Home repairs, replacements and insurance: What homeowners need to know

Home repairs, replacements and insurance: What homeowners need to know

If you own a home, eventually you’re going to experience some breakdowns, damage and disrepair. Homes tend to age quietly but expensively, and needed fixes can cluster at the worst times.

If you’re not well prepared, the unexpected bills associated with repairs and replacements can quickly escalate and overwhelm your finances. Homeowners insurance has your back in some of these instances, but it’s not designed to automatically safeguard you against mechanical breakdowns, system failures and other costly events.

Car and home insurance comparison platform The Zebra explores how neglected home repairs can be a threat to your finances, what insurance covers and does not cover, why regular maintenance is important and insurance tips for homeowners.

Common Major Home Expenses Homeowners Face

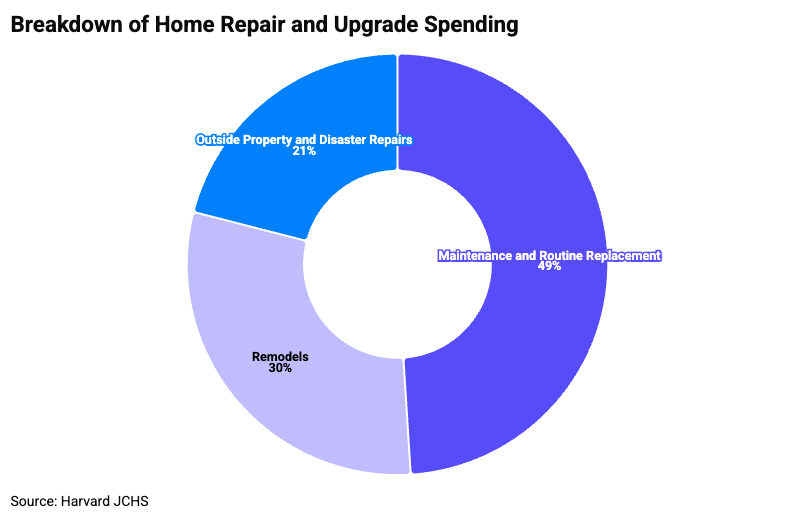

Make no mistake: Home repair and upgrade expenses are climbing fast. Per Harvard Joint Center for Housing Studies data, 49% of all home improvement spending is now devoted to routine maintenance and repairs, including non-discretionary fixes like replacing a roof or HVAC system. And according to Angi's 2026 State of Home Spending Pulse Report, as financial concerns grow, 71% of homeowners are prioritizing preventive maintenance to avoid future spikes in spending, even as 62% express greater worry about affording upkeep than they did in 2024. Additionally, 48% report that stress from mandatory repairs has intensified since January 2025.

“The cost of home repairs has risen significantly in recent years, driven by higher material and labor prices,” says Beth Swanson, insurance analyst for The Zebra. “Homeowners with brand-new houses may be protected by a builder warranty for the first year, or an optional home warranty, but most major repairs eventually become out-of-pocket expenses.”

Roof replacement

A roof replacement or repair is usually one of the biggest bills. “Costs for a new roof can vary, often ranging from $10,000 to $25,000 or more, depending on the size of the home,” cautions Michael Barrett of Barrett Insurance Agency.

HVAC systems

HVAC systems are another expensive fix, with replacements often ranging between $7,000 and $15,000. While some fixes are minor, depending on the age of the system, the cost to repair may exceed the cost of buying a new unit.

Plumbing and electrical

Pipe fixes, electrical rewiring and water leakage damage are other significant expenses. Plumbing replacement can cost you more than $20,000. And if a water pipe bursts causing major water damage to your home, mold remediation expenses can put your repair bill in the tens of thousands,” says Jordan Blake, with Shoreline Public Adjusters, LLC.

What Homeowners Insurance Does and Doesn’t Cover

Homeowners insurance can safeguard your finances from specific covered losses, such as fire, windstorms, hail, theft and sudden water damage from internal systems. But it doesn’t cover gradual wear and tear, mechanical breakdowns or system failures.

“Wear and tear happens to anything exposed to the elements or used regularly over time. Deterioration from age or normal use is not considered accidental damage, which is why it is not covered by homeowners insurance,” Swanson adds.

Repairs can be covered by a homeowners policy, but a covered loss usually must occur first that triggers the needed repair.

“Insurance will cover sudden losses, but it never functions as a service contract for old equipment or materials,” says Rami Sneineh, vice president of Insurance Navy Brokers. “Homeowners often forget that residential structures deteriorate at a steady rate of about 1% of the property value every year. Many mistake normal wear and tear for sudden damage because they don’t track decay over time.”

