How the cost of raising a child has skyrocketed over 25 years

This story originally appeared on Magnifi and was produced and distributed in partnership with Stacker Studio.

How the cost of raising a child has skyrocketed over 25 years

Starting a family is a big decision—one that younger generations are waiting longer to make. A CNBC/Harris poll in 2021 found 44% of older millennials (ages 33 to 40) said the pandemic caused them to decide not to have kids or to postpone having children. And as COVID-19 fades from a global crisis into a regular part of everyday life, Americans are grappling with inflation everywhere they look.

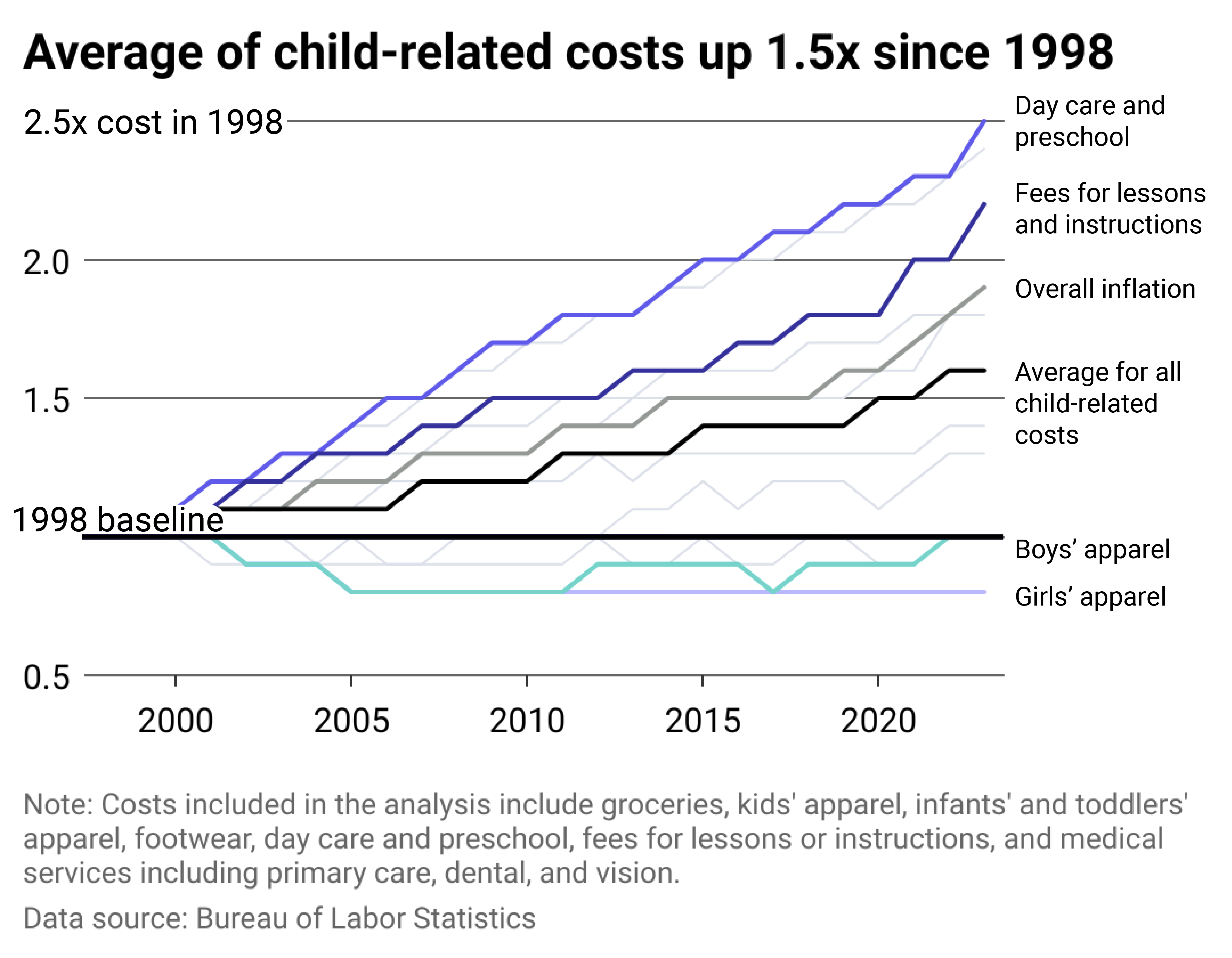

Magnifi, an AI investing app, analyzed historic price data from 1998 to 2023 from the Bureau of Labor Statistics and found a 63% rise in costs for goods and services essential to raising a child. The analysis includes groceries; infants' and kids' apparel; footwear; day care and preschool; physician, dental, and eye care services; as well as the cost of lessons and instructions outside of public education. The price data was re-indexed to 1998 values to study how various goods have increased in relation to one another over the past 25 years.

The current ballpark figure a parent can expect to spend on their child from birth through the age of 17 is roughly $310,000, according to the latest estimate from the nonpartisan public policy organization The Brookings Institution.

New costs have also been thrust into the picture in the past decade or more, including smartphones, which were first introduced to the market around the mid-2000s. The typical child now receives their first cellphone at around 11 years old, according to Stanford researchers. But unlike smartphones, the cost of which has deflated since 2019 as the tech becomes ubiquitous, most goods and services have seen a dramatic rise in price in just 25 years.

As prices of most goods inflate, the cost to raise a child is rising

Since the turn of the century, day care and preschool costs have risen at a faster rate than other basic expenditures for children. From 1998 through today, early childhood education has increased by 2.5 times in price. The growing expense of early childhood education and care, specifically, has been described as an economic crisis by business coalitions.

