Made in the USA: American artists rule Spotify at home and abroad

Made in the USA: American artists rule Spotify at home and abroad

America exports more music than any other country. But the real story isn’t how U.S. artists dominate globally; it’s what’s happening at home.

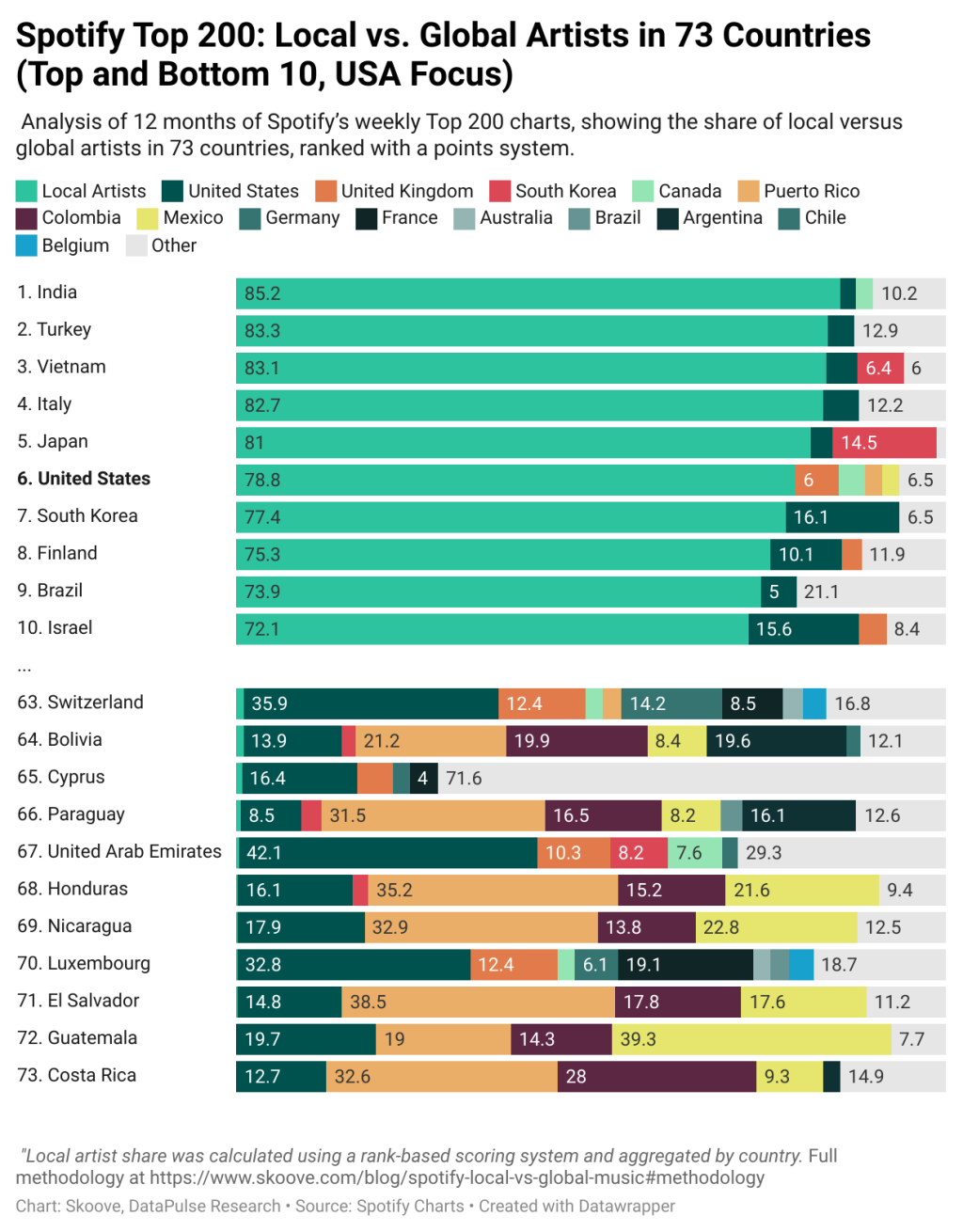

To explore these patterns, the piano learning app Skoove partnered with the analysts at DataPulse Research to break down more than a year of Spotify Top 200 data across 73 countries. The dataset includes over 800,000 data points, revealing how local music ecosystems thrive or fade in the algorithmic era.

