How to open a health savings account if you’re self-employed

How to open a health savings account if you’re self-employed

Self-employed individuals, such as small-business owners and independent contractors, are always looking for ways to reduce their tax bill and better manage healthcare costs. One often overlooked option among many new entrepreneurs is a health savings account (HSA).

An HSA is a tax-advantaged account that lets you pay for qualified medical expenses, such as certain vision care and dental services, with tax-free dollars. Unlike a flexible spending account (FSA), which is sponsored and managed by an employer, you can set up and manage your own HSA, even if you are self-employed. GoodRx, a platform for medication savings, shares important considerations to keep in mind before opening an HSA on your own.

Key takeaways:

- You can open a health savings account (HSA) as a self-employed freelancer or business owner if you have a qualified high-deductible health plan.

- An HSA can help self-employed individuals save money on out-of-pocket healthcare expenses, such as reading glasses and over-the-counter medications.

- Make sure you understand HSA rules before opening an account.

Can a self-employed person have an HSA?

Yes. A self-employed individual may be eligible for an HSA if they have a qualified high-deductible health plan (HDHP). This includes Instacart shoppers, freelance consultants, Uber drivers, and small-business owners. You do not need to have an employer or a full-time job to be eligible for an HSA.

What are the requirements to open an HSA?

There are a few rules that self-employed individuals should be aware of before opening an HSA. First, you must have a qualified HDHP. Your health insurance plan must meet annual out-of-pocket expense limits and minimum deductible amounts. These plans typically come with higher deductibles and lower monthly premiums than other types of coverage.

If your HDHP qualifies, you have to ensure that you meet other requirements. Here are a few of the HSA qualifications outlined by the Internal Revenue Service:

- You have no other health coverage except certain disregarded coverage, like dental and vision insurance.

- Individuals enrolled in Medicare are not allowed to contribute to an HSA.

- Dependents on someone else’s return may not take the deduction.

- You have HDHP coverage on the first day of the last month of the year to meet the last-month rule. This is December 1 for many self-employed individuals, whose insurance plan year often begins on January 1.

Beginning January 1, 2026, the eligibility rules for health savings accounts (HSAs) will expand. Under the One Big Beautiful Bill Act (OBBBA), bronze and catastrophic Affordable Care Act (ACA) marketplace plans will be reclassified as qualifying HDHPs. This change will make it easier for more self-employed individuals to benefit from the tax advantages of an HSA without having to switch to a traditional HDHP.

How do you open an HSA?

If you meet the qualifications to open an HSA, you will have to find a custodian or an administrator. This can be a bank, a credit union, an insurance company, or a brokerage approved by the IRS. A few things to consider when opening an account are:

- What are the administration fees?

- Is there a minimum dollar amount to open the account?

- Are there investment options?

- Is there a minimum cash account balance needed before I can invest my funds?

- How much are the investment fees?

- Will I get a debit card or have to submit receipts for reimbursement?

As a sole proprietor, you will not have an employer contributing on your behalf or covering administrative fees. Do your research and ask the right questions to ensure that the HSA meets your needs. You can compare HSA providers online to help you make the best decision.

Sole proprietors vs. traditional employees

The HSA qualifications for a traditional employee and a sole proprietor are the same. But there may be a difference in making contributions to the account.

Traditionally, an employee tells their employer how much they would like to contribute to their HSA. An employer may also contribute money to enhance employee benefits. The amount contributed by an employer and employee must not exceed annual limits. The payroll department will deduct money from your paycheck to fund the HSA. This is called a pretax contribution. Employees can contribute money to their HSA before their income is taxed. This can reduce your taxable income and save you money during tax time.

Being an entrepreneur can provide more freedom, but it also comes with more responsibility. A sole proprietor has to set up their own HSA contributions. You can transfer money from your checking account to your HSA whenever you want to. Many self-employed individuals make after-tax contributions to fund their HSA. This provides an opportunity to claim a deduction when you file your tax returns.

How much can I contribute to my HSA?

Your HSA contribution limits depend on whether your health plan has individual or family coverage. Other variables that affect how much you can contribute are:

- Your age. If you are 55 or older, you can contribute an additional $1,000 to your account.

- The date you become an eligible individual. If you qualify to make HSA contributions by December 1, you may be eligible to contribute the maximum amount based on the last-month rule.

- The date you stop being an eligible individual. You cannot make deductible contributions for any month in which you did not meet HSA requirements.

