Average consumer debt jumped 7% in 2022—historic growth as pandemic wanes

Average consumer debt jumped 7% in 2022—historic growth as pandemic wanes

More than $1 trillion was added to the overall debt carried by consumers in 2022—an extraordinary increase not seen in over a decade. The 7% increase was fueled by elevated levels of inflation, sharp increases in consumer demand and near-full employment levels that kept already cash-flush consumers spending.

In the background, and almost certain to inform consumer borrowing behavior in 2023, is the ratcheting up of interest rates by the Federal Reserve. In its wake is a shakeup of home prices and mortgage affordability; ever-increasing interest rates on variable-rate credit cards, which now average close to 20%; and a marked increase in personal loan activity.

As part of our ongoing review of consumer debt and credit in the U.S., Experian examined representative and anonymized credit data from the third quarter (Q3) of 2019 through Q3 2022 to identify trends within balance and delinquency data for household credit categories.

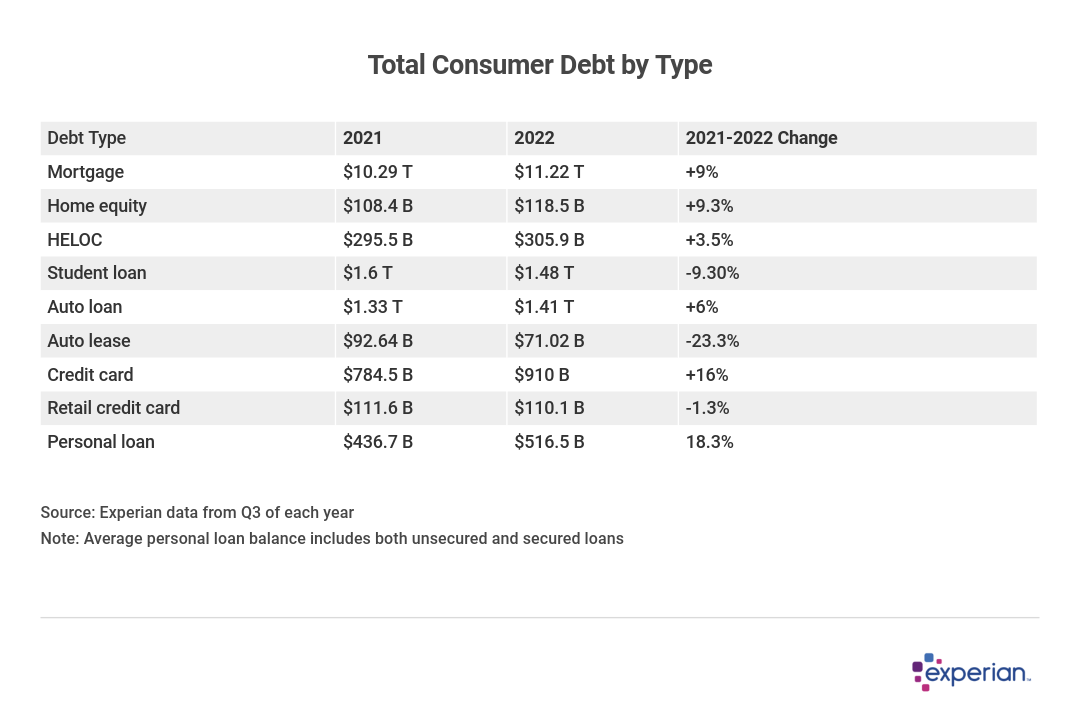

The total consumer debt balance increased to $16.38 trillion in 2022, up from $15.31 trillion in 2021. The 7% increase from 2021 to 2022 was larger than the 5.4% increase in the same period from 2020 to 2021.

All 50 states and Washington, D.C., experienced increases in average debt balances in 2022. The larger increases were in the Western states, with Idaho and Utah leading the nation. Oklahoma and Connecticut had the two smallest increases in average debt last year.

