$1.5 billion of unclaimed tax refunds are about to expire

$1.5 billion of unclaimed tax refunds are about to expire

You wouldn't think that anyone would forget to collect a tax refund, but it happens. Typically, taxpayers have three years to file and claim their tax returns. However, because the 2020 tax season coincided with the beginning of the COVID-19 pandemic, the filing deadline for 2019 earnings has been extended until July 17, 2023. Anyone with unclaimed tax refund money from their 2019 earnings stands to lose this cash if they don't file their return by this fast-approaching date.

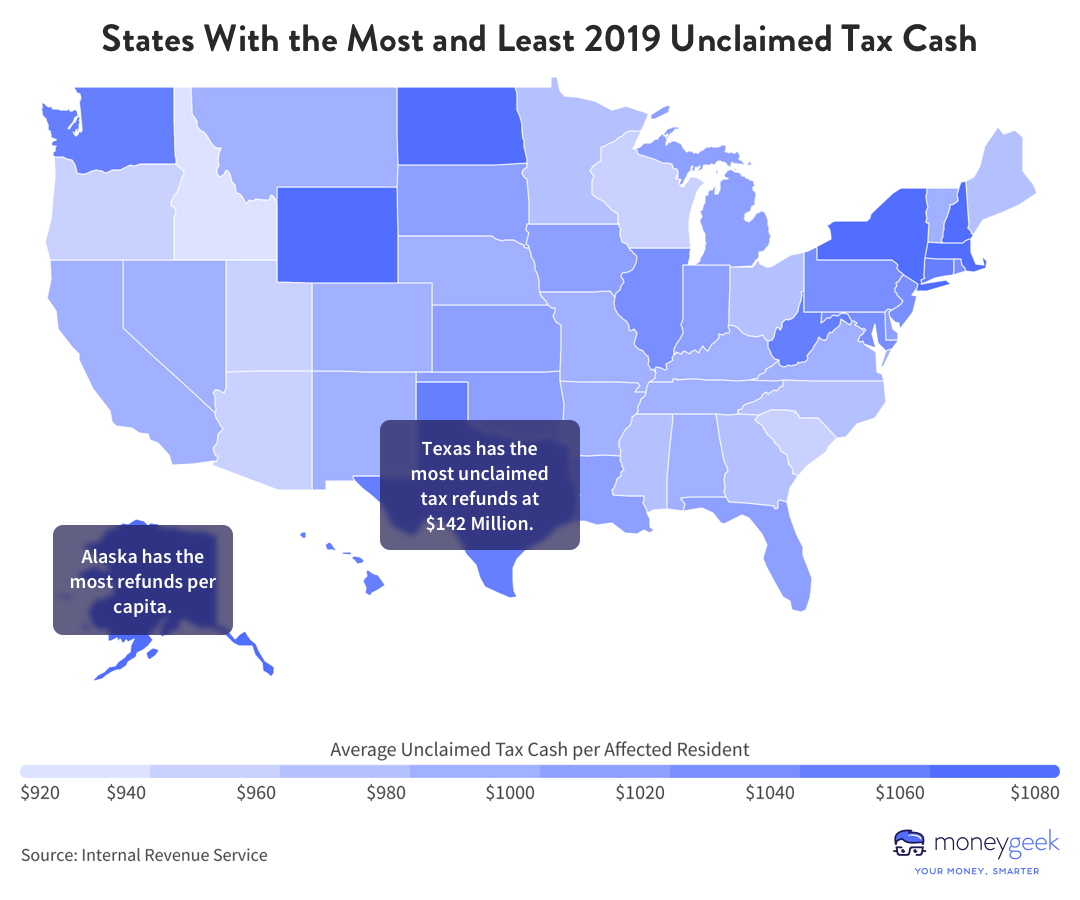

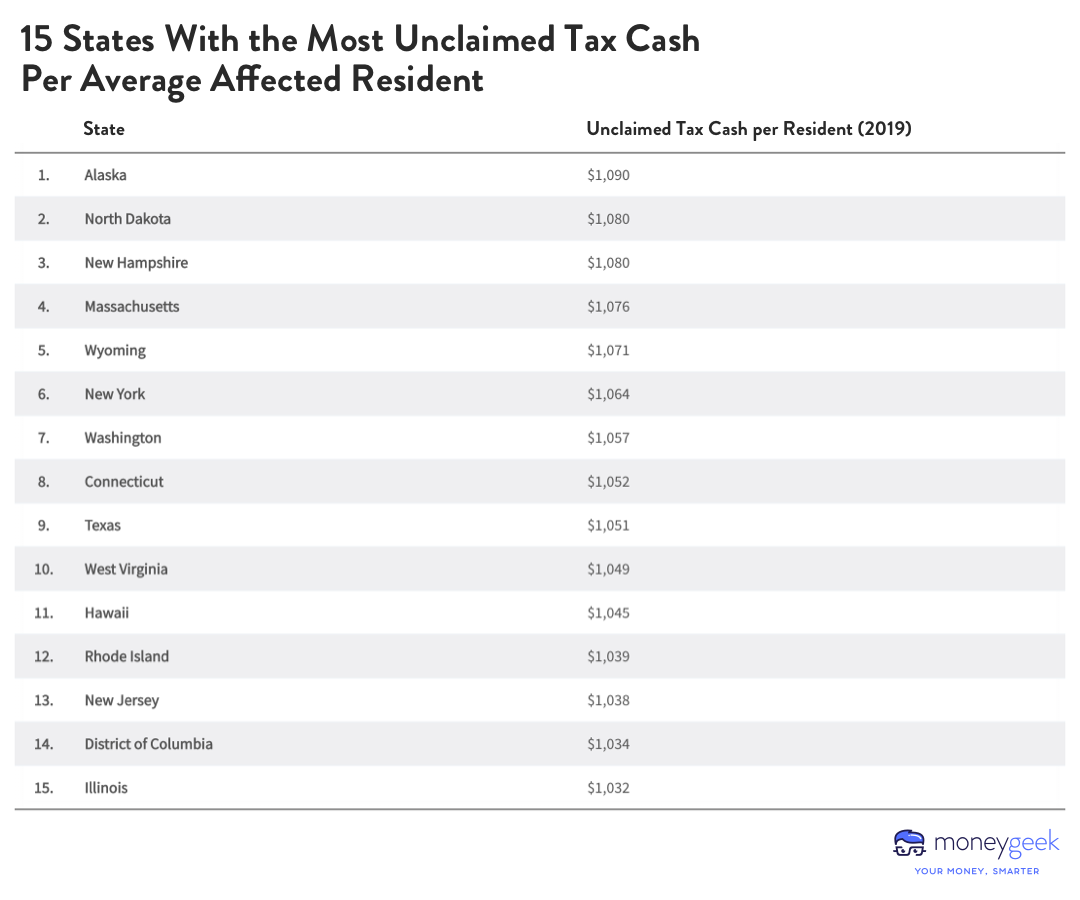

MoneyGeek analyzed 2019 unclaimed tax refund data from the Internal Revenue Service (IRS) and estimated the average amount of unclaimed tax cash per affected resident in every state. We found that while the average resident in some states could gain more from filing their taxes, Americans across the board are sitting on significant refunds.

KEY FINDINGS:

- There's still $1.5 billion in total unclaimed tax refunds for 2019 earnings — that's an average of $1,006 per eligible individual.

- Six of the 10 states with the biggest average unclaimed tax refunds are in the Northeast, leaving an average of $1,065 unclaimed for 2019.

- Residents of Alaska have the most unclaimed tax cash for 2019, valued at around $1,090 per affected resident. Idaho residents have the smallest amount of unclaimed money at $921.

Missing the July 17 deadline for claiming 2019 taxes could mean losing an average of $1,006

If you earned money in 2019 and didn't file your taxes in 2020, there may be some cash owed to you that you could lose out on if you don't try to collect it soon. If you have unclaimed taxes to collect, you could be in for a pleasant windfall, with the average unclaimed tax refund totaling $1,006.

In addition to a potential refund, many low- and moderate-income workers may also be eligible for the Earned Income Tax Credit (EITC), worth as much as $6,557 in 2019. This tax credit is available to individuals with incomes that met the following criteria in 2019:

