Average credit score in the US climbs to 715 in 2023: Here's why that matters

Average credit score in the US climbs to 715 in 2023: Here's why that matters

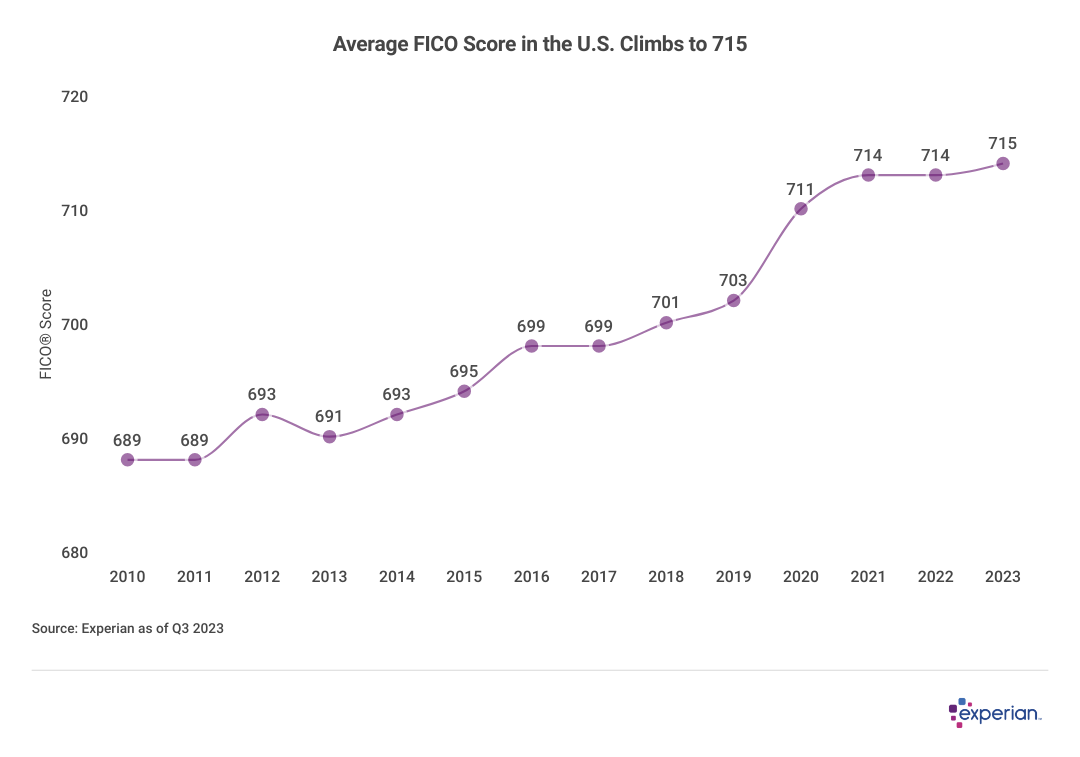

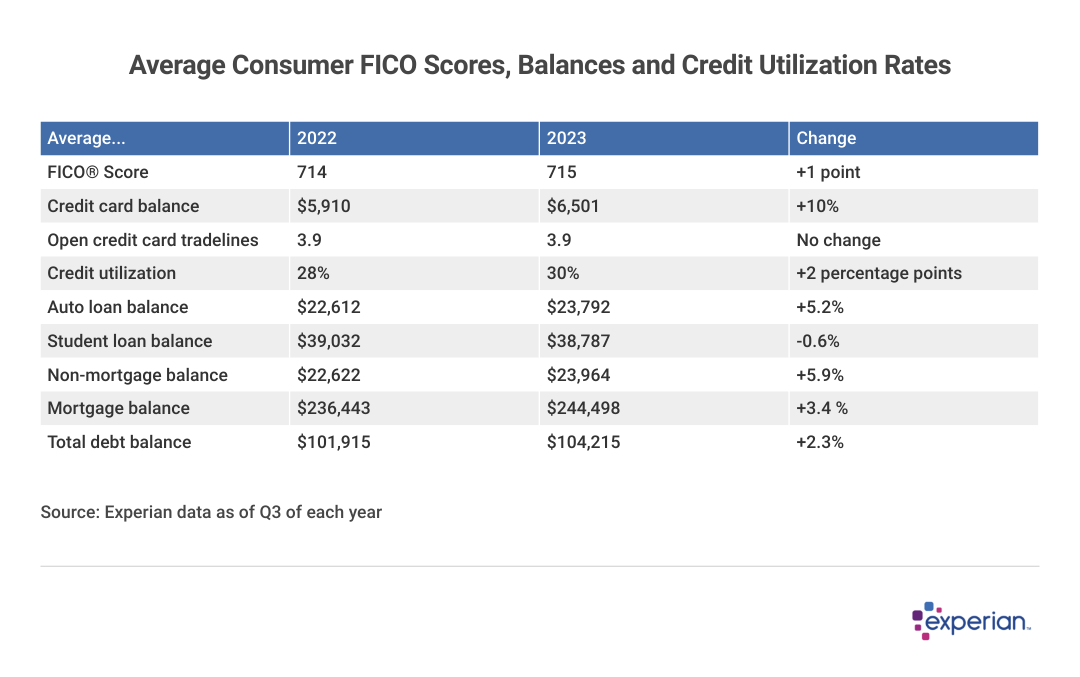

The average FICO Score in the United States was 715 in 2023, according to Experian data, increasing by one point from its 714 average in the third quarter (Q3) of 2022. It marks the tenth consecutive year that average FICO Scores in the U.S. haven't decreased on an annual basis. The last annual decline occurred in 2013.

Here are some of the key consumer credit highlights of in 2023:

- Despite economic headwinds, consumer finances remained strong. Except for the anomalous-in-every-way recession sparked by the pandemic in 2020, economic growth, near-full employment levels, lower delinquency rates, and lower debt service obligations, as well as a more informed consumer borrower, have all played a role in the average FICO Score increases over the past decade.

- Consumers are now largely aware of the importance of credit scores. Many financial transactions most consumers engage with—such as auto financing and credit card purchases—depend on credit scores to qualify and participate. The economic turmoil of the past few years has caused some consumers to take a renewed interest in their personal creditworthiness (more on that later).

- Credit scores continue to tick upward (for now, at least). While an average FICO Score on the upswing can indicate, in very broad terms, that consumers have fared well in recent years, it doesn't necessarily mean that average score increases will persist indefinitely.

The following analysis examines the effects economic forces have on Americans' credit scores.

Since 2013, the average credit score has risen nearly 25 points

Despite the slight increase over the past 12 months, average FICO Scores have meandered throughout 2023, with average scores increasing from 714 to 716 this past summer, before settling at 715 at the end of the Q3 2023. Nonetheless, average balances for most types of loans, as well as both fixed and variable rates on those loans, have increased sharply as the Federal Reserve attempted to keep the lid on inflation by raising the key fed funds rate throughout 2023.

