Americans' confidence in their ability to retire remains shaken

This story originally appeared on Wealth Enhancement and was produced and distributed in partnership with Stacker Studio.

Americans' confidence in their ability to retire remains shaken

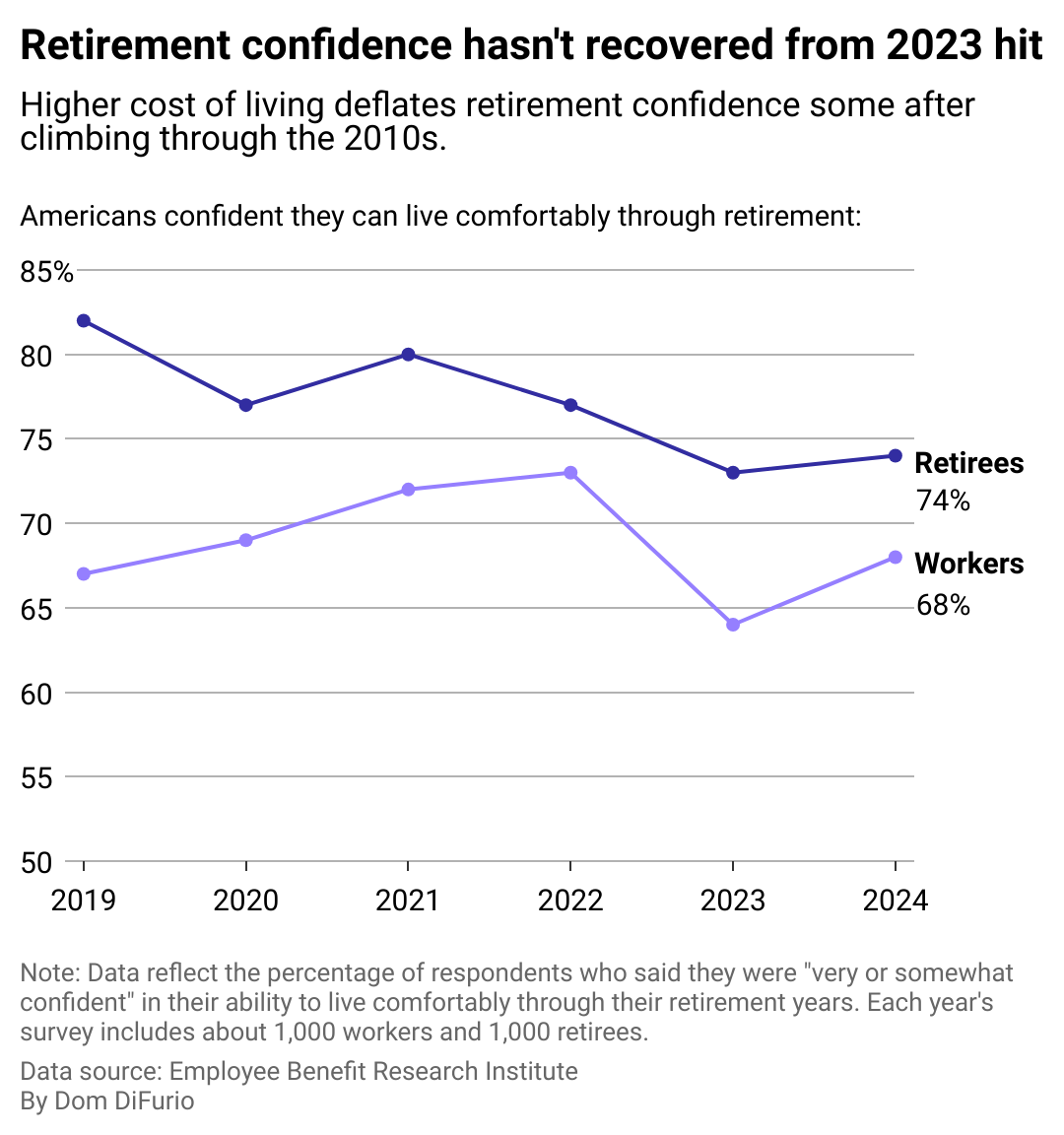

Americans' attitudes about life after work have shifted some in the last two years as higher costs of living force them to reconsider retirement plans despite stable incomes and a healthy stock market.

Wealth Enhancement analyzed Employee Benefits Research Institute data to illustrate how American confidence in retirement has changed amid rising inflation. The survey included responses from more than 2,500 Americans, roughly half of which were workers and the other half retirees.

The good news is that 7 in 10 Americans feel "confident or somewhat confident" they'll have enough money to live comfortably through their retirements. Just 1 in 5 (21%) workers are "very confident," down from the historic high of 29% recorded in 2021, when interest rates were low, and middle- and lower-income families saw their bottom lines bolstered by COVID-19 pandemic stimulus.

The ongoing high inflation comes at a pivotal moment for the U.S. population. By 2030, the entire boomer generation will have reached the traditional retirement age of 65. Starting this year, an estimated 11,200 Americans will turn 65 every day, according to an Alliance for Lifetime Income analysis.

Financial advisors and other experts suggest saving 15% of your annual income, which may not be feasible for many Americans. Almost half of the nation lacks any savings in a retirement account. Depending on your earnings and how much you can expect from social security, financial advisors recommend that those retiring at 65 have assets totaling between 7.5 and 13.5 times their gross income at the time of their retirement.

However, living cost increases since 2021 have hit workers in the lowest income brackets hardest thus far. Earnings reports from some of the nation's largest companies indicate that consumers are pulling back on spending in places like fast-food restaurants and retail stores.

As a new financial reality sets in, survey data shows that Americans are adjusting their retirement strategies and expectations.

Most are optimistic, though fewer are as confident as they were before record inflation set in

Despite a slight uptick in the 2024 survey results, EBRI classifies the confidence gain this year as statistically insignificant– though it may forecast improving economic conditions for workers and retirees.

Among the things weighing on both retirees and workers when thinking about retirement is the rise in prices in recent years—a trend that has yet to fully return to pre-pandemic norms. Typically, consumer prices rise about 2% on average each year. But in 2021, consumers dealt with a 7% annual inflation rate, then 6.5% in 2022, and 3.4% in 2023.

About 8 in 10 workers and 7 in 10 retirees told EBRI they're concerned about inflation remaining elevated over the next calendar year. And to the dismay of consumers tired of higher costs on rent and vehicle payments, as well as grocery and restaurant prices, inflation hasn't fallen much further this year.

Workers nearing retirement may face a more sobering retirement reality

Other surveys of Americans nearing retirement suggest a more dramatic expectation shift than EBRI's confidence measurements across worker and retiree populations.

About 7 in 10 Americans surveyed by insurance firm Nationwide this year don't anticipate a traditional retirement. Survey respondents aged 55 to 65 don't believe they'll be able to achieve retirement as early as 65, and 4 in 10 of them anticipate they'll have to work after that age out of necessity.

Despite retiring later, older Americans are still increasingly likely to have a longer retirement than generations past, heightening uncertainty about whether or not their funds will last. Though the cost of living varies widely from state to state, the national average for retirement expenses is $835,453 and $1,003,548 for a 25- and 30-year retirement, respectively. After a COVID-era dip, life expectancy continues to rise, particularly among women, who tend to have lower lifetime earnings than men—and therefore less saved for retirement.

Retirement advisors polled by Nationwide suggest those nearing retirement take several measures to ensure a comfortable lifestyle: Plan for taxes and health care costs and delay receiving social security benefits until at least full retirement age to maximize the amount received.

Story editing by Alizah Salario. Copy editing by Paris Close. Photo selection by Ania Antecka.