Despite continued economic struggles, consumer credit scores are on the rise

Despite continued economic struggles, consumer credit scores are on the rise

Consumer credit was in an interesting place midway through the 2023 fiscal year. Economic indicators painted a mixed picture at the end of the second quarter (Q2), with some looking up and some seeing a downturn.

For this analysis, Experian examined publicly available economic data as well as representative and anonymized credit data from Q2 2022 through Q2 2023—the most recent quarter available.

A few key factors are represented in the plus column:

- Most industries are still hiring; unemployment rates and claims remain low.

- Most consumers say they're doing at least OK economically.

- Credit scores continue to improve.

But the minus column is far from blank:

- Incomes aren't keeping up with inflation.

- There are fears that U.S. consumers have largely exhausted the savings they socked away during the rainy days of the pandemic.

- Increasing monthly payments for credit cards, mortgages, and auto loans, among other types of debt, are claiming a greater share of consumers' income every month.

- In the months ahead, new bills (student loan repayments have resumed after a three-year pause), and higher bills (insurance premiums are up sharply) could add more to existing debt burdens.

- Anyone purchasing a new home or car is paying much more than they were five years ago, even after controlling for inflation.

Although interest rate hikes over the past year have helped tamp down inflation, higher credit card interest rates as a result of those hikes will influence current household balances as well as future spending. (As of Q2 2023, the average credit card interest rate topped 22%, according to Federal Reserve data.)

On the whole, it certainly isn't a clear sky for the consumer as we approach the 2023 holiday season. Nonetheless, market observers and financial executives appear to be split on consumer resilience. In this midyear consumer credit review, we'll look at the changes in average FICO Scores and balances for major types of consumer debt, and go over some of the head and tail winds driving the consumer's weather vane for the rest of 2023 and beyond.

Average FICO Score reaches 716 as consumer debt growth slows

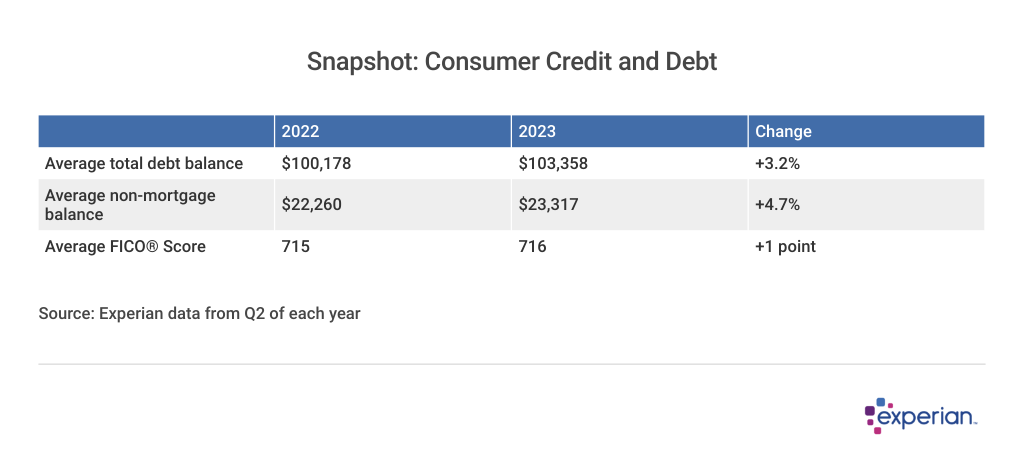

Growth in average consumer debt levels has slowed compared with the prior year. From Q2 2022 through Q2 2023, average total debt balances grew 3.2% to $103,358.

When looking at debt including auto loans, personal loans, and credit cards but excluding mortgages, the average balance increased 4.7% to $23,317. Over the same period, inflation increased by 3%, as measured by the consumer price index.