American listeners are fiercely loyal to their own talent. Based on the analysis of Spotify’s weekly charts, U.S.-based artists captured 79% of chart positions within the country, placing the U.S. sixth out of 73 in local artist loyalty. The U.S. trails only countries like India, Italy, and Vietnam in favoring local artists more. Still, it dominates European markets, where local artists capture just 29% in the U.K., 48% in Germany, and 60% in France.

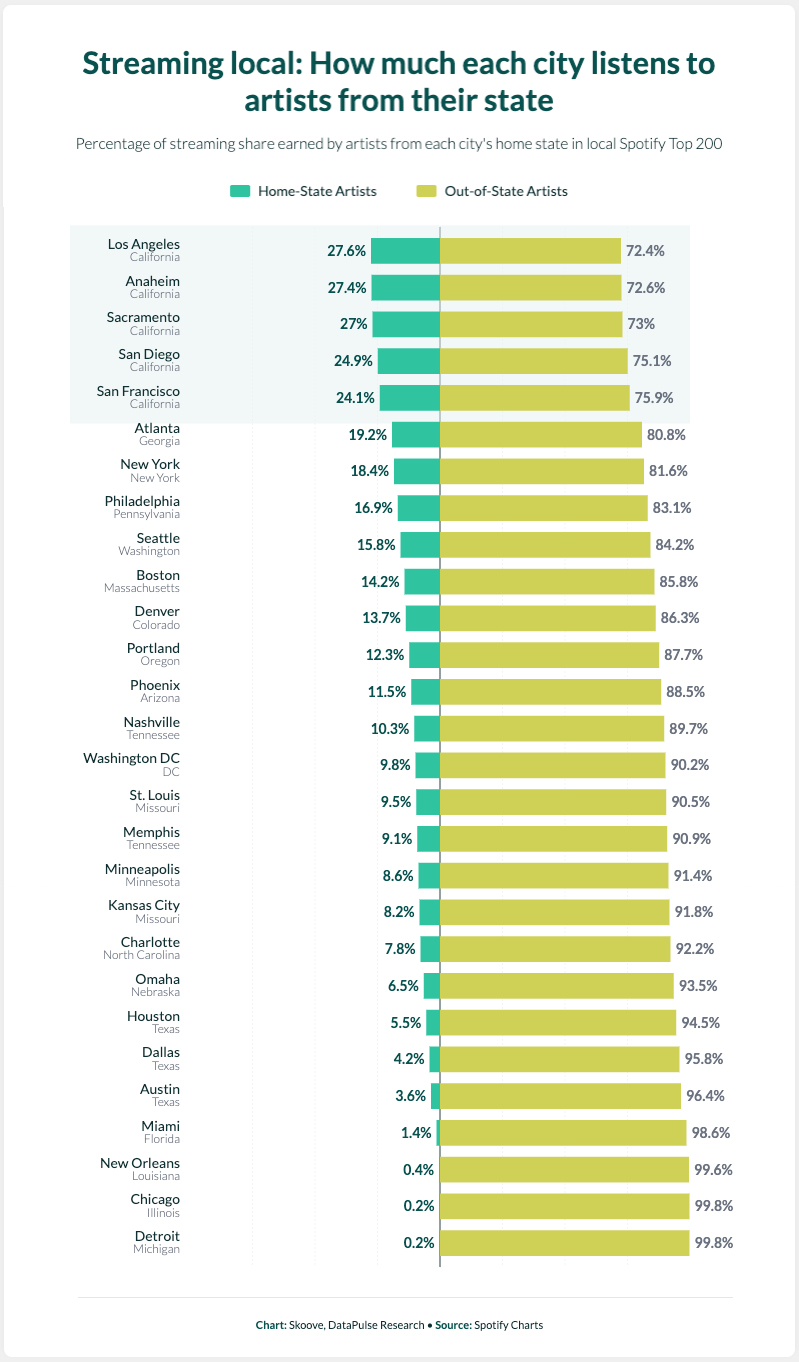

But zoom into individual cities and the story explodes. Every Californian city where Spotify publishes a Top 200 chart ranks in the national top five for hometown pride, led by Los Angeles, where 28% of the chart belongs to California artists. Meanwhile, Chicago gives just 0.2% to Illinois artists, Detroit 0.2% to Michigan artists, and even New Orleans, the birthplace of jazz, manages only 0.4% for Louisiana artists. That’s a staggering 138-fold difference between LA and Chicago.

In a nutshell:

- 79% of U.S. charts feature American artists (No. 6 globally for local loyalty).

- California owns hometown pride: Los Angeles dedicates 28% to local artists, vs Chicago’s 0.2%.

