Where wealthy millennials are moving

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.

Where wealthy millennials are moving

According to the Census Bureau, the median income in the U.S. is around $75,000, with millennials earning higher than average at roughly $84,000 annually. But many millennials eclipse the median, with some households bringing in more than $200,000 per year—earning the classification of "high earners," per the IRS. These millennials in particular have more disposable income and economic freedom than their median counterparts, so their impact on local economies can be outsized. When these wealthy millennials choose to move for job opportunities, lifestyle, family and other reasons, their disproportionate economic power also goes with them.

With this in mind, SmartAsset examined the latest tax return data to determine which states these wealthy millennials are moving to and from.

Key Findings

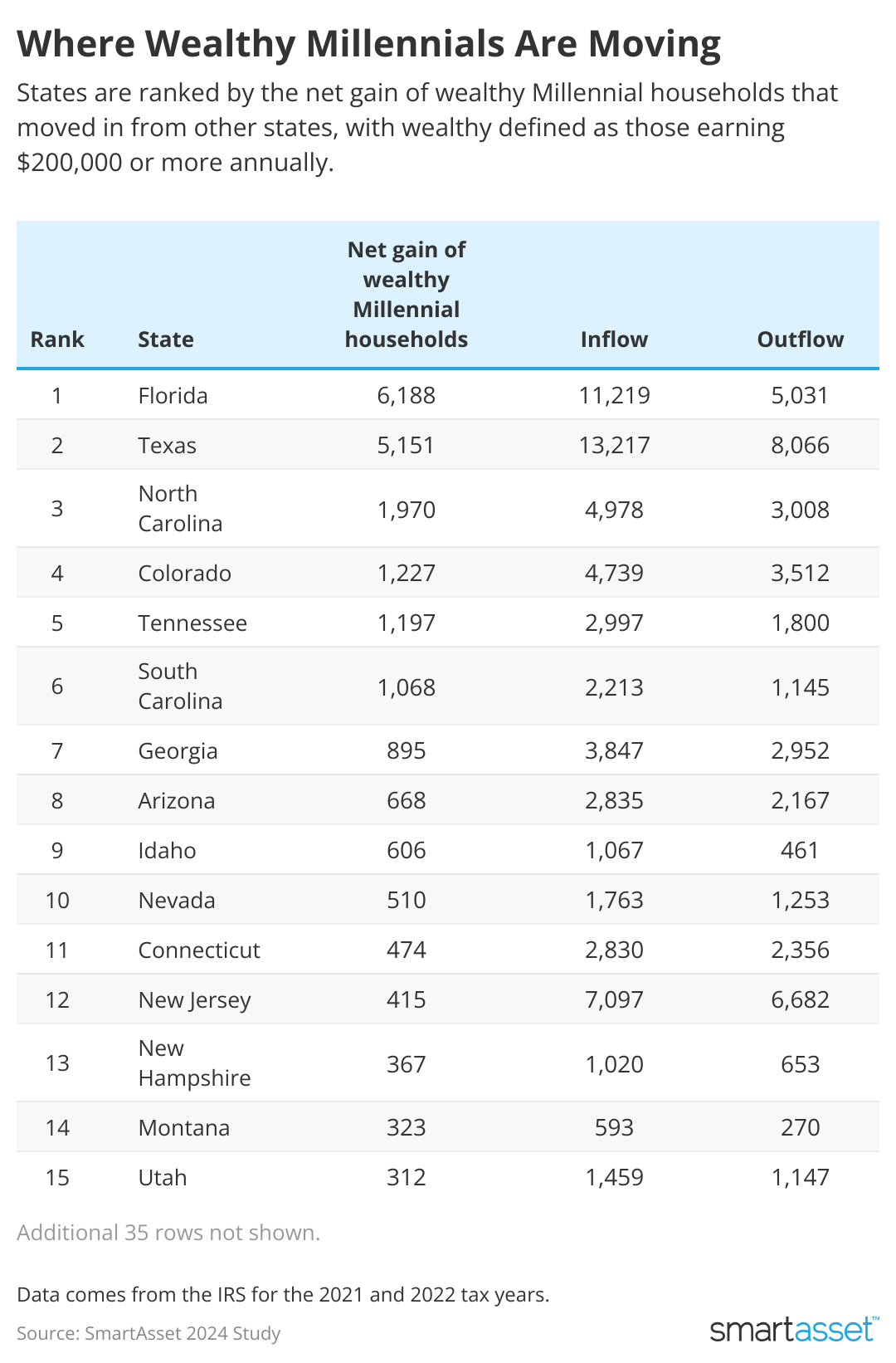

- Florida and Texas gained the most wealthy millennial households. When looking at the inflow and outflow of wealthy millennials, Florida had the highest net immigration of high earners in this age group with 6,188 households. Texas ranked second with a net gain of 5,151 households. Trailing behind in third was North Carolina with a net of 1,970 households moved in.