Disparity between non-mortgage debt and inflation has cooled this year

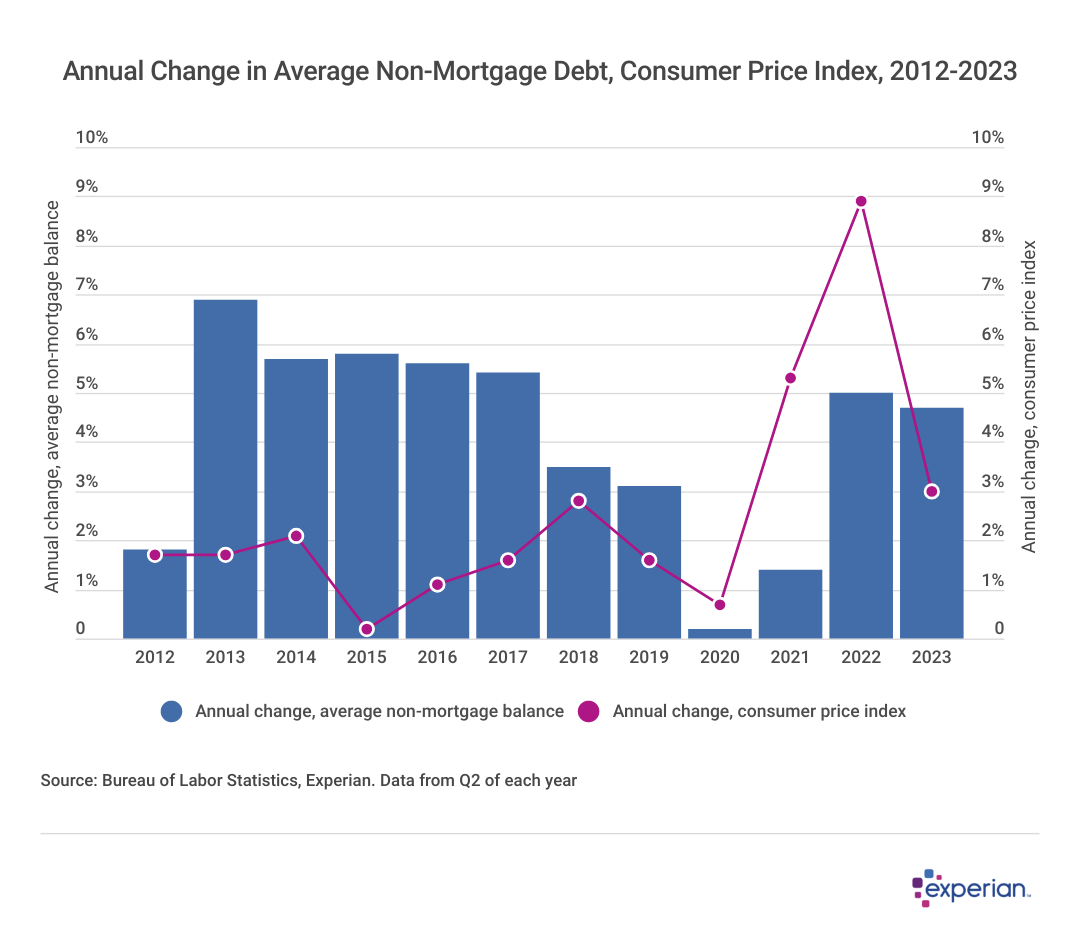

In looking at historical changes in average total debt balances and how those fluctuations stacked up relative to inflation trends over the same period, non-mortgage balances typically grew faster than inflation. Non-mortgage balances also grew faster compared to the consumer price index, which was the case throughout the past decade.

The aberration was the period from 2020 to 2022, when inflation grew faster than non-mortgage debt. Household spending, which can increase non-mortgage debt, is also increasing more than inflation. Spending increased by a 4.8% annual rate this past August, more than the rate of inflation.

Some increase in non-mortgage debt can be indicative of a healthy economy, as it's traditionally viewed as a result of consumers feeling confident that they'll have the wherewithal to finance and afford new discretionary spending.