Case in Point: Your Roof

To illustrate that last point, consider the roof of your home. If a large tree limb falls on and damages your roof due to a windstorm (one of the perils likely named in your homeowners insurance policy), your insurer will be required to pay for the needed repairs to your roof as well as any inside ceiling damage (after you meet your deductible). But if you have a leaky roof where the culprit is 30-year-old shingles, this would not be considered an accidental event or covered peril, which means the repair costs are your responsibility.

“When a homeowner makes an insurance claim for roof damage, their insurer will check if the damage was a result of a covered peril, such as wind or hail, or if it was caused by natural wear and tear,” Blake explains. “This is why insurers often inquire about the age of your roof before issuing a policy.”

How Depreciation Affects Insurance Payouts

Even if a repair or replacement is covered, you have to factor in depreciation, which is the gradual diminishing of the value of your home’s components over time due to age, wear, condition and remaining useful life.

“Older components receive lower insurance payouts because carriers assume part of the loss reflects normal aging rather than sudden damage. Also, depreciation may apply even when coverage exists, unless replacement cost coverage and specific endorsements are in place,” notes Dennis Shirshikov, a professor of finance and economics at City University of New York.

If your homeowners policy provides actual cash value coverage, that means it covers the replacement cost minus depreciation for age and condition. But if your policy provides replacement cost coverage (which usually means a higher premium), your carrier will pay the full current market price to repair or replace the damage with new materials of similar quality and kind, without any depreciation deduction.

How Maintenance Affects Insurability

The upkeep of your home affects more than just repair costs: It can also directly affect your ability to get and keep insurance coverage.

“Insurance companies have a financial stake in the condition of your home,” says Swanson. “If they are agreeing to insure it and potentially pay for major losses in the future, they expect homeowners to take reasonable steps to maintain their property.”

Neglected roofs, plumbing, HVAC equipment or electrical systems, for example, can lead to coverage denials, higher premiums, non-renewals, or claim denials if damage is linked to known issues that were not addressed earlier. That’s why it’s best to keep up with recommended maintenance and be honest with your carrier when they ask questions about home components.

Planning Ahead for Major Repair and Replacement Bills

A wise homeowner knows that nothing lasts forever. Eventually, you’ll need a roof tear-off, the furnace will require upkeep, and the water heater will need to be replaced. That’s why it’s best to be prepared for both the anticipated and unanticipated.

“Homeowners need to stop seeing big repairs as shocking or unexpected things that just happen to their house without warning or explanation. Instead, think of your house as another member of the family — a family member that requires care and planning,” advises Blake. “Thus, major repairs should be factored into your household budget and planning, just as you would with medical or retirement expenses.”

Think of insurance as a financial backstop, not a maintenance plan.

“Homeowners insurance was created to protect people from major, unexpected losses that would be difficult or impossible to afford on their own, and that purpose has not changed,” adds Swanson. “Maintaining your home is your responsibility, while insurance is there to step in when something truly catastrophic happens.”

It’s a smart financial habit to have an emergency fund set aside to at least cover your deductible and possibly your depreciation. Additionally, consider purchasing a separate warranty or maintenance plan that can provide a financial cushion for predictable breakdowns or problems.

Other Best Practices for Homeowners

Here are some other tips for best practices to not be surprised or left in the lurch by sudden and expensive home repairs.

Shop Around and Compare

Take the time to conduct a homeowners insurance checkup, at minimum annually or at the time of renewal, especially if you have an aging home that’s at least 10 to 15 years old. That means scrutinizing your policy and/or shopping around among different carriers for better rates and coverage levels.

Review Your Policy

“Remember that coverage needs to change as systems age and renovations are completed,” says Shirshikov. “Carefully review roof endorsements, deductibles, replacement cost options, renovation updates, and policy exclusions before a claim might arise, which can help you avoid surprises and ensure that your coverage aligns with current risk exposure.”

Know Your Coverage

“Understand the concept of depreciation, roof schedules, and exclusions well before any damage occurs. This means you’ll have more power over the financial result,” Blake says. The biggest mistake you can make is to wait until after a loss to read and comprehend your policy.

Adjust Your Deductible

Additionally, determine the right deductible amount for your budget. “Make sure you are comfortable with that first dollar expense,” recommends Barrett. “If you have a $1,000 deductible versus a $500 deductible, ensure you can swing that cost if a loss occurs.”

Wrapping Up

Home repairs are like death and taxes. No home stays in perfect condition forever. The best thing you can do is budget for repairs so you’re not caught off guard by maintenance and fixes that home insurance doesn’t cover.

And keeping up on maintaining your home will help prevent more expensive repairs down the road.

This story was produced by TheZebra and reviewed and distributed by Stacker.