These 25 counties have the most debt in collections in the US

These 25 counties have the most debt in collections in the US

Household debt reached a record $17.29 trillion in the third quarter of 2023, according to the New York Federal Reserve.

Excluding housing debt, the total was $4.8 trillion, up 6.4% from the same period a year earlier. Delinquencies of over 90 days have been rising steadily since 2021, although they are still at low levels by historical standards.

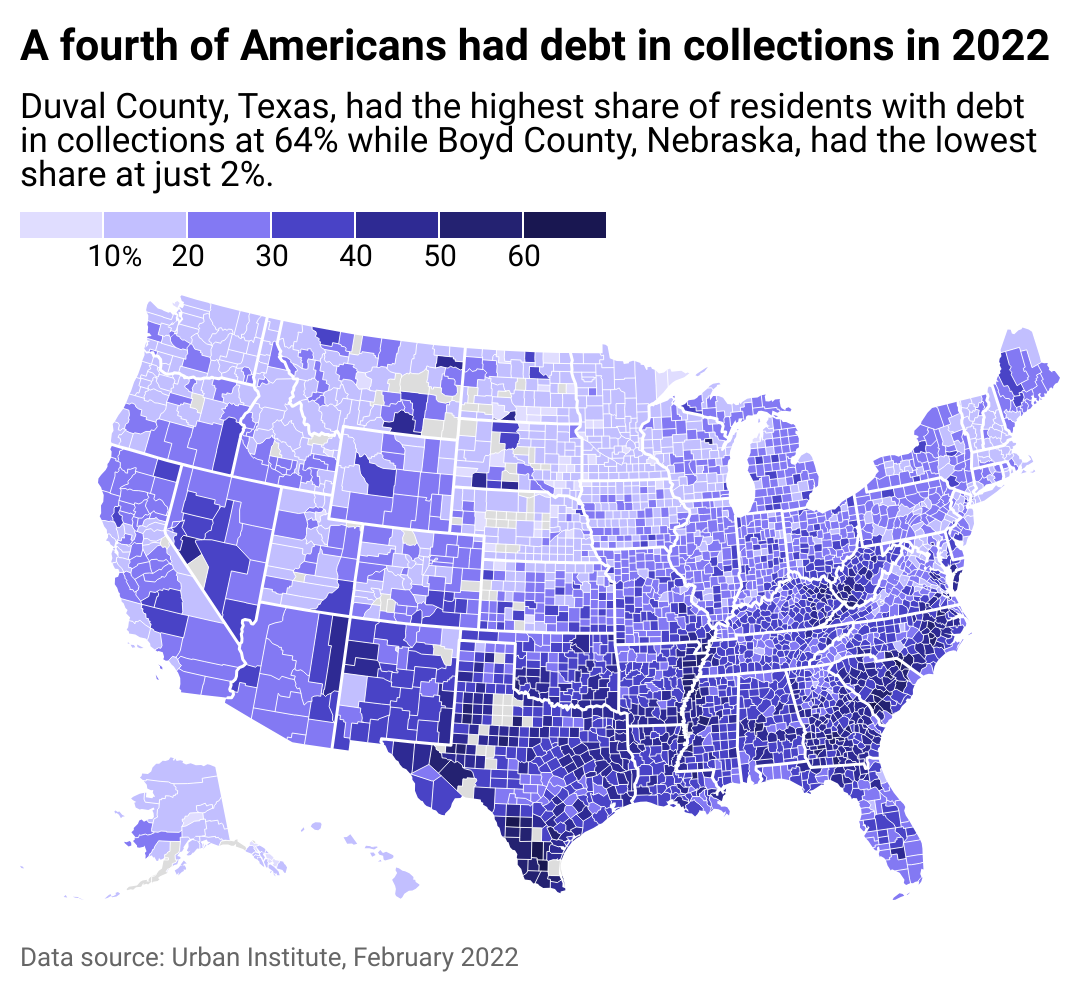

Data from the think tank Urban Institute details where the people most likely to miss their debt payments live. Their data shows that excluding mortgages, 26% of American adults were significantly late on their debt payments in February 2022. The median debt in collections totaled $1,739, with unpaid medical bills being the most common.

The Urban Institute's data shows that non-white households tend to have much higher rates of default than white households and that households in less affluent counties tend to have higher debt default rates than wealthier ones.

Based on the think tank's data, we estimate that a household living in a predominantly white county with an income of $150,000 has roughly a 13% chance of being seriously delinquent in its debt payments. In comparison, a household living in a predominantly non-white county with an income of $50,000 has a 47% chance of having debt in collections.

Academic research from the National Bureau of Economic Research in 2019—using more granular data and sophisticated statistical techniques—found other factors, such as a borrower's credit history and total loan balances, matter a great deal, too.

