Winter is coming: Can homeowners withstand another polar vortex this year?

Winter is coming: Can homeowners withstand another polar vortex this year?

It's that time of year again. The days get shorter, nights get longer, and the air gets chilly. For homeowners, this means it's time to prep your property for the winter. From strong winds that loosen your shingles to frozen pipes that burst, the cold season can wreak havoc on your property — especially if you live in one of the states with the highest winter weather risk.

Finding where winter hits the country hardest

To find the states with the most expected winter weather risk this season, MoneyGeek analyzed expected property damage from winter weather overall and per capita using FEMA's National Risk Index. MoneyGeek also broke down the percentage of expected damage from ice storms, cold waves and winter weather to help property owners identify the best homeowners insurance policy for their needs.

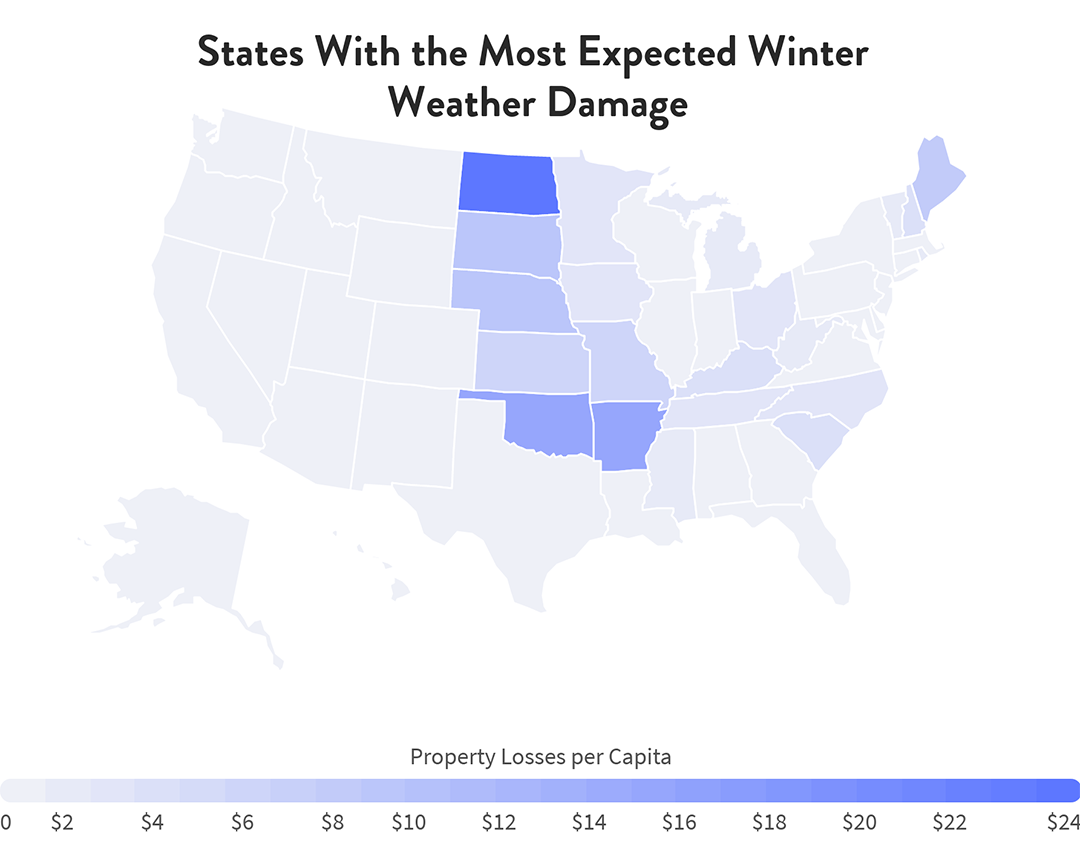

States expected to have highest costs from winter weather damage (2022–2023)

Using data from FEMA's National Risk Index, MoneyGeek developed predictions for winter weather-related property damage this year. This analysis identified that are expected to have the highest property damage costs per capita this winter.