- Wealthy millennials have a preference for Colorado and Georgia compared to peers in other generations. In both states, the number of high-earning millennial households make up 87% of the net gain of all high-earning households that moved to each. Colorado gained 1,227 wealthy millennial households, out of a total net gain of 1,403 households earning $200,000 or more per year. For Georgia, 895 of the 1,024 wealthy households that moved in were millennials. Overall, Colorado ranked fourth and Georgia ranked seventh for where most wealthy millennials moved.

- Wealthy millennials leave California and New York. California lost a net of 9,181 wealthy millennial households, the most studywide. New York lost second-most at 4,251 net households. Illinois (-3,163) and Massachusetts (-1,927) also lost a significant amount of wealthy millennials.

- Utah has the highest percentage of wealthy households that are millennials. Out of a total of 94,488 households making over $200,000 per year, 25% are millennials in Utah. Overall, Utah ranks 15th for where high-earning millennials moved. Washington state has the second-highest rate of millennials among high-earners at 24.6%. Meanwhile, New Mexico has the lowest occurrence of wealthy millennials at just 15% of all households earning $200k+.

- Wealthy millennials in these states earn the most, on average. When adjusting the total AGI for this age group across the number of returns in each state, Wyoming, Nevada and Arkansas come out on top. On average, the AGI for wealthy millennials in Wyoming is $755,000, compared to $705,000 in Nevada and $679,000 in Arkansas.