The regions with the most debt

Plotting the debt data on a map reveals some striking geographic trends. Counties in the South and the Appalachian mountains tended to have very high delinquency rates. In contrast, counties in the Great Plains region north of Oklahoma, the northwest, and New England were likelier to have far lower debt delinquency rates.

Duval County, Texas, in the southern part of the state, had the highest delinquency rate—64% of its adult residents had defaulted on their debt payments in February 2022. Meanwhile, only 2% of Boyd County, Nebraska, residents had debt in collections.

Research, including a 2019 study published by the American Journal of Public Health, has found medical debt is a major contributor to personal bankruptcies. The problem is especially acute for the uninsured, who can face far bigger medical bills. Many states, particularly in the South, chose to not expand Medicaid, health coverage for low-income Americans, after the Affordable Care Act passed. Texas, for instance, has the highest share of people without health insurance at 16.6%.

Debt delinquencies for young adults tended to be rarer. The Urban Institute estimates that only 20% of Americans aged 18 to 24 had debt in collections in February 2022. This, however, could change soon. In June 2023, Congress announced it would end the student loan pause, meaning from Sept. 1 last year, 28 million predominantly young borrowers have had or will have to start making interest payments.

More worryingly, the share of credit card bills becoming at least 90 days late hit 5.8% in the third quarter of 2023, its highest level since 2011. The Urban Institute's data could look much less rosy in a year's time.