Total Consumer Debt:

- 2019: $14.14 T

- 2020: $14.53 T

- 2021: $15.31 T

- 2022: $16.38 T

- 2021-2022 Change: +7%

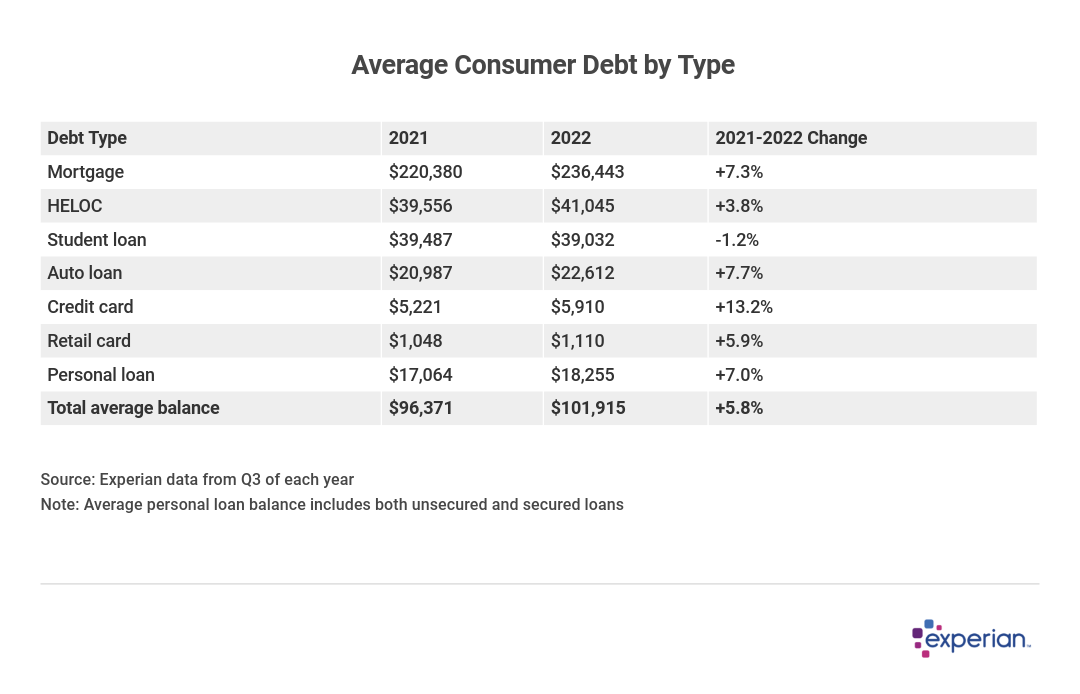

Consumer demand for most types of loans increased more than usual in 2022

- The largest percentage increases were for personal loans, where total balances grew by 18.3%, and credit card balances, which grew by 16%.

- Balances of home-based loan types—mortgages, home equity loans and home equity lines of credit—all grew as mortgage interest rates increased.

- Retail credit card balances declined, as consumer financing for department stores became increasingly supplemented, if not supplanted, with buy now, pay later financing.

- In the auto financing space, consumer demand for new auto loans was abundant, as dealers sold cars as soon as they arrived on dealers' lots for much of 2022. Most cars sold for more than their manufacturer's sticker price, and auto loan balances grew by 6%. Conversely, the relatively smaller auto lease market actually fell by 23%, as inventory was diverted from the lease market to the auto loan market.

- Finally, student loan balances declined in 2022, as eligible borrowers await the Supreme Court's decision on the Biden Administration's student debt forgiveness plan, which would cancel more than $400 billion in outstanding loans. Meanwhile, student loan payments—and the accrual of interest—have been on hold since March 2020. Additionally, loan balances were canceled for thousands of borrowers through the Public Service Loan Forgiveness program. Overall, student loan balances fell by 9.3% in 2022.

Each of these types of debt illustrates a similar picture: Inflation, which grew at a pace not seen in 40 years, played a role in increasing nominal average balances of all types of debt, more than it had in the previously low-inflation environment of the 21st century. Average credit card balances increased the most, driven by increased demand for goods and services as economic activity resumed as pandemic restrictions and supply chain disruptions eased.

