Are employee reimbursements taxable under IRS rules?

Are employee reimbursements taxable under IRS rules?

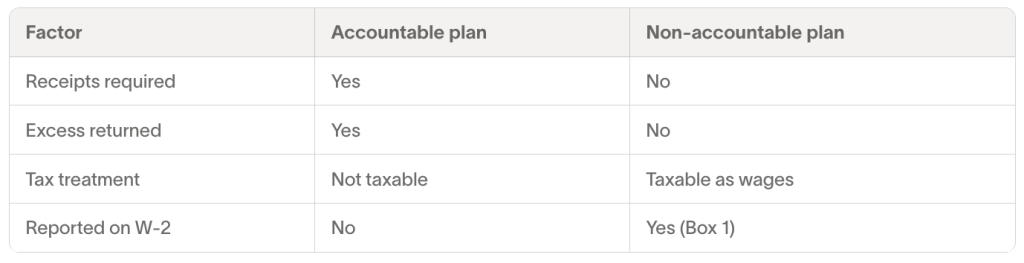

Expense reimbursements are generally not taxable when paid under an IRS-compliant accountable plan, but they are taxable under a non-accountable plan. The difference comes down to whether your reimbursement process meets specific IRS requirements around documentation, timing, and returning excess funds:

- Accountable plan: Not taxable when IRS rules are met

- Non-accountable plan: Fully taxable as wages

If you’re looking for broader context on how reimbursements work operationally, see this guide on expense reimbursement. This article by Ramp focuses specifically on when reimbursements become taxable income and how finance teams can stay compliant.

What is an accountable plan under IRS rules?

An accountable plan is the IRS classification that allows employee reimbursements to be excluded from taxable income. To qualify, the reimbursement arrangement must meet all IRS requirements. If even one requirement is missed, the reimbursement is treated as taxable wages.

Business connection requirement

The expense must have a clear business purpose and be incurred while the employee is performing their job. Common examples include travel to a client meeting or the purchase of supplies needed to complete a work assignment. Personal expenses or costs that aren’t directly related to business activity don’t meet this requirement and can’t be reimbursed tax-free.

Substantiation requirement

Employees must substantiate each expense with receipts, invoices, or other adequate records. Documentation should show the amount, date, place, and business purpose of the expense. Digital receipts and expense reports are acceptable as long as they capture the required details and are retained for audit purposes.

Return of excess requirement

If an employee receives an advance or reimbursement that exceeds their actual expenses, they must return the excess amount to the company. Any excess that isn’t returned becomes taxable income. This rule applies even if the original expense would otherwise qualify as non-taxable under an accountable plan.

Reasonable time requirements

The IRS defines a “reasonable period of time” for substantiating expenses and returning excess funds under the 30/60 rule:

- Substantiation deadline: Within 60 days of incurring the expense

- Return of excess deadline: Within 120 days of receiving the advance

If these timing rules are met, reimbursements paid under an accountable plan aren’t subject to income or payroll taxes.

What is a non-accountable plan?

A non-accountable plan is any reimbursement arrangement that fails to meet one or more IRS accountable plan requirements. Under a non-accountable plan, the full reimbursement amount is treated as taxable wages and is subject to income tax withholding and payroll taxes.

Even if your company generally follows accountable plan rules, the IRS treats the following payments as non-accountable:

- Excess reimbursements that employees don’t return to the company

- Reimbursement of non-deductible expenses

An arrangement that reimburses expenses by reducing wages, salary, or other pay is also considered non-accountable. Employees must be entitled to their full compensation regardless of whether they incur business expenses on the company’s behalf.

Wage recharacterization and compliance risk

If employees receive the same total pay whether or not they incur business expenses, the IRS may treat reimbursements as recharacterized wages. In that case, the arrangement fails accountable plan rules even if employees later submit receipts, and the payments become taxable as wages.

This issue commonly arises when reimbursements are used to offset salary or function as a fixed allowance rather than repayment of actual expenses.

When are employee reimbursements taxable income?

Even when reimbursements are paid under an accountable plan, certain payments can still become taxable based on the type of expense or how the reimbursement is handled. IRS limits, documentation gaps, and personal use all affect whether a reimbursement must be treated as wages.

The sections below outline how tax treatment varies by common expense category.

Travel reimbursements

Travel reimbursements for airfare, lodging, and ground transportation are generally non-taxable when they’re properly substantiated under an accountable plan. If a trip includes both business and personal travel, only the business-related portion can be reimbursed tax-free. Personal travel costs must be treated as taxable income if reimbursed by the employer.

Mileage reimbursements exceeding the IRS rate

Mileage reimbursements paid at or below the IRS standard mileage rate are not taxable. Any amount paid above the IRS rate is treated as taxable wages. Because the standard mileage rate changes annually, employers should reference IRS guidance to ensure reimbursement rates remain compliant.

