States with the most households at risk of eviction

States with the most households at risk of eviction

The average American renter spends 31.2% of their income on housing, an all-time high that's exacerbated by the fact that more than 12 million people in the U.S. live in poverty despite working full-time. The coronavirus has deepened America's housing crisis by leaving tens of millions without jobs and facing potential eviction.

Three things happened this summer to aggravate the situation even further. An emergency federal eviction moratorium expired; federal supplementary unemployment aid expired; and Congress failed to agree on another round of stimulus aid.

The result is a looming housing crisis, the size and severity of which is difficult to overstate. As many as 40 million renters could be at risk of eviction in the coming months, according to the Aspen Insitute. The Centers for Disease Control (CDC) recently issued a nationwide moratorium on evictions through the end of 2020, but it comes with stipulations and requires struggling tenants to advocate for themselves.

Some states have created extra protections for renters, while many have not. Of the states that have their own state-mandated bans on evictions, many protections are ending soon. In many cases, however, the damage has already been done: Struggling American renters by midsummer had already amassed more than $21 billion in back rent. A crisis is brewing, and renters face different risks depending on where they live.

To determine the states with the most households at risk of eviction, Stacker analyzed data from global advisory firm Stout that provides estimates of the renting households unable to pay rent and at risk of eviction in every state based on the U.S. Census' American Community Survey and Household Pulse Survey. We've ranked all 50 states and Washington D.C. according to the estimated share of renters in these states at risk of eviction over the next month. These estimates reflect the households with no or slight confidence that they will be able to pay rent. You can find more information about Stout's methodology here.

Keep reading to see how many households are at risk of eviction in your home state.

You may also like: How America has changed since the first Census in 1790

#51. Vermont

- Estimated share of households unable to pay rent: 7.9% of all renting households

- Total estimated households unable to pay rent: 5,000

- Estimated rental shortfall in the next month: $8 million

- Estimated total eviction filings in the next four months: 4,000

Vermont renters have received protections from the federal CARES Act, a state law placing a moratorium on evictions during COVID-19, and a series of emergency rules issued by the state judiciary. The Vermont State Housing Authority is working to help landlords recoup back rent losses and although tenants can still be evicted, there are strict rules delegating when, how, and under what conditions those eviction proceedings can go forward.

#50. Montana

- Estimated share of households unable to pay rent: 12.3% of all renting households

- Total estimated households unable to pay rent: 15,000

- Estimated rental shortfall in the next month: $17 million

- Estimated total eviction filings in the next four months: 10,000

Montana’s governor has issued a directive that protects renters from being evicted despite the end of the federal moratorium. It’s up to renters, however, to demonstrate that they’ve incurred financial hardship as a result of the crisis and meet several other qualifying conditions.

#49. Wisconsin

- Estimated share of households unable to pay rent: 13.4% of all renting households

- Total estimated households unable to pay rent: 99,000

- Estimated rental shortfall in the next month: $112 million

- Estimated total eviction filings in the next four months: 67,000

As many as 200,000 Wisconsin renters—more than a quarter of all renters in the state—are at risk for eviction as the expiration of supplementary unemployment assistance further squeezed tens of thousands of already-struggling households. These households are not protected from eviction by the federal government or their own state.

#48. North Dakota

- Estimated share of households unable to pay rent: 13.8% of all renting households

- Total estimated households unable to pay rent: 15,000

- Estimated rental shortfall in the next month: $18 million

- Estimated total eviction filings in the next four months: 10,000

Hundreds of renters have already been evicted in North Dakota over the course of the COVID-19 crisis, however those numbers represent a decrease in evictions carried out in 2019 and 2018. The state has implemented a COVID Emergency Rent Bridge during the pandemic to provide rental assistance to qualified applicants who have lost income during COVID-19.

#47. New Hampshire

- Estimated share of households unable to pay rent: 15.4% of all renting households

- Total estimated households unable to pay rent: 22,000

- Estimated rental shortfall in the next month: $29 million

- Estimated total eviction filings in the next four months: 15,000

Eviction notices in New Hampshire must explain the appeals process to tenants in writing and also disclose that tenants have options besides moving out immediately. The measure dates to 2018 when the state Supreme Court issued the directive after it became clear that many residents didn't know they forfeited their right to contest evictions the moment they moved out.

