While demand for personal loans cooled in 2023, the average personal loan balance grew 6.3%

This story was produced by Experian and reviewed and distributed by Stacker Media.

While demand for personal loans cooled in 2023, the average personal loan balance grew 6.3%

Higher interest rates are changing the way consumers use and perceive personal loans. Today, more consumers appear to be turning to personal loans to consolidate debt and finance major purchases to avoid the bitter pill of higher rates with other financing options.

Personal loans were always an option for consumers frustrated with stubborn credit card balances. That was true when interest rates were lower, as they were for much of the 2010s. Beginning in 2022 and continuing last year, however, growing credit card balances and rapid rate hikes meant using personal loans to lower one's monthly payments and took on a new urgency.

As part of an ongoing review of consumer debt and credit in the U.S., Experian examined representative and anonymized credit data through the third quarter (Q3) of 2023 to identify trends in both secured and unsecured personal loans.

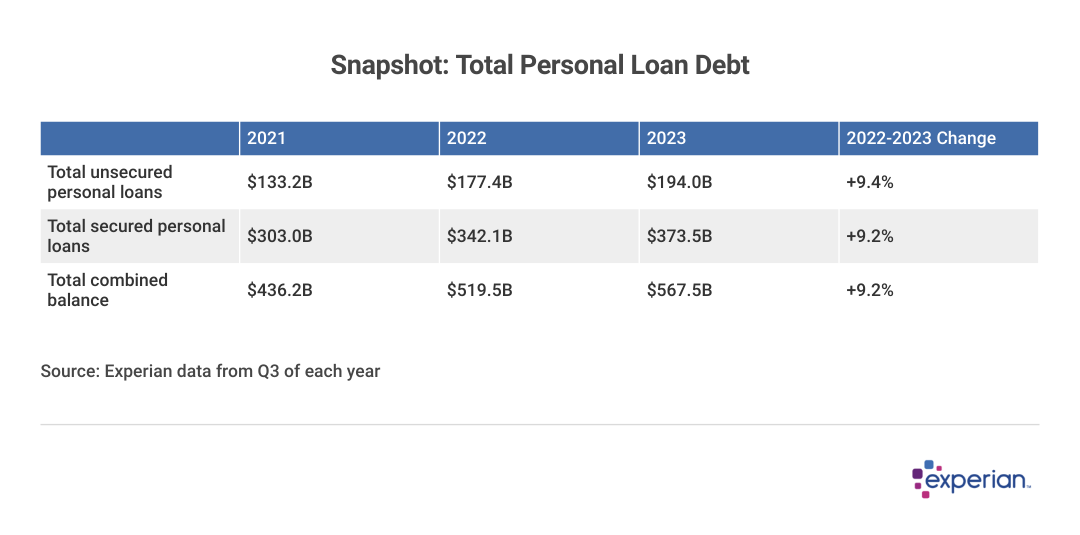

Total U.S. Personal Loan Debt Increases 9.2%

Like credit card balances, personal loan balances grew sharply in 2023, but not nearly as much as they did in 2022. Unsecured loans—the type offered to borrowers largely based on the applicant's credit history and income—grew by 9.4% in 2023. Loans secured by assets such as boats, campers, RVs and other types of collateral grew by a similar amount.

