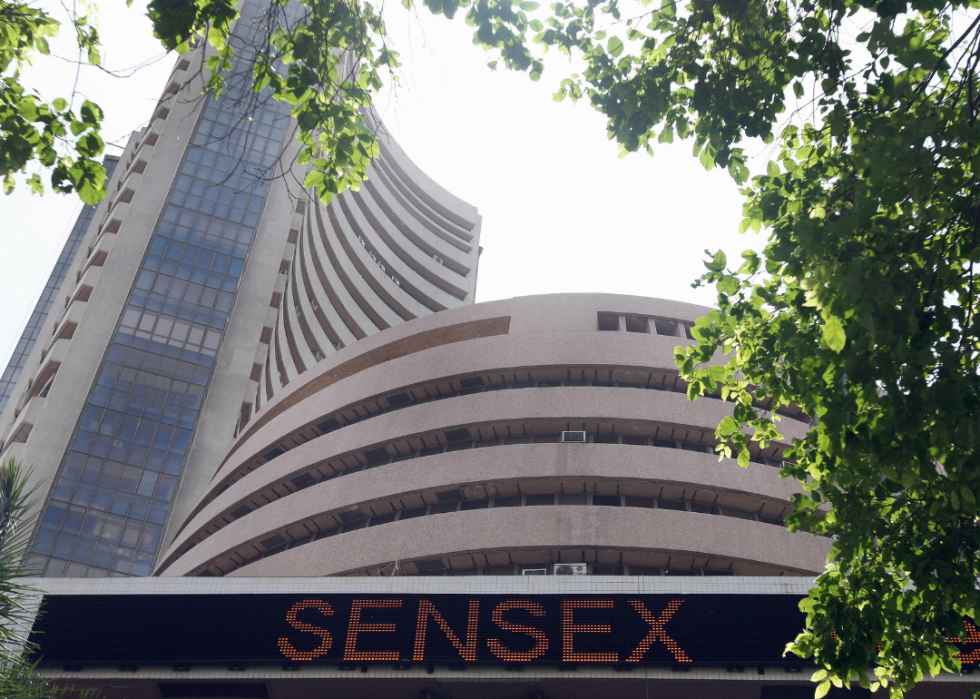

1992: Stock market scam

India’s $1.3 billion securities scam left the State Bank of India and other banks short millions of dollars and in some cases insolvent after making unsecured loans to speculators investing in stocks and bonds. Small investors were devastated. Harshad Mehta, one of the country’s best-known brokers who manipulated prices to stoke a market boom, was arrested and accused of fraud, charges he denied. The stock market had more than doubled in the previous year, but it fell when it was revealed the banks were holding promissory notes that had no value. The crash came as the country was moving toward a free market economy and forced the resignation of the minister of commerce.

1997: Asian financial crash

The financial crisis that swept Asia began in Thailand on July 2, 1997: After exhausting its foreign currency reserves, Thailand devalued its currency relative to the U.S. dollar. The financial problems spread to equities and real estate. Currencies in Malaysia, the Philippines, and Indonesia also weakened; South Korea came close to default; and some countries found themselves in recessions. Economists at the Federal Reserve Bank of New York argued that although the countries had shown strong growth before the crisis, their financial institutions had made poor loans, and their domestic economies and real estate markets were overheated. Others pointed to the problems of crony capitalism. Governments and institutions such as the International Monetary Fund, the World Bank, and the Asian Development Bank provided financial support, but they also required reforms.

2000: Dot-com bubble burst

The so-called “dot-com” bubble burst on March 10, 2000, when a period of enthusiastic investment in technology stocks came to an end. With the internet taking off at the time, investors were lured by marketing and rapid growth of startups but had an unrealistic time frame for online companies to succeed. Some of the companies had no business plans or earnings at all. The Nasdaq composite rose more than 500% between 1995 and March 2000, then it fell to a low in October 2002. Amazon survived the bubble burst and two decades later, in the first quarter of 2021, reported $8.1 billion in profit, up 220% from the previous year. Driving sales was the coronavirus pandemic.

2008: Stock market and housing crash

At the core of the Great Recession a housing crash hit the United States, spurred by lax lending practices to those with little ability to repay. Even those with no money for a down payment, low credit scores, or unreliable income were able to borrow money, often with little documentation. The expanded mortgage market drew $1 trillion in new funds, driving down borrowing costs. A decade ago, home buyers were easily able to get interest-only loans and other risky mortgages pushed by banks. Most home buyers in 2021 face a tightened mortgage market, must provide documentation, make down payments, and have high credit scores.

2010: Flash crash

The Dow Jones Industrial Average lost 9% of its value—nearly 1,000 points—on May 6, 2010. It was already down 4% in the afternoon when it toppled another 5% to 6% in minutes, then rebounded as quickly. It was the fastest fall ever seen, but by the end of the day, was down only 3%. U.S. regulators blamed computerized trading and a $4.1 billion sell order by the investment firm Waddell & Reed. One lesson learned, from the Securities and Exchange Commission: “Under stressed market conditions, the automated execution of a large sell order can trigger extreme price movements.” Later a futures trader, who was accused of helping to trigger the crash from his parents home in London by manipulating prices, was spared prison time because of autism.

2015-2016: China’s stock market crash

Chinese stocks tumbled during the summer of 2015, scaring investors who had borrowed to buy stocks as their prices soared and the Chinese government promoted new companies. The volatility dragged down PetroChina, the state-owned oil producer, and government-backed investment houses before stabilizing. Then, in January 2016, stocks fell again, with the Shanghai and Shenzhen stock markets crashing on Jan. 4, the first day of trading, and on Jan. 7. At the time, a new circuit breaker kicked in that was designed to halt falls. The U.S.-China Economic and Security Review Commission, which was created by Congress, noted the stock markets remained a small part of the economy but criticized the Chinese government for immediately intervening.

2020: The coronavirus crash

As the coronavirus pandemic began to shut down the U.S. in March 2020, the markets crashed. On March 16, 2020, the Dow Jones Industrial Average, the S&P 500 and the Nasdaq composite fell between 12% and 13%. The S&P 500 ultimately dropped 34% between Feb. 19 and March 23. But the markets recovered quickly, and by August, the S&P 500 had returned to its highs. The pandemic’s effects on other aspects of the U.S. economy have been longer lasting: As companies shuttered, workers lost their jobs and others began working from home.

This story was produced and distributed in partnership with Stacker Studio.