Where laid-off tech workers are going

After several years of voracious hiring, tech jobs are no longer the most secure place for today's white-collar workers: Some of the biggest employers have slashed head counts this year.

Companies like Google and Amazon spent 2021 and early 2022 hoarding talent from each other, and are now kicking workers off payrolls by the thousands. So which parts of the economy are benefitting from all the talent shuffling around in a trade which consultancy firms estimate is still short of workers?

Using data from Revelio Labs, Stacker ranked the 25 industries where the highest shares of laid-off tech workers have landed their next roles. The analysis covers departures from many of the biggest players—formerly collectively known as FAANG—that saw layoffs in the last half of 2022, including Amazon, Microsoft, Meta, Oracle, and Salesforce, as well as about 20 others.

Revelio draws on online public employment records data, identifying worker separations related to significant layoff events affecting 200 employees, or 30% of a company workforce, over a 30-day period. It also includes separations at companies that had mass layoff events.

The unemployment rate in the information sector—which includes most tech industries, in addition to others—increased from 2.3% in March 2022 to 3.1% in March 2023, with a total of 84,000 unemployed people nationwide, according to the Bureau of Labor Statistics.

During the height of the COVID-19 pandemic, technology was in high demand. It helped workers clock in and earn paychecks from the safety of home as well as keep in touch with family and friends. Many tech leaders say they mistakenly thought those trends would be stickier than they have actually been, as higher interest rates have driven consumer credit debt up—and consumer spending on goods down. At the same time, tech workers, ironically, were not overwhelmingly happy with their jobs, surveys suggest. Some reports from idle employees suggest tech firms may have had a difficult time integrating new hires.

There were 58,000 information sector layoffs in February 2023, over five times higher than a year prior, according to preliminary estimates from BLS. The layoff rate in the information sector increased from 0.4% in February 2022 to 1.9% in February 2023. This is a much steeper increase than the layoff rate for all industries, which remains at 1%.

Artificial intelligence products rolled out at the beginning of this year are also forecast to improve knowledge workers' productivity, and could factor into any head count reductions made over the next several months. The race to build the dominant AI product suite could propel the growth of new companies, but there's also been an increased willingness among Americans to start their own businesses since 2020.

About 45% of laid-off tech workers left the tech industry, and nearly half wound up in a significantly different role than the one they were laid off from, according to data from Revelio.

#23. Computer systems design services (tie)

- Share of laid-off tech workers that got a job in this industry: 0.6%

Companies in this space work in information technology consulting and systems integration, helping back-end employee databases and other software systems connect with customer-facing portals and communication tools.

#23. General medical and surgical hospitals (tie)

- Share of laid-off tech workers that got a job in this industry: 0.6%

Specialized surgery is a lucrative field where technology increasingly plays a role in operating on patients. The demand for health care services is expected to increase through the decade as the U.S. population ages.

#23. Other management consulting services (tie)

- Share of laid-off tech workers that got a job in this industry: 0.6%

This industry comprises firms that are hired to provide consulting services for managing employees.

#22. Administrative management and general management consulting services

- Share of laid-off tech workers that got a job in this industry: 0.7%

Management consultation services help firms with integrating new talent into their existing operations and company-wide performance improvement projects.

#18. Offices of real estate agents and brokers (tie)

- Share of laid-off tech workers that got a job in this industry: 0.8%

The real estate industry has leaned heavily into the tech space in recent years, birthing a slew of software and big data collection suites that benefit institutional buyers and property management companies.

#18. Financial transactions processing (tie)

- Share of laid-off tech workers that got a job in this industry: 0.8%

As banking has gone digital, so too has the infrastructure that facilitates payments. Financial technology companies in this space have found success on the heels of the booming popularity of digital wallet apps like PayPal and Venmo.

#18. Automobile manufacturing (tie)

- Share of laid-off tech workers that got a job in this industry: 0.8%

Automakers are spending their time these days bringing new electric and hybrid electric vehicles to market as quickly as possible—and they're hiring tech talent to fuel the electric revolution.