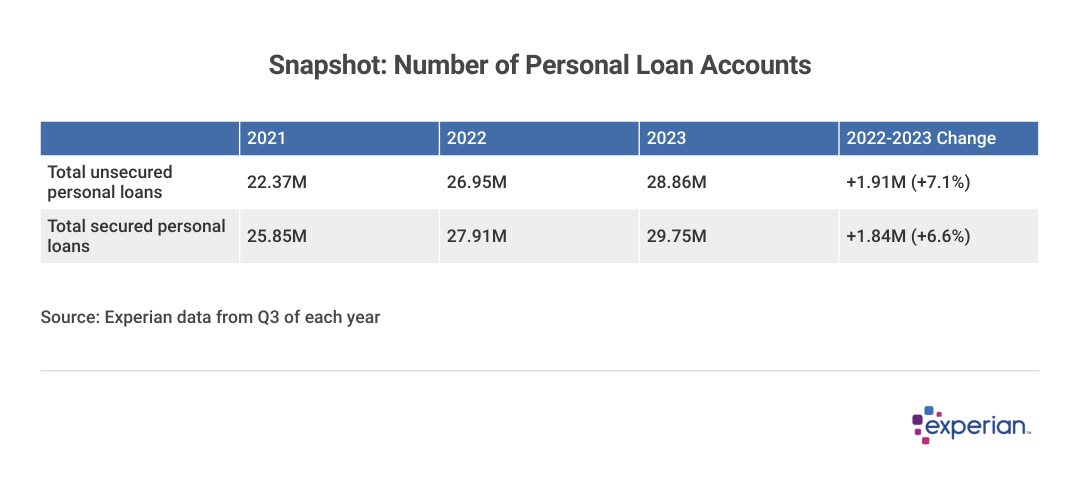

More Than 3.5 Million Personal Loan Accounts Added in 2022

The number of existing unsecured personal loans increased by nearly 2 million accounts to 28.9 million in 2023. However, the almost 7% increase in 2023 was still not nearly as large as the 20.4% increase seen in 2022, when more than 3.5 million new personal loan accounts were added.

The amounts currently owed on personal loan balances continue to grow as well. The 6.3% overall increase in the average personal loan balance to $19,402 in 2023 slowed slightly versus 2022's jump to $18,255 from $16,458 in 2020 and $17,064 in 2021, despite higher interest rates for most types of loans due to the Federal Reserve methodically raising the key federal funds rate.

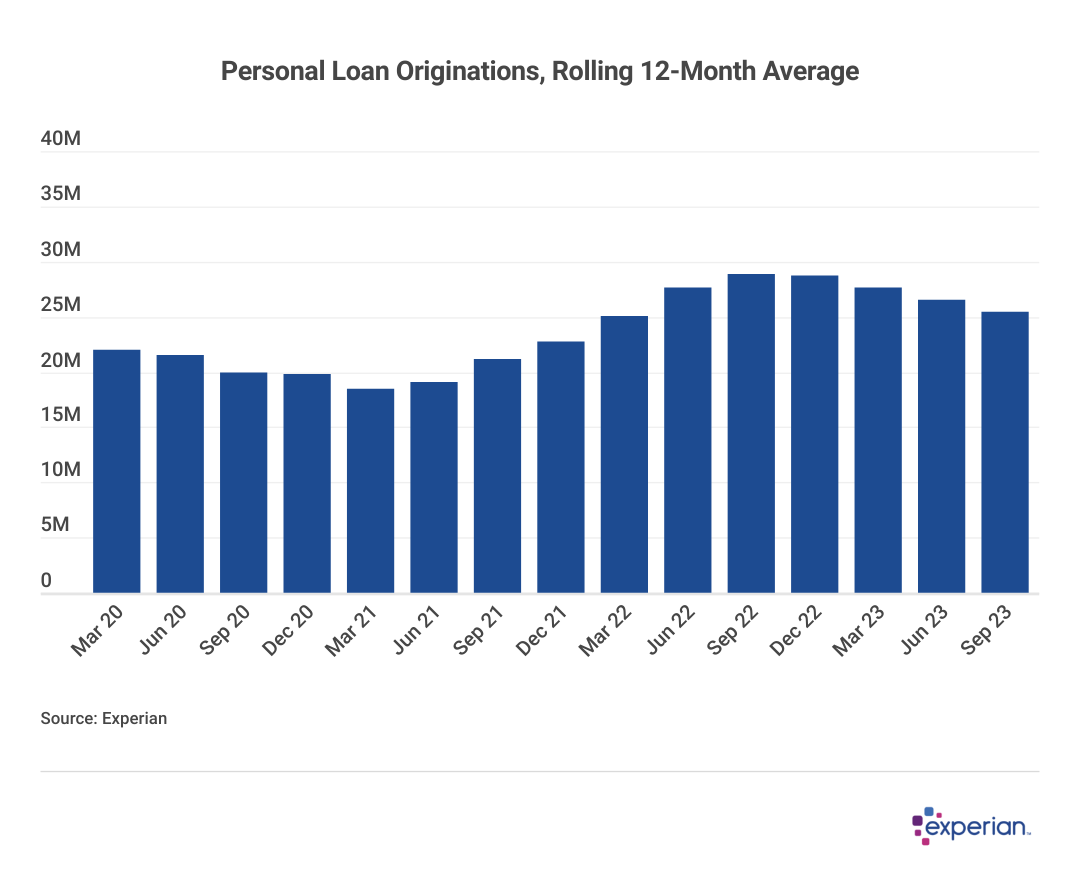

Demand for Personal Loans Has Steadied

Growth in the number of new personal loans softened somewhat in 2023 from the large jump the year prior, when consumers returned to personal loans largely to tame rising credit card rates. Still, there were 25.5 million loans made in the 12 months ending in September 2023—higher than the 21.2 million personal loans originated in 2019.

