Owning a home in these cities may not be worth it

Owning a home in these cities may not be worth it

Homeownership has long been considered an essential component of the American Dream. Owning a home signifies financial stability, putting down roots, and transitioning into adulthood. Renting, on the other hand, is often seen as throwing away money.

But the ideal of homeownership is a relatively recent concept. Fewer than half of the American population owned a home until the 1940s, when a law was passed to make government-subsidized mortgages available to the middle class. Today, around 66% of the U.S. population owns their own home. But with skyrocketing interest rates, low inventory, and record-high real estate prices, does buying a home still make financial sense?

The research team at Today's Homeowner compared the costs of owning and renting over a 30-year period to determine which move saves the most money. We also surveyed 1,000 current renters about the barriers they face on the path to homeownership.

The findings may be a surprise for homeowners and renters alike: In some areas, homeowners will spend more than renters over a 30-year period.

Key findings

- Long-term renting is currently cheaper than homeownership in 46 of the 97 major cities researched.

- 69% of renters believe that renting is the best financial decision for them right now.

- Renters will spend an average of $1.26 million over the course of 30 years while homeowners will spend $1.30 million.

- Just 9 out of the 97 cities analyzed had monthly mortgage payments that were cheaper than monthly rental payments.

- In at least seven major cities in California, long-term renting is cheaper than owning a home. Renters save $900,540 on average in California over a 30-year period.

- Owners come out ahead of renters in at least 51 U.S. cities. On average, owners saved $175,811 over a 30-year period.

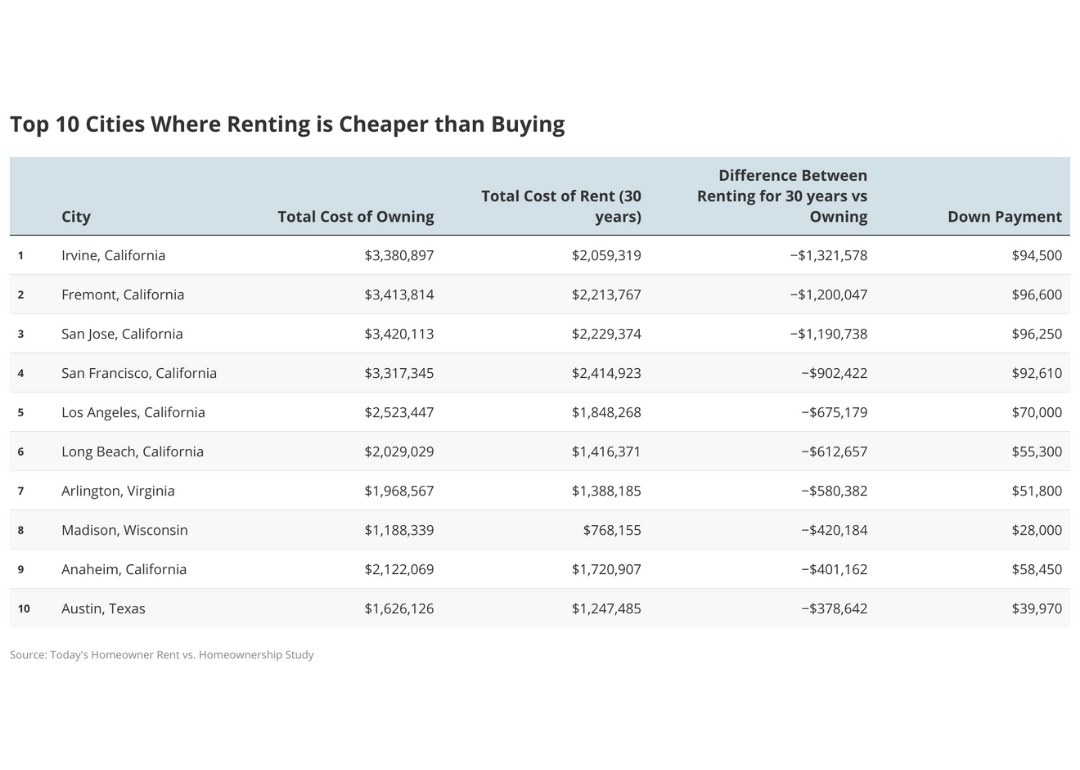

Where is it cheaper to rent than buy?

