This story originally appeared on MoneyTransfers.com and was produced and distributed in partnership with Stacker Studio.

What it costs to send money from 21 countries

Sending money between countries and continents is increasingly common. Every day, people send money to family members across the globe. Someone might need to transfer money to pay for a destination wedding, add a prized antique from an overseas dealer to an art collection, or buy a specialty product from another country.

Transferring funds comes with a fee, though there are now cheaper and faster ways to send money worldwide. This is reflected in the global average transfer per transaction cost decline in 2022 from 6.09% in the first quarter to 6.01% in the second quarter, as reported by the World Bank. Sending money from country to country is referred to as remittance. A typical remittance transaction starts with the sender paying the remittance to the sending agent via check, cash, credit or debit card, or other means of payment. The sending agent, in turn, instructs his agent in the receiver's country to pay the remittance to the receiver. These sending agencies, banks, or post offices are the primary remittance service providers.

Depending on your region or country, the cost of sending or receiving money from other countries can vary greatly.

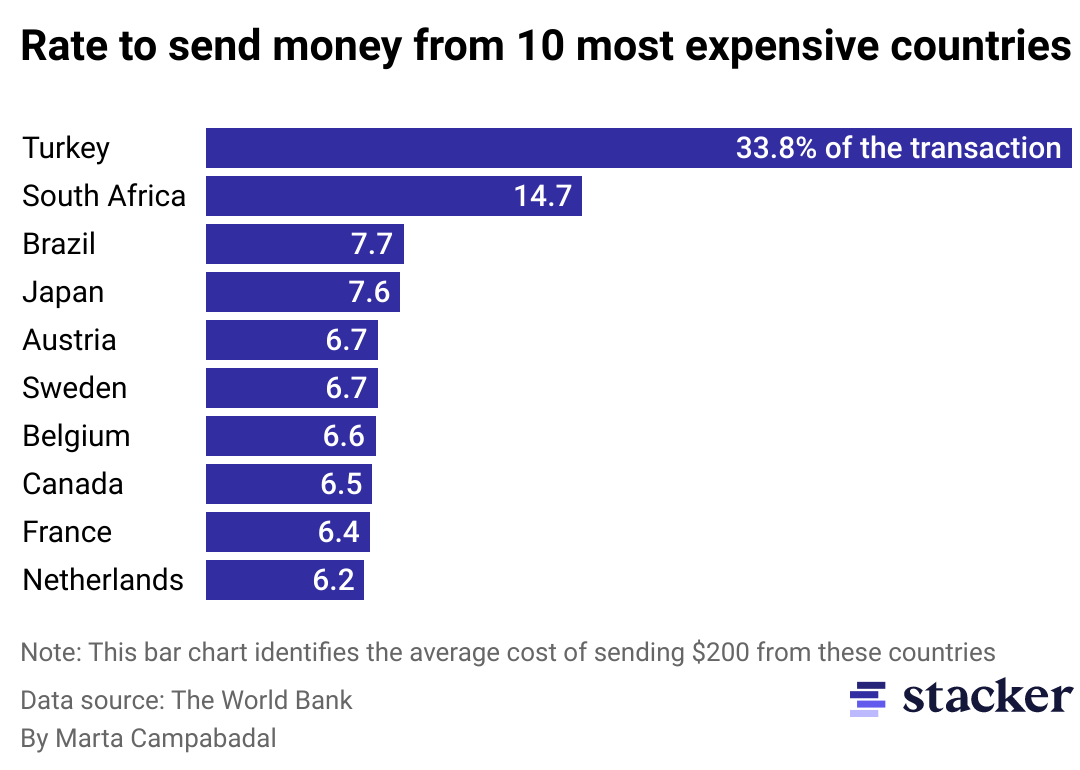

In places like Turkey, for example, each $200 transfer can incur a 33.8% fee, while in South Korea, just 2.9% is charged. There are numerous contributing causes to where a particular country stands on the transfer fee spectrum. Saudi Arabia, for example, is famous for its seemingly endless oil wealth. The extremely prosperous Arab country is home to several expatriates who represent their country's interests as far as they concern the Saudi oil and commercial industries, thus monetary transfers into and out of the nation are plentiful and volume contributes where high rates might otherwise be demanded.

Australia's regulatory organizations require potential remittance service providers to register with the Australian Transaction Reports and Analysis Centre before offering such services. Nevertheless, fees in the nation remain moderate relative to many other nations with competitively developed financial networks. And Brazil recently reached an all-time high in remittances of $454.14 million in June 2022, which continues a steady growth since 2018.

