A closer look at the rise in jewelry spending led by middle-aged consumers

This story originally appeared on Jewel360 and was produced and distributed in partnership with Stacker Studio.

A closer look at the rise in jewelry spending led by middle-aged consumers

The COVID-19 pandemic hurt many industries, but one category shined: jewelry.

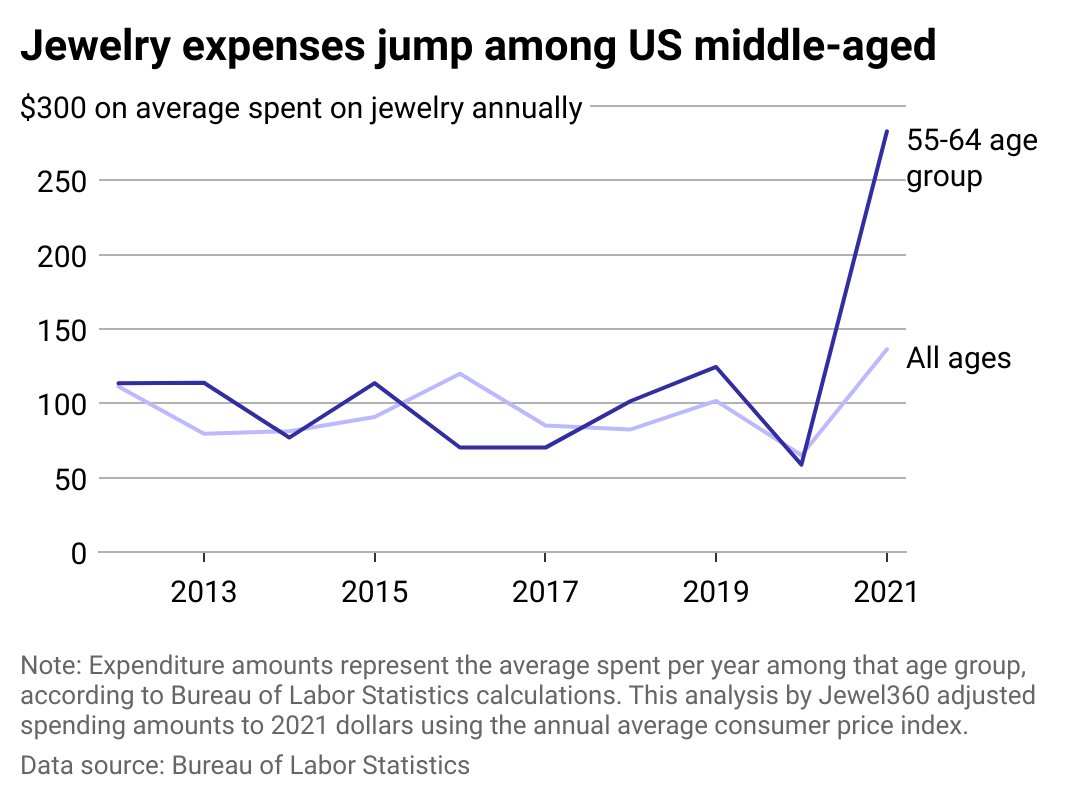

Overall jewelry sales increased nearly 38% in 2021 to $94.2 billion, according to the Bureau of Economic Analysis. Consumers nearly doubled their spending, laying out an average of $136.33 on jewelry in 2021, compared to $65.04 in 2020, the Bureau of Labor Statistics reported.

Using BLS data, Jewel360 analyzed the jump in average U.S. consumer spending on jewelry in 2021, largely driven by middle-aged adults. Expenditures were converted to 2021 dollars using annual average CPI values.

After a year of lockdowns, travel restrictions, and COVID-19 stimulus payments, consumers saw the allure of fine jewelry. A 2021 survey by industry group The Plumb Club found 39% of respondents bought more jewelry because they were at home more. Giving gifts of fine jewelry replaced marking special occasions with experiences, and people became more interested in jewelry's longevity and legacy potential.

The work-from-home trend also inspired jewelry purchases. The Plumb Club's survey found 41% of respondents wanted jewelry they could show off on video calls.

As couples resumed having weddings, jewelry purchases increased. In 2020, the number of weddings fell 40% to 1.27 million, according to The Wedding Report. Recovery began in 2021, with 1.93 million weddings as couples who postponed their celebrations rescheduled them.

While some of this spending growth is inflationary, the jewelry category experienced lower inflation rates than other consumer categories. In 2021, jewelry's 9% inflation rate was lower than other consumer categories like gas (50%), meat (15%), furniture (14%), and new vehicles (12%), according to the Consumer Price Index.

One element keeping jewelry prices in check was the price of gold. Gold prices fell 7% for the year, per the World Gold Council, even with higher consumer demand. Diamonds were also sought after. Industry analyst Edahn Golan reported that prices increased 25.8% from the lowest bottom point in July 2020.

After dipping amid the pandemic, jewelry sales spiked—especially among middle-aged Americans

Historically, middle-aged people typically spend the most on jewelry—Edahn Golan suggests this can be attributed to the fact they're generally at the height of their earning power.

Those with pre-tax incomes of $200,000 or more didn't feel as many economic effects from the pandemic, and they spent the most on jewelry, dropping an average of $4,153 per household in 2021, according to BLS' Consumer Expenditure Survey.

For some, jewelry purchases made during and following the peak of the COVID-19 pandemic may have served as a way to comfort themselves. Edahn Golan noted a trend in increased diamond jewelry sales in the years after 9/11 and the 2008 economic crisis. Sales since the pandemic have also followed that pattern.

Story editing by Jeff Inglis. Copy editing by Kristen Wegrzyn.