Our study found that long-term renting is cheaper than homeownership in 46 out of 97 cities, which is likely due to rising interest rates, soaring home prices, and high down payments. California cities occupy seven of the top 10 spots on the list of places where renting is more affordable than buying. A renter in Irvine, California, for example, will save almost $1.3 million over 30 years by renting their home instead of buying. In four California cities, mortgages require a downpayment that could cost buyers as much as $90,000.

The three non-California cities in the top ten are Arlington, Virginia; Austin, Texas; and Madison, Wisconsin. While down payments in these cities are in a more modest range of $28,000 to $52,000, renters can still expect to save around $400,000 to $600,000 over 30 years.

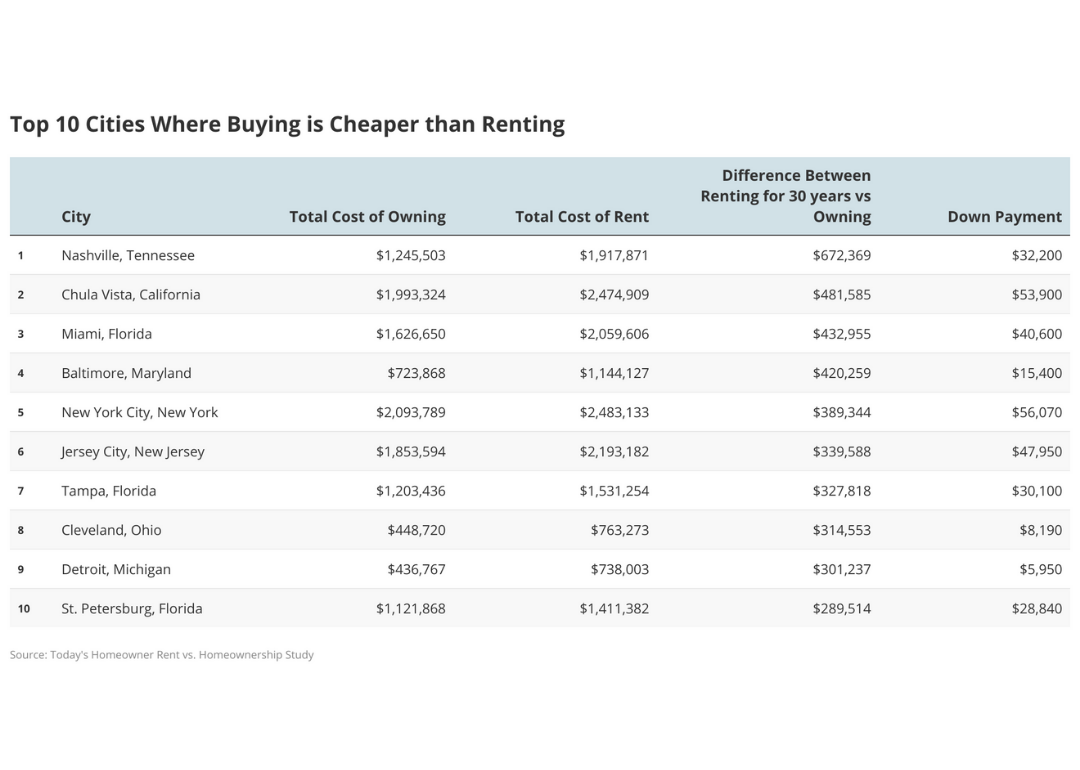

Where is it cheaper to buy than rent?

There are still many places in the U.S. where buying a home is cheaper than renting over a 30-year period. The list of the top 10 cities where owning is cheaper features geographically diverse locations, including cities on the East Coast and in the South and Midwest. New York City is one surprising location where homeowners save over renters— owners will spend $2.1 million on average over 30 years while renters will spend $2.4 million.