#46. Nebraska

- Estimated share of households unable to pay rent: 16.5% of all renting households

- Total estimated households unable to pay rent: 40,000

- Estimated rental shortfall in the next month: $49 million

- Estimated total eviction filings in the next four months: 27,000

Nebraskans struggling to pay rent can apply for their share of millions of dollars worth of CARES Act relief funds allocated to the state. Even still, Legal Aid attorneys there are preparing for a wave of evictions in the near future and are mounting a campaign to guide vulnerable residents through the legal process.

#45. Iowa

- Estimated share of households unable to pay rent: 17.5% of all renting households

- Total estimated households unable to pay rent: 59,000

- Estimated rental shortfall in the next month: $59 million

- Estimated total eviction filings in the next four months: 40,000

The Iowa government is offering financial assistance to residents who suffered a COVID-related loss of income since the start of the pandemic. Eligible applicants may receive $3,200 for rental assistance—including arrears—for up to four months.

#44. Maine

- Estimated share of households unable to pay rent: 18.1% of all renting households

- Total estimated households unable to pay rent: 27,000

- Estimated rental shortfall in the next month: $30 million

- Estimated total eviction filings in the next four months: 18,000

The Maine state government in early August announced it would extend its rental relief program and double the benefits it pays out. The program, which had paid $500 directly to landlords on behalf of struggling tenants for up to three months, now pays up to $1,000.

#43. Wyoming

- Estimated share of households unable to pay rent: 18.2% of all renting households

- Total estimated households unable to pay rent: 11,000

- Estimated rental shortfall in the next month: $12 million

- Estimated total eviction filings in the next four months: 8,000

Virtually all state-mandated protections for renters in Wyoming have expired. Tenants there who aren’t able to pay the rent can check their eligibility for the CDC’s eviction moratorium.

#42. Oregon

- Estimated share of households unable to pay rent: 18.3% of all renting households

- Total estimated households unable to pay rent: 106,000

- Estimated rental shortfall in the next month: $126 million

- Estimated total eviction filings in the next four months: 72,000

Even before the pandemic, about 25% of Oregon renters spent half their income on rent, making tenants there particularly vulnerable to a catastrophe. At the end of June, however, the legislature passed a law preventing residential and commercial evictions through the end of September.

#41. Utah

- Estimated share of households unable to pay rent: 19.3% of all renting households

- Total estimated households unable to pay rent: 54,000

- Estimated rental shortfall in the next month: $69 million

- Estimated total eviction filings in the next four months: 36,000

Utah lawmakers in June voted to create a $20 million rental assistance program for state residents. And while people across the country struggled following the loss of the federal $600 employment benefit, Utah responded in early August by offering rental assistance to anyone who lost the federal benefit and is now unable to keep up with their expenses.

#40. Massachusetts

- Estimated share of households unable to pay rent: 20.7% of all renting households

- Total estimated households unable to pay rent: 196,000

- Estimated rental shortfall in the next month: $270 million

- Estimated total eviction filings in the next four months: 132,000

More than 300,000 Massachusetts residents missed rent or mortgage payments in July and more than 570,000 anticipated being unable to make payments in August. Without federal aid, the state is bracing for an imminent housing crisis that could total $135 million per month in missed housing payments.

#39. Missouri

- Estimated share of households unable to pay rent: 21.9% of all renting households

- Total estimated households unable to pay rent: 164,000

- Estimated rental shortfall in the next month: $178 million

- Estimated total eviction filings in the next four months: 110,000

A group of tenant advocates and organizations on Aug. 20 called for the Missouri Supreme Court to declare a moratorium on evictions for six months in the face of a looming rent crisis. Without such a move, the group predicts 200,000 evictions will be filed in the next four months. Advocates also requested that Gov. Mike Parson provide financial assistance for landlords who agree to halt rental arrears and discontinue court proceedings for evictions.

#38. Arkansas

- Estimated share of households unable to pay rent: 22.2% of all renting households

- Total estimated households unable to pay rent: 79,000

- Estimated rental shortfall in the next month: $75 million

- Estimated total eviction filings in the next four months: 53,000

Renters in Arkansas are not protected by a state ban on evictions and the rental assistance offered by the state is fairly limited. Evictions have been on the rise throughout the state, with 136 of 270 evictions in July filed against women.

