Is real estate actually a good investment?

This story originally appeared on Wealth Enhancement Group and was produced and distributed in partnership with Stacker Studio.

Is real estate actually a good investment?

It's well-documented that the surest, and often best, return on investments comes from playing the long game. But between stocks and real estate, which is the stronger bet?

To find out, financial planning firm Wealth Enhancement Group analyzed data from academic research, Standard and Poor's, and Nareit to see how real estate compares to stocks as an investment.

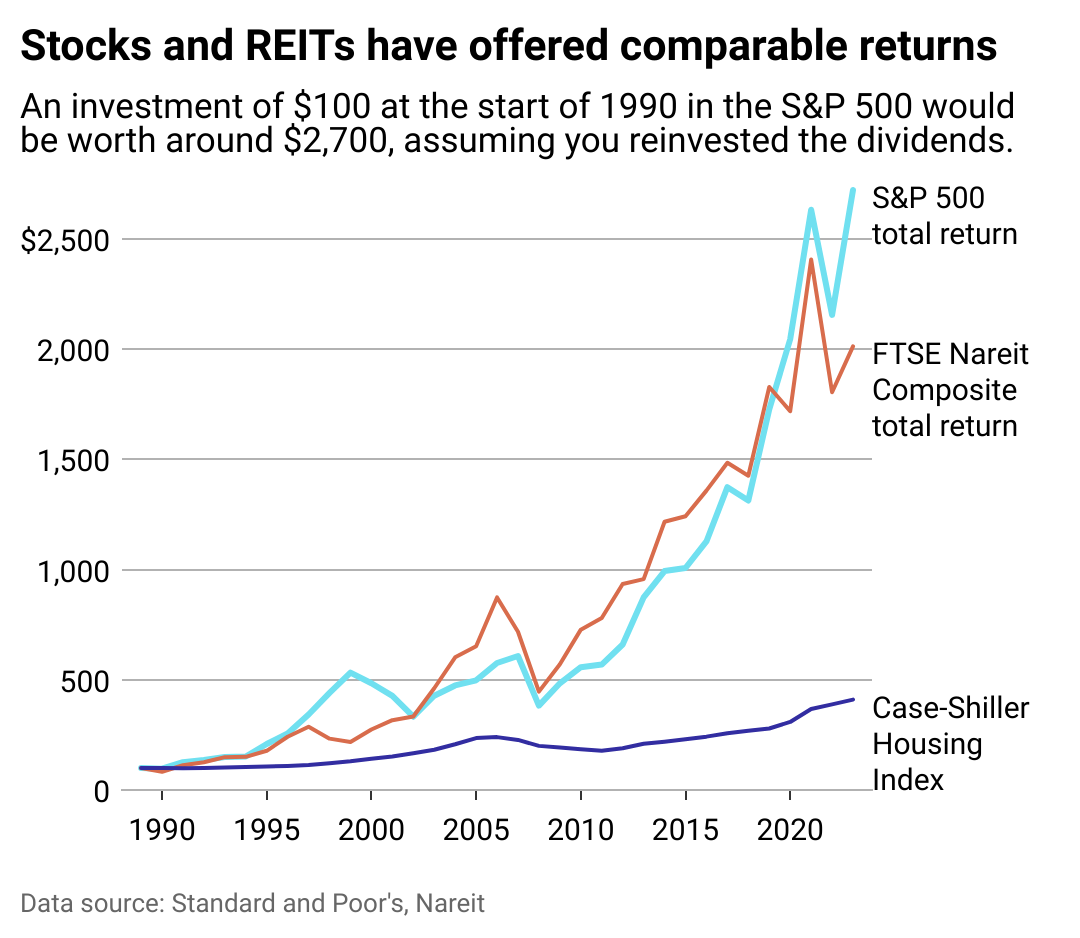

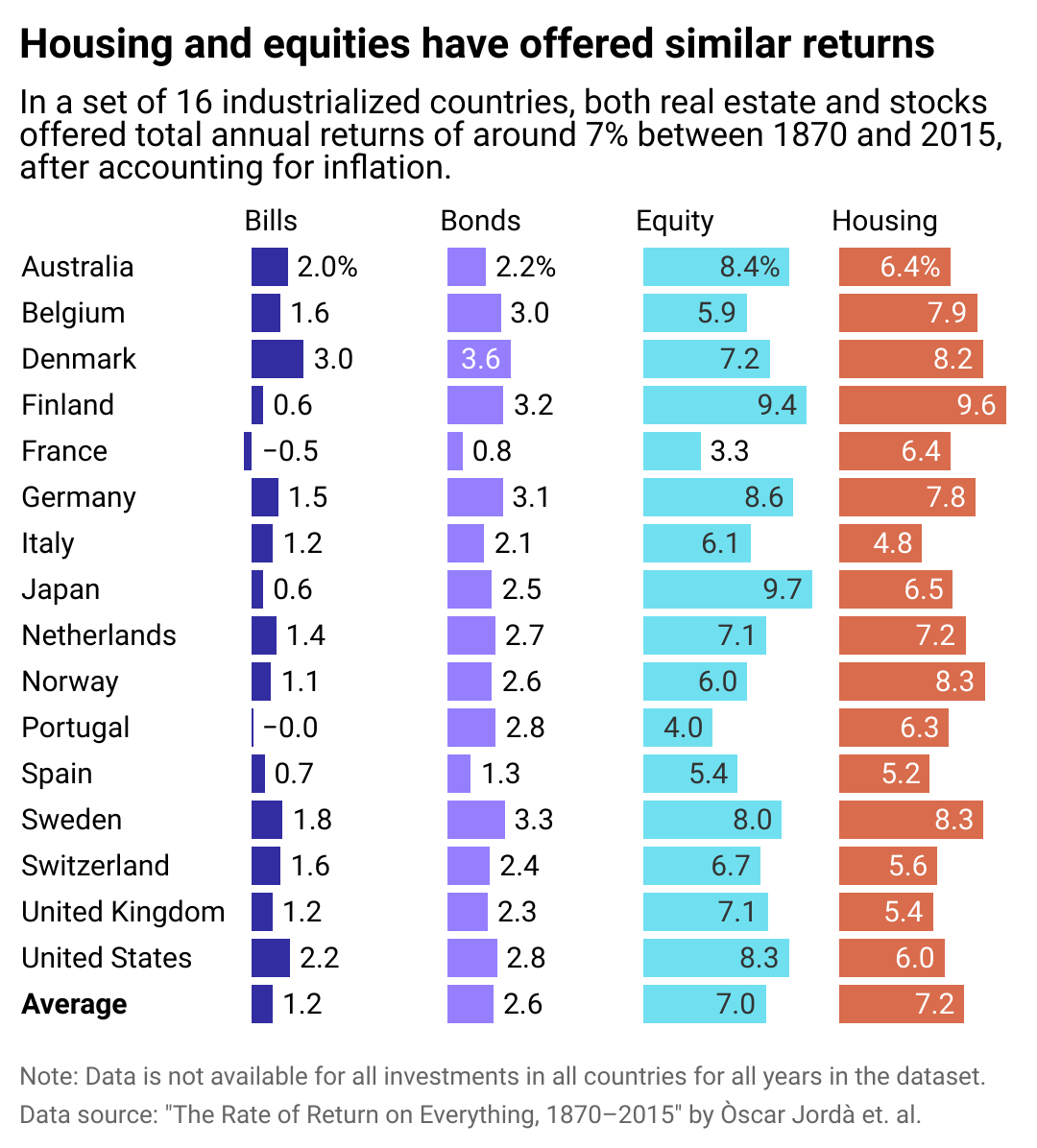

Data going back to 1870 shows the well-established power of real estate as a powerful "long-run investment." From 1870-2015, and after adjusting for inflation, real estate produced an average annual return of 7.05%, compared to 6.89% for equities. These findings, published in the 2019 issue of The Quarterly Journal of Economics, illustrate that stocks can deviate as much as 22% from their average, while housing only spreads out 10%. That's because despite having comparable returns, stocks are inherently more volatile due to following the whims of the business cycle.

Real estate has inherent benefits, from unlocking cash flow and offering tax breaks to building equity and protecting investors from inflation. Investments here also help to diversify a portfolio, whether via physical properties or a real estate investment trust. Investors can track markets with standard resources that include the S&P CoreLogic Case-Shiller Home Price Indices, which tracks residential real estate prices; the Nareit U.S. Real Estate Index, which gathers data on the real estate investment trust, or REIT, industry; and the S&P 500, which tracks the stocks of 500 of the largest companies in the U.S.

High interest rates and a competitive market dampened the flurry of real-estate investments made in the last four years. The rise in interest rates equates to a bigger borrowing cost for investors, which can spell big reductions in profit margins. That, combined with the risk of high vacancies, difficult tenants, or hidden structural problems, can make real estate investing a less attractive option—especially for first-time investors.

Keep reading to learn more about whether real estate is a good investment today and how it stacks up against the stock market.

Stocks and housing have both done well

REITs can offer investors the stability of real estate returns without bidding wars or hefty down payments. A hybrid model of stocks and real estate, REITs allow the average person to invest in businesses that finance or own income-generating properties.