#18. All other transit and ground passenger transportation (tie)

- Share of laid-off tech workers that got a job in this industry: 0.8%

This industry consists largely of companies operating bus and shuttle services that are not urban or rural transit systems.

#17. Travel agencies

- Share of laid-off tech workers that got a job in this industry: 0.9%

Americans shifted their spending habits last year to prioritize spending on services they couldn't enjoy during the heat of the pandemic. The trend, sometimes referred to as "revenge travel," has bolstered the travel industry, which has also been influenced by tech startups like Airbnb over the past decade.

#14. Employment placement agencies (tie)

- Share of laid-off tech workers that got a job in this industry: 1.0%

This industry includes firms that help match people looking for jobs with employment. Sometimes those positions are temporary. Contract and temp roles are being used by some companies as they cut back on payroll expenses during the economic uncertainty of the past year.

#14. Miscellaneous intermediation (tie)

- Share of laid-off tech workers that got a job in this industry: 1.0%

This industry includes companies or individuals that buy and sell securities like stock options. Retail investing saw a boom in 2021 as pandemic bailout money floated through the economy and stock option trading gained new adherents.

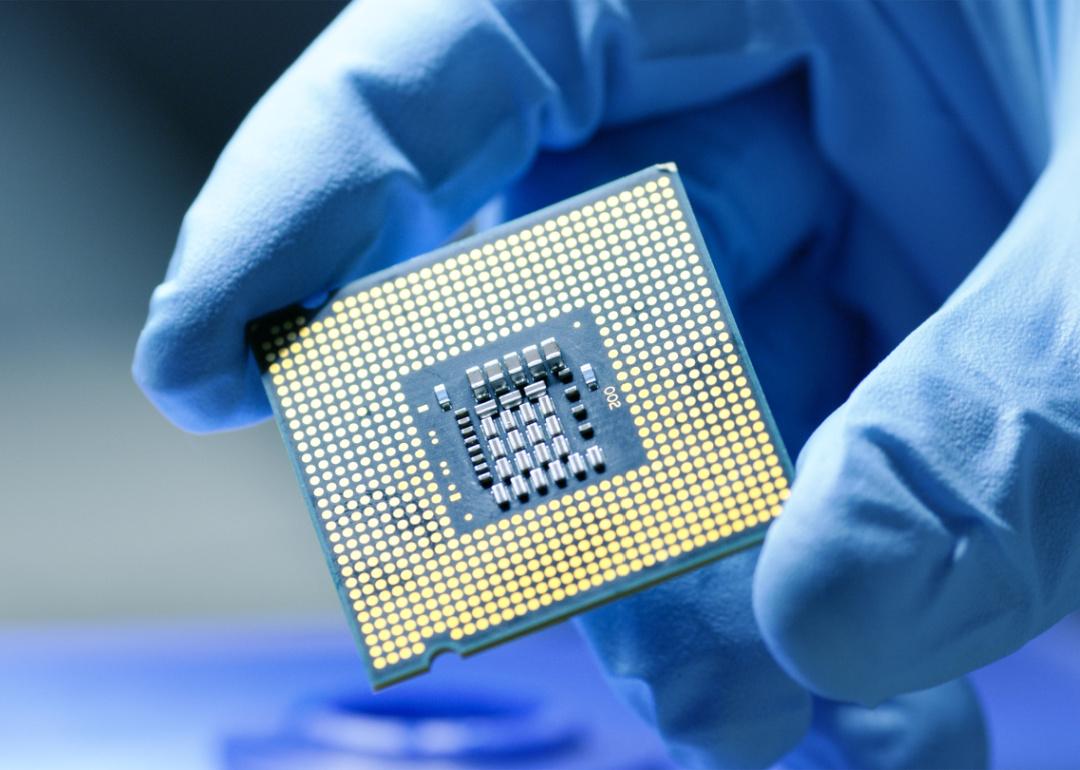

#14. Semiconductor and related device manufacturing (tie)

- Share of laid-off tech workers that got a job in this industry: 1.0%

The U.S. is facing a shortage of critical technology invented in America but now monopolized in other countries—computer chips. The industry has seen an influx of federal funding in the last year through legislation aimed at shoring up domestic production of the tech needed in everything from vehicles to smartphones and even kitchen appliances.

