Nearly two-thirds of new office construction is in the Sun Belt—but don't count out the coasts

This story originally appeared on Firmspace and was produced and distributed in partnership with Stacker Studio.

Nearly two-thirds of new office construction is in the Sun Belt—but don't count out the coasts

New office construction faces twin post-COVID-19 pandemic pressures. On the one hand, higher Federal Reserve interest rates designed to fight inflation that arose from pandemic supply chain shortages make it harder and more expensive to finance new projects.

On the other, remote and hybrid work seem to be sticking around, even as pandemic-related concerns have become less urgent for many following the national vaccine rollout. Many cities are reporting office occupancy rates at about 50% of pre-pandemic levels, according to card swipe data tracked by Kastle Systems.

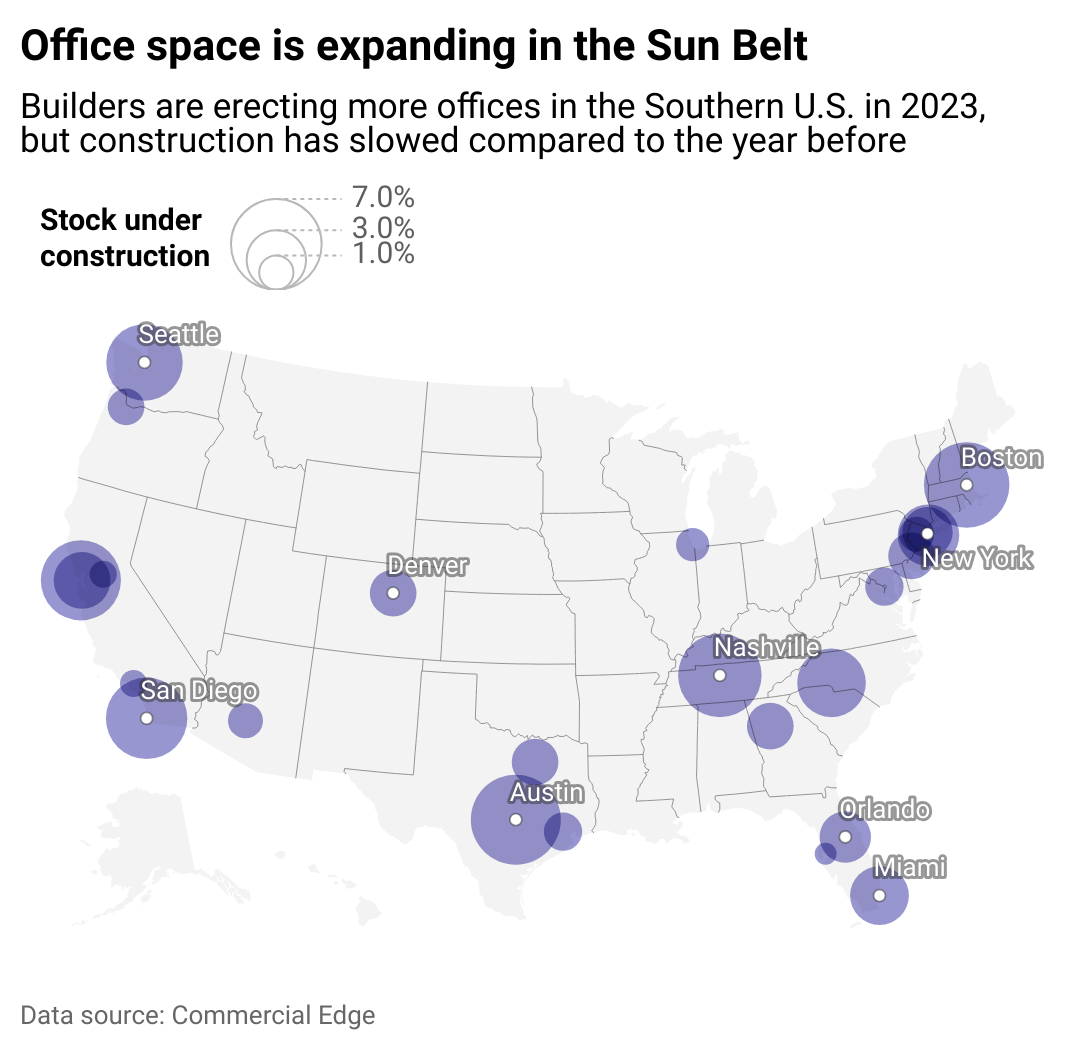

About 115 million square feet of office space is currently under construction. That sounds like a lot but it's actually less than earlier in 2023. The pipeline is constricting somewhat as projects that started in the back half of 2022 are now getting underway and fewer new buildings are breaking ground in an uncertain market. Of the new office projects under construction, nearly two-thirds are being built in the Sun Belt, and Austin, Texas, is at the fore.