- Genre beats geography: Tennessee’s Morgan Wallen (7%) nearly matches Missouri’s Chappell Roan and SZA combined (8%) in their own city.

- American music conquers the Anglosphere: Canada allocates 76% of chart positions to U.S. music, while India resists at just 2%.

The US Spotify top 25: Who dominates the charts?

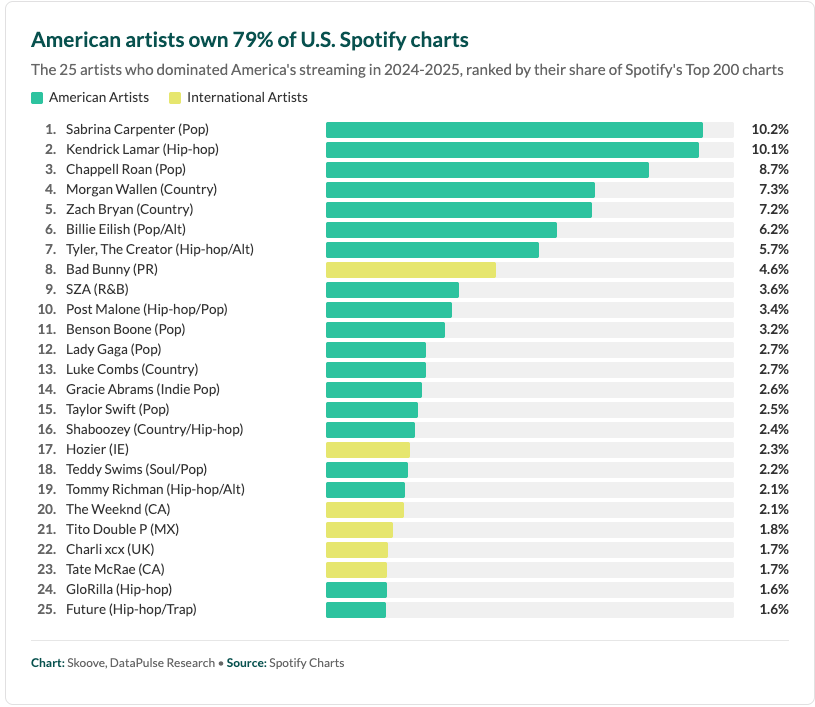

To gauge nationwide popularity, 12 months of Spotify's weekly Top 200 charts were analyzed to rank the top 25 artists by their streaming share in the U.S.

- Pop dominates with Sabrina Carpenter (No. 1, 10%) and Chappell Roan (No. 3, 9%) leading the charge, while country music flexes its muscle through Morgan Wallen (No. 4, 7%) and Zach Bryan (No. 5, 7%).

- Hip-hop remains king: Kendrick Lamar commands 10% of streams, nearly matching the No. 1 pop artist, while Travis Scott, Eminem, and Future all secure spots in the top 15.

- International artists struggle: Only five non-U.S. artists crack the top 25, led by Puerto Rico's Bad Bunny (No. 20) and Canada's The Weeknd (No. 22)

What about hometown pride?

Here's where the story gets surprising: While American artists capture 78.8% of national charts, most U.S. cities barely listen to their own state's artists.

Chicago—home to Kanye, Chance the Rapper, and house music—offers just 0.2% of chart positions to Illinois artists. Similarly, Detroit, which gave the world Motown and Eminem, matches that with 0.2% for Michigan artists. Even New Orleans, where jazz first took shape, devotes only 0.4% to Louisiana talent.

The notable exception? California. Every city analyzed from the Golden State ranks in the national top five, with Los Angeles streaming 28% California artists, 138 times more hometown loyalty than Chicago. The reason is clear: California doesn't just produce artists but global megastars like Kendrick Lamar, Billie Eilish, and Tyler, The Creator, who dominate both worldwide and at home.

The chart below reveals which cities actually support their home-state artists and which musical capitals have surprisingly abandoned their own.

Genre beats geography

This divide highlights the influence of regional music preferences. Take Kendrick Lamar, for example: The California rapper accounts for roughly 10% of streaming activity in his home state's cities. However, he also enjoys significant popularity in cities like Detroit, Portland, and Phoenix, far from home, where listeners embrace his West Coast sound. In contrast, he gets minimal play in Southern strongholds like Memphis and Nashville, where country music reigns.

The reverse is equally telling. Missouri native Chappell Roan and St. Louis-born SZA, raised in New Jersey, are more popular in Northeast and West Coast cities than in their home state. In St. Louis, these two artists capture just 8% of chart presence combined, barely beating Tennessee's Morgan Wallen at 7%. A country superstar from another state nearly matches their presence in Missouri's largest city.

