Can't get approved for a loan? Rejections are spiking as interest rates rise

This story originally appeared on altLINE and was produced and distributed in partnership with Stacker Studio.

Can't get approved for a loan? Rejections are spiking as interest rates rise

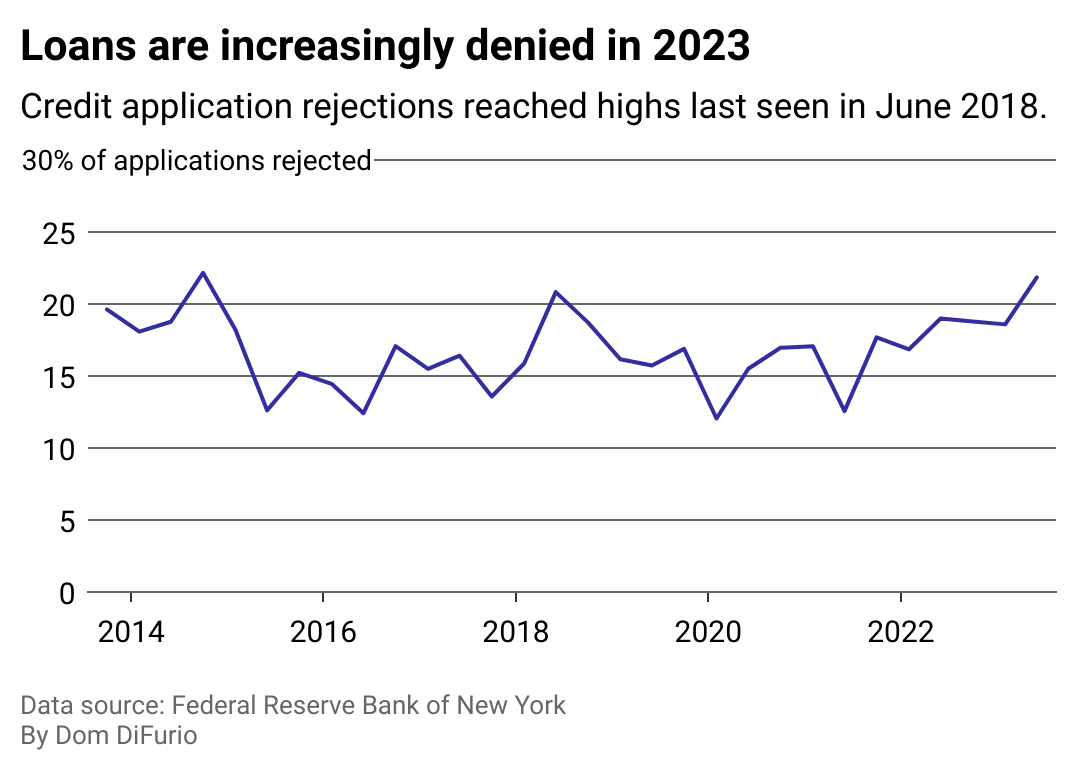

Americans are being rejected for loans at rates unseen in at least five years.

The difficulty getting approval is hitting applicants across the board—including those in the market for homes, mortgage refinancing, vehicles, credit cards, and credit card limit increases.

altLINE analyzed data from the Federal Reserve Bank of New York's Credit Access Survey to illustrate how Americans interact with lenders as benchmark interest rates rise.

Lenders reject loan applicants for a number of reasons, many of which are related to the interest rate environment in which banks are lending. After the Federal Reserve has raised benchmark interest rates 11 times since early 2022, borrowing any amount of money is more expensive now than in recent years.

Lenders may also reject loan applications from people with low credit scores, more debt than their income can support, insufficient income, and unsteady employment

Rejections for all types of loans are up

Interest rates for the most common loan for financing a home purchase, the 30-year fixed-rate mortgage, are climbing toward 23-year highs. Interest rates on new vehicle loans are pushing monthly payments to record levels. Credit cards are carrying the highest interest rates ever recorded.

On top of higher interest rates, banks responded to the collapse of Silicon Valley Bank in the spring by further restricting to whom they loaned money. And, unfortunately for already debt-strapped consumers, interest rates are expected to stay high—at current rates, or even higher—at least until 2024.

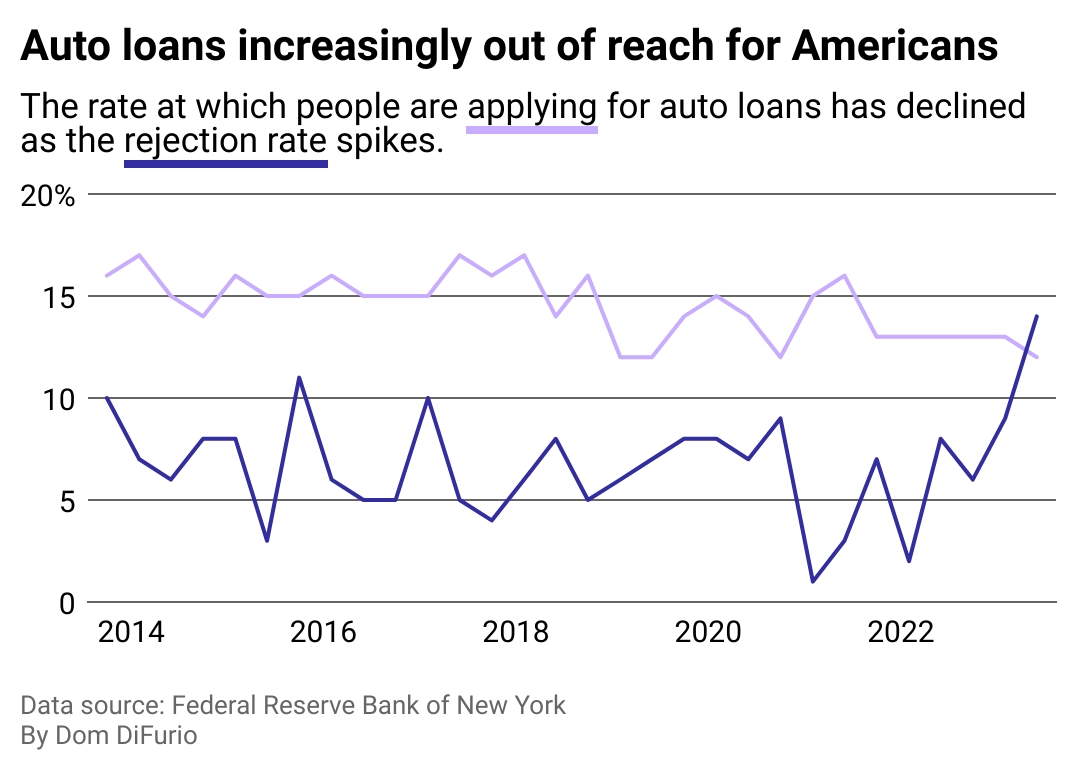

Vehicle financing denied at the highest rate in recorded history

Buyers use a loan to finance most new vehicles sold in the U.S. According to the latest Experian report, the number of Americans taking out loans for new vehicles declined nearly 4 percentage points in the second quarter of this year compared to the same period in 2022.

That's as average monthly payments have ballooned 25% between the second quarter of 2021, when inflation really began to heat up the car market, through the same period in 2023. For loans issued to buy new vehicles between April and June 2023, the average monthly payment is $729.

The three-fold hit from interest rates, inflated prices, and tightened lending have placed consumers in a precarious place. Today, higher shares of American borrowers are behind on vehicle loan payments than before the COVID-19 pandemic.

Story editing by Jeff Inglis. Copy editing by Kristen Wegrzyn.