Due to the impact of the COVID-19 pandemic, remittance totals to various countries have shifted. In 2018, Portugal topped all EU member states in remittances received, whereas, by 2020, France, Germany, and Belgium headed the list of inbound personal remittances. As of 2021, none of the top five countries for total remittance were EU members. And one of the priciest countries in the world for transfers, South Africa, is also the one with the largest remittance send markets in the whole African continent.

Regardless of the fickle nature of global financial architecture, the transfer of funds is a significant financial driver in most nations. To take a look at the differences, MoneyTransfers.com used data from the World Bank's remittances report to determine average fees incurred when sending money from 21 countries that are among G20 countries. The G20 is a consortium of 19 countries and the European Union that represent more than 80% of global gross domestic product. Because transfers are only possible between certain countries, not all G20 countries are listed. While the World Bank monitors prices across all global geographic regions, it did not include any data on corridors originating within Russia due to the ongoing war in Ukraine in the first half of 2022.

Furthermore, due to a lack of data, its research didn't add select countries like China, Indonesia, Argentina, Mexico, Russia, and 17 countries in the European Union. The countries were ranked from least to most expensive based on the average percentage charged for sending out $200 and $500, respectively, or their respective equivalent.

Keep reading to see what it costs to send money from 21 countries.

The 5% commitment

There is a combined effort by the G8 and the G20 to reduce the global average total cost of sending money to 5%. One of the UN's Sustainable Development Goals is to bring the percentage down to 3% by 2030, making it easier and more accessible for a broader range of parties to move money around domestically and to other countries. This goal is especially favorable for migrant senders whose remittances make up a good portion of the revenue of developing nations. Current reports show Turkey is the most expensive country from which to send money, with an average cost of 33.8% of the transaction being deducted. South Africa follows closely, with 14.7% of the transaction being paid in fees.

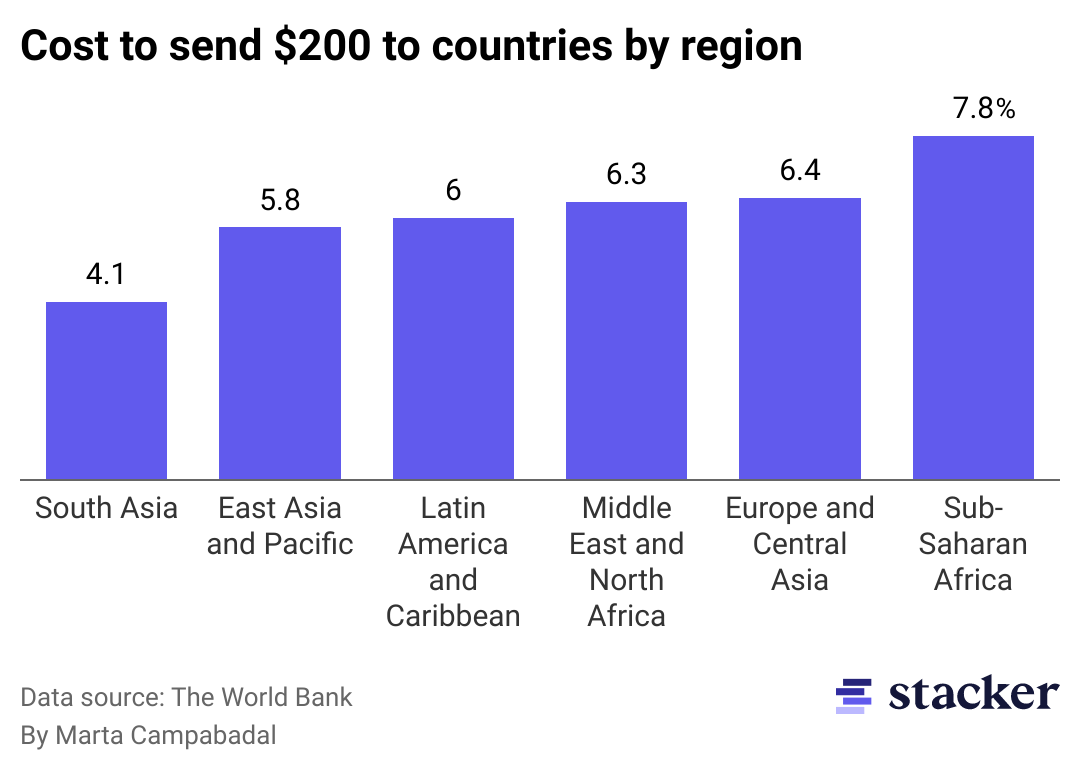

Regional averages suffer from a disparity in cost between using banks and digital channels

There are several choices for senders when it comes to remittance. Senders can opt for digital payment channels or more traditional channels, such as banks. The World Bank Report reveals that banks are still the most expensive channel for remittance, costing an average of 10.92% per transaction. The study also shows the average cost of sending remittances within a single bank system, or to a bank's partner, is 8.36%. Rates, on average, dip slightly in sending money to a bank regardless of the originating bank, hovering around 6.39% per transaction.

