Robinhood’s new concierge service signals a push toward all-in-one financial platforms. Is consolidating worth it?

Robinhood’s new concierge service signals a push toward all-in-one financial platforms. Is consolidating worth it?

Investing today isn’t just about stocks or retirement accounts. Providers are racing to combine investing, taxes, estate planning, banking and financial advice into a seamless, unified experience.

Robinhood’s newly launched, limited-access Concierge service is a timely example. Eligible clients gain full-service tax filing, estate planning documents and access to a certified financial planner (CFP). The offering is currently available by invitation and slated to run through April 2026. While Concierge currently targets high-asset households — $1 million in assets or a $500,000 transfer — it hints at a bigger ambition: Turning a simple trading app into an all-in-one wealth platform.

As this article from Finder.com explains, the move is part of a larger trend in wealth management. With trillions of dollars expected to transfer across generations in the so-called Great Wealth Transfer, companies are competing not just on returns, but on convenience — offering bundled access to a broad range of financial services under one digital roof.

Research backs up this shift. A 2023 FIS survey found that nearly half of consumers — from Boomers to Gen Z — say that access to a single platform to manage all their financial services is their top priority. Meanwhile, a 2022 Cerulli report found that 58% of retail investors would like to consolidate investable assets with one provider, yet only 37% currently do. These numbers make it clear: Investors want simplification, and providers are racing to deliver it.

How Robinhood Concierge works

Robinhood brings together three main services through partners:

- Full-service tax filing via Taxfyle, pairing clients with a CPA or Enrolled Agent.

- Estate planning documents via Vanilla, including wills, revocable trusts and powers of attorney.

- Dedicated CFP access to help manage services across financial needs.

While Robinhood itself doesn’t provide tax or estate services, it manages the overall experience — including perks like a 1% match on qualifying transfers and priority support.

Building these services also aligns with Robinhood’s broader goal of capturing a larger share of clients’ financial lives. During Robinhood’s most recent earnings call, CEO Vladimir Tenev emphasized the company’s three-part strategy: “number one in active traders, number one in wallet share for the next generation, and [its] long-term mark, number one global financial ecosystem.”

He also highlighted Robinhood’s push toward “family investing,” aiming to make the platform multigenerational and better suited as clients inherit and manage wealth across generations. Combined with its referral program for advisers and a focus on high-quality registered investment advisors (RIAs), Robinhood is positioned to benefit from the $100 trillion-plus Great Wealth Transfer while expanding beyond trading into a comprehensive wealth platform.

