These are the people most likely to be burdened by medical debt in the US

This story originally appeared on Care Better and was produced and distributed in partnership with Stacker Studio.

These are the people most likely to be burdened by medical debt in the US

Of every five adults in America, two are currently saddled with debt from a medical procedure, emergency room visit, dental procedure, or other health care expense.

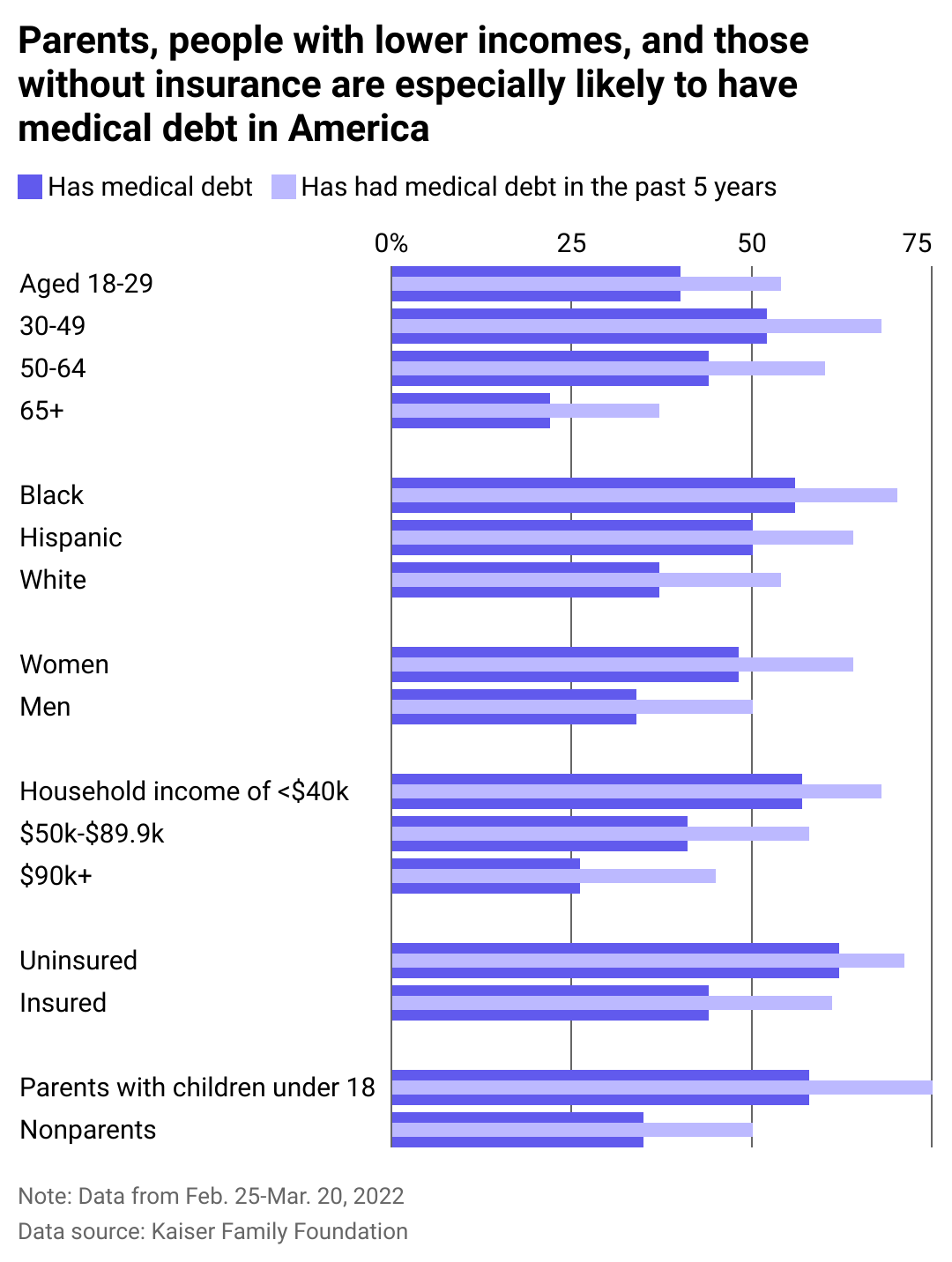

Care Better analyzed data from the Kaiser Family Foundation to visualize which groups of Americans are most likely to hold medical debt. The numbers come from a survey fielded from Feb. 25 through March 20, 2022. The survey included 2,375 adult respondents and is nationally representative of the overall American population.

The responses reveal an uneven distribution of medical debt, dampening the economic potential for a subset of the American population. Stakeholders in the health care sector pin this on a variety of factors, including lack of insurance. Americans who don't have health insurance are more likely than those who are insured to carry medical debt. But insured Americans report carrying medical debt, too.

The average health care plan sponsored by an employer carries a deductible higher than what many Americans report they can afford in emergency out-of-pocket expenses, according to the American Hospital Association. Nearly 2 in 5 Americans reported in 2022 that they couldn't afford a $400 emergency expense, and the typical deductible is around $1,400 per year.

The AHA reports that every year, its members provide tens of billions of dollars worth of uncompensated care for those who need it, and encourages health plans to ensure "that the coverage they offer provides protection against unaffordable bills and medical debt."

Over the last decade, health care costs have risen faster than inflation in most years, and they have certainly increased faster than wages, which were largely stagnant prior to the COVID-19 pandemic. These costs are hitting Americans with the lowest incomes and highest expenses the hardest.

America's medical debt is far from evenly distributed

The lowest-earning Americans tend to be the ones most likely to carry medical debt or dental debt, according to Kaiser Family Foundation survey data. Fewer than half of Americans making $90,000 per year or more have carried that debt in the last five years, whereas more than two-thirds of those earning $40,000 or less have had medical debt in that same time period.