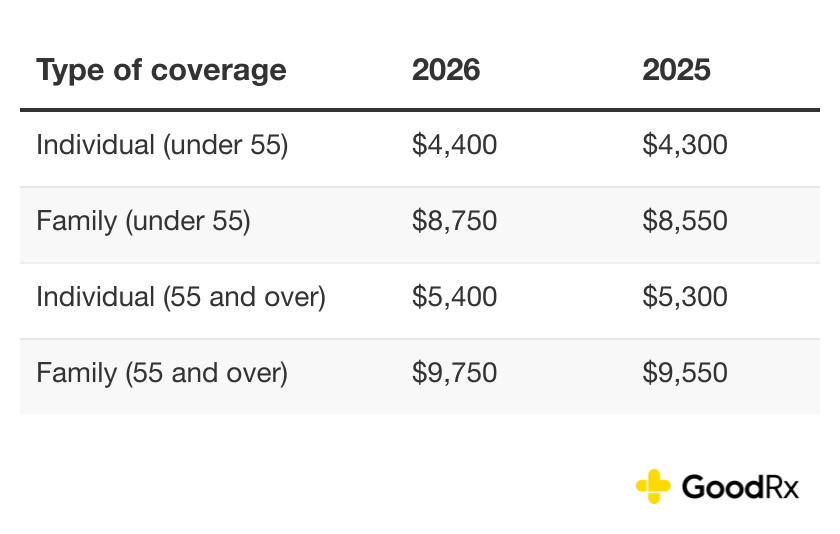

The contribution limits for 2025 are $4,300 for individual HSA plans and $8,550 for a family plan. If you are 55 or older at the end of the tax year, you are eligible to make a catch-up contribution of $1,000. You have until the tax deadline of the following year to make your contribution. That means you can contribute to a 2025 HSA until April 15, 2026, unless the tax-filing deadline changes.

Here are the maximum HSA contribution limits for 2025 and 2026:

What are the benefits of having a health savings account if you’re self-employed?

An HSA is a financial instrument that you own, saves you money, and provides tax incentives. Here are some additional benefits that can come in handy for self-employed individuals:

- The contributions stay in your account until you use them.

- You are not required to contribute a minimum amount.

- You can invest the funds.

- You may use funds for qualified medical expenses.

Unlike a flexible spending account, which requires you to use or lose the money you’ve saved, your HSA dollars roll over every year until you use them. You are not penalized if you do not contribute to your account. There is no minimum contribution each year, but there is a cap on the amount you can contribute. You can make the most of your HSA contributions by investing your money. As your money grows, you will have more money available to fund future medical expenses.

An HSA pairs well with HDHP coverage because it covers qualified expenses you incur before meeting your deductible. This includes but is not limited to:

- Acupuncture

- Birth control pills

- Eye surgery

- Lab fees

- X-rays

For a full list of qualified expenses, check out IRS Publication 502. The CARES Act added over-the-counter medication and menstrual products to the list.

What are the downsides of an HSA?

HSA perks go only so far if you don’t know how to fully use them. Here are some possible downsides that you should consider, including:

- Insurance plan requirements: Only individuals enrolled in a qualified HDHP can contribute to an HSA. With this type of plan, you’ll need to pay for your healthcare expenses out of pocket until you meet your deductible, which can be thousands of dollars.

- Annual contribution limits: There is a cap on how much you can contribute to an HSA every year. If you contribute beyond the limits, you could face a 6% excess contribution penalty.

- Spending restrictions: Your HSA is used to pay for qualified medical expenses. If you spend your HSA dollars on non-qualified expenses, you will owe income tax on the distribution. You will also face a penalty if you are under 65.

- Investment risks: If you invest the funds in your HSA, your investment could lose value if market conditions are not favorable.

- Account fees: Depending on your HSA provider, you may have to pay fees for services such as account maintenance, investments, transactions, and paper statements.

- Ineligibility with Medicare: You can no longer contribute to an HSA after you enroll in Medicare. But you will still be able to use the funds in your account to pay for qualified medical expenses.

The bottom line

Self-employed individuals can contribute money to an HSA and use the funds to pay for qualified medical expenses. If you want to open an account, make sure you have a qualifying health plan and understand HSA rules. You should also inquire about the account requirements to ensure you’re not faced with any unexpected fees. An HSA can be very beneficial to self-employed individuals, but it’s important to do your research to determine if it’s the best account for your needs.

This story was produced by GoodRx and reviewed and distributed by Stacker.