Down payments are also not prohibitively costly in the top 10 cities where it's cheaper to buy than rent. In Detroit, Michigan, for example, a down payment could be as low as $5,950, while in Baltimore, Maryland, it could be just $15,400. In Nashville, Tennessee — our number one spot — buyers will save almost $700,000 over renters.

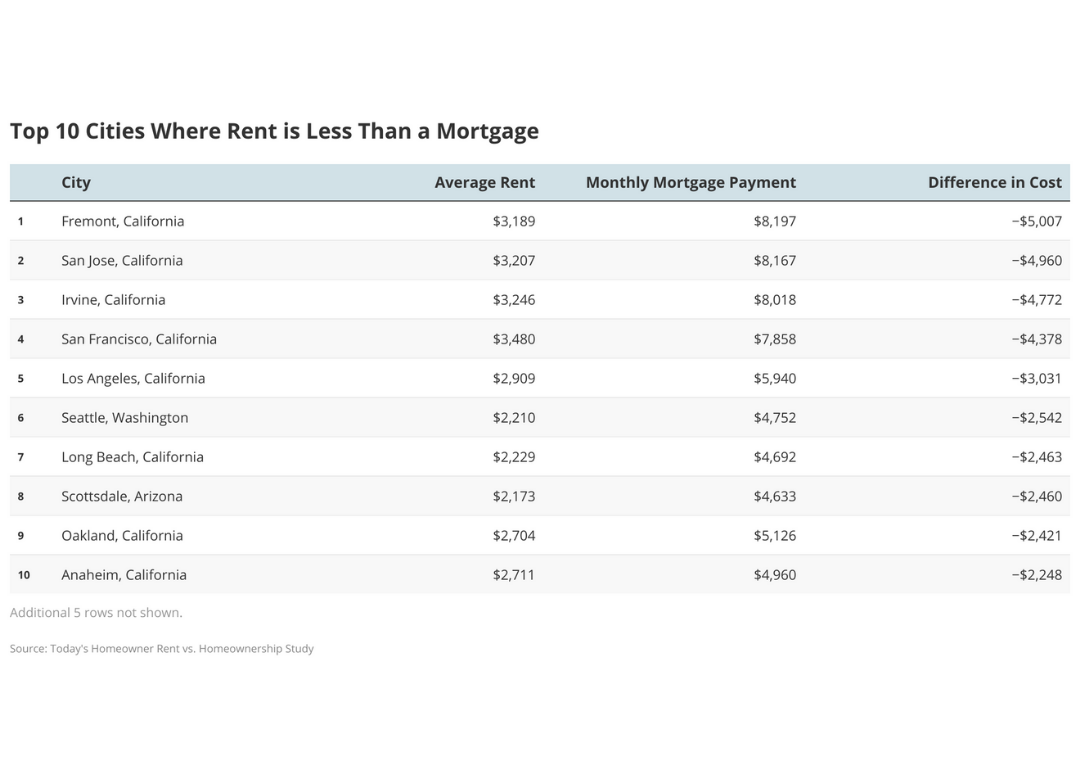

Where are rents cheaper than mortgages?

Even when considering the short-term benefits of renting versus owning, the study showed that renters come out ahead. Between August 2022 and July 2023, rental prices were lower than monthly mortgage payments in 88 out of 96 major cities. Not surprisingly, the top 10 list where rents are cheaper than monthly mortgages was again dominated by eight locations in California, where housing prices are at all-time highs.

Rising mortgage rates are one reason for the high mortgage payments. Rates were historically low from 2008 until 2022. But over the past three years, rates have climbed from around 3% to 7% nationwide. As a result, mortgage holders in a city like San Francisco, California — which came in at number four on the list — can expect to pay about $8,000 in monthly payments compared to the average rent of around $3,500.