#37. South Dakota

- Estimated share of households unable to pay rent: 22.5% of all renting households

- Total estimated households unable to pay rent: 23,000

- Estimated rental shortfall in the next month: $19 million

- Estimated total eviction filings in the next four months: 15,000

Although the courts in South Dakota did issue rulings designed to prevent the spread of COVID-19, they did not mandate protections against evictions for renters. Even more discouraging for underwater renters is the fact that the state's governor said implicitly that she would not consider rent freezes, a moratorium on evictions, or even a ban on utility shutoffs.

#36. Alaska

- Estimated share of households unable to pay rent: 23.0% of all renting households

- Total estimated households unable to pay rent: 18,000

- Estimated rental shortfall in the next month: $25 million

- Estimated total eviction filings in the next four months: 12,000

By late August, Alaska’s state rental protections had expired along with the federal government’s. Some renters who live in public housing might be eligible for relief funding, and some municipalities in the state are partnering with the United Way to assist at-risk tenants.

#35. Minnesota

- Estimated share of households unable to pay rent: 23.4% of all renting households

- Total estimated households unable to pay rent: 138,000

- Estimated rental shortfall in the next month: $152 million

- Estimated total eviction filings in the next four months: 93,000

Gov. Tim Waltz’s Executive order 20-79, which went into effect Aug. 4, loosened restrictions on landlords seeking to carry out evictions. Landlords may now evict some residents who caused property damage or in some cases if the property managers or their families need to move into the residence. Evictions for nonpayment, however, are still banned.

#34. Washington

- Estimated share of households unable to pay rent: 24.0% of all renting households

- Total estimated households unable to pay rent: 245,000

- Estimated rental shortfall in the next month: $366 million

- Estimated total eviction filings in the next four months: 165,000

Landlords in Washington are forbidden from evicting tenants for nonpayment through Oct. 15. They can, however, serve eviction notices to tenants who are dangerous, are participating in criminal activity, or who have destroyed property.

#33. Pennsylvania

- Estimated share of households unable to pay rent: 24.5% of all renting households

- Total estimated households unable to pay rent: 359,000

- Estimated rental shortfall in the next month: $378 million

- Estimated total eviction filings in the next four months: 243,000

Pennsylvania enforced an eviction moratorium for more than five months, but that protection expired at the end of August. Gov. Tom Wolf, who cited limits to his executive powers as an explanation for why he could not extend the moratorium, has called upon the state legislature to extend the eviction moratorium.

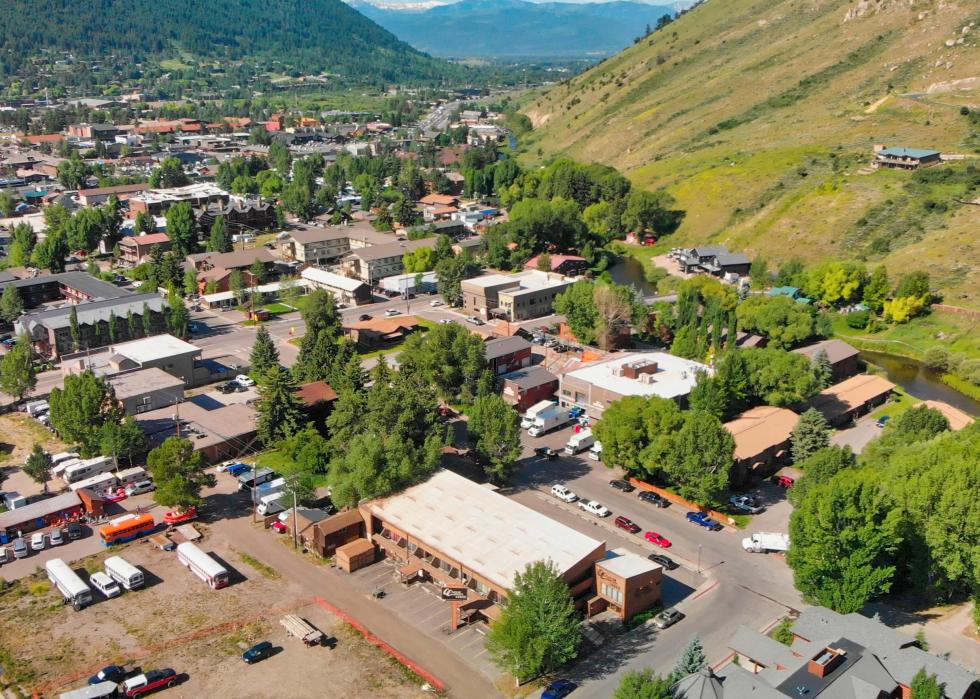

#31. Colorado

- Estimated share of households unable to pay rent: 24.9% of all renting households