Average consumer credit balances by type

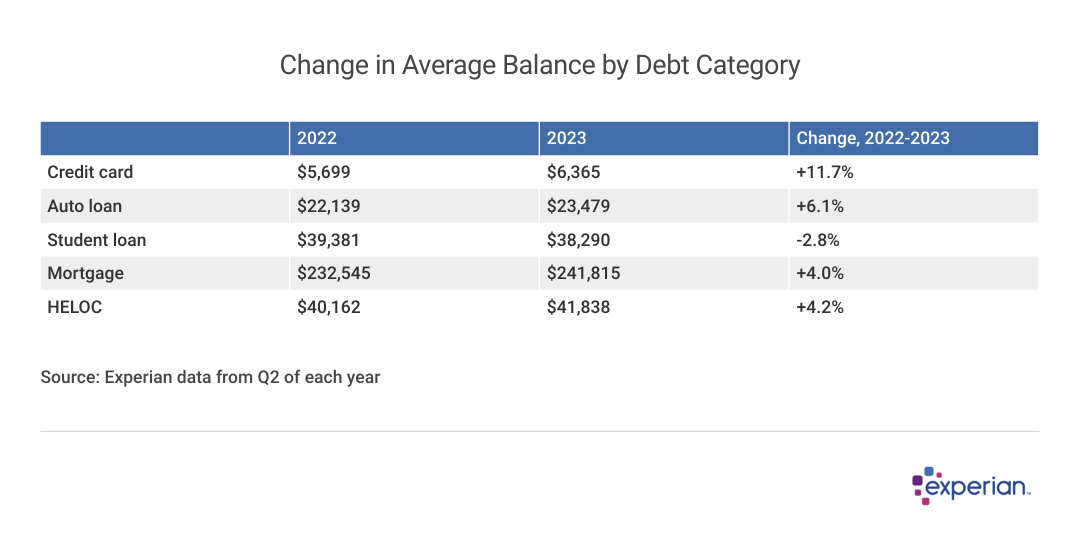

Average balances carried by consumers increased in 2023, though the rate of increase slowed for each type of debt.

Average mortgage, HELOC balances increase despite fewer new mortgages

Even though mortgage financing activity has slowed considerably—new mortgages are being written at just over half the rate they were in 2022, which was already a slow year—mortgage and HELOC balances continue to increase, each up 4%.

Credit utilization and delinquency rates increase from 2022

Average credit card debt continues to increase at double-digit rates. Some of the increase may be due to pent-up demand for travel, but larger interest charges are playing a co-starring role. The average credit card balance among consumers is $6,365 as of Q2 2023, which is 11.7% higher than it was at the same point in 2022.

Meanwhile, average credit utilization rates increased from 27% to 28% in 2023. While still not as high as in previous years—average utilization rates were higher as recently as 2019—the direction indicates that consumers are relying more heavily on credit.