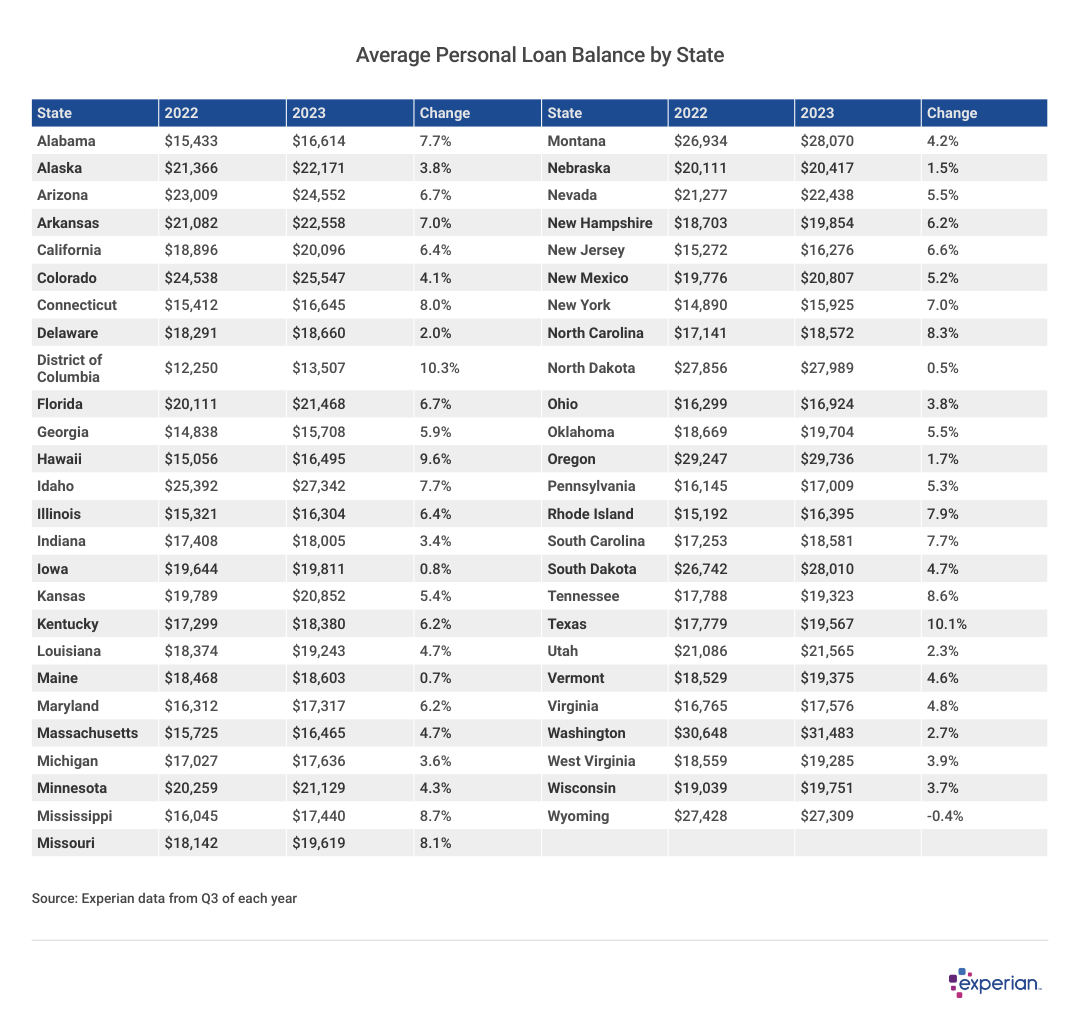

Average Personal Loan Balances Increase in Nearly All States

The rash of new personal borrowing from last year also calmed some in 2023, although average balance increases are still outpacing inflation by a significant margin. Despite the 9% increase in 2023, that's still much less than the 17% increase in 2022, when the Federal Reserve first started ratcheting up rates.