Even Texas, with its vibrant music scene, shows only modest hometown pride, with only 4%-6% of streams going to local artists. Despite notable acts like Beyoncé, Travis Scott, and Megan Thee Stallion, Texas cities tend to stream California artists at far higher rates than their own.

Overall, genre preferences trump geographic loyalty. Artists find their biggest audiences not necessarily where they are from, but where their sound resonates culturally. Country music thrives in country markets, while hip-hop prevails in cities where hip-hop has roots, regardless of the artist's hometown. California's musical dominance stems not just from having great artists but those whose genres align with local tastes.

American artists around the world

While American artists claim 79% of U.S. charts, their global dominance tells a more nuanced story.

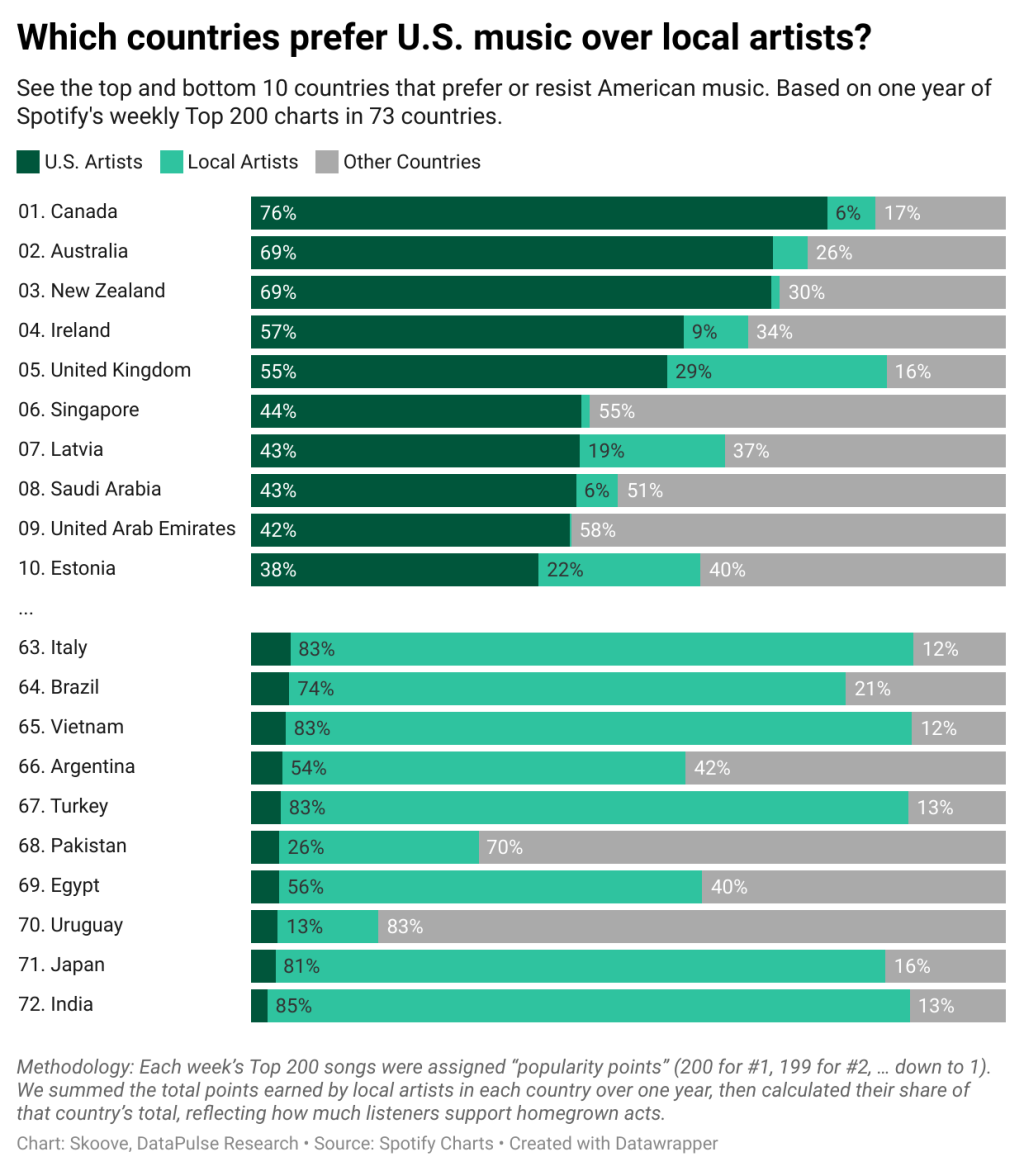

In the Anglosphere, American hits dominate as if they were local. Canada dedicates 76% of its charts to U.S. music, almost as much as America itself. Australia and New Zealand hover near 70%, while the U.K. still gives 55% to American artists despite its massive music industry. These countries don't just share a language; they share a musical universe.