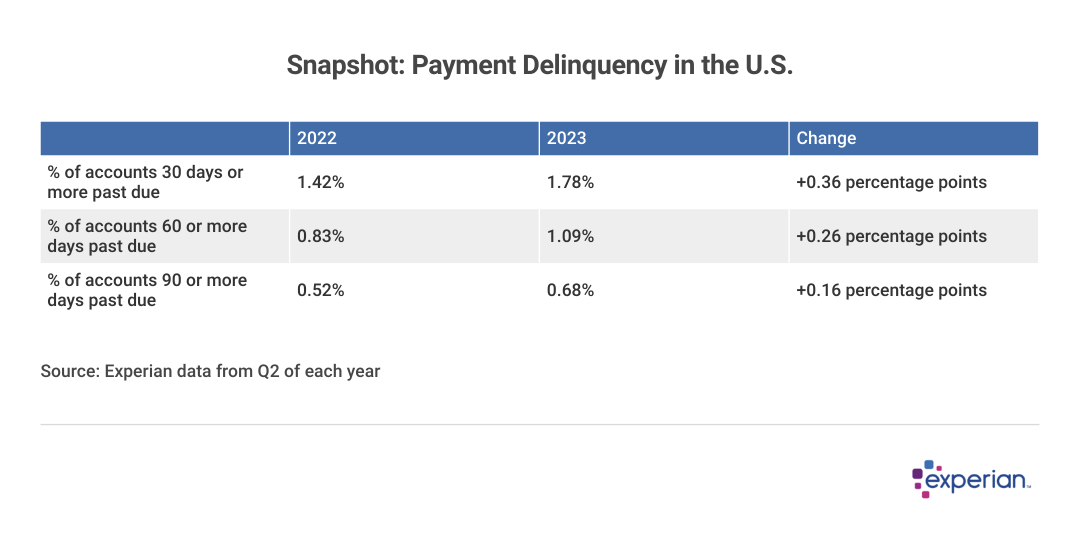

Delinquency rates also increased in 2023, but, like credit utilization, still haven't exceeded the pre-pandemic levels seen in 2019, when the economy was still considered relatively healthy. The percentage of accounts reported as 30 or more days delinquent was 1.78% as of Q2 2023, still lower than the pre-pandemic level of 1.90% in 2019, according to Experian data. About a third of delinquent accounts are 90 days or more past due.

These delinquency levels include most types of consumer credit accounts, such as credit cards, auto loans, and mortgages.

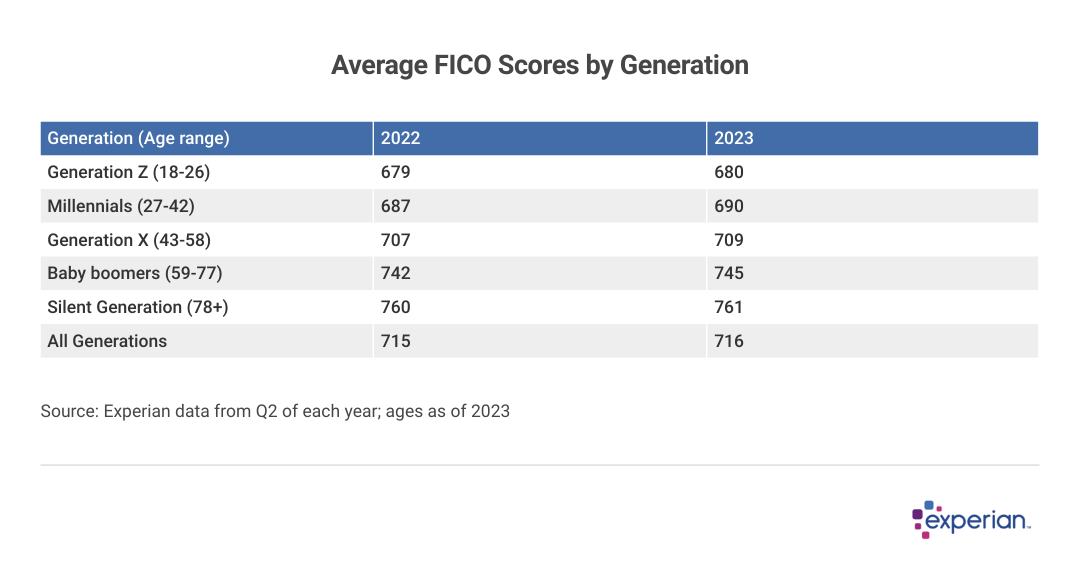

Average FICO Scores continue to improve across all age groups

Despite increasing delinquency levels, and anxiety about the financial health of the consumer headed into the holiday season, credit scores continue to improve. Overall, the average FICO Score in Q2 2023 improved by one point, from 715 to 716.

Every age cohort Experian tracks saw improvement in average FICO Scores as well. The eldest among us, the Silent Generation, currently sport an average credit score of 761, which is firmly within the "very good" credit score range of 740 to 799. Baby boomers and millennials improved the most, with both generations improving their FICO Scores by three points from 2022 to 2023.