To analyze these trends, Firmspace tapped data from CommercialEdge's July National Office Report to see which major metros have started building the most new office buildings so far in 2023. Metros are ranked by the square footage of office buildings being constructed as a percentage of total offices in that city. For tiebreakers, the raw number of square feet was used.

New office buildings are under construction across the country

More office stock is under construction in Sun Belt states compared to their northern counterparts. Mid-sized cities are also leading the way, with more growth in cities like Dallas and San Diego, potentially benefiting from a pandemic outflow of residents from bigger cities. Coastal cities, from Seattle to San Diego to Miami to New York, are also leading, with the Nashville area as a more central outlier.

#15. Philadelphia

- Share of office space currently being built: 1.7% (3.1M square feet)

- Sales price YTD: $177 per square foot

- Sales YTD: $358M

Philadelphia's population fell by 2.3% from April 2020 to July 2022, according to the Census Bureau, declining to less than 1.6 million. The overall decline is led by baby boomers; however, the city experienced a net increase of 6,249 new Gen Z residents during 2021, an analysis of Census Bureau data found.

The unemployment rate in Philadelphia County is 5.4% as of August 2023, according to the Bureau of Labor Statistics, higher than the current national unemployment rate. But office space in the City of Brotherly Love is still in demand: Independence Health Group recently announced plans to sublease 224,000 square feet, the Philadelphia Inquirer reported. Plus, the recently completed Morgan Lewis building is designed for hybrid work, with flexible workspaces, outdoor decks, and other amenities, according to CBRE.

#14. Atlanta

- Share of office space currently being built: 1.7% (3.3M square feet)

- Sales price YTD: $147 per square foot

- Sales YTD: $148M

The unemployment rate in Fulton County, which contains Atlanta, is 4%, according to the BLS, slightly higher than the 3.8% national unemployment rate. Tech giant Cisco Systems is opening up a new midtown office with upgraded hybrid work tools and an experiential product showroom. Harry Norman, Realtors, a top luxury real estate brokerage, is leasing 20,000 square feet of office space in Buckhead for an amenity-filled worker experience.

#13. Dallas

- Share of office space currently being built: 1.7% (4.8M square feet)

- Sales price YTD: $238 per square foot

- Sales YTD: $433M

Dallas' population dropped slightly by 0.4% from April 2020 to July 2022 to just below 1.3 million, according to the Census Bureau. The unemployment rate in the Dallas-Fort Worth-Arlington area is 4.2%, according to the BLS, higher than the national unemployment rate.

KDC and Pacific Elm Properties are putting up a new 30-story office tower downtown near Klyde Warren Park that will become the new home for Bank of America, one of the region's largest employers. FCP is building two office projects in Dallas' Design District, the Dallas Morning News reports, and wants to begin a third.

#12. Manhattan, New York

- Share of office space currently being built: 2.0% (9.2M square feet)

- Sales price YTD: $645 per square foot

- Sales YTD: $1.3B

Developer Vornado is on track to finish Penn 2, a 31-story office tower atop the historic Penn Station, by the end of 2023. About a mile away is the just-completed 27-story One Madison Avenue, adjacent to Madison Square Park. Yet the population of New York City fell 5.3% to about 8.3 million from April 2020 to July 2022, according to the Census Bureau.

#11. Orlando, Florida

- Share of office space currently being built: 2.1% (1.2M square feet)

- Sales price YTD: $150 per square foot

- Sales YTD: $23M

The public-private partnership behind Creative Village plans to transform 68 acres of city-owned land in downtown Orlando into a mixed-use urban development, including up to 900,000 square feet of office space. Orlando's population grew by 2.7% from April 2020 to July 2022 to about 316,000, according to the Census Bureau. The unemployment rate in the Orlando-Kissimmee-Sanford metro area is lower than the national average at 3.1%, according to BLS.

#10. Bay Area, California

- Share of office space currently being built: 2.6% (5.3M square feet)

- Sales price YTD: $430 per square foot

- Sales YTD: $407M

Boston Properties is building a 1.1 million-square-foot tech campus called Platform 16 in downtown San Jose. A six-story office infill in SoMa in San Francisco recently topped out the construction of a new space with a retail ground floor and 46,390 square feet of office space. The unemployment rate in the San Francisco-Oakland-Fremont area is 4%, higher than the current national unemployment rate, according to the BLS.

#9. Miami

- Share of office space currently being built: 2.8% (2.0M square feet)

- Sales price YTD: $261 per square foot

- Sales YTD: $286M

The 55-story 830 Brickell Office Tower on Brickell Point being developed by OKO Group and Cain International is nearing completion. Abbhi Capital is developing a 35-story office tower at Miami Worldcenter, north of downtown. The unemployment rate in the Miami metro area is 1.9%, according to BLS, well below the U.S. national unemployment rate of 3.8%. Miami-Dade's population fell 1% to 2,673,837 from April 2020 to July 2022, according to the Census Bureau.

