Millennials may be the real winners of baby boomers' pandemic wealth accumulation

Millennials may be the real winners of baby boomers' pandemic wealth accumulation

Millennials own just a small fraction of America's real estate wealth, but that could change in the coming decade as they inherit trillions of dollars from their boomer parents.

This so-called "great wealth transfer" is expected to move more than $53 trillion in boomer assets to younger generations, according to the Boston-based research firm Cerulli Associates.

Creditnews estimates that a sizeable part of that transfer will be comprised of real estate, and millennials are likely to be the biggest beneficiaries.

Cerulli estimates that a sizeable part of that transfer will be comprised of real estate, and millennials are likely to be the biggest beneficiaries.

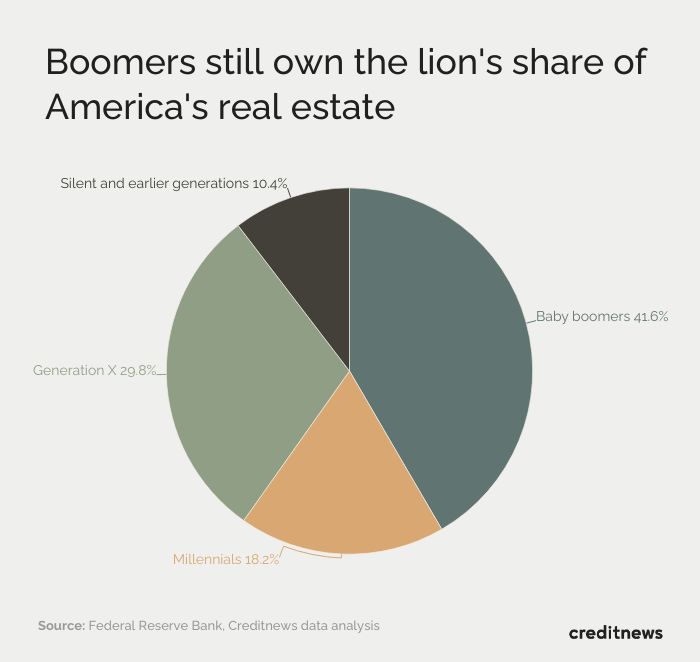

Baby boomers today account for 41.6% of America's real estate wealth. That's nearly $19 trillion worth of property at today's prices, according to Fed data.

The lion's share of that wealth was gobbled up during the pandemic.

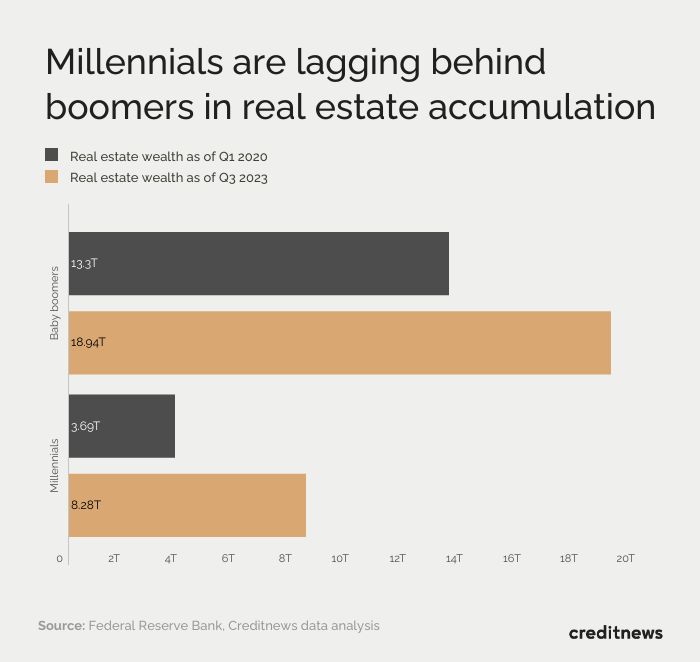

Between 2020 and Q3 2023, boomers racked up a whopping $5.6 trillion in real estate wealth, a 42% increase. That's more than what prime homebuying-age millennials accumulated over the same period.

Owning a home is a lot harder these days

Baby boomers have been snatching up houses since their mid-20s when mortgage rates hit a record 18.36%. But even then, financing a home was much more affordable than it is today.

According to the Berkeley Economic Review, 45% of boomers purchased their first house between the ages of 25 and 34. That's a big head start compared to their millennial children.

"Millennials are buying houses seven to 10 years later in life than previous generations, therefore owning homes and gaining equity seven to 10 years less," said Matt Walsh, a Virginia-based Realtor.

Because of that, Walsh thinks "millennials, on average, will never achieve the same housing wealth as the boomers."

Although lagging behind boomers, millennials have made significant headway in recent years

From 2020 through Q3 2023, the value of millennials' assets jumped from $3.69 trillion to $8.28 trillion.

But even with that jump, they account for just 18.2% of the country's real estate wealth—a far cry from baby boomers' 41.6%.

According to a recent Creditnews report, after COVID-19, younger generations are having a much harder time buying a house because they are trapped in a vicious cycle of rising mortgage rates and historically low supply.

Due to these factors, only 28% of homebuyers in 2023 were millennials—down from 43% the year before. And only 4% of the home purchases in 2023 came from Gen Zers.

Even though central banks eye a handful of rate cuts in 2024, home prices probably won't budge because housing supply remains critically low, according to the National Association of Realtors (NAR).

NAR data shows that existing home inventory is still at one of the lowest levels in history. Real estate brokerage Redfin also reported just 5.4 million new listings in 2023— a 16.4% decline from 2022 and the lowest level on record.

It's not just real estate

The wealth gap between boomers and millennials isn't limited to real estate.

According to Fed data, boomers have accumulated a staggering $77.55 trillion in wealth as of the third quarter of 2023. A lot of that wealth is parked in stocks and mutual funds, constituting $20.18 trillion of boomers' assets.

Baby boomers also amassed $8.72 trillion in pension benefits and $8.05 trillion in business assets.

In comparison, the millennial generation has just over $20 trillion in assets, only $0.4 trillion of which is held in stocks. That could soon change as millennials inherit $53 trillion worth of boomer nest eggs over the next decade.

This story was produced by Creditnews and reviewed and distributed by Stacker Media.