5 tips to build a budget, according to industry pros

This story originally appeared on TD Bank Group and was produced and distributed in partnership with Stacker Studio.

5 tips to build a budget, according to industry pros

Regardless of your life stage, learning to build an effective budget is an essential skill. When planning your financial journey, budgets can help you stay on track with your financial goals by helping you navigate your spending habits.

Read these tips to help you create a plan for your financial goals. Of course, drawing up a budget and following through with it is often easier said than done. It requires a great deal of control and self-discipline. Buying on impulse—or according to your mood—can drive you to buy something you don't necessarily need.

Including an amount for possible unexpected expenses in your budget is also important. Half of Canadians say they couldn't cover an unexpected $1,000 expense, according to a 2022 survey by the Angus Reid Institute. A 2019 report by the Financial Consumer Agency of Canada found that only 49% of Canadians have a budget.

Continue reading for five tips to help you with building a budget.

Start with a motivating goal in mind

Drawing up a budget can be difficult; it requires self-discipline and, most importantly, a "why." Clearly defining your goal and setting objectives for the year, quarter, and month can help you stay on track with your budget.

Identifying your core goals and differentiating them from high to low priority is important. By establishing your motivation for each of your goals, you will be better able to adjust your budget as your current life situation may change. Knowing the "why" behind your goals can help you make your budget stick.

Compile your monthly income and expenses—and watch out for one-off costs

The next step in making an effective budget is outlining what you're budgeting with and for. Start by listing your income and your expenses. Also, be aware that there are slightly more than four weeks in a month. On average, there are approximately 4.3 weeks in a month. You can calculate a more accurate reflection of your monthly income (or expenses) by multiplying your monthly income (or expenses) by 12, then dividing the result by 52 (the number of weeks in a year).

Once you've calculated your monthly income, the next step is to know where it goes. To calculate your expenses, it is a good practice to list your monthly costs and categorize them into "fixed" and "variable" expenses. As the name implies, "fixed" costs are predictable expenses you spend consistently, while "variable" can change monthly.

Consider the 50-20-30 framework

To use the 50-30-20 framework, first create three spending categories: your needs (mandatory expenses), your wants, and your debt and savings payments. Then allocate a percentage of your monthly income (after tax) to each of these three categories as follows: 50% of your monthly income should be applied towards your needs like rent, utilities and health care; 30% should go towards your wants like eating out, shopping and saving for a holiday; and 20% should go towards your savings or towards paying down any debt you may have.

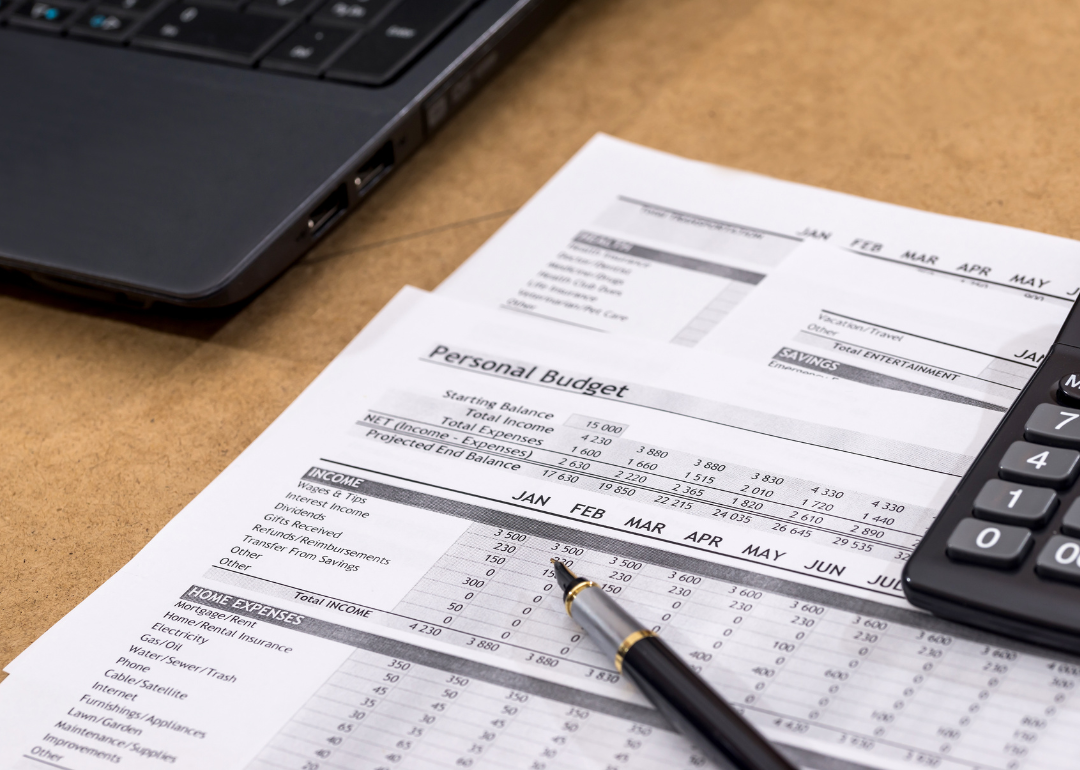

Create a system for easily assessing your financial standing—and consider who you share the information with for accountability

A budget is only helpful if you implement it. You need to easily track your spending to adjust and monitor your progress in executing your budget. The traditional way to keep tabs on your spending is to put everything down with pen and paper. Alternatively, there are many mobile apps available that can help you track your spending.

In cases where more than one person is affected by a budget, it is a good idea to get everyone on board, so they log their spending and help keep budgets accurate.

Revisit your goals and financial assumptions regularly

A budget is a tool for financial planning; however, you can't always predict what might happen, and you need to be prepared for the unexpected.

It's a good practice to revisit your financial plan whenever you make a major financial decision and at least once a year to account for changes that may have occurred. For example, after purchasing a big-ticket item like a car, you may need to revise your budget to accommodate the cost of such purchase.