Digital payment channels are a somewhat different story, in the sense that rates are relatively lower. The average cost of digital remittances to mobile wallets was 4.00%, and the average cost for services that disbursed remittances in cash was 5.83%. These percentages vary from region to region.

Interestingly, from a regional perspective, sub-Saharan Africa, which has the world's lowest regional gross domestic product, is the most expensive region to send money to. In comparison, South Asia remains the region with the lowest cost-receiving, recorded at 4.05% of the total average cost in the second quarter of 2022. This region comprises several nations—Afghanistan, Bhutan, Pakistan, and Sri Lanka, among them—that have suffered many recent civil and international conflicts that may account for a dearth of financial infrastructure contributing to lower overall transfer costs.

#21. South Korea

- Average cost of sending $200: 2.9% (3.2% cheaper than the average G20 country)

- Average cost of sending $500: 1.87% (2.3% cheaper than the average G20 country)

#20. Italy

- Average cost of sending $200: 4.4% (1.8% cheaper than the average G20 country)

- Average cost of sending $500: 3.% (1.2% cheaper than the average G20 country)

#19. Saudi Arabia

- Average cost of sending $200: 4.9% (1.3% cheaper than the average G20 country)

- Average cost of sending $500: 3.13% (1% cheaper than the average G20 country)

#18. Spain

- Average cost of sending $200: 5.5% (0.7% cheaper than the average G20 country)

- Average cost of sending $500: 3.79% (0.4% cheaper than the average G20 country)

#17. United States

- Average cost of sending $200: 5.6% (0.6 cheaper than the average G20 country)

- Average cost of sending $500: 3.95% (0.2% cheaper than the average G20 country)

#16. United Kingdom

- Average cost of sending $200: 5.6% (0.5% cheaper than average G20 country)

- Average cost of sending $500: 3.99% (0.18% cheaper than the average G20 country)

#15. Australia

- Average cost of sending $200: 5.8% (0.4% cheaper than the average G20 country)

- Average cost of sending $500: 3.76% (0.4% cheaper than the average G20 country)

#14. India

- Average cost of sending $200: 5.8% (0.33% cheaper than the average G20 country)

- Average cost of sending $500: 3.54% (0.6% cheaper than the average G20 country)

#13. Germany

- Average cost of sending $200: 5.8% (0.3% cheaper than the average G20 country)

- Average cost of sending $500: 3.94% (0.2% cheaper than the average G20 country)

#12. Czech Republic

- Average cost of sending $200: 5.9% (0.2% cheaper than the average G20 country)

- Average cost of sending $500: 4.18% (0.01% more expensive than average G20 country)

#11. Portugal

- Average cost of sending $200: 6.2% (just right the average G20 country)

- Average cost of sending $500: 4.14% (0.04% cheaper than average G20 country)

#10. Netherlands

- Average cost of sending $200: 6.2% (0.1% more expensive than the average G20 country)

- Average cost of sending $500: 4.66% (0.5% more expensive than average G20 country)

#9. France

- Average cost of sending $200: 6.4% (0.3% more expensive than the average G20 country)

- Average cost of sending $500: 4.42% (0.2% more expensive than average G20 country)

#8. Canada

- Average cost of sending $200: 6.5% (0.36% more expensive than the average G20 country)

- Average cost of sending $500: 4.43% (0.3% more expensive than average G20 country)

#7. Belgium

- Average cost of sending $200: 6.6% (0.43% more expensive than the average G20 country)

- Average cost of sending $500: 4.89% (0.7% more expensive than average G20 country)

#6. Sweden

- Average cost of sending $200: 6.7% (0.58% more expensive than the average G20 country)

- Average cost of sending $500: 5.2% (1% more expensive than average G20 country)

#5. Austria

- Average cost of sending $200: 6.7% (0.60% more expensive than the average G20 country)

- Average cost of sending $500: 4.28% (0.1% more expensive than average G20 country)

#4. Japan

- Average cost of sending $200: 7.6% (1.4% more expensive than the average G20 country)

- Average cost of sending $500: 4.13% (0.04% cheaper than average G20 country)

#3. Brazil

- Average cost of sending $200: 7.7% (1.6% more expensive than the average G20 country)

- Average cost of sending $500: 7.2% (3% more expensive than average G20 country)

#2. South Africa

- Average cost of sending $200: 14.7% (8.6% more expensive than the average G20 country)

- Average cost of sending $500: 8.68% (4.5% more expensive than average G20 country)

#1. Turkey

- Average cost of sending $200: 33.8% (27.7% more expensive than average G20 country)

- Average cost of sending $500: 15.64% (11.5% more expensive than average G20 country)