Financial concerns are the biggest obstacle to buying

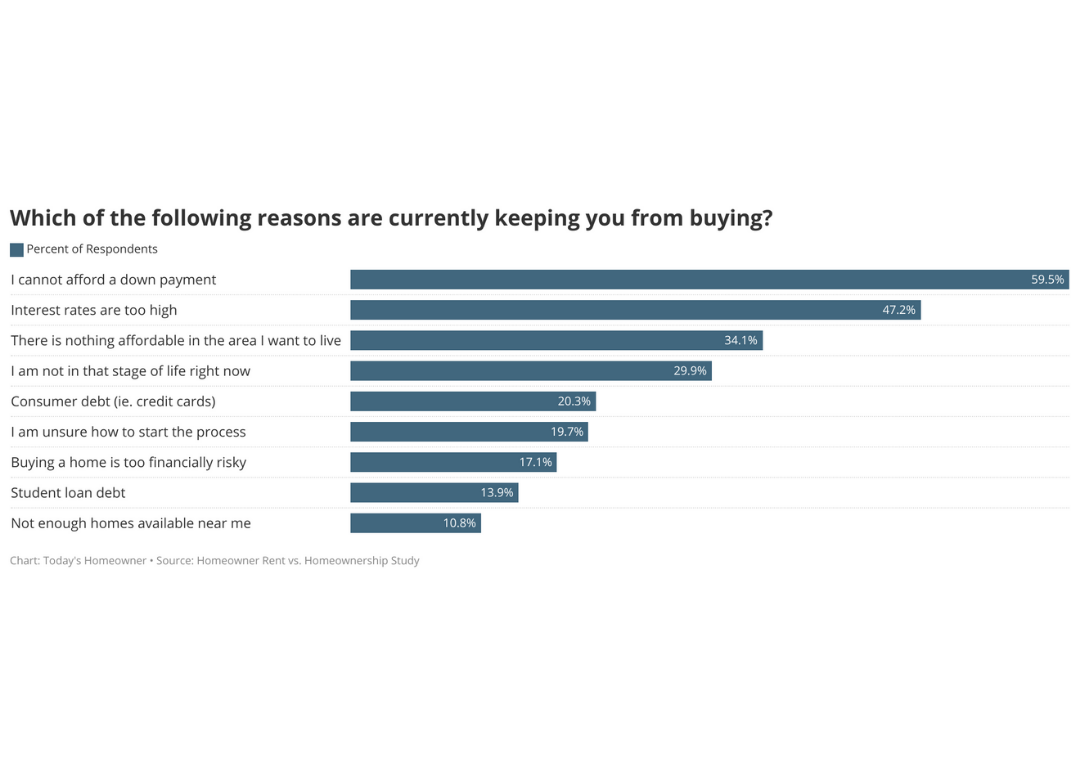

Many renters feel that homeownership is currently out of reach. Although 78.3% of renters aspire to become homeowners, 69.4% think renting is the better option right now. One of their primary reasons for staying away from homeownership at the moment was the state of the housing market.

With down payments nationwide averaging just under $33,000, 59% of surveyed respondents admitted they could not afford a down payment. They also mentioned rising interest rates and a lack of affordable local options.

Consumer debt is also a serious barrier to homeownership, according to 20% of the renters surveyed. Inflation has meant that the cost of living has increased dramatically for most people, and salaries haven't kept pace with those costs. Credit card debt alone has skyrocketed nationally to $986 billion, up from $927 billion before the pandemic.