The trend reached a tipping point during the pandemic years for many workers in the U.S. economy—particularly women—for whom child care became so expensive or hard to find that they were pushed out of the economy. Men and women initially experienced similar job losses at the start of the pandemic, but men reentered the workforce at higher rates, according to BLS data.

The next biggest increases occurred in the costs of dental care and fees for lessons and instructions, which have also more than doubled in that time frame. A cart full of groceries, meanwhile, is also going to cost a family with children 1.9 times as much as it did in 1998. Baby food and formula, specifically, have increased in price slightly more over that period, increasing 2.1 times from their 1998 cost.

Other everyday items kids need are increasing in cost, too. Kids' shoes are up 1.3 times what they cost in 1998. Meanwhile, children's clothing is the only item that has remained at or just below the cost it was in 1998.

Private school tuition triples over two decades

The cost of tuition for families who choose to enroll children in the private education system has ballooned more than three times the rates paid in 1998. In 2023, the average cost for private school tuition for K-12 students was $12,427 per year, according to Private School Review. That cost varies from state to state, with residents of Northeastern U.S. states paying upward of $20,000 per year on average.

Just under 10% of children in the U.S. are enrolled in private schools, according to the latest data from the National Center for Education Statistics. That's around 5 million K-12 students, a number that's remained relatively steady since 2009.

Cost for extra space rising rapidly with the pandemic housing frenzy

Space comes at a premium, and it can be expensive to house a growing family. Consumer Price Index data shows that the cost of housing has nearly doubled since 1998—a similar rate to groceries but at a much higher cost. Today, the median monthly housing cost of a one-bedroom mortgaged or rental home in the U.S. is around $990, Census Bureau data shows.

For families looking to expand and add bedrooms, costs can rise dramatically. A two-bedroom costs a median of $1,050 monthly, and for a three-bedroom, that rises again to about $1,140. For four or more bedrooms, median monthly housing costs are over $1,700. Naturally, these costs vary by location. In California, housing costs increase by 18% when upgrading from a one-bedroom to a two-bedroom, and another 27% when upgrading from three to four or more bedrooms.

Data reporting by Dom DiFurio and Paxtyn Merten. Story editing by Ashleigh Graf. Copy editing by Tim Bruns.