5 quick upgrades that could earn a home insurance discount

5 quick upgrades that could earn a home insurance discount

Nobody likes paying home insurance, but what if you could turn that expense into a source of savings? The secret is simple: Insurance companies reward low-risk homes with significant premium discounts. Many homeowners don’t realize that strategic, focused upgrades to their property can translate into big, long-term savings. By investing in safety, security, and risk mitigation, you not only protect your home but also prove to your insurer that you are a responsible partner in preventing costly claims. CheapInsurance.com outlines the smart improvements that directly reduce risk, allowing you to lower your insurance premium and make those upgrades pay for themselves over time.

1. The Safety Trifecta: Smoke, Carbon Monoxide, and Smart Detection

The basics are the big wins.

Homes equipped with properly installed and functioning smoke alarms and carbon monoxide (CO) detectors are universally considered safer. It’s a simple equation: Early detection means less damage, fewer claims, and lower payouts for the insurer. That’s why nearly every insurance provider offers a discount for these essential safety features.

But let’s talk about strategy. It’s not just about having a single unit gathering dust. Maintenance is the key to both safety and savings. Test your detectors monthly, replace batteries annually, and ensure they meet all local safety codes. Going a step further, consider upgrading to a monitored fire alarm system that automatically alerts the fire department. This high level of protection often qualifies for the most substantial fire-related discounts, as it practically guarantees a faster response time. By taking these small, consistent steps, you are actively proving that you’re a responsible homeowner worthy of premium relief.

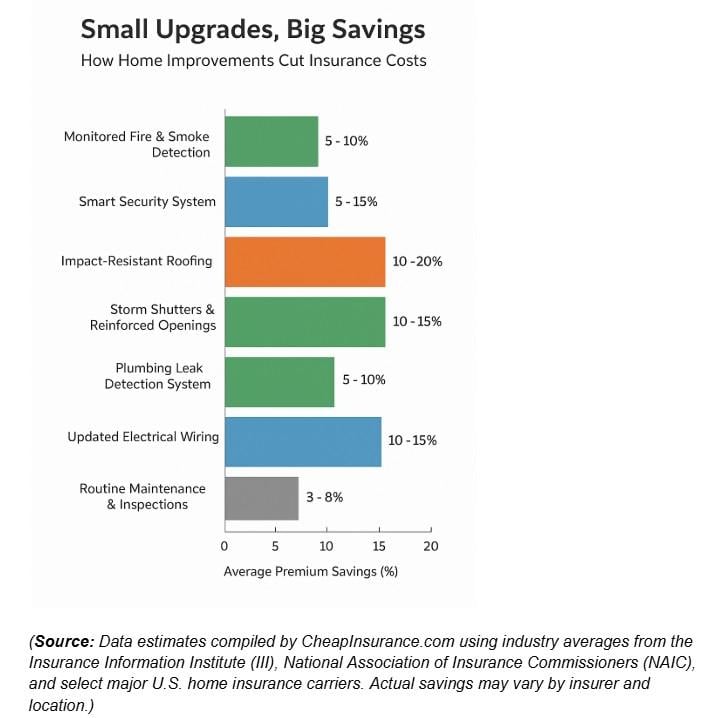

Data estimates for the above data visualization were compiled by CheapInsurance.com using industry averages from the Insurance Information Institute (III), National Association of Insurance Commissioners (NAIC), and select major U.S. home insurance carriers. Actual savings may vary by insurer and location.)

2. Lock It Up: Security Systems and Smart Home Technology

A home security system, which can range from simple reinforced locks to sophisticated, monitored networks, signifies a massive reduction in the risk of theft, vandalism, and unauthorized entry. Insurance carriers, particularly those covering high-crime areas, generously reward properties that deter loss before it happens.

The landscape of security has been completely revolutionized by smart technology, and insurers are taking notice. Modern smart locks, video doorbells, and motion-sensor cameras that alert you (and potentially a monitoring service) instantly are not just cool gadgets; they are powerful loss-prevention tools. Even basic, nonmonitored additions like deadbolts on every exterior door, reinforced window locks, and motion-sensor floodlights can qualify for savings.