- $50,162 ($55,952 if married and filing jointly) for those with three or more qualifying children

- $46,703 ($52,493 if married and filing jointly) for people with two qualifying children

- $41,094 ($46,884 if married and filing jointly) for those with one qualifying child

- $15,570 ($21,370 if married and filing jointly) for people without qualifying children

How to file your 2019 taxes

Fortunately, you have options if you think the IRS does owe you a refund for the money you earned in 2019. The process for filing older tax returns is the same as filing for the current tax year; taking the following steps will jumpstart the process of receiving your 2019 returns before the July 17, 2023, deadline.

Gather essential documents.

To file your 2019 taxes, you'll need several documents, including any W-2 and 1099 forms for income earned that year. If you don't have copies of these and are unable to obtain them through other means, the IRS has a "Get Your Tax Record" page that allows you to request electronic transcripts of wage and income statements, past tax records and more.

File your refund.

Depending on how complicated your tax situation is, you can file online with tax preparation software or hire a tax accountant.

Receive your unclaimed tax cash.

Typically, most people who file their tax refunds electronically receive them within 21 days. However, if you file your tax return by mail, it could take up to four weeks to receive your refund.

15 states with the biggest 2019 unclaimed tax refunds

MoneyGeek estimated the average amount of unclaimed tax cash each state has per affected resident to find the states with the most unclaimed cash left over from the 2020 tax season, which coincided with the beginning of the COVID-19 pandemic.

Alaska residents with unclaimed tax refunds stand to gain the most by filing unclaimed refunds for 2019 earnings by the July 17 deadline — an average of $1,090. Many of the states on MoneyGeek's top 15 list are located in the Northeastern United States, where the population and cost of living are high.

This story was produced by MoneyGeek and reviewed and distributed by Stacker Media.