Americans with higher costs due to raising children also report higher levels of medical debt. Roughly 3 in 5 parents with kids under the age of 18 are saddled with unpaid bills of some sort, compared with about 1 in 3 nonparents. Racial inequity is also present when it comes to the medical debt burden in America, with Black and Hispanic Americans being more likely to carry medical debt than their white counterparts.

Though a quarter of adults report they could pay off their medical debt in two years, about 1 in 5 report that they may never pay it off. When medical and dental costs become insurmountable for Americans, many borrow in order to make the debt right in the short term, accruing interest via credit cards or loans in the long term. The adults burdened by this debt report making financial sacrifices, including a significant number who say they've borrowed from family members or drained savings accounts.

Those Americans also report an emotional toll from the debt, dimming their outlook for the future. Unpaid bills may prompt health care providers to deny someone care down the road. They are often sent to aggressive collection agencies and might see their credit scores suffer. Lower credit scores make it difficult to qualify for a vehicle loan to commute to work, purchase a home, or borrow in case of future emergencies.

These harms to the financial health of Americans have led to calls for new policies, including a proposal by the Consumer Financial Protection Bureau to remove medical bills from consumers' credit scores.

Hospitals themselves have stepped in to offer financial assistance and cover unpaid medical bills where possible, but even they have taken a harder stance in recent years, pressuring insurers to provide more affordable terms for Americans.

Since 2012, all but a handful of state legislatures have expanded Medicaid coverage to even more lower-income households. In states that have, uninsured rates have fallen considerably. Those changes have led to a lowering of the overall costs of uncompensated care in those states and helped support local economies.

Unfortunately, more people could find themselves saddled with medical debt in the years ahead, as a result of declining rates of insured Americans this year. COVID-era bailout bills expanded eligibility for, and automatically enrolled a record number of Americans in, health insurance, but those programs came to an end this year, and millions of lower-income Americans appear poised to lose coverage.

Story editing by Jeff Inglis. Copy editing by Tim Bruns.