Radical economic policy proposals and what they would entail

Radical economic policy proposals and what they would entail

Finance and economics might not be everyone's favorite topic, but these industries are important because they shape the world and are often at the forefront of innovation and political change.

After sifting through reports across the internet and political spectrum, Stacker created a list of 20 radical economic proposals currently under discussion. You don't have to spend a lifetime in the library or earn a four-year degree in economics to impress people with your intellectual prowess, just mention one of these trending ideas to spark a conversation.

Read on to find out more about popular economic proposals that involve changing the retirement age, nationalizing cryptocurrency, and supplying future newborns with personal trust funds. The list begins with a proposal to re-evaluate land taxation.

ALSO: State of the U.S. economy during the year you were born

Land value tax

The idea of a land value tax has long been popular with economists like Adam Smith and Milton Friedman. A land value tax imposes a fee on the value of the land, regardless of what exists on it. Therefore, erecting a building, whether it be a home or factory, would not change the tax. Land value tax proposals are seen as a way to reduce inequality. While the U.S. does not have this kind of tax, Pennsylvania did attempt to create such a tax in 2011.

Increase the retirement age

Americans are living longer than before, but the country’s retirement age has not shifted to accommodate its citizen’s increased longevity. Some see this as a problem, which is why there are Republican-led efforts to raise the Social Security and Medicare ages to 70 years old. Around 55 million people are currently on Medicare. In theory, increasing the retirement age would save the U.S. government up to $100 billion a year. However, critics say the change would hurt poor Americans the most.

Race-based reparations

The United States became one of the world’s wealthiest and most powerful nations from decades of unpaid slave labor and unequal wages for minorities. Recent reports revealed that for a white family with $100 there is a black family with $5.04, and one economic proposal for closing the racial wealth gap involves paying reparations. This idea received a groundswell of attention following Ta-Nehisi Coates’ 2014 essay "The Case for Reparations." Some proposals for this idea include taxing the wealthiest, creating first-time homeowner grants, and funding higher education. Bills have been proposed to research and fund reparations, but there is strong political dissent to the idea.

Job guarantee

Democratic leaders are pushing for a program that guarantees jobs. However, their proposals differ on what those programs would look like. Senators Cory Booker, Kirsten Gillibrand, and Bernie Sanders all support a work guarantee program that would place job-seekers in industries like construction or childcare, and guarantee workers a living wage and health insurance. Programs like these would cost more than $500 billion a year. However, proponents argue these programs could be paid for by adjusting the American tax system. India ran a jobs program with its Mahatma Gandhi National Rural Employment Guarantee Act, and South Africa has its own version with the Expanded Public Works Programme.

Incredibly expensive concert tickets

Music superfans will give a paycheck and a half to see their favorite artists. Tickets for Beyoncé, Adele, and Guns N' Roses are typically expensive because they are sold through a second market of scalpers. This type of market exists because a lot of people are willing to pay way more than the face-value ticket price. Ticket scalping is a $5 billion industry, but it would all disappear if musicians would perform more shows or sell their tickets at a higher price.

Ending the mortgage interest tax deduction

Homeowners can deduct the interest paid on their mortgages from their annual taxes for their first and second homes. This version of the tax break on home-buying has been in effect since 1986. India has a similar policy, while the United Kingdom overturned its interest deduction in 2000. Other European nations allow citizens to deduct any form of interest paid from their taxes. In America, progressive proponents for ending the mortgage deduction argue the measure benefits the wealthy and hurts low-income people who can’t afford to own homes. Ending the deduction could provide the U.S. government with $77 billion a year.

Paying college athletes

College football and basketball brings in millions of dollars annually for the National Collegiate Athletic Association. Recent court cases have attempted to get the NCAA to pay its college athletes, since the organization profits from student athletes who often don’t have time to work other jobs. Some economists have argued all Division I athletes should receive a cash stipend while others say athletes should be paid based on the revenue they generate for the program. Determining the value of each player and creating a fair system to pay them accordingly has proven difficult for economists.

Universal basic income

Universal basic income or guaranteed income programs are used throughout the world—from Finland to Kenya. In these programs, the government gives every citizen a monthly stipend, regardless of their current job or economic status. Proponents of the measure say the cash can greatly improve quality of life if people use it to cover basic costs like housing, food, and health care. While Democrats are the usual supporters of this kind of program, universal basic income does have some Republican support.

Ending occupational licensing

Some industries—such as installing home entertainment systems in Connecticut or running a floral shop in Florida—require members to be licensed to work. Some economists argue that work licenses stifle innovation and restrict the kinds of people who can work in an industry because they are costly and time-consuming. According to the Brookings Institution, a left-leaning think tank, occupational licensing unfairly burdens the impoverished who may lack the means to enter the industry. According to one study, licensed professionals lose up to $711 million in possible business because their license is only viable in one state.

Postal banking

Imagine being able to use your local post office like a bank. That is the basic idea behind postal banking, a policy proposal championed by New York Sen. Kirsten Gillibrand. Her plan would allow people to open checking and savings accounts at post offices and take out small short-term loans. These services would help people who do not have the means or capital to access larger banks and protect them from predatory payday lenders. Also, money flowing into the U.S. Postal Service could save it from its recent decline. The idea will likely gain Democratic support since Gillibrand is seen as a potential 2020 presidential candidate.

Single-payer health care

Championed by Sen. Bernie Sanders during the 2016 Democratic presidential primary, single-payer health care is getting more attention from mainstream Democrats. Under a single-payer plan, the government offers health insurance to all citizens, including coverage for primary care, prescription drugs, dental, and vision. America is the only large country in the world without universal health coverage. Opponents to such a system argue healthy Americans would be paying the bills of sick Americans, pointing out that 5% of people use 50% of health care costs.