No home repairs or bad neighbors: The pros and cons of renting

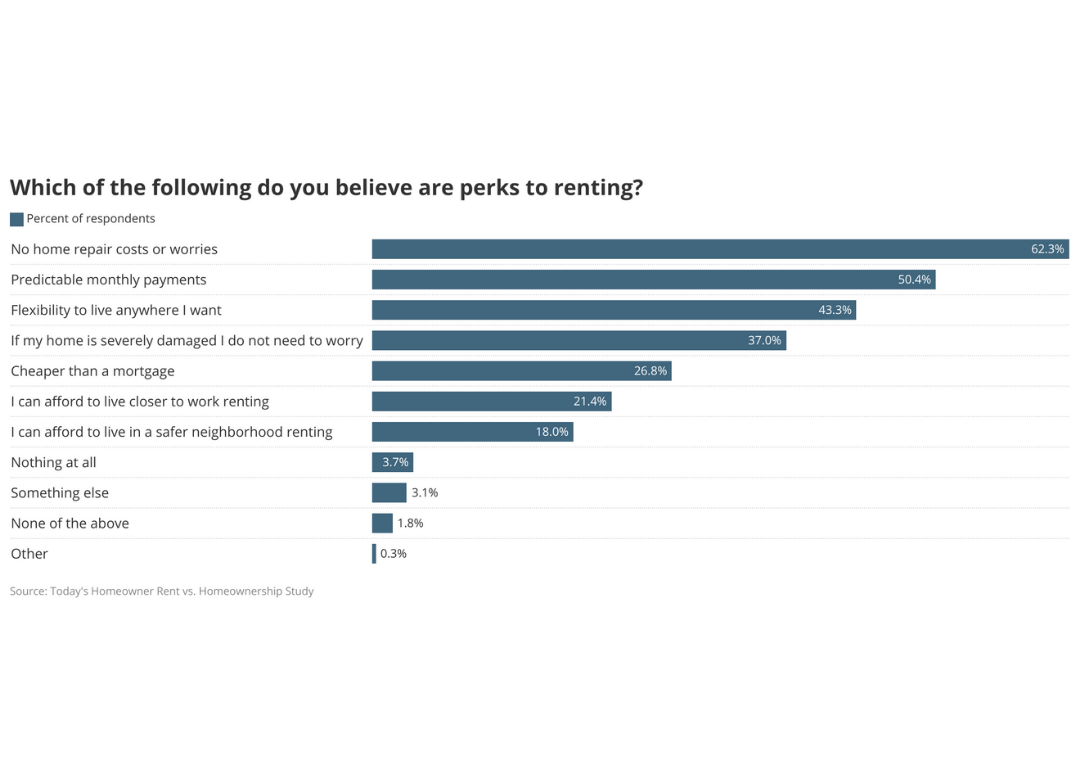

There are advantages and disadvantages to renting your home. Our survey found that 62% of respondents noted that avoiding housing costs was an important consideration when choosing to rent instead of buy.

These costs can be steep. A roof may need to be replaced twice over a 30-year period, which can cost about $12,000 on average. Other major expenses of homeownership include replacing HVAC systems or furnaces, which can cost up to $9,000. Even a single window costs between $400 and $1,000 to replace. Overall, homeowners can expect to pay up to $90,000 on average for home repairs over a 30-year period.