- Total estimated households unable to pay rent: 180,000

- Estimated rental shortfall in the next month: $261 million

- Estimated total eviction filings in the next four months: 121,000

Colorado's Emergency Rental and Mortgage Assistance for Households program invites eligible residents to apply for help paying rent. There are several conditions, including income caps, not having already received assistance, and documentation showing financial hardship due to COVID-19.

#31. Arizona

- Estimated share of households unable to pay rent: 24.9% of all renting households

- Total estimated households unable to pay rent: 214,000

- Estimated rental shortfall in the next month: $259 million

- Estimated total eviction filings in the next four months: 144,000

The rules protecting Arizona renters from evictions changed on Aug. 22. Renters now have to prove pandemic-related financial hardships and provide documentation that they applied for outside rental assistance in order to remain in their homes or apartments.

#30. Virginia

- Estimated share of households unable to pay rent: 26.0% of all renting households

- Total estimated households unable to pay rent: 262,000

- Estimated rental shortfall in the next month: $370 million

- Estimated total eviction filings in the next four months: 177,000

A divided Virginia Supreme Court voted on Aug. 7 in favor of a temporary moratorium on evictions. The relief for renters is set to expire Sept. 7. The state has used $50 million from federal coronavirus aid for statewide rent relief programs.

#28. Rhode Island

- Estimated share of households unable to pay rent: 26.4% of all renting households

- Total estimated households unable to pay rent: 38,000

- Estimated rental shortfall in the next month: $36 million

- Estimated total eviction filings in the next four months: 26,000

Rhode Island’s new “Safe Harbor” initiative is a $7 million program designed to reduce evictions by providing cash and mediation services. Safe Harbor was spearheaded by a partnership between the state and the Rhode Island United Way. In Rhode Island, 98% of landlords go to court with legal representation while just 2% of tenants have a lawyer.

#28. North Carolina

- Estimated share of households unable to pay rent: 26.4% of all renting households

- Total estimated households unable to pay rent: 338,000

- Estimated rental shortfall in the next month: $366 million

- Estimated total eviction filings in the next four months: 228,000

State and federal eviction moratoriums expired for North Carolinians in midsummer. That, combined with the expiration of expanded unemployment benefits, leaves more than 700,000 residents in precarious financial straits—especially now that landlords can begin evicting low-income residents from public housing.

#27. Maryland

- Estimated share of households unable to pay rent: 26.6% of all renting households

- Total estimated households unable to pay rent: 185,000

- Estimated rental shortfall in the next month: $226 million

- Estimated total eviction filings in the next four months: 125,000

Maryland took decisive action to protect renters during the COVID-19 crisis, but many property owners complained that the state didn't do enough to protect landlords. A group of 23 landlords in early August announced a lawsuit against three municipalities to collect back rent and late fees, which the landlords have been forbidden from collecting, and rent increases, which they were forbidden from charging.

#26. Delaware

- Estimated share of households unable to pay rent: 26.8% of all renting households

- Total estimated households unable to pay rent: 27,000

- Estimated rental shortfall in the next month: $33 million

- Estimated total eviction filings in the next four months: 18,000

More than 61,000 Delaware residents were still unemployed as of mid-August, an increase of more than 200% over the same time last year. In response, the state allocated an extra $40 million—half from the federal CARES Act and the other half from the state’s own relief bill—to existing rent-relief programs. Eligible renters can apply for up to $5,000 to be paid directly to their landlords.

#25. Hawaii

- Estimated share of households unable to pay rent: 27.0% of all renting households

- Total estimated households unable to pay rent: 47,000

- Estimated rental shortfall in the next month: $99 million

- Estimated total eviction filings in the next four months: 32,000

There’s a moratorium on evictions in Hawaii, but Honolulu Civil Beat reports that social service agencies and nonprofits are indicating that many landlords are either unaware of the order or are simply ignoring it. Many renters in Hawaii report that their landlords are moving forward with evictions without the consent of the courts or the sheriff’s office.