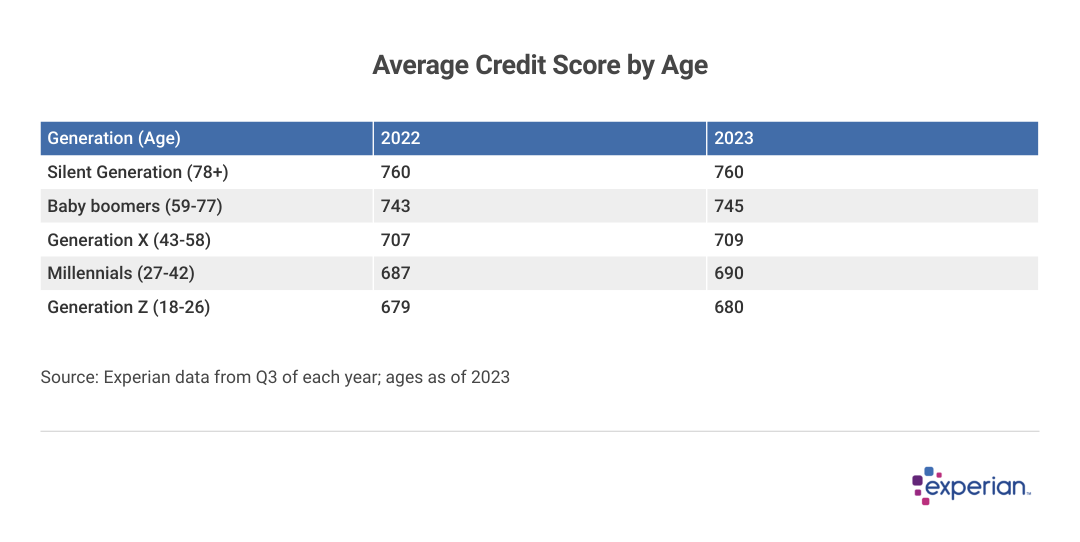

Average credit scores by age increase slightly for most

FICO Score increases were broadly distributed among the generations, with only the Silent Generation not showing an increase in their average FICO Score over the past year. Other generations notched a one-, two- or three-point increase in 2023. On average, younger generations have scores that are considered good, while the average scores of the two older generations are considered very good to lenders.

Although a consumer's age isn't considered in determining a FICO Score, the length of their credit history is a factor, as the scores above neatly illustrate. Seniors likely have accrued years of credit history, while Generation Z is just getting started on their financial journeys.