But renting is not without its drawbacks

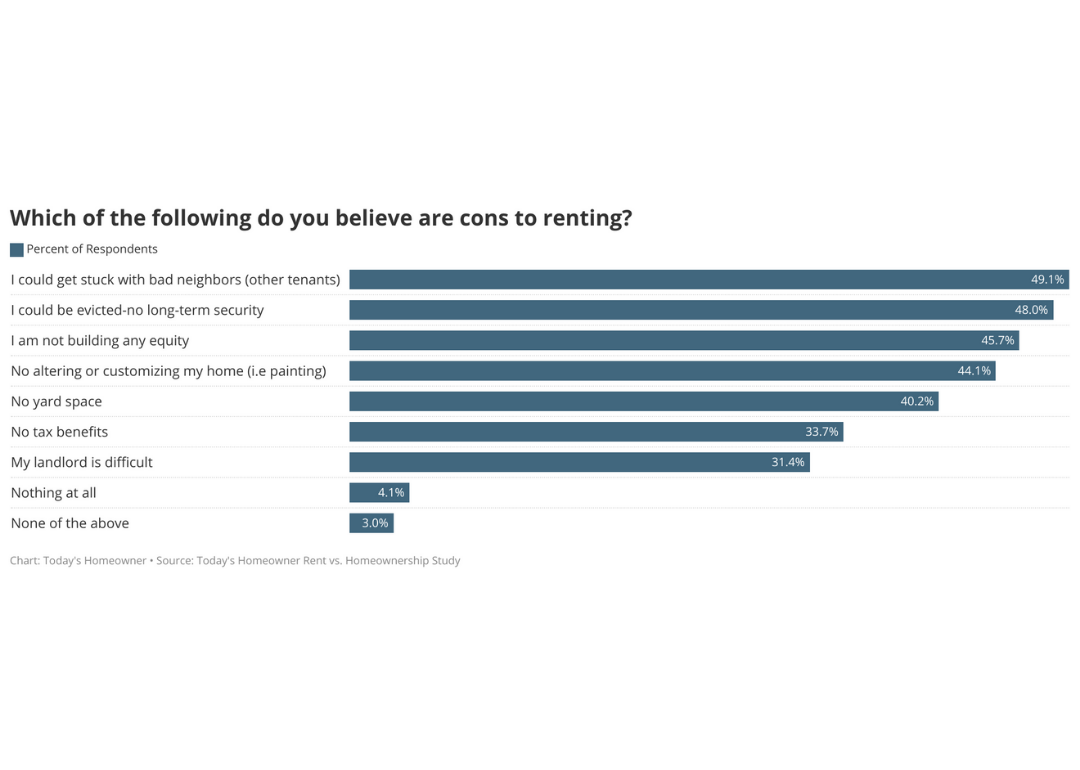

Some concerns with renting that survey respondents highlighted include getting stuck with bad neighbors (49%) and the possibility of eviction (48%). The Department of Housing and Urban Development estimates that around 2 million renters face eviction proceedings each year, particularly in low-income areas where affordable housing is in short supply.

Our survey also found that 46% of respondents say not being able to build equity is a disadvantage of renting. Ideally, homeowners can borrow from their home equity to cover expenses or make improvements and eventually make a profit when they sell their homes. Currently, homeowners nationwide have an estimated $136,000 in home equity.

Final takeaways

So is renting or buying the better option? It depends. For those in markets where housing prices have skyrocketed, renting may be the way to go for both short- and long-term scenarios. But in many places, owners will still come out on top even with higher interest rates — especially if they intend to stay in their houses for the long term.

Buying a house may not be the right choice for everyone financially. Potential homeowners need to base their calculations not only on where they live, but also on whether both the short- and long-term costs of homeownership make sense for them.

Methodology

To compare how much homeowners and renters would be spending over the course of 30 years, the research team at Today's Homeowner analyzed housing cost data from Redfin and Zillow in 97 of the largest U.S. cities. We did not include utilities in our analysis, and keep in mind that these figures are rough estimates, not exact figures.

Homeownership costs:

- Total mortgage costs: The total mortgage payments were calculated using the average sale price of homes from July 2022 Redfin data and the average yearly interest rates from Freddie Mac. We assumed a 7% downpayment.

- Property taxes: Data comes from the 2021 1-Year ACS. To estimate the average property tax increase by city, we estimated the annual average increase over the past 20 years to project increases over the next 30 years.

- Maintenance costs: We averaged key home improvement costs using Angi estimates. We broke those down further into annual projects and singular projects based on how frequently the projects need to be completed.

- Annual projects: gutter cleaning, vent cleaning, full lawn service, HVAC repair, pressure washing

- Singular projects: roof repair, resurfacing driveway, fence installation, siding replacement, window replacement, interior painting, replace HVAC, toilet replacement, deck repair, flooring replacement, mold remediation

- Homeowners insurance: annual homeowners insurance premiums from 2022 Quadrant Information Services

Rental costs:

- Rental housing costs: Average rent data comes from Zillow between August 2022 and July 2023. We estimated the increase in rent by calculating the average annual rental cost increases from the Department of Housing and Urban Development's fair market rent values. We increased rent every year for 30 years by this average and added it up to calculate total rent costs.

- Renters insurance: Annual renters insurance premiums from 2022 Quadrant Information Services

Limitations:

Our calculations assume that property taxes and rental costs will increase steadily over the next 30 years based on estimations and historical averages. Homeownership and rental costs were calculated for a three-bedroom home.

Survey:

We surveyed 1,000 renters about their opinions surrounding renting versus purchasing a home. We also explored the reasons people decide to rent or buy property and when they want to become homeowners. The survey responses were collected September 13-14, 2023. Using raw survey data, we weighted responses to align with population demographics across age, gender, and income status to represent all U.S. adults.

This story was produced by Today's Homeowner and reviewed and distributed by Stacker Media.