#8. Brooklyn, New York

- Share of office space currently being built: 3.1% (1.1M square feet)

- Sales price YTD: N/A per square foot

- Sales YTD: N/A

Two Trees is wrapping construction on the revamped Domino Sugar Refinery as a new commercial building in the Williamsburg neighborhood. In November 2022, FXCollaborative and JEMB Realty completed the 36-story One Willoughby Square office skyscraper in downtown Brooklyn. But the New York City borough's population fell 5.3% to just below 2.6 million from April 2020 to July 2022, according to U.S. Census Bureau data. Meanwhile, Brooklyn's unemployment rate is 6% according to BLS, higher than the current national unemployment rate.

#7. Charlotte, North Carolina

- Share of office space currently being built: 3.9% (3.0M square feet)

- Sales price YTD: $156 per square foot

- Sales YTD: $143M

With a growing population—up 2.6% to 897,720 from April 2020 to July 2022, according to Census Bureau data—and an unemployment rate below the national average (3.3%), Charlotte is primed for business growth. The Keith Corp. filed plans to build a 225-foot office tower outside the I-277 loop near Morehead and McDowell. Local developer Lincoln Harris has received approval to install a new 10-story office tower inside Phillips Place at South Park.

#6. Seattle

- Share of office space currently being built: 4.9% (6.8M square feet)

- Sales price YTD: $290 per square foot

- Sales YTD: $73M

Home to major employers like Amazon, Boeing, and Starbucks, Seattle has several office spaces under construction. Urban Visions has plans to build The Net, a 77-story super-tall office building in downtown Seattle. Plus, Lincoln Property Company, Intercontinental Real Estate Corp., and Sound Transit broke ground in 2023 on the new University District Station Building, a 266,000-square-foot office building, north of downtown Seattle.

#5. San Francisco

- Share of office space currently being built: 5.4% (8.5M square feet)

- Sales price YTD: $464 per square foot

- Sales YTD: $378M

The population of San Francisco fell 7.5% to 808,437 from April 2020 to July 2022, according to the Census Bureau. However, construction continues, as Tishman Speyer recently completed construction on the first office building of the redeveloped waterfront Mission Rock complex. Developed as a joint venture between Hines, Urban Pacific, and Goldman Sachs Asset Management, 276,000 square feet of office space are planned at 550 Howard in SoMa.

#4. San Diego

- Share of office space currently being built: 5.6% (5.2M square feet)

- Sales price YTD: $398 per square foot

- Sales YTD: $482M

Holland Partner Group, North America Sekisui House, and Lowe are partnering on a 37-story mixed-use project in downtown San Diego. IQHQ is building the 1.7-million-square-foot San Diego Research and Development District on the city's waterfront. The city's population fell 0.4% from April 2020 to July 2022, and its unemployment rate is 4.3%, according to BLS data, above the 3.8% national unemployment rate.

#3. Nashville, Tennessee

- Share of office space currently being built: 5.9% (3.4M square feet)

- Sales price YTD: $261 per square foot

- Sales YTD: $75M

In Capitol View, Southwest Value Partners is building the 558,000-square-foot Amazon Juno office space and the 300,000-square-foot Nashville Yards Creative Office. The unemployment rate for the greater Nashville area is 2.7%, according to BLS, below the national unemployment rate. The city's largest employers include Nissan North America, HCA Healthcare Inc., and Randstad, according to the Nashville Chamber of Commerce.

#2. Boston

- Share of office space currently being built: 6.2% (15.1M square feet)

- Sales price YTD: $455 per square foot

- Sales YTD: $1.3B

HYM Investment Group just opened the new 43-story, 1-million-square-foot office tower at One Congress. Commercial real estate developers Samuels & Associates have been completing the $700 million development of two new buildings in Boston's Back Bay, with toymaker LEGO Group announcing it will move its American head office there. The unemployment rate for the Boston-Cambridge-Quincy area is 2.7%, according to BLS, lower than the national unemployment rate. Some of the largest employers in Boston are the Dana-Farber Cancer Institute, TIAA, and Boston Globe Media partners.

#1. Austin, Texas

- Share of office space currently being built: 6.9% (6.2M square feet)

- Sales price YTD: $320 per square foot

- Sales YTD: $281M

Hines is nearing completion on the 93,000-square-foot T3 Eastside at 1200 East 4th Street. A development consortium is working on the 48-story The Republic, south of Republic Square, due for completion by early 2025. Major employers in Austin include Apple, Charles Schwab, and IBM, per Austin Chamber of Commerce data. Austin's population rose 1.3% to 974,447 from April 2020 to July 2022, according to Census Bureau data.

Data reporting by Elena Cox. Story editing by Jeff Inglis. Copy editing by Tim Bruns. Photo selection by Clarese Moller.