#25. Greene County, North Carolina

- 53.7% of residents have debt in collections

-- owing a median amount of $1,639.50

- 43.82% of residents have medical debt in collections

- 11.32% of residents have missed student loan debt in default

- 8.42% of residents are at least 60 days delinquent on their car/retail loans

- 7.49% of residents are delinquent on their credit card payments

#24. Lenoir County, North Carolina

- 53.9% of residents have debt in collections

-- owing a median amount of $1,540.50

- 43.84% of residents have medical debt in collections

- 14.58% of residents have missed student loan debt in default

- 7.02% of residents are at least 60 days delinquent on their car/retail loans

- 6.29% of residents are delinquent on their credit card payments

#23. Frio County, Texas

- 53.9% of residents have debt in collections

-- owing a median amount of $1,517.50

- 23.25% of residents have medical debt in collections

- 12.86% of residents have missed student loan debt in default

- 9.81% of residents are at least 60 days delinquent on their car/retail loans

- 3.65% of residents are delinquent on their credit card payments

#22. Lake County, Tennessee

- 54.1% of residents have debt in collections

-- owing a median amount of $1,719.50

- 27.67% of residents have medical debt in collections

- Data on student loans is unavailable

- 5.36% of residents are at least 60 days delinquent on their car/retail loans

- Data on credit card debt are unavailable

#21. Pemiscot County, Missouri

- 54.2% of residents have debt in collections

-- owing a median amount of $2,109

- 37.3% of residents have medical debt in collections

- Data on student loans is unavailable

- 10.3% of residents are at least 60 days delinquent on their car/retail loans

- 5.14% of residents are delinquent on their credit card payments

#20. Stewart County, Georgia

- 54.2% of residents have debt in collections

-- owing a median amount of $1,795

- 26.14% of residents have medical debt in collections

- Data on student loans is unavailable

- 12.5% of residents are at least 60 days delinquent on their car/retail loans

- 4.29% of residents are delinquent on their credit card payments

#19. Sharkey County, Mississippi

- 54.4% of residents have debt in collections

-- owing a median amount of $2,020.50

- 30.4% of residents have medical debt in collections

- Data on student loans is unavailable

- Data on car/retail loans are unavailable

- 7.69% of residents are delinquent on their credit card payments

#18. Phillips County, Arkansas

- 54.4% of residents have debt in collections

-- owing a median amount of $2,082.50

- 25.44% of residents have medical debt in collections

- 22.06% of residents have missed student loan debt in default

- 10.2% of residents are at least 60 days delinquent on their car/retail loans

- 7.61% of residents are delinquent on their credit card payments

#17. Chicot County, Arkansas

- 54.6% of residents have debt in collections

-- owing a median amount of $1,945.50

- 32.21% of residents have medical debt in collections

- 24% of residents have missed student loan debt in default

- 11.19% of residents are at least 60 days delinquent on their car/retail loans

- 6.52% of residents are delinquent on their credit card payments

#16. Dillon County, South Carolina

- 54.6% of residents have debt in collections

-- owing a median amount of $1,605

- 32.08% of residents have medical debt in collections

- 13.53% of residents have missed student loan debt in default

- 10.95% of residents are at least 60 days delinquent on their car/retail loans

- 6.93% of residents are delinquent on their credit card payments

#15. Pecos County, Texas

- 55.1% of residents have debt in collections

-- owing a median amount of $2,174.50

- 41.65% of residents have medical debt in collections

- Data on student loans is unavailable

- 7.77% of residents are at least 60 days delinquent on their car/retail loans

- 6.8% of residents are delinquent on their credit card payments

#14. Scotland County, North Carolina

- 55.5% of residents have debt in collections

-- owing a median amount of $1,671

- 37.07% of residents have medical debt in collections

- 13.87% of residents have missed student loan debt in default

- 10.45% of residents are at least 60 days delinquent on their car/retail loans

- 5.48% of residents are delinquent on their credit card payments

#13. Anson County, North Carolina

- 55.7% of residents have debt in collections

-- owing a median amount of $1,910

- 42.76% of residents have medical debt in collections

- 9.76% of residents have missed student loan debt in default

- 7.12% of residents are at least 60 days delinquent on their car/retail loans

- 8.25% of residents are delinquent on their credit card payments

#12. Franklin, Virginia

- 56% of residents have debt in collections

-- owing a median amount of $1,340

- 35.6% of residents have medical debt in collections

- Data on student loans is unavailable

- 9.76% of residents are at least 60 days delinquent on their car/retail loans

- 7.27% of residents are delinquent on their credit card payments

#11. Mingo County, West Virginia

- 56.3% of residents have debt in collections

-- owing a median amount of $1,511

- 31.74% of residents have medical debt in collections

- 13.56% of residents have missed student loan debt in default

- 5.96% of residents are at least 60 days delinquent on their car/retail loans

- 8.2% of residents are delinquent on their credit card payments

#10. Marion County, South Carolina

- 57.6% of residents have debt in collections

-- owing a median amount of $1,884

- 31.75% of residents have medical debt in collections

- 13.41% of residents have missed student loan debt in default

- 10.43% of residents are at least 60 days delinquent on their car/retail loans

- 8.5% of residents are delinquent on their credit card payments

#9. Jim Wells County, Texas

- 57.7% of residents have debt in collections

-- owing a median amount of $2,742

- 33% of residents have medical debt in collections

- 8.38% of residents have missed student loan debt in default

- 8.94% of residents are at least 60 days delinquent on their car/retail loans

- 6.77% of residents are delinquent on their credit card payments

#8. Lee County, South Carolina

- 57.7% of residents have debt in collections

-- owing a median amount of $2,708

- 29.38% of residents have medical debt in collections

- 27.78% of residents have missed student loan debt in default

- 12.06% of residents are at least 60 days delinquent on their car/retail loans

- 11.73% of residents are delinquent on their credit card payments

#7. Zapata County, Texas

- 58.8% of residents have debt in collections

-- owing a median amount of $2,173

- 26.56% of residents have medical debt in collections

- Data on student loans is unavailable

- 9.15% of residents are at least 60 days delinquent on their car/retail loans

- 9.3% of residents are delinquent on their credit card payments

#6. Jim Hogg County, Texas

- 59.9% of residents have debt in collections

-- owing a median amount of $2,489

- 35.21% of residents have medical debt in collections

- Data on student loans is unavailable

- 10% of residents are at least 60 days delinquent on their car/retail loans

- Data on credit card debt are unavailable

#5. Zavala County, Texas

- 60.3% of residents have debt in collections

-- owing a median amount of $1,434.50

- 18.03% of residents have medical debt in collections

- Data on student loans is unavailable

- 13.82% of residents are at least 60 days delinquent on their car/retail loans

- 5.32% of residents are delinquent on their credit card payments

#4. Marlboro County, South Carolina

- 60.9% of residents have debt in collections

-- owing a median amount of $1,784

- 37.14% of residents have medical debt in collections

- 11.4% of residents have missed student loan debt in default

- 15.24% of residents are at least 60 days delinquent on their car/retail loans

- 6.51% of residents are delinquent on their credit card payments

#3. Brooks County, Texas

- 61.2% of residents have debt in collections

-- owing a median amount of $2,441.50

- 32.33% of residents have medical debt in collections

- Data on student loans is unavailable

- 13.33% of residents are at least 60 days delinquent on their car/retail loans

- 3.8% of residents are delinquent on their credit card payments

#2. Allendale County, South Carolina

- 62.5% of residents have debt in collections

-- owing a median amount of $2,606

- 29.03% of residents have medical debt in collections

- Data on student loans is unavailable

- 8.99% of residents are at least 60 days delinquent on their car/retail loans

- 8.11% of residents are delinquent on their credit card payments

#1. Duval County, Texas

- 64.1% of residents have debt in collections

-- owing a median amount of $2,334

- 33.33% of residents have medical debt in collections

- Data on student loans is unavailable

- 11.7% of residents are at least 60 days delinquent on their car/retail loans

- 2.44% of residents are delinquent on their credit card payments

Story editing by Ashleigh Graf. Copy editing by Kristen Wegrzyn. Photo selection by Clarese Moller.