While North Dakotans will each pay about $23 to cover winter storm damages in winter 2022–2023, the cost for Arkansas and Oklahoma residents will be approximately $14 per person. However, it's important to note that Oklahoma's total expected property damage cost is over $53.8 million and Arkansas' is north of $41.9 million, while North Dakota's is about $15.5 million. Therefore, the difference in the per capita average also reflects population size.

According to MoneyGeek's study, Nebraska and South Dakota will be the fourth and fifth most expensive states in terms of per capita winter storm damage. Homeowners here will pay just under $9 per person to cover seasonal repairs.

Below, you can find a description of winter weather conditions for the top five states on this list to offer readers a better understanding of possible winter storm damage and seasonal risks, followed by a list of the 10 states with the most expected winter storm damage this season.

5 worst states for winter weather damage

1. North Dakota

- $23 total expected property damage costs per capita

- $15.5 million total expected property damage costs

Winter weather in North Dakota usually lasts from November through March and can be accompanied by strong winds that create blizzard conditions. Temperatures fall below 0 degrees Fahrenheit for 40 to 70 days on average, increasing risks to the home, including freezing and bursting water pipes.

2. Arkansas

- $14.36 total expected property damage costs per capita

- $41.9 million total expected property damage costs

According to the official Arkansas website, November marks the start of winter in this state, with light frost conditions and colder weather beginning toward the end of the month. By January, winter conditions become harsher, with average minimum temperatures of 28.8 degrees Fahrenheit and an average snowfall of 2.3 inches. By March, the weather is often milder, but residents often see at least one final snowfall this month.

3. Oklahoma

- $14.33 total expected property damage costs per capita

- $53.8 million total expected property damage costs

The Oklahoma Climatological Survey describes the state's winters as shorter and less severe than those of neighboring states. While extreme cold is infrequent, snowfall can range from less than two inches in some parts of the state to nearly 30 inches in others. Temperatures drop below 32 degrees Fahrenheit for 60 to 140 days in different parts of the state.

4. Nebraska

- $9 total expected property damage costs per capita

- $16.2 million total expected property damage costs

The National Weather Service indicates that the average winter season extends from November to March in eastern Nebraska and from October to April in western parts of the state. Snow and strong winds create the riskiest conditions, with dangerous wind chills and the possibility of blizzards. Other seasonal risks include power outages, tree damage and downed power lines.

5. South Dakota

- $8 total expected property damage costs per capita

- $6.6 million total expected property damage costs

Located toward the north of the country in the Great Plains area, South Dakota is exposed to cold arctic winds and low temperatures. The National Oceanic and Atmospheric Administration indicates that blizzards and snowstorms can lead to the death of livestock during the winter months. This affects South Dakota's agricultural economy while also causing devastating floods once the snow starts to melt.