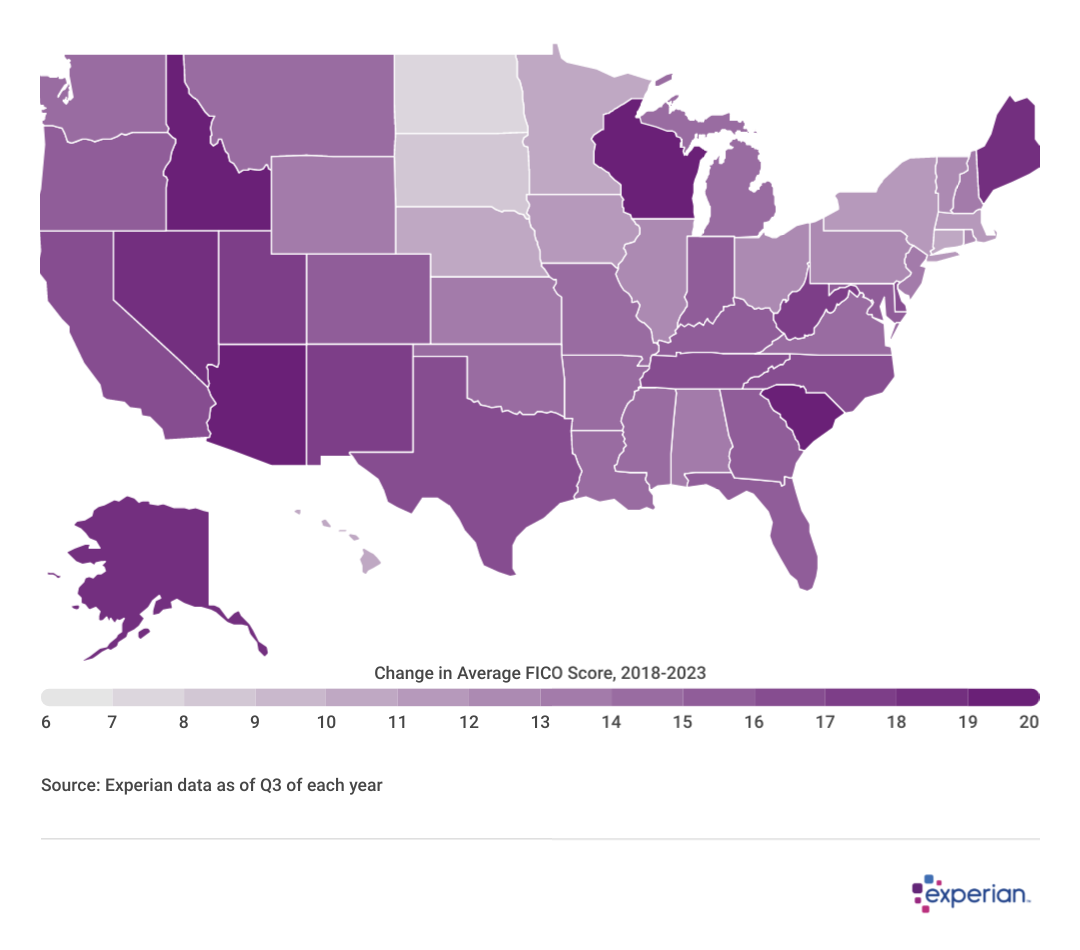

Average credit score by state changes slightly

Average FICO Scores in most states remained unchanged or only moved by one point since 2022, suggesting that consumer credit remains stable regardless of regional or local economic conditions. The outlier states were dispersed throughout the country, with Kentucky, Maine, New Mexico, Oklahoma, South Carolina, and West Virginia average scores jumping three points in the past 12 months.

Average credit scores over the past five years have shown significant improvement at the state level, with average scores increasing by anywhere from six to 19 points during that time frame.

Credit utilization ratios increase as lenders mind credit limits

Lenders are being more discerning about how much credit they'll extend to their borrowers in the form of unsecured credit lines. That tightening of credit limits, combined with an overall increase in credit card balances throughout 2023, contribute to consumers now using 30% of the credit extended to them, up from 28% in 2022 (both figures as of Q3 of respective years).

At an individual level, 30% usage of one's credit is the point at which credit utilization begins to have a greater negative effect on credit scores. In general, the lower the utilization ratio, the better for credit scores.

Average utilization ratios for those with a 660 FICO Score (considered fair by lenders) was 54% in 2023. But for those with a 720 FICO Score (considered good), the average utilization ratio was 34%.

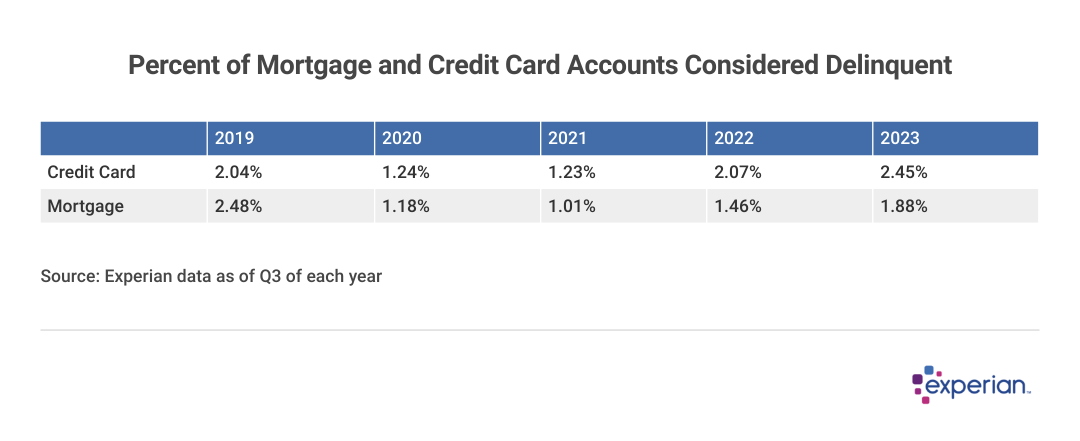

Delinquency rates return to normal levels, but trend is still upward

Delinquency levels were abnormally low during the pandemic, as government relief programs and subdued economic activity meant more consumers than usual were keeping up with credit card and other debt obligations.