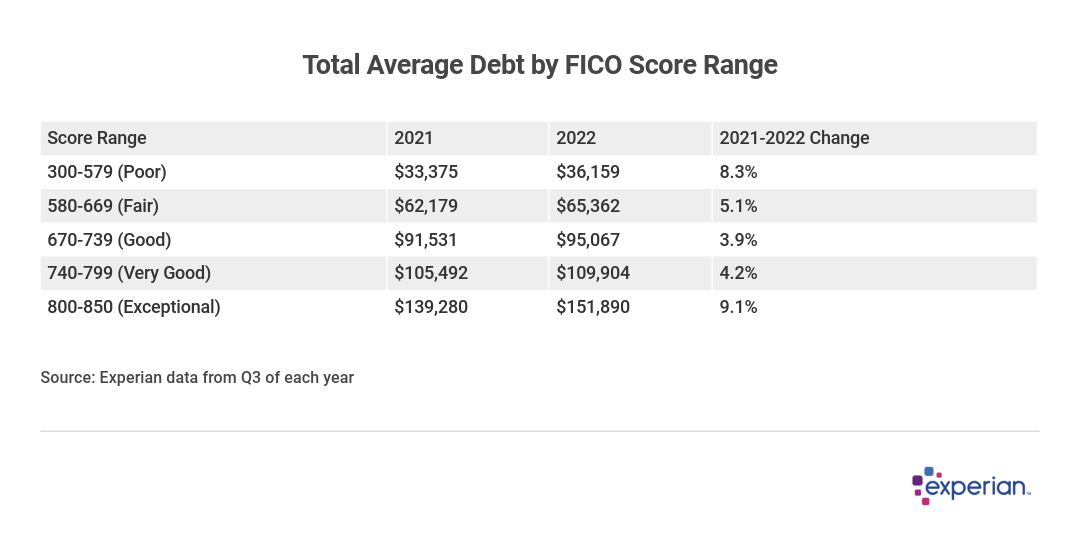

Average overall debt increases, no matter the credit score

Balances grew for all borrowers, no matter their risk to lenders. Typically, those with very good or exceptional FICO Scores are able to finance more than those with lower scores. Nonetheless, average balances grew the most in percentage terms among those with the highest credit scores and lowest credit scores. Even those with good scores—comprising more than 35% of all U.S. consumers—saw overall average debt increase by 3.9% to $95,067 last year.

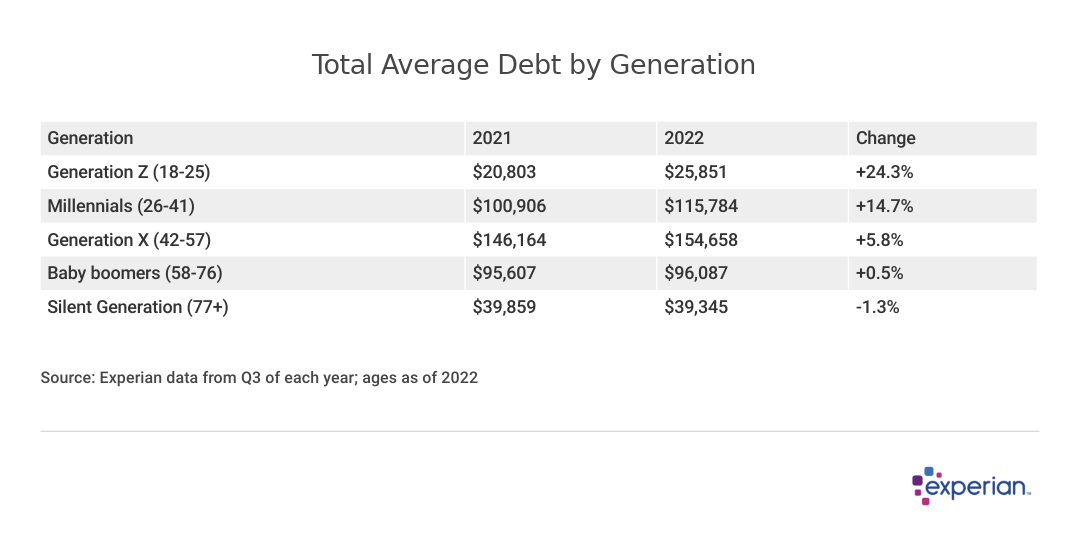

Debt trends follow similar pattern across generations

Average overall debt increased among all except the oldest of U.S. consumers in 2022. Through a generational lens, 2022 echoed 2021: Debt balances held by older generations have largely leveled off, while younger generations continued to amass debt at double-digit annual rates.