Top 10 States Wealthy Millennials Are Moving To

- Florida

- Net gain of wealthy millennial households: 6,188

- Wealthy millennial inflow: 11,219

- Wealthy millennial outflow: 5,031

- Total number of millennial returns with income $200k+: 137,049

- Average AGI for wealthy millennial households: $551,114

- Percent of wealthy households that are millennials: 15.6%

- Texas

- Net gain of wealthy millennial households: 5,151

- Wealthy millennial inflow: 13,217

- Wealthy millennial outflow: 8,066

- Total number of millennial returns with income $200k+: 261,892

- Average AGI for wealthy millennial households: $469,975

- Percent of wealthy households that are millennials: 22.7%

- North Carolina

- Net gain of wealthy millennial households: 1,970

- Wealthy millennial inflow: 4,978

- Wealthy millennial outflow: 3,008

- Total number of millennial returns with income $200k+: 78,142

- Average AGI for wealthy millennial households: $430,957

- Percent of wealthy households that are millennials: 20.2%

- Colorado

- Net gain of wealthy millennial households: 1,227

- Wealthy millennial inflow: 4,739

- Wealthy millennial outflow: 3,512

- Total number of millennial returns with income $200k+: 76,264

- Average AGI for wealthy millennial households: $451,535

- Percent of wealthy households that are millennials: 22.3%

- Tennessee

- Net gain of wealthy millennial households: 1,197

- Wealthy millennial inflow: 2,997

- Wealthy millennial outflow: 1,800

- Total number of millennial returns with income $200k+: 43,778

- Average AGI for wealthy millennial households: $505,905

- Percent of wealthy households that are millennials: 19.5%

- South Carolina

- Net gain of wealthy millennial households: 1,068

- Wealthy millennial inflow: 2,213

- Wealthy millennial outflow: 1,145

- Total number of millennial returns with income $200k+: 27,501

- Average AGI for wealthy millennial households: $431,694

- Percent of wealthy households that are millennials: 17.2%

- Georgia

- Net gain of wealthy millennial households: 895

- Wealthy millennial inflow: 3,847

- Wealthy millennial outflow: 2,952

- Total number of millennial returns with income $200k+: 78,314

- Average AGI for wealthy millennial households: $446,434

- Percent of wealthy households that are millennials: 20.4%

- Arizona

- Net gain of wealthy millennial households: 668

- Wealthy millennial inflow: 2,835

- Wealthy millennial outflow: 2,167

- Total number of millennial returns with income $200k+: 47,404

- Average AGI for wealthy millennial households: $471,591

- Percent of wealthy households that are millennials: 17.9%

- Idaho

- Net gain of wealthy millennial households: 606

- Wealthy millennial inflow: 1,067

- Wealthy millennial outflow: 461

- Total number of millennial returns with income $200k+: 11,997

- Average AGI for wealthy millennial households: $450,278

- Percent of wealthy households that are millennials: 19.5%

- Nevada

- Net gain of wealthy millennial households: 510

- Wealthy millennial inflow: 1,763

- Wealthy millennial outflow: 1,253

- Total number of millennial returns with income $200k+: 19,608

- Average AGI for wealthy millennial households: $704,865

- Percent of wealthy households that are millennials: 17.6%

Top 10 States Wealthy millennials Are Moving Out Of

- California

- Net loss of wealthy millennial households: -9,181

- Wealthy millennial inflow: 14,139

- Wealthy millennial outflow: 23,320

- Total number of millennial returns with income $200k+: 589,524

- Average AGI for wealthy millennial households: $557,054

- Percent of wealthy households that are millennials: 23.1%

- New York

- Net loss of wealthy millennial households: -4,251

- Wealthy millennial inflow: 11,340

- Wealthy millennial outflow: 15,591

- Total number of millennial returns with income $200k+: 242,762

- Average AGI for wealthy millennial households: $577,533

- Percent of wealthy households that are millennials: 21.6%

- Illinois

- Net loss of wealthy millennial households: -3,163

- Wealthy millennial inflow: 3,694

- Wealthy millennial outflow: 6,857

- Total number of millennial returns with income $200k+: 127,494

- Average AGI for wealthy millennial households: $470,112

- Percent of wealthy households that are millennials: 21.5%

- Massachusetts

- Net loss of wealthy millennial households: -1,927

- Wealthy millennial inflow: 3,683

- Wealthy millennial outflow: 5,610

- Total number of millennial returns with income $200k+: 112,546

- Average AGI for wealthy millennial households: $479,226

- Percent of wealthy households that are millennials: 21.3%

- Pennsylvania

- Net loss of wealthy millennial households: -609

- Wealthy millennial inflow: 3,883

- Wealthy millennial outflow: 4,492

- Total number of millennial returns with income $200k+: 103,435

- Average AGI for wealthy millennial households: $420,588

- Percent of wealthy households that are millennials: 19.6%

- Minnesota

- Net loss of wealthy millennial households: -365

- Wealthy millennial inflow: 1,399

- Wealthy millennial outflow: 1,764

- Total number of millennial returns with income $200k+: 58,174

- Average AGI for wealthy millennial households: $397,778

- Percent of wealthy households that are millennials: 22.6%

- Louisiana

- Net loss of wealthy millennial households: -325

- Wealthy millennial inflow: 643

- Wealthy millennial outflow: 968

- Total number of millennial returns with income $200k+: 20,847

- Average AGI for wealthy millennial households: $413,864

- Percent of wealthy households that are millennials: 19.8%

- Washington

- Net loss of wealthy millennial households: -222

- Wealthy millennial inflow: 6,605

- Wealthy millennial outflow: 6,827

- Total number of millennial returns with income $200k+: 144,475

- Average AGI for wealthy millennial households: $459,701

- Percent of wealthy households that are millennials: 24.6%

- Michigan

- Net loss of wealthy millennial households: -189

- Wealthy millennial inflow: 1,986

- Wealthy millennial outflow: 2,175

- Total number of millennial returns with income $200k+: 60,457

- Average AGI for wealthy millennial households: $418,757

- Percent of wealthy households that are millennials: 18.1%

- Missouri

- Net loss of wealthy millennial households: -168

- Wealthy millennial inflow: 1,341

- Wealthy millennial outflow: 1,509

- Total number of millennial returns with income $200k+: 35,841

- Average AGI for wealthy millennial households: $435,553

- Percent of wealthy households that are millennials: 19.9%

Data and Methodology

To determine where wealthy millennials are moving, SmartAsset examined the latest IRS data, which comes from the 2021 and 2022 tax years. Wealthy households are defined here as those with adjusted gross incomes of $200,000 or more, which the IRS deems as the threshold for "high earners." Applicable tax returns filed for households aged 26 to 45 were considered. The inflow of qualifying households in each state were compared with the outflows to determine the net migration of high-earning households. The average AGI for a state's wealthy millennials households was also considered.