State-sponsored cryptocurrency

Cryptocurrency offers users a digital money system that tracks all the transactions of an individual coin. With its ability to keep detailed records within the currency system, cryptocurrency can be more transparent for nations concerned with fraud or tax evasion. It also does not require a bank to hold it. Venezuela and Russia are looking into using the technology throughout their nation’s banking system, which would save money on banking fees and locate financial power more locally than in large financial institutions.

Value-added tax

A value-added tax taxes a product along the production line each time the item’s value is increased. For example, a piece of metal is taxed when it is turned from ore into a beam, then again when the beam it is placed in the body of a car, and once more when that car is sold. The tax is levied every time the item changes hands or value, which makes it a consumption tax. America is one of the few countries in the world without a value-added tax system. Opponents say this tax would hurt consumers because they would have to pay higher prices on the assembled items they buy. Democrats and Republicans both support and oppose creating this kind of a tax.

Legalize marijuana

Marijuana is legal for recreational use in Alaska, California, Colorado, Massachusetts, Maine, Oregon, and Washington. Recreational marijuana was legalized in Colorado in 2014, and one county experienced a $58 million boost in the local economy. California is expected to see a $15 million increase in sales revenue and 81,000 new jobs after legalizing the drug. States like Michigan and Maryland are expected to vote in the fall on whether to legalize weed.

Expanded paternity leave

The vast majority of countries have paid maternity leave, while just 70 have paid paternity leave. Forcing men to step away from work to care for their children has been shown to improve relationships and create more equitable workplaces. Since 2016, Swedish men have up to 90 days of paid paternal leave. In the U.S., women are protected in taking up to 12 weeks of maternity leave, but this is not required. There is no major proposal coming for paid paternity leave in America. However, experiments with such programs have proven positive for business.

Carbon taxes

Nearly 12 U.S. states are looking to create carbon taxes, which would force companies to pay a fee for emitting carbon dioxide or other greenhouse gases. Canada, China, and the European Union are in agreement on the idea, too. How much money the tax would generate for the U.S. government depends on the level of taxation, but some estimates put the figure in the trillion-dollar range. However, those speaking out against the tax say it will create a nightmare for environmental regulation.

Legalized sports betting

Betting on sports in mostly illegal in the United States, apart from a few states and a slowly growing list of states looking to change that. However, some economists have warned the combination of sports and smartphone technology could create young gambling addicts. Meanwhile, states like New Jersey who legalized the gambling in 2018 say they could earn $10 billion a year.

Baby bonds

Think of a baby bond proposal like a trust fund for every American. Under the proposal from Duke University, every child would receive between $500 and $20,000 based on the parents’ wealth. The money would be untouchable until the child turns 18. That’s when he or she will be able to use the money however desired. The proposals are a way of spurring savings, especially in nonwhite American households.

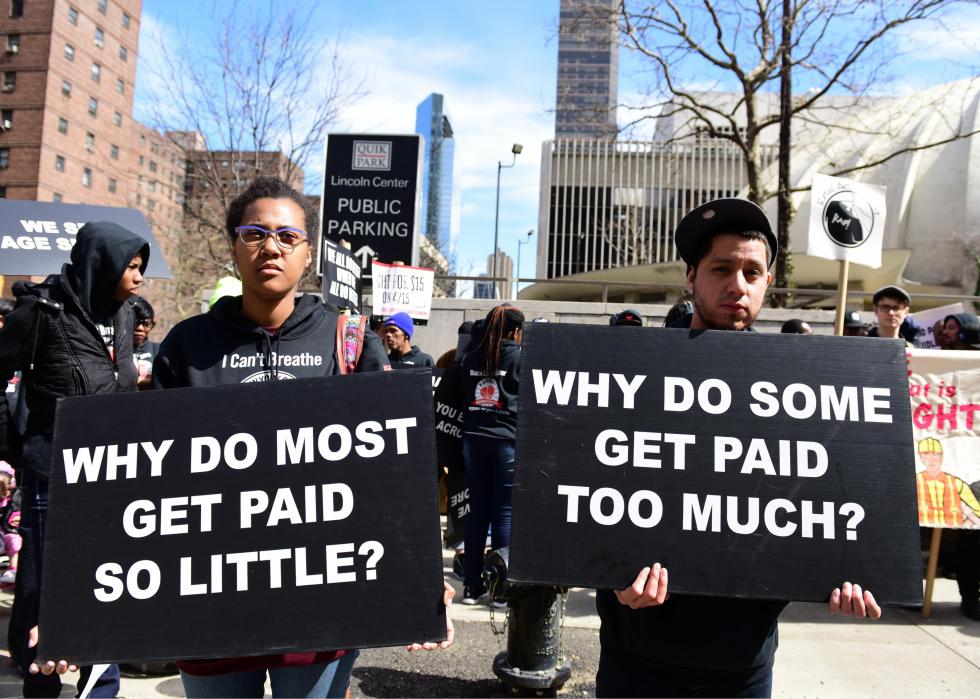

Living wages

Rather than simply raising the minimum wage to a certain amount, such as $15 per hour, some economists would like to see the United States move to a living wage system, where hourly wages are determined by what the cost is to cover basic necessities. For example, if you earn the current minimum wage in the United States, you would only be able to live sustainably in 12 counties across the nation. In Los Angeles, the minimum wage would need to be almost $30 for an adult with a child to cover costs. California’s current minimum wage is $11 per hour. Sen. Bernie Sanders called for this policy during his run for president.

Open borders

Having open borders, or no longer restricting the movement of people across countries, is a politically divisive issue. However, economically not having strict borders would increase the global gross domestic product by 147% or $78 trillion. An estimated 630 million people would move if there were no borders. However, very few political leaders around the world have championed this issue.