Now that economic activity has normalized, relatively speaking, so have derogatory marks on credit reports, which can reduce FICO Scores. As of Q3 2023, 2.45% of credit card accounts were 30 or more days past due, according to Experian data, up from 2.07% in Q3 2022.

Among other delinquency data, mortgages remain a bright spot. As most homeowners with mortgages financed them at rates significantly lower than the 7% or higher rates prevailing for a 30-year fixed-rate mortgage in 2023, more homeowners are keeping up with their payments than before the pandemic. Only 1.88% of mortgage borrowers are behind on their payments in Q3 2023, versus 2.48% in Q3 2019.

Where consumers stand heading into 2024

While there's no such thing as an average consumer, there are plenty of measurable attributes credit bureaus collect about U.S. consumers to compile averages. Trends, if any, can confirm other observations about the economy.

In general, while average balances for most types of debts were higher in 2023 than in 2022, the rate of the current increase is significantly less than the 2021-to-2022 increases. Broadly speaking, the slowdown in inflation throughout 2023 contributed, as expected, to a slowing of the amount of debt consumers are assuming.

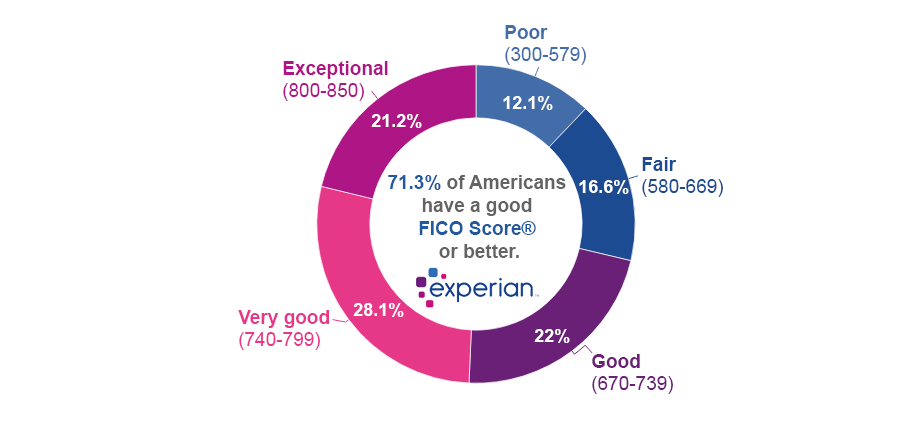

Meanwhile, average FICO Scores remain healthy, and increased by a point from 714 to 715 in 2023, which places the average FICO Score in the higher end of the good credit score range. A decade ago, the average FICO Score was on the lower end of the good range.

Why are average scores significantly higher than 10 years ago?

There are a number of causes behind the steady increase in scores over the past decade. Some are observable in the economic data, such as steadily decreasing unemployment levels between 2010 and now. Demographic changes have also played a role as the number of older consumers grows. The number of Americans over age 65 grew by almost 40% in 10 years, and older Americans have been shown to be less likely to miss payments.

But perhaps the biggest contributor to rising credit scores is that more consumers are willing and able to pay all of their bills. Credit awareness and education has grown exponentially since the global financial crisis of 2007 and 2008.

This change contributes to credit score increases as much as improved economic conditions.