The next 10 states for winter weather damage

6. Maine

- $7 total expected property damage costs per capita

- $9.6 million total expected property damage costs

7. Missouri

- $6 total expected property damage costs per capita

- $34.9 million total expected property damage costs

8. Kansas

- $5 total expected property damage costs per capita

- $15.2 million total expected property damage costs

9. South Carolina

- $3.33 total expected property damage costs per capita

- $15.4 million total expected property damage costs

10. Kentucky

- $3.27 total expected property damage costs per capita

- $14.2 million total expected property damage costs

11. New Hampshire

- $3.25 total expected property damage costs per capita

- $4.4 million total expected property damage costs

12. Tennessee

- $2.61 total expected property damage costs per capita

- $16.6 million total expected property damage costs

13. Ohio

- $2.50 total expected property damage costs per capita

- $28.8 million total expected property damage costs

14. Iowa

- $2.49 total expected property damage costs per capita

- $7.6 million total expected property damage costs

15. North Carolina

- $2.48 total expected property damage costs per capita

- $23.6 million total expected property damage costs

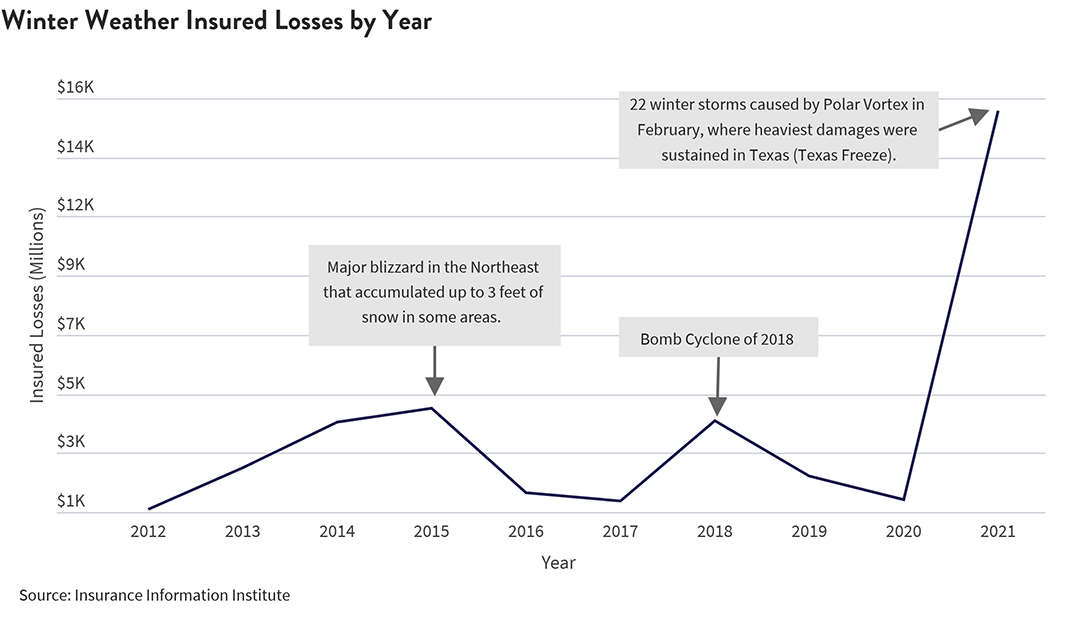

How to prepare your home for winter weather

Preparing your home for winter weather can keep you safe in case of a storm and save you thousands of dollars, too. Considering how high winter weather insured losses were in 2021 compared to previous years, it's more important now than ever to buy a quality home insurance policy, as well as take steps to protect your property.

To prepare the inside and outside of your home for winter weather, Consumer Reports recommends:

- Protecting your indoor pipes

- Insulating your attic

- Servicing your heating equipment

- Installing glass storm windows

- Hiring a licensed roofing contractor to inspect and repair your roof

- Cleaning your gutters

- Repairing your outdoor flooring

- Removing tree limbs

- Preparing outdoor water sources

- Marking pathways before heavy snowfall

Damages related to the list above reflect many of the top winter home insurance claims. After the 2021 polar vortex became the most costly weather disaster in the history of Texas, it prompted many homeowners — not just in Texas but across the country — to question how much insurance coverage they might need to prepare for this winter season.

Knowing your local weather prediction for this year can help you identify how much home insurance coverage you need to protect your property; looking for cheap homeowners insurance in your area that meets these coverage needs is crucial to financially securing your home in the event of winter damage.

MoneyGeek Expert Tip

Before the season begins, take some time to review your homeowners insurance policy for these four types of coverage:

- Dwelling

- Personal property

- Living expense

- Liability

In some cases, you may also want to consider secondary coverage to cover the cost of repairing structures beyond your dwelling (such as fences or a detached garage), as well as medical payments for visitors who may become injured while at your home.

Methodology

MoneyGeek analyzed FEMA's National Risk Index data to determine expected annualized property damage losses from winter weather events across the country. Their analysis included property losses from snowstorms, sleet, freezing rain, ice storms and cold waves. MoneyGeek analyzed total property damage and ranked states by per capita losses to determine which states are the most burdened by property damage due to winter storms.

This story was produced by MoneyGeek and reviewed and distributed by Stacker Media.