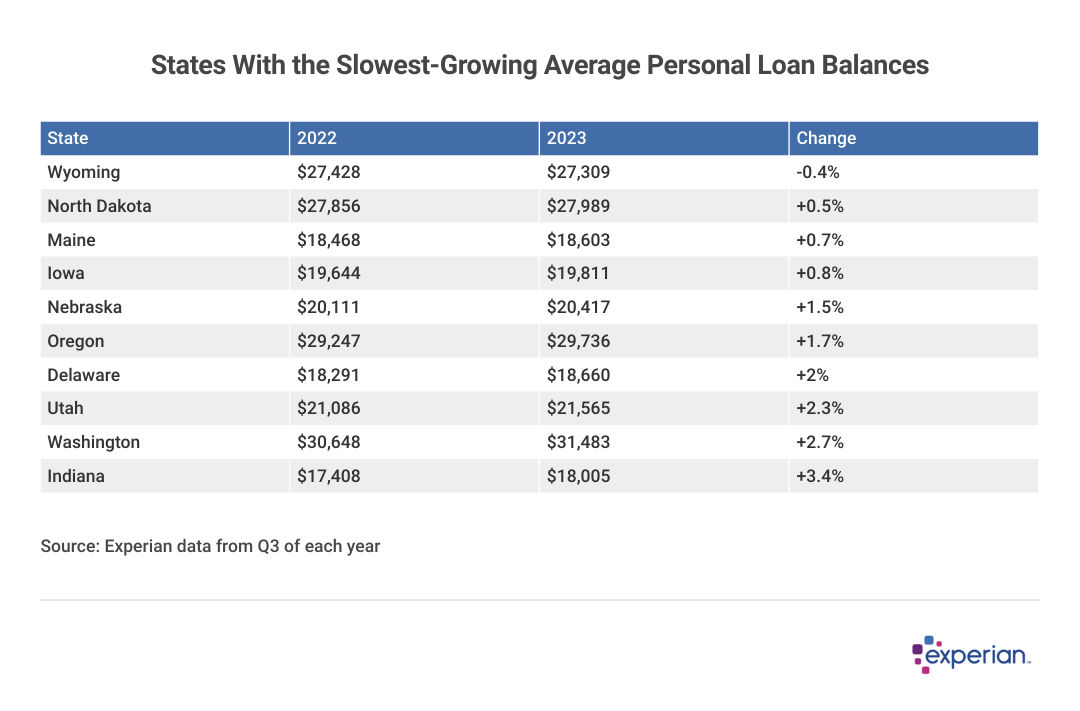

Most of the Slowest-growing States Beat National Averages

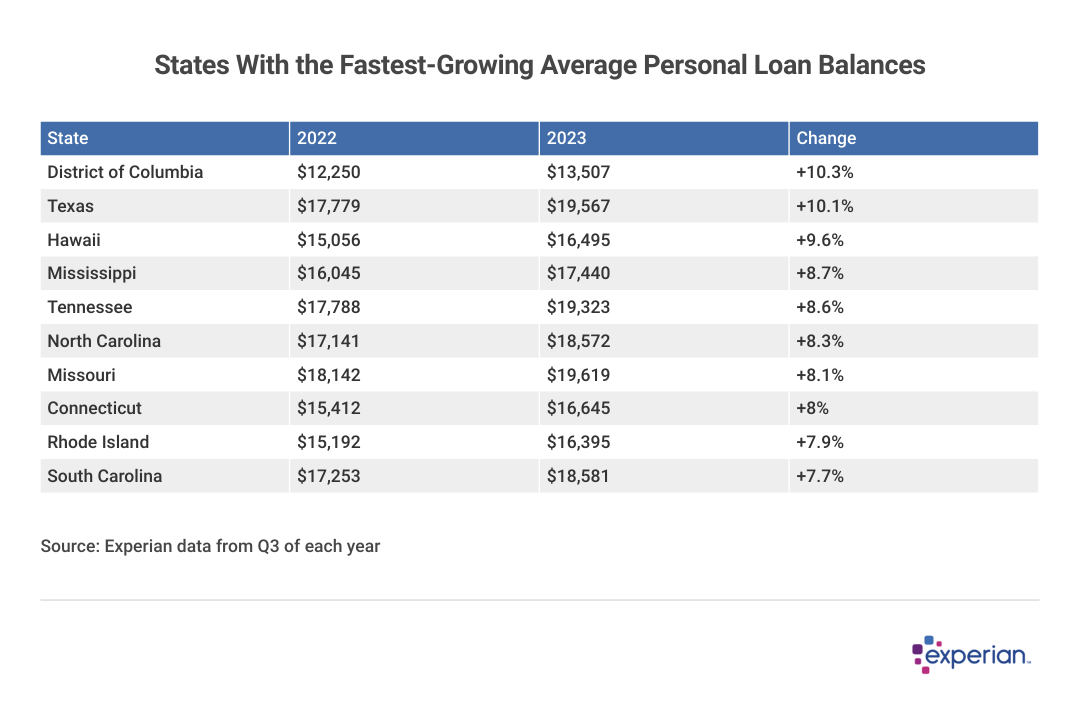

The states with faster-growing balances all have below-average balances, while most of the slower-growing states have average balances higher than the national average. So in both cases, these outlying states may be reverting to the average.

One curiosity: Each of the 10 states with the lowest year-over-year increases in personal loan balances were firmly in the northern parts of the continental U.S.

States With Fastest-growing Balances Show They Are Below Average

Another coincidence: Nearly all of the 10 states with the largest personal loan balance increases were Sunbelt states.