#24. New Mexico

- Estimated share of households unable to pay rent: 28.0% of all renting households

- Total estimated households unable to pay rent: 66,000

- Estimated rental shortfall in the next month: $63 million

- Estimated total eviction filings in the next four months: 45,000

Just as in Hawaii, tenants and landlords in New Mexico appear to be stumbling through a web of restrictions and protections that the state enacted in response to the coronavirus. The Santa Fe New Mexican reports that the government’s temporary eviction moratorium doesn’t prevent rent-related costs from piling up. The result is an environment in which both tenants and landlords are facing legal confusion and intense financial pressure with no clear path forward.

#23. California

- Estimated share of households unable to pay rent: 29.0% of all renting households

- Total estimated households unable to pay rent: 1.6 million

- Estimated rental shortfall in the next month: $2.6 billion

- Estimated total eviction filings in the next four months: 1.1 million

California Gov. Gavin Newsom on Aug. 31 extended the state’s moratorium on evictions, which it enacted in response to the COVID-19 crisis. The mandate prevents renters from being evicted through February 2021, provided they pay at least 25% of their rent through the end of 2020.

#22. Indiana

- Estimated share of households unable to pay rent: 29.5% of all renting households

- Total estimated households unable to pay rent: 220,000

- Estimated rental shortfall in the next month: $204 million

- Estimated total eviction filings in the next four months: 148,000

Indiana's moratorium on evictions expired in mid-August. Anticipating a massive wave of court cases, the state's Supreme Court set up a tenant/landlord task force to mediate disputes, mitigate damage to both parties, and keep a backlog from piling up in the courts.

#21. Michigan

- Estimated share of households unable to pay rent: 29.6% of all renting households

- Total estimated households unable to pay rent: 312,000

- Estimated rental shortfall in the next month: $329 million

- Estimated total eviction filings in the next four months: 211,000

In the early months of the summer, the courts in Michigan, like those in Indiana, correctly predicted a wave of evictions once the federal moratorium expired. A priority-based framework for hearing eviction cases was deployed, with priority going to cases where tenants were dangerous, threatening, or causing property damage. Next are cases with at least 120 days of nonpayment, then those with 90 days, then cases dealing with tenants who haven’t paid in 60 days, and then finally 30 days.

#20. Kentucky

- Estimated share of households unable to pay rent: 30.3% of all renting households

- Total estimated households unable to pay rent: 152,000

- Estimated rental shortfall in the next month: $179 million

- Estimated total eviction filings in the next four months: 102,000

Kentucky Gov. Andy Beshear signed an executive order at the end of August that allocates at least $15 million of the state’s share of CARES Act funding for dealing with rental assistance and nonpayment. The order further requires landlords to give tenants 30 days’ notice before filing and to engage in a sit-down meeting first to try to work something out prior to eviction.

#19. Washington D.C.

- Estimated share of households unable to pay rent: 31.4% of all renting households

- Total estimated households unable to pay rent: 49,000

- Estimated rental shortfall in the next month: $70 million

- Estimated total eviction filings in the next four months: 33,000

Washington D.C. is under an emergency eviction moratorium until Oct. 8. The District went a step further and extended the ban on evictions until at least two months after the emergency decree expires, which means renters are protected under most circumstances until December at the earliest.

#18. Florida

- Estimated share of households unable to pay rent: 31.6% of all renting households

- Total estimated households unable to pay rent: 786,000

- Estimated rental shortfall in the next month: $1.0 billion

- Estimated total eviction filings in the next four months: 530,000

The governor of Florida in early August extended a moratorium on evictions in the state for the third time. The extension only protected renters who could prove a COVID-19-related hardship, however, and didn’t address back rent, arrears, and other debt, and expired for good on Sept. 1.

#17. Idaho

- Estimated share of households unable to pay rent: 31.7% of all renting households

- Total estimated households unable to pay rent: 54,000

- Estimated rental shortfall in the next month: $65 million

- Estimated total eviction filings in the next four months: 37,000

The end of the federal CARES Act eviction ban had a swift impact on Idaho renters. Less than one month later, the state's courts were flooded with an increase in cases greater than any caseload seen there since May. The state's Housing Preservation Program, however, is helping thousands of residents with rental assistance in the short term.

