This story was produced by Experian and reviewed and distributed by Stacker Media.

Average credit card debt by age in 2024

While a rising cost of living has consumers of all ages reaching for plastic, people in their prime spending years are seeing the greatest impact on their balances, according to Experian data.

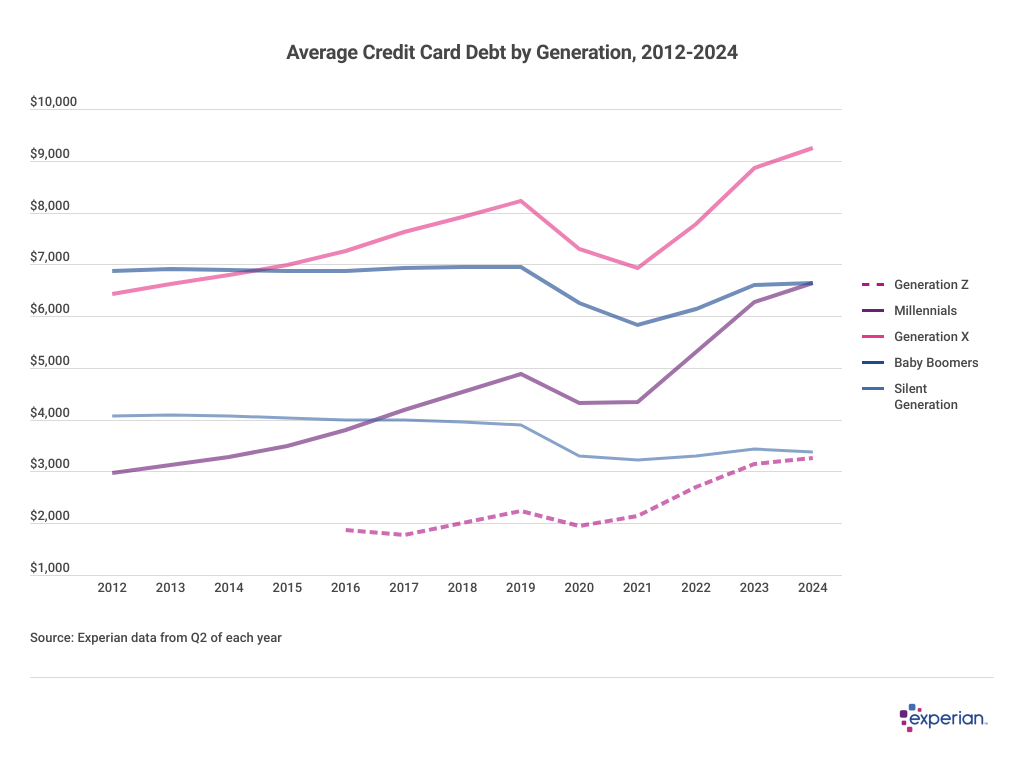

Average credit card balances have increased the most for millennials and Generation X, much more than balances of the two older generations. Generation Z's balance grew as well, although more modestly.

Credit card debt is the most common type of debt in the U.S., with 45% of households carrying a credit card balance from month to month, according to Federal Reserve data. However, pricey life events that tend to create lasting debt, including weddings and home renovations, are generally paid for by those in prime earning and spending years.

That spending in the prime of life is beginning to appear more prominently, Experian data shows, as interest rates and other factors raise balances for some, though not all, ages.

Average Credit Card Debt up for Gen Z, Millennials and Gen X

Despite a brief spending decline during the pandemic, Generation X's average credit card balance has grown by close to 50% since 2012, and now exceeds $9,000. Over the same period, the average credit card debt among millennials has more than doubled to just over $6,600. (Gen Z, the shorter squiggle at the bottom of the chart, are just getting started on their financial journeys.)

Compare the trajectory of the millennial and Gen X lines above with those of older consumers. Baby boomers, who in 2012 had the largest average credit card debt, now owe slightly less than they did 12 years ago. Those born before 1946 also have much less average credit card debt than they did in 2012.

One explanation is well known: Older consumers tend to spend less than younger consumers, no matter their credit. According to Department of Commerce data, personal expenditures peak at ages 45 to 54—prime Gen X years—and then decline with age.

Generation X, who in 2015 surpassed baby boomers as the generation with the largest average credit card debt, shows no sign that their credit card balances will be declining anytime soon. Millennial credit credit card balances show a similarly aggressive shape to that of Gen X, the latter soon eclipsing the balances of baby boomers as well.

Meanwhile, the average balances of older Americans, as expected, have continued to plateau or decrease, even in the face of rising interest rates and inflation.

What's Changed and What Hasn't

While it may be tempting to resort to moralizing about spending among those with growing credit card balances, the explanations are more grounded in economics than changes in consumer behavior. Or, at least, the economy is driving consumer behavior in new directions, which is now showing up on many people's credit card statements.

In 2012, most consumers were still dealing with some sort of fallout from the Great Recession and the general collapse in residential home prices. The average FICO Score was well below 700, a result of increased delinquencies. Lenders pulled back on the number of loans they would underwrite, and increased unemployment rates meant many consumers couldn't keep up with either home, auto or credit card payments.

In sports terms, we might consider the first half of the 2010s as a rebuilding period. Unemployment rates declined, some homeowners got relief from mortgages that were dwarfing the market price of their homes, and consumers got new protections from less-than-friendly credit card terms that would often trigger late payments, such as floating due dates and universal default triggers.

By mid-decade, much of the economy was on sounder footing, as lower unemployment rates meant that consumers could borrow again—assuming their credit was up to snuff. For many, that proved to be the case, as average credit scores climbed, and have continued to climb nearly every year since.

Even with an unprecedented plunge in economic activity due to the pandemic, and inflation that still persists to some degree, consumers were able to maintain their credit scores. If anything, Generation Z is probably the most credit-aware generation the U.S. has seen. Consider, even 20 years ago, how difficult obtaining one of your credit scores was. Now, more than 80% of consumers know their credit score, including most of Generation Z, according to an Experian survey.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.