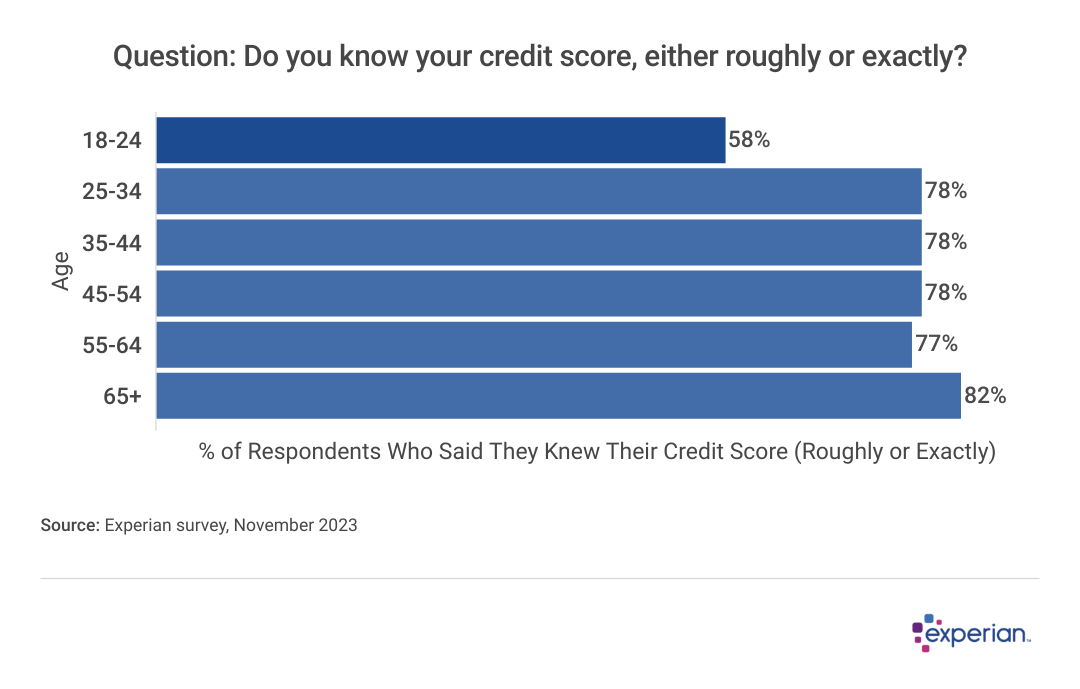

Most consumers claim to know their credit score

Most consumers—nearly 4 in 5—say they know their credit score, according to a November 2023 survey. The youngest consumers surveyed (ages 18 to 24) were less sure where they stood. Understandable, as many young adults under age 25 are only beginning to pay their own bills and handle other financial tasks.

Nonetheless, consumers broadly appear to have a decent understanding of where they stand with their current credit scores, which equips them with key information they can use to make better financial decisions.

How to improve your credit score

First things first: If you're one of the consumers with an exceptional credit score of 800 or higher, there may still be some extra points for you to collect—by continuing to make on-time payments on any debt obligations. But keep in mind it won't necessarily result in lower loan or credit card rate offers from lenders, as you're likely already receiving their lowest rates.

But for the vast majority of consumers with FICO Scores lower than that, the same rules apply that likely allowed those consumers to reach the exceptional level over a number of years. Some of the primary factors affecting your FICO Score are:

- Paying all of your bills on time: Most types of missed payments are reported to credit bureaus by lenders after being 30 or more days late, although some types of bills won't be reported depending on the amount and type of bill received.

- Per Federal Reserve data, average credit card APRs are exceeding 22% as we enter 2024. For consumers carrying balances, reducing the balances on credit card accounts can improve FICO Scores faster than waiting around for your credit to age. And if your credit is already good or better, then perhaps consider either a 0% introductory APR balance transfer offer from a new lender, which could lower interest paid for a number of months, or a debt consolidation loan, which for those with good credit will likely result in a fixed-rate loan that's lower than the balances on one's variable-rate credit card balances.

- Applying for credit only when needed: New credit card offers—especially those enticing consumers with bonus airline miles or other incentives—may be exciting, but consider that many offers will result in a hard credit inquiry from the lender. Typically, applying for new credit will temporarily depress your score slightly. This is especially important for consumers who are considering financing bigger-ticket items like a car or a home in the near future, where higher scores can translate into significant savings in lower interest payments.

Adhering to the three suggestions above will improve credit scores for most people. An added bonus: The longer you lower balances and make on-time payments, the older your credit history also becomes, which is another positive that influences credit scores.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.