#16. Ohio

- Estimated share of households unable to pay rent: 32.2% of all renting households

- Total estimated households unable to pay rent: 478,000

- Estimated rental shortfall in the next month: $428 million

- Estimated total eviction filings in the next four months: 322,000

An organization called Ohio Legal Help created a webpage to inform renters in the state about their rights, legal status in the face of eviction, and where to look for help. With state-level protections mostly expired, struggling renters in Ohio have the option to check their eligibility for the new CDC moratorium.

#15. Georgia

- Estimated share of households unable to pay rent: 32.3% of all renting households

- Total estimated households unable to pay rent: 408,000

- Estimated rental shortfall in the next month: $454 million

- Estimated total eviction filings in the next four months: 275,000

A wave of eviction cases in Georgia crashed on the courts shortly after the CARES Act moratorium expired and left renters in the state completely exposed. It started in Chatham County, where hundreds of cases were quickly backlogged, and began spreading across the state’s other 158 counties.

#14. Texas

- Estimated share of households unable to pay rent: 33.3% of all renting households

- Total estimated households unable to pay rent: 1.2 million

- Estimated rental shortfall in the next month: $1.4 billion

- Estimated total eviction filings in the next four months: 779,000

Almost 40% of households renters in Texas were unsure whether they could come up with rent money in August. That same month, the Texas attorney general advised local governments that they are forbidden from interfering with or attempting to stop or slow evictions related to the pandemic.

#13. Illinois

- Estimated share of households unable to pay rent: 33.4% of all renting households

- Total estimated households unable to pay rent: 513,000

- Estimated rental shortfall in the next month: $670 million

- Estimated total eviction filings in the next four months: 346,000

Struggling renters in Illinois got some good, albeit fleeting, news at the end of August when Gov. J.B. Pritzker announced an extension of the state’s eviction moratorium for another 30 days. That extension, however, lasts only through September and does not relieve renters of any obligations regarding back-due payments.

#12. New Jersey

- Estimated share of households unable to pay rent: 34.7% of all renting households

- Total estimated households unable to pay rent: 387,000

- Estimated rental shortfall in the next month: $551 million

- Estimated total eviction filings in the next four months: 261,000

New Jersey Gov. Phil Murphy in August unveiled a $25 million plan to help cover rent payments that thousands of residents couldn't make between April land July. The federal funds will go directly to landlords, who will then be required to cancel fees and back rent owed by tenants.

#11. Kansas

- Estimated share of households unable to pay rent: 34.9% of all renting households

- Total estimated households unable to pay rent: 124,000

- Estimated rental shortfall in the next month: $122 million

- Estimated total eviction filings in the next four months: 84,000

Kansas Gov. Laura Kelly in August expressed frustration with Congress’s failure to come to an agreement on renewed COVID-19 relief legislation. Kelly also announced she was reinstating the state’s eviction limits, which had kept many Kansas renters in their homes. The limits, however, only protect tenants who can prove pandemic-related hardships and they expire on Sept. 15, although Kelly may consider extending the deadline if Congress is still stalled by then.

#10. New York

- Estimated share of households unable to pay rent: 35.2% of all renting households

- Total estimated households unable to pay rent: 1.1 million

- Estimated rental shortfall in the next month: $1.7 billion

- Estimated total eviction filings in the next four months: 766,000

More than 35% of households that rent in New York, which stood as America’s original COVID-19 hotspot, are at risk of facing eviction. Gov. Andrew Cuomo on Aug. 20 extended an eviction moratorium and other residential protections to commercial renters. In New York City, where renters make up two-thirds of the population, evictions are on hold until at least Oct. 1.

#9. Connecticut

- Estimated share of households unable to pay rent: 35.4% of all renting households

- Total estimated households unable to pay rent: 157,000

- Estimated rental shortfall in the next month: $203 million

- Estimated total eviction filings in the next four months: 106,000

Eviction protections for renters in Connecticut were set to expire on Sept. 9, but Gov. Ned Lamont on Aug. 20 used his emergency powers to extend Connecticut’s ban on evictions until at least October. The move requires him either to seek legislative support or to declare a public health emergency.