Generation Z experienced a nearly 25% jump in average debt balance, which is in line with the additions of new debt the generation is broadly taking on. While this increase may seem striking, it's largely a result of milestone responsibilities such as first-ever car payments, student loans or, in some cases, mortgages. And while Gen Z takes on new debts, older generations are going through the inverse pattern of shedding debt as they pay off financial obligations they took on when they were younger.

Mortgage debt increases alongside higher mortgage rates

The U.S. continues to face a housing shortage, and rising interest rates designed to tamp down inflation are also dumping cold water on new home purchases. That's especially the case for those financed by conventional 30-year mortgages, which saw rates increase from about 3% at the beginning of 2022 to more than 6% by autumn.

One standout is the 13% jump in mortgage balances held by Generation Z, which may appear startling. But keep in mind that currently this generation represents less than 1% of all mortgage borrowers. As they get older and increase their incomes, their share is certain to increase.

Auto loan debt begins to stabilize

The big seller's market in 2021 was the automotive sector, and prices for both new used vehicles continued to increase in 2022. However, a combination of increasing car lot inventory and consumer sticker shock meant that loan balances didn't increase as sharply in 2022 as in 2021.

Younger generations, often purchasing their first car, have higher average auto loan balances. Older consumers, perhaps waiting a bit until their next auto purchase, saw less of an increase compared with 2021, and balances for Generation X borrowers actually fell slightly last year.

Student loan debt decreases as borrowers await court ruling

Federal student loan repayments and interest remained paused throughout 2022 and are still suspended, so most federally backed student loan debts aren't growing. (The pause is still in effect, as borrowers await a court decision challenging the legality of a student loan forgiveness plan announced in August 2022.)

Credit card debt increases more sharply among younger consumers

Generation Z—the oldest of whom turned 25 in 2022—saw their credit card balances increase by 25.1% last year, although they still have the lowest average balances. Millennial card debt grew nearly as much at 23.4%, but the average balance of $5,649 among millennials is nearly twice that of Generation Z. All other generations have higher balances than they did a year ago, as well, though their growth wasn't as sharp.

Personal loan debt increases sharply as consumers consolidate revolving credit card debt

Loan balances grew among all consumers, but grew the most for the younger generations. Even the Silent Generation, the oldest of U.S. consumers, saw their usually static average personal loan balances increase by 5.1% in 2022, though their overall debt is lower than it was in 2021. Most often, personal loans are used for debt consolidation, and new loan activity has increased following interest rate hikes that have increased the cost to carry a balance on variable-rate credit cards.

Factors attributable to increases in debt

Debt levels have increased more than in previous years, and although the reasons are many, most fall into one of three broad categories.

- Inflation: Perhaps the most obvious explanation, the 8% increase in consumer prices from September 2021 through September 2022 broadly fed all types of debt balances, from simple grocery store credit card swipes to new mortgages for homes with much higher price tags.

- Interest rates: The Federal Reserve, in its efforts to calm inflation, embarked on an interest rate increase campaign throughout 2022, raising the key fed funds rate from a rock-bottom 0.25% to more than 4% by September. While not all types of borrowing are impacted by Fed rate hikes the same way, credit cards tend to bear the most immediate and drastic impact.

- Consumer demand: The U.S. and the world largely reopened in 2022 after more than a year in economic "hibernation" due to the global pandemic. Broadly, more consumers started buying up goods and services they were deprived of in 2020 and 2021. Moreover, bank account balances remained relatively flush, thanks to government stimulus payments many consumers socked away, and unemployment remained low, which kept household incomes stable if not rising for much of the year.

Each of these factors is expected to cool in 2023. Inflation appears to be slowing into the new year, and consumers are beginning to show they're in fact sensitive to price increases and are purchasing less than in 2022. And Fed watchers are expecting rate increases to end by spring 2023. Assuming a mitigation of each of these three factors, debt levels aren't likely to increase as much in 2023.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.