How AI is transforming accounting

How AI is transforming accounting

Once synonymous with spreadsheets and manual ledger entries, the accounting profession is undergoing a radical shift. Artificial intelligence (AI) is already reshaping industries like healthcare, logistics and financial management.

Initial fears that AI would eliminate accounting jobs overlooked its true potential. By automating repetitive tasks, AI allows accountants to focus on strategic, analytical, and advisory roles, making their work more engaging and impactful.

In fact, a recent survey conducted by Stanford Graduate School of Business researchers found that AI-powered tools shifted 8.5% of accountants’ time from data entry to higher-value strategic work like business communication and quality assurance.

Accounting firms, finance teams, and business owners alike are embracing AI-powered tools to streamline operations, detect fraud, and drive strategic insights. The trend is no longer theoretical. Paylocity, a human capital management and finance software provider, shares how AI is reshaping workflows across industries and redefining the role of the modern accountant.

Market Growth Signals Major Investment Ahead

According to market research firm Mordor Intelligence, the global AI accounting market is projected to jump more than fivefold from $6.68 billion in 2025 to $37.6 billion by 2030.

The surge is driven by rapid advancements in generative AI and large language models, which enable automation of traditionally time-intensive tasks.

These technologies are already making accounting more scalable and accessible for organizations of all sizes, offering real-time analysis and operational efficiency that was once available only to enterprise firms.

From Manual Tasks to Machine Intelligence

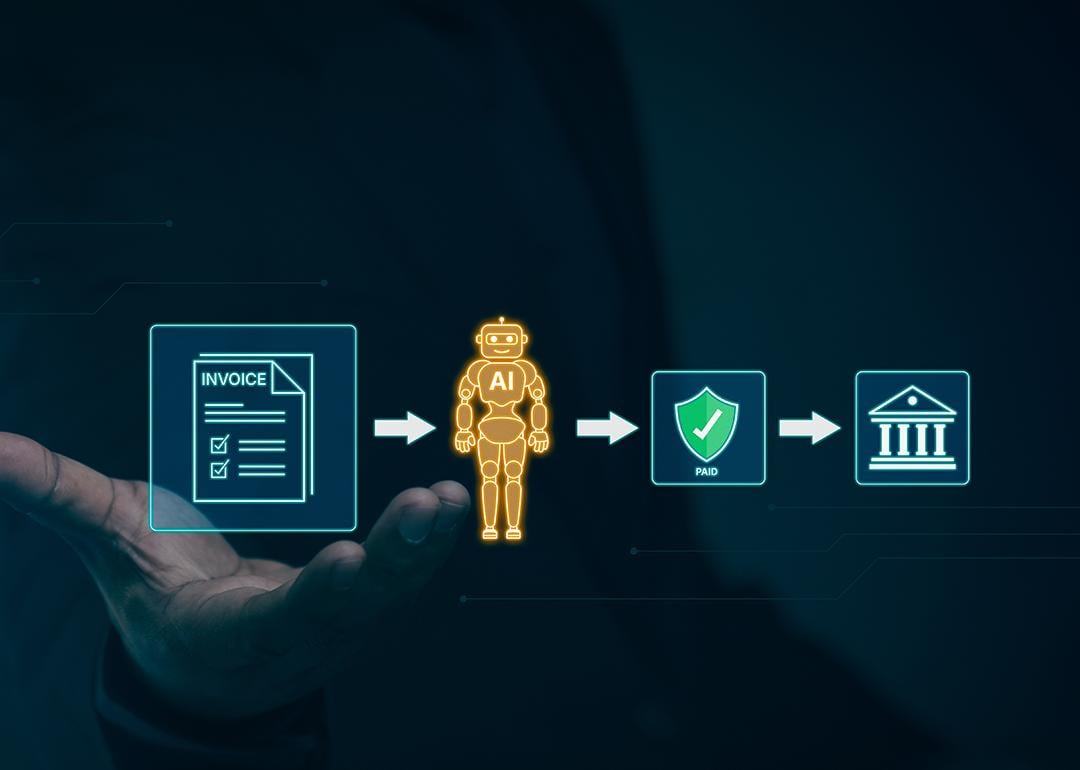

In practical terms, AI’s footprint in accounting is broad and growing. Key areas of disruption include:

- Automation of Repetitive Tasks: Tools leveraging machine learning and optical character recognition (OCR) can now categorize expenses, reconcile accounts, and process receipts in seconds — eliminating hours of manual tedious work.

- Real-Time Fraud Detection: AI models are increasingly used to monitor transactions and identify irregularities, helping organizations spot fraud patterns that might escape human review.

- Smarter Expense Management: AI-enabled apps can scan receipts, auto-fill reports, and apply policy-based categorization — reducing the administrative burden for both employees and finance teams.

- Intelligent Document Handling: AI also assists in parsing key information from contracts and compliance documents, streamlining workflows in audit-heavy industries.

What’s Holding AI Back in Accounting

Despite the promise, integrating AI into accounting systems comes with challenges.

- Workforce Anxiety: Concerns about job displacement persist. Instead of replacing accountants, AI is more likely to shift their focus toward strategic advisory roles. Education and upskilling initiatives are critical to easing the transition.

- Cost and Expertise: Small businesses, in particular, may find initial investments in AI infrastructure daunting. Data from Paylocity, indicates 53% of procurement professionals identify skill gaps as a major obstacle to adopting compliant processes. However, cloud-based, modular platforms and vendor partnerships offer lower-barrier entry points.

Accountants: From Tallying to Advising

While automation eliminates some routine functions, industry analysts say AI will not replace accountants. Instead, it will free them to focus on higher-order thinking — such as financial strategy, forecasting, and client advising.

This also drives finance team engagement and retention. Freed from the grind of repetitive, burnout-inducing tasks, accountants are stepping into more strategic, value-driven roles.

Interpretation of tax law, business-specific consulting, and ethical judgment remain distinctly human tasks. Likewise, future accountants may spend less time tallying receipts and more time guiding business growth.

The Bottom Line

As AI tools become more sophisticated and accessible, the accounting profession is poised for its most significant evolution in decades. The shift promises operational gains and a reimagining of how businesses engage with their finances.

The benefits for those willing to adapt are tangible: increased accuracy, improved compliance, and stronger financial insights. The question is no longer if AI will change accounting, but how fast.

This story was produced by Paylocity and reviewed and distributed by Stacker.