The real surprise comes from unexpected markets. Saudi Arabia and the UAE both stream 43% American music, more than most European countries. Singapore matches them at 44%, while Latvia isn't far behind at 43%. This isn't about cultural proximity; it's about American music functioning as a global lingua franca, the default soundtrack for cosmopolitan audiences worldwide.

But three giants refuse to fall in line. India gives just 2% of chart positions to American music. Japan manages 3%. Turkey holds at 4%. These aren't just big markets; they're musical fortresses with thriving local industries that have successfully resisted American cultural hegemony. Even in the streaming age, Bollywood beats Billboard, J-pop trumps Top 40, and Turkish pop holds its ground.

The lesson? American music dominates where English dominates, surprises in unexpected markets, but hits a wall where local industries have the scale and pride to compete. This pattern contrasts sharply with South Korea's approach, which maintains 77% local dominance at home while simultaneously exporting K-pop globally—a dual strategy the U.S. pioneered and Korea has perfected.

Methodology

Country-level study

The study was conducted using data from the top 200 songs streamed weekly on Spotify in 73 countries. The data covers every week from May 23, 2024, to July 10, 2025. The countries are predominantly located in Europe, the Americas, and East Asia, with a handful of countries from the Middle East, sub-Saharan Africa, South Asia, and Central Asia.

Chart performance was analyzed using a points system: The No. 1 song received 200 points, No. 2 received 199 points, and so on. This allows for weighting the chart position appropriately — a No. 1 hit counts more than a No. 200 track. The percentages shown throughout this report represent each country's or artist's share of total points, effectively measuring their share of Top 200 streaming activity weighted by chart position.

For songs with multiple artists, every artist on the track received the full points for that rank. For example, if a No. 1 song featured three artists, each of those three artists was awarded 200 points.

Artists were analyzed by their country of origin, not the location of their record label, agents, or other business affiliations.

Finally, for every country, the percentage of chart positions occupied by "local" artists (from the home country) versus "foreign" artists (from other countries) was calculated. Comparing these numbers, allowed countries to be ranked by their support for local music and showed what kinds of music people prefer from outside their own borders.

Global monoculture stars study

Once the calculations for each country were ready, the researchers dug into individual artists to see who is the most globally ubiquitous.

Using the same raw data set, country data was aggregated into seven regions: Europe; eastern Asia; southern, central, and western Asia; northern America (U.S. and Canada); south and central America (including Mexico); Oceania; and Africa. From this, each artist's chart presence in each region was calculated. This revealed the percentage of streaming activity each artist captured across the seven different parts of the world.

From this data, it was apparent that some superstar artists were enormously popular, but only in one or two regions. Therefore, to assess each artist's reach globally, artists were ranked by their median score among the seven regions. Notably, huge artists like Bad Bunny (the artist with the most total chart points globally) do not make it into the top 25 music monoculture stars because they are not ubiquitous: They dominate in some regions and have minimal presence in others.

City-level study

A study was run to evaluate "local" versus "foreign" music preferences at the city level. The methodology was similar to the country-level study, but with a smaller data set (the top 100 songs streamed weekly on Spotify, not the top 200).

In Europe, researchers looked at the music charts in 14 cities spanning Germany, France, the U.K., and Spain from April 18, 2024, to April 10, 2025. They analyzed chart performance using a points system (1-100 scale) to weight songs by their ranking. Like the country-level methodology, they calculated the share going to "local" songs (artists from the home country) versus "foreign" songs. In Paris, for example, French songs account for an impressive 62% of the city's streaming activity.

Researchers also analyzed 34 U.S. cities (including San Juan, Puerto Rico) using a data set of the top 100 songs streamed weekly on Spotify between May 23, 2024, and May 15, 2025. This data set predominantly featured U.S.-based artists, so hometown popularity needed to be redefined. For each city, to be considered a "local" artist meant they must be from within the same state. (As an example, local artist support in Nashville would include all artists from the state of Tennessee.)

This story originally appeared on Skoove, was produced in collaboration with DataPulse Research, and reviewed and distributed by Stacker.