How other platforms approach consolidation

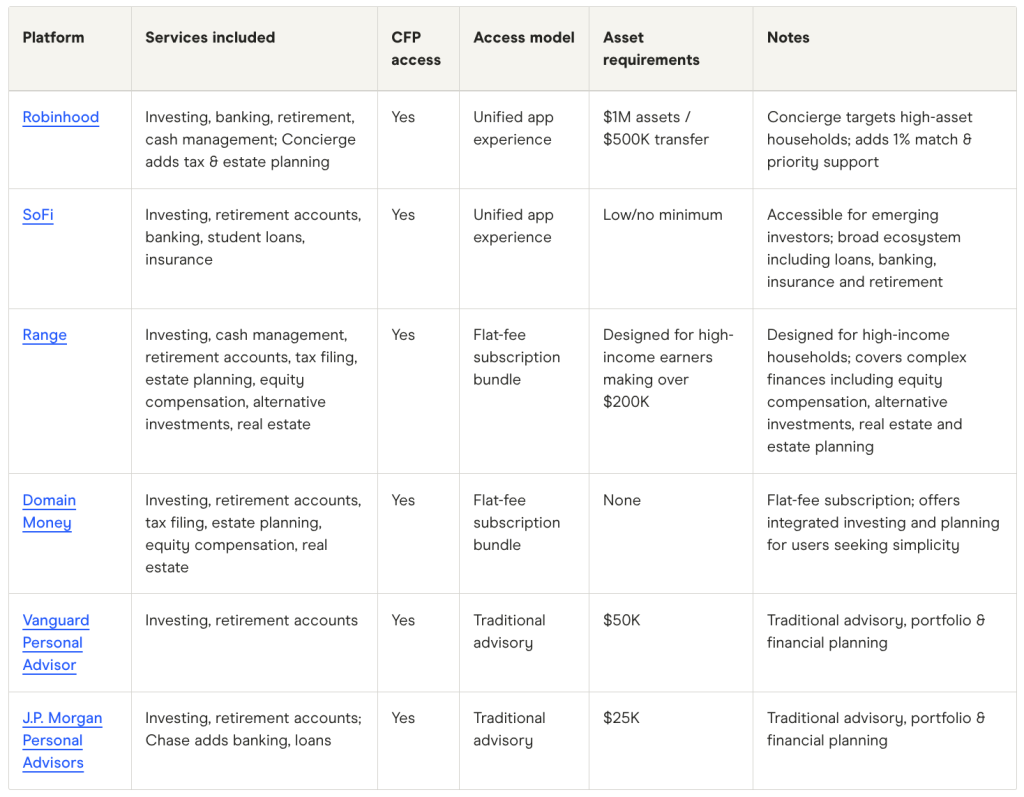

Here’s a snapshot of how Robinhood compares to other digital-first platforms and traditional brokers when it comes to bundling multiple financial services:

The takeaway: Both traditional brokers and digital-first platforms offer broad services, but digital providers are increasingly bundling them into unified, app-based experiences — often with lower minimums or simplified access.

Why bundling financial services matters

Bundling your financial services can offer real advantages:

- Convenience. One login, one support team, everything connected.

- Simplified communication. Advisors and planners can see your full portfolio.

- Time savings and reduced complexity. Decisions across tax, estate and investing are linked.

- Continuity. Easier to manage finances as your wealth evolves.

But there are trade-offs:

- Third-party execution. Some services may be handled by external partners rather than the platform itself. However, this isn’t the case for providers such as Range, where everything is done in-house.

- Limited flexibility. Bundles may reduce choice of specialists.

- Asset concentration. Having everything in one place carries risk.

- Eligibility restrictions. Some services are gated by high asset minimums.

Why consolidation matters beyond convenience

Consolidation offers a clearer view of your finances, making planning simpler and more strategic. It also allows platforms to offer continuity, coordination and insights that are hard to achieve when your accounts are scattered across multiple providers. FIS and Cerulli research suggest this isn’t speculation — investors want consolidation, and the opportunity is substantial as trillions transfer to younger generations.

This unified approach also serves as a strategic lever for platforms. As Robinhood’s earnings call highlighted, the company aims to increase wallet share, serve multiple generations through “family investing” and play a larger role in wealth management.

Still, trade-offs remain. Even broad, team-based platforms operate within a defined ecosystem. That’s efficient for most investors. But those with highly specialized needs — like complex cross-border estates, operating businesses or ultra-high-net-worth trusts — may still need independent outside counsel.

Flexibility is another consideration. Bundling investing, taxes, estate planning, equity compensation and banking often means using the platform’s advisor network and workflows. This can streamline decisions but may limit the ability to swap out one specialist without affecting others.

Finally, the more integrated your finances, the harder switching providers becomes. Brokerage moves are easy, but transferring tax records, estate documents and advisory relationships is more complex — a trade-off between continuity and flexibility.

Who this makes sense for

An all-in-one platform isn’t for everyone. It may be ideal for:

- High-net-worth households seeking coordinated, convenient services.

- Busy professionals who don’t have time to juggle multiple advisors and services.

- Investors seeking a unified experience across investments, taxes and estate planning.

Investors with highly complex estates, unique tax situations or a preference for in-person advisory may still benefit from traditional brokerages or specialized advisors. Range, for instance, covers everything from investing to tax filing to estate planning to help with equity compensation.

Is an all-in-one platform worth it?

Bundled financial services are a growing trend, reflecting a shift in both consumer expectations and platform strategy. Platforms like Robinhood Concierge, Range and SoFi are experimenting with ways to bundle investing, tax filing, estate planning and advisory services — offering convenience, continuity and potentially better engagement as investors’ wealth evolves.

While Robinhood Concierge currently targets high-asset clients, the broader trend indicates that digital-first platforms are preparing to serve investors across the wealth spectrum. Whether consolidating is right for you depends on your financial complexity, comfort with digital tools and appetite for centralized management.

This story was produced by Finder.com and reviewed and distributed by Stacker.