While there may seem to be a contradiction between rising delinquency rates and rising credit scores, consider that the vast majority of consumers are largely still able to pay their debts on time. As payment history is the most important factor in calculating one's FICO Score, making timely debt payments can go far in improving FICO Scores, both for individuals and the population as a whole.

Will Americans start spending (and borrowing) less?

Two broad types of consumer spending drive two-thirds of the U.S. economy. First, there's spending on consumer staples, which includes the basics of food, clothing and other items essential for a baseline quality of living. And then there's consumer discretionary spending, or money spent on movies, concerts, vacations, holidays and the like—in other words, the fun stuff.

It's the latter on which market observers are placing their concerns, as well as their bets, on the overall economy as we near the holiday season—when discretionary spending peaks. To see where consumer credit may be headed for the remainder of 2023, watch the following areas.

Higher average monthly payments

Already, Experian data shows that average monthly payments required to service consumer debts increased by 8.5% in the 12 months culminating with Q2 2023. On average, consumers send $1,148 to banks and other financial institutions to repay loans each month.

While most people's mortgages don't increase from one month to the next, other expenses associated with debt, such as credit card minimum payments, are evidently increasing for many consumers. And a new auto loan or lease is certainly likely to be higher if a consumer buys or leases a new or used vehicle.

Also, this isn't an up-to-the-minute reflection of recent changes in average monthly payments. Additional monthly payment costs, particularly those about to affect student loan borrowers, have yet to be factored into the data. And mortgage rates are even higher than last year, so any new mortgage borrowers will likely pay significantly more each month than many current owners with rates of 4% or less on their existing mortgages.

Interest rate pause, then what?

We're much closer to the end than to the beginning of interest rate hikes, according to experts. The federal funds rate, currently 5.50%, is either at or near the level where the Federal Reserve is likely to no longer raise rates.

There appears to be little agreement on what happens next—both with the economy and in the committee room where the Federal Reserve board meets. The expectation among some is that inflation needs to be completely extinguished before the Federal Reserve will consider lowering the key fed funds rate, which, in turn, would lower borrowing rates for credit cards, mortgages and other loans. For their part, members of the Federal Reserve expect that they may keep rates higher for longer, with most members of the Federal Open Market Committee expecting its key policy rate will still be above 5% throughout 2024.

Until rate hikes definitively end, the economy may need to endure the potential pain of slower growth—not only possibly less holiday shopping, but even fewer home sales, either of which could mean the need for fewer workers down the road.

Credit utilization and loan officer expectations

As for the here-and-now of mid-2023, lenders are becoming choosier about the borrowers they work with, and adjusting their terms accordingly. According to the most recent Loan Officer Survey in July, banks reported tighter levels of standards in every loan category compared with 2022.

Part of that tightening can be expressed as extending less credit to consumers, even if they qualify for a credit card or a loan. So credit utilization can increase not only for consumers carrying higher balances but also lenders reducing credit limits for some of their new and existing customers.

Everything everywhere all at once as headwinds multiply

Not only are consumers experiencing higher interest rates, higher monthly payments and tightened qualifications for receiving additional credit, but they will face numerous new headwinds in the coming months.

- Student loan borrowers resume monthly payments. Student loan payments will average more than $200 per month per borrower, according to Experian data. While a new repayment plan implemented by the Department of Education may mitigate the monthly payment amount for lower-income borrowers, any additional student loan payments will likely eat into consumer savings, discretionary spending or both.

- Consumers face rapidly increasing insurance premium costs. While auto insurance premiums continue to rise, repairs and replacements of vehicles are also more expensive. In many regions of the country, homeowners insurance has also sharply risen due in part to increased environmental risks.

- Borrowing costs for the consumer have increased, reducing discretionary spending. With average credit card APRs of 22% in mid-2023, those consumers carrying balances may already be feeling the pinch and may be unable to spend more. Those who do have room to spend may spend less than they otherwise would if APRs were lower.

The U.S. consumer is famously considered resilient in the financial media. All told, as 2023 comes to a close, consumers are likely to face one of their biggest financial challenges yet.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.