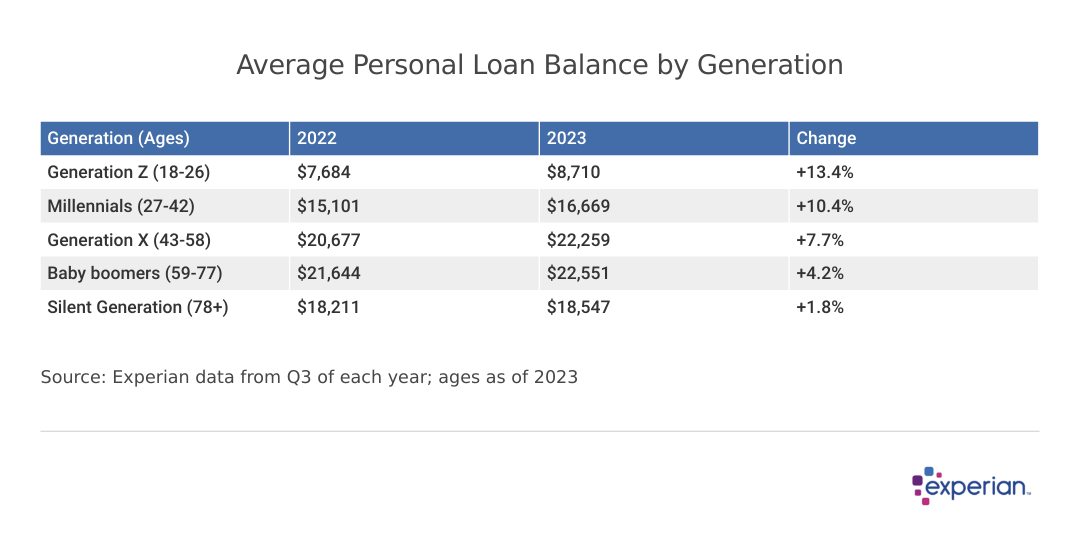

Average Balances Are Growing Faster Among Younger Generations

As observed in other types of consumer loans, younger generations are borrowing and owing more on average than baby boomers and other older consumers. Consider again the 6.3% overall increase in balances: Younger generations saw balances increase more than twice the overall rate in some cases, while personal loan balances increased little among older borrowers.

Younger Generations See Balances Grow By More Than Twice the Overall Rate

Baby boomers have the largest balances in 2023, but Generation X will likely soon owe the most on balances in the years to come based on current trends.