Pro-tip on smart tech: Ask your agent specifically about “smart home discounts.” Many insurers offer a blanket discount for properties with multiple interconnected, loss-mitigation smart devices, such as smart water leak sensors combined with smart locks. You get enhanced safety, convenience, and a lower bill.

3. Fortify Against the Elements: Weather and Disaster Mitigation

If you live in a region prone to severe weather, be it hurricanes, intense thunderstorms, hail, or even high winds, reinforcing your home against the elements can unlock some of the biggest discounts available. Insurers call this loss mitigation, and they love it because weather-related claims are often the costliest.

Key upgrades to explore:

- Impact-resistant roofing: Replacing your old roof with material rated to withstand high winds and hail is a major move. In some coastal and storm-prone states, these upgrades are required to qualify for certain windstorm coverage, often yielding discounts of 15% or more on the wind-related portion of your premium.

- Storm shutters and reinforced openings: Installing storm-grade shutters or impact-resistant glass on windows and doors drastically reduces the chance of high-wind damage and water intrusion.

- Seismic retrofitting: For homeowners in earthquake-prone zones, retrofitting your home (bolting the frame to the foundation) may not only be critical for survival but can lead to significant savings on your separate earthquake insurance policy.

- Elevating critical systems: Raising HVAC units, electrical panels, and water heaters above potential flood levels demonstrates a strong defense against water damage, a top claim source.

Insurers recognize that a small investment now prevents a catastrophic claim later. They reward proactive homeowners who are less likely to file a weather-related claim.

4. Fire and Water System Upgrades

Older homes, while charming, often come with outdated electrical and plumbing systems that pose a significant fire and water-damage risk. These two risks are a nightmare for underwriters, and addressing them can lead to surprisingly steep premium reductions.

- Modernizing electrical wiring: If your home still relies on old knob-and-tube or aluminum wiring, replacing it with modern copper wiring eliminates a major fire hazard. Many carriers will refuse to insure homes with certain outdated wiring types unless a complete update is performed, resulting in an immediate and necessary premium adjustment.

- Plumbing system overhaul: Burst pipes are a leading cause of expensive claims. Replacing old, failure-prone plumbing (like polybutylene or certain galvanized pipes) not only saves you from a potential flood but also shows the insurer you’ve eliminated a known liability. Furthermore, installing automatic water shut-off devices that detect leaks and immediately cut the main water supply can qualify for an additional, high-value discount of up to 10%.

These upgrades not only make your home safer but also often bring it up to modern building codes, which is a powerful signal of responsibility to any insurance company.

5. Embrace the Routine: The Power of Maintenance and Organization

The unsung hero of home insurance savings and the final step is the most cost-effective of all: establishing and maintaining a consistent home maintenance routine. Simple, consistent care prevents the slow, insidious damage that often leads to costly claims, such as mold from leaky roofs or water damage from clogged gutters.

Insurance companies often provide incentives for homeowners who demonstrate ongoing care and risk management because it signifies a responsible attitude.

Maintenance That Matters to Insurers

- Gutter cleaning: This prevents water backup and foundation damage.

- Roof and foundation inspection: This catches minor leaks or cracks before they become structural catastrophes.

- Servicing systems: Annual maintenance of your heating, cooling, and plumbing systems prevents unexpected failures and emergencies.

By keeping records of this maintenance, you build a powerful case for yourself as a low-risk client. Don’t be shy, share this information with your agent.

The real magic happens when you combine, or stack, your upgrades. Many insurers allow you to combine discounts for a truly significant reduction in your rate. Adding smoke detectors (fire safety), a monitored security system (security), and weatherproofing measures (mitigation) together could result in an overall premium reduction that far exceeds the sum of the individual discounts.

Review your home insurance policy annually and, most importantly, communicate with your insurance agent or broker. Every time you complete an upgrade, whether it’s installing a smart lock or replacing your electrical panel, call them. Make sure all eligible discounts are applied. This is your money, and with a little strategy, you can keep more of it while enjoying a safer, smarter home.

This story was produced by CheapInsurance.com and reviewed and distributed by Stacker.