#12. Investment advice (tie)

- Share of laid-off tech workers that got a job in this industry: 1.1%

The investment advice industry includes money managers like those employed by financial advisory giants Fidelity and Charles Schwab.

#12. Warehouse clubs and supercenters (tie)

- Share of laid-off tech workers that got a job in this industry: 1.1%

The warehouse clubs and supercenters industry includes big box wholesalers like Costco and Sam's Club. The biggest players in this space, like Walmart, are leaning toward automation and technology to propel financial growth over the next decade.

#11. Security and workflow software

- Share of laid-off tech workers that got a job in this industry: 1.2%

The security for digital operations is projected to remain in high and climbing demand as online threats grow. The industry is in dire need of more engineering and tech talent to meet the demands of companies that want to shore up cybersecurity and remain compliant with emerging data privacy laws.

#9. All other telecommunications (tie)

- Share of laid-off tech workers that got a job in this industry: 1.5%

This industry includes professionals working in telecom companies to provide internet services, including internet telephony (or Voice over Internet Protocol) services, which is more software-intensive than hardware-driven.

#9. Communications equipment manufacturing (tie)

- Share of laid-off tech workers that got a job in this industry: 1.5%

This industry is responsible for producing the hardware that goes into GPS systems, smart TVs, and satellites.

#8. Commercial banking

- Share of laid-off tech workers that got a job in this industry: 1.6%

Commercial banks have been raking in profit as interest rates have risen, allowing them to expand operations. Companies in this space include large investment banks like JPMorgan Chase and Bank of America.

#7. Colleges, universities, and professional schools

- Share of laid-off tech workers that got a job in this industry: 2.3%

Some laid-off tech talent is finding purpose working in institutions of higher education. These organizations are increasingly offering remote learning opportunities, especially since the pandemic, and will need to grapple with the introduction of AI into the learning environment, as ChatGPT showed this year.

#6. Computer programming services

- Share of laid-off tech workers that got a job in this industry: 2.4%

Companies in this space are contracted by firms that need software designed or upgraded.

#4. Electronic shopping/e-commerce (tie)

- Share of laid-off tech workers that got a job in this industry: 2.5%

Online commerce boomed in the two years immediately following the pandemic, and companies in the space are still snapping up talent—even if direct sellers are experiencing tough times as consumer purchasing habits shift to spending on services.

#4. Data processing, hosting, and related services (tie)

- Share of laid-off tech workers that got a job in this industry: 2.5%

This industry provides systems for hosting databases and accessing them. The advent of cloud computing has supercharged businesses providing these services, which are hired by firms looking to outsource these operations.

#3. Other computer related services

- Share of laid-off tech workers that got a job in this industry: 5.1%

Workers in other computer related services provide business-to-business services in information technology systems. They might help a less-tech savvy firm upgrade its digital operations.

#2. Websites and social media

- Share of laid-off tech workers that got a job in this industry: 9.5%

Twitter may have slashed its staff under Elon Musk's ownership, but the websites and social media industry is still creating jobs elsewhere—and those efforts are absorbing stray tech workers.

#1. Software publishers

- Share of laid-off tech workers that got a job in this industry: 24.5%

Software publishing in the U.S. has historically been largely concentrated in California. Many of the laid-off tech workers are likely getting snapped up by rival and smaller companies in the state. The financial turmoil in the tech industry has also coincided with dropping home prices in some of California's hottest real estate markets over the last year.