#8. West Virginia

- Estimated share of households unable to pay rent: 35.5% of all renting households

- Total estimated households unable to pay rent: 58,000

- Estimated rental shortfall in the next month: $46 million

- Estimated total eviction filings in the next four months: 39,000

Legal Aid organizations have outlined tenants’ rights in West Virginia, where a huge percentage of renters face eviction with very little legal protection. Landlords must get a court order before they enforce an eviction, but COVID-19-specific hardship is not enough to prevent eviction outright.

#7. South Carolina

- Estimated share of households unable to pay rent: 36.6% of all renting households

- Total estimated households unable to pay rent: 192,000

- Estimated rental shortfall in the next month: $201 million

- Estimated total eviction filings in the next four months: 130,000

A housing crisis was looming in South Carolina well before the pandemic, with an eviction rate higher than any other in the U.S. and double that of the next state. The expiration of federal rental protections during COVID-19 and the loss of extra unemployment aid means rental assistance needs in the state will approach $835 million.

#6. Nevada

- Estimated share of households unable to pay rent: 37.9% of all renting households

- Total estimated households unable to pay rent: 175,000

- Estimated rental shortfall in the next month: $219 million

- Estimated total eviction filings in the next four months: 118,000

Nevada’s statewide ban on evictions was set to expire on Sept. 1. The state, however, recently passed a bill that expands aid to renters and assists them in fighting eviction proceedings beyond traditional court hearings.

#5. Tennessee

- Estimated share of households unable to pay rent: 38.7% of all renting households

- Total estimated households unable to pay rent: 308,000

- Estimated rental shortfall in the next month: $303 million

- Estimated total eviction filings in the next four months: 208,000

Tennessee officials are bracing for more than 280,000 potential eviction filings in the coming months, according to a local Fox affiliate. With a moratorium on evictions having already expired, advocates and Legal Aid representatives are reporting that landlords are trying to get around the clogged court system by illegally attempting to evict delinquent tenants on their own.

#4. Alabama

- Estimated share of households unable to pay rent: 38.9% of all renting households

- Total estimated households unable to pay rent: 198,000

- Estimated rental shortfall in the next month: $168 million

- Estimated total eviction filings in the next four months: 134,000

The only protections Alabama provided for its tens of thousands of struggling renters came early in the crisis and expired just as the summer was beginning. The crisis has not subsided, federal protections have run out, and Alabamans are largely on their own. Landlords there can evict for nonpayment without any duty to mitigate damages.

#3. Oklahoma

- Estimated share of households unable to pay rent: 39.2% of all renting households

- Total estimated households unable to pay rent: 180,000

- Estimated rental shortfall in the next month: $178 million

- Estimated total eviction filings in the next four months: 121,000

All qualifying Oklahomans are eligible to receive some of the state’s $10 million eviction mitigation fund, which was allocated from the state’s share of the CARES Act fund. The problem is that in Oklahoma, where a person lives in the state determines what resources they’re eligible for. A coalition of legal professionals, advocates, and community leaders was formed to help renters understand their rights and access to resources in the complicated statewide system.

#2. Mississippi

- Estimated share of households unable to pay rent: 40.4% of all renting households

- Total estimated households unable to pay rent: 121,000

- Estimated rental shortfall in the next month: $102 million

- Estimated total eviction filings in the next four months: 82,000

The looming eviction crisis is more immediate in Mississippi than virtually anywhere else in the country. Many renters in the country's poorest state were already on the brink before the pandemic sent unemployment there soaring so high that tens of thousands of Missippians weren't even counted as unemployed because they fell out of the workforce altogether.

#1. Louisiana

- Estimated share of households unable to pay rent: 41.0% of all renting households

- Total estimated households unable to pay rent: 214,000

- Estimated rental shortfall in the next month: $223 million

- Estimated total eviction filings in the next four months: 144,000

Black renters are at far greater risk of mass eviction in Lousiana than the larger population—nowhere more so than in New Orleans. Dilapidated post-Katrina structures, high housing costs, and flimsy tenant rights are creating a perfect storm that advocates worry will explode into a full-fledged crisis of homelessness in weeks, not months—and much of the rest of Louisiana is not far behind.