REITs delivered slightly better returns than the S&P 500 over the past 20-, 25-, and 50-year blocks. However, in the short term—the last 10 years, for instance—stocks outperformed REITs with a 12% return versus 9.5%, according to data compiled by The Motley Fool investor publication.

Whether a new normal is emerging that stocks will continue to offer higher REITs remains to be seen.

This year, the S&P 500 reached an all-time high, courtesy of investor enthusiasm in speculative tech such as artificial intelligence. However, just seven tech companies, dubbed "The Magnificent 7," are responsible for an outsized amount of the S&P's returns last year, creating worry that there may be a tech bubble.

While indexes keep a pulse on investment performance, they don't always tell the whole story. The Case-Shiller Index only measures housing prices, for example, which leaves out rental income (profit) or maintenance costs (loss) when calculating the return on residential real estate investment.

Housing returns have been strong globally too

Like its American peers, the global real estate market in industrialized nations offers comparable returns to the international stock market.

Over the long term, returns on stocks in industrialized nations is 7%, including dividends, and 7.2% in global real estate, including rental income some investors receive from properties. Investing internationally may have more risk for American buyers, who are less likely to know local rules and regulations in foreign countries; however, global markets may offer opportunities for a higher return. For instance, Portugal's real estate market is booming due to international visitors deciding to move there for a better quality of life. Portugal's housing offers a 6.3% return in the long term, versus only 4.3% for its stock market.

For those with deep enough pockets to stay in, investing in housing will almost always bear out as long as the buyer has enough equity to manage unforeseen expenses and wait out vacancies or slumps in the market. Real estate promises to appreciate over the long term, offers an opportunity to collect rent for income, and allows investors to leverage borrowed capital to increase additional returns on investment.

Above all, though, the diversification of assets is the surest way to guarantee a strong return on investments. Spreading investments across different assets increases potential returns and mitigates risk.

Story editing by Nicole Caldwell. Copy editing by Paris Close. Photo selection by Lacy Kerrick.