What Borrowers Can (and Do) Expect in 2024

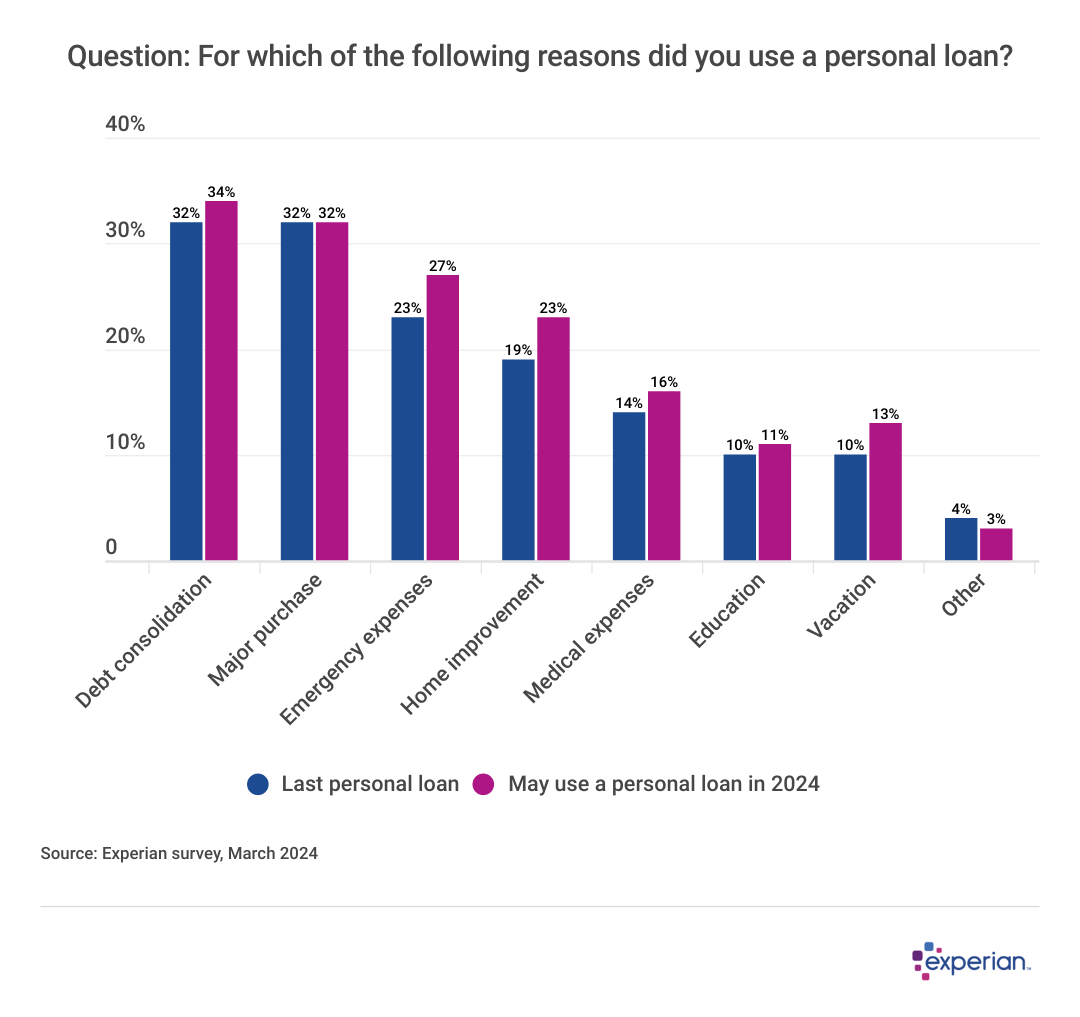

When asked in a recent Experian survey of more than 1,000 consumers, most people suggested they're aware of personal loans and have made use of them in the past. Nearly half said they plan to use them in the upcoming year.

Let's take the past first: 57% of survey respondents (ages 21 through 65) said they've used personal loans in the past. Among these consumers, about one-third used a personal loan for debt consolidation, while another third used one for a major purchase.

Debt Consolidation Most Popular Reason for Personal Loans

As for the near future, nearly half of those surveyed (46%) said they intend to use a personal loan sometime this year. Debt consolidation, major purchases and emergency expenses are the most popular uses for these loans.

Consumers aren't the only ones feeling the pinch of higher interest rates. Lenders, as well, need to pay for the dollars they lend to consumers. As their borrowing costs increase, lenders are passing on those costs to borrowers, just as credit card issuers passed on variable APR rates to card users. However, fixed-rate APRs of most personal loans do offer consumers both consistency in monthly payment amounts as well as rates that are typically lower than the average credit card rates if their credit is in good shape.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.