Meal and entertainment reimbursements

Business meal reimbursements are generally non-taxable to employees when the expense is properly documented and has a clear business purpose.

Entertainment reimbursements require careful documentation and may be subject to additional restrictions. While employer deductibility rules differ, those limitations don’t change whether a properly substantiated meal reimbursement is taxable to the employee.

Moving expense reimbursements

The Tax Cuts and Jobs Act (TCJA) of 2017 made most moving expense reimbursements taxable starting in 2018. The primary exception applies to active-duty military members who move due to military orders. Many TCJA provisions are scheduled to sunset at the end of 2025, so this treatment may change in the future.

Per diem reimbursements

A per diem allowance is a fixed daily amount for lodging, meals, and incidental expenses incurred while traveling for work. Per diem payments are non-taxable only if they don’t exceed IRS per diem rates and the employee substantiates the time, place, and business purpose of the travel. Any amount paid above the IRS rate is taxable income.

Do reimbursements show up on a W-2?

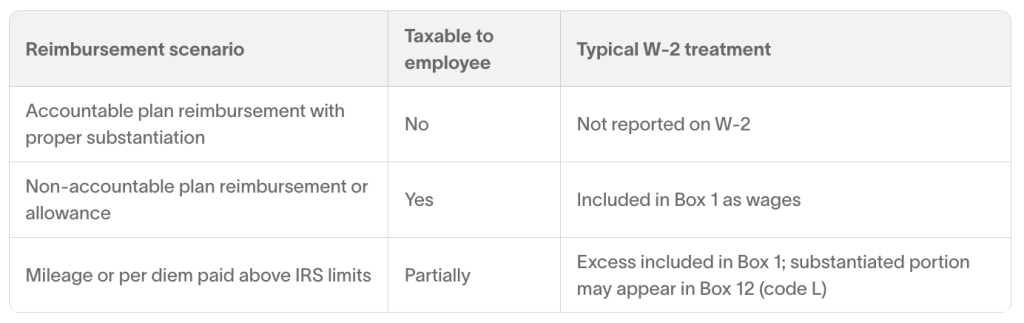

Whether reimbursements appear on a W-2 depends on whether they’re taxable. Non-taxable reimbursements paid under an accountable plan generally don’t appear on the form, while taxable reimbursements must be reported as wages.

Tax treatment also affects how reimbursements are split and reported when payments exceed IRS limits.

Taxable reimbursement reporting

Reimbursements paid under a non-accountable plan, as well as any excess amounts employees don’t return, must be included in Box 1 of the W-2 as wages. These amounts are subject to income tax withholding, Social Security tax, and Medicare tax.

If only part of a reimbursement is taxable, such as mileage or per diem paid above IRS-allowed rates, only the excess portion is treated as wages.

Non-taxable reimbursement reporting

Properly substantiated reimbursements paid under an accountable plan aren’t included in Box 1 of the W-2. In some cases, employers may report substantiated employee business expenses in Box 12 using code L, which is informational and doesn’t affect taxable wages.

Employer compliance risks for reimbursable expenses

Misclassifying employee reimbursements can create compliance issues that extend beyond a single payroll error, often due to gaps in expense management around documentation, approvals, or reimbursement timing. For finance teams, the risk often shows up later in the form of tax liabilities, employee disputes, or audit findings.

- Reclassification risk: The IRS may reclassify reimbursements as wages if accountable plan rules aren’t met, triggering back taxes and penalties

- Payroll tax liability: Employers may owe unpaid Social Security and Medicare taxes on amounts that should have been treated as taxable wages

- Employee disputes: Employees can face unexpected tax bills if reimbursements were incorrectly treated as non-taxable

- Audit exposure: Missing receipts or incomplete documentation increase the likelihood of payroll or income tax audits

Can employees deduct unreimbursed business expenses?

The Tax Cuts and Jobs Act (TCJA) of 2017 suspended many miscellaneous itemized deductions starting in 2018. As a result, most employees can no longer deduct unreimbursed business expenses on their federal tax returns.

This suspension is scheduled to last through the end of 2025 unless Congress extends or changes the law. Until then, employees generally need to rely on employer reimbursement policies rather than tax deductions to recover business costs.

There are limited exceptions. The following groups may still be able to deduct unreimbursed business expenses in specific circumstances:

- Armed forces reservists

- Qualified performing artists

- Fee-based public officials

- Disabled employees with impairment-related work expenses

- Teachers

When questions arise, it’s best to consult a tax professional for guidance.

Fringe benefit payments

The tax code defines a fringe benefit as a form of pay provided in addition to regular wages. When employees receive something of value in connection with their work, such as personal use of a company vehicle, the IRS generally treats it as taxable unless a specific exclusion applies.

A taxable fringe benefit must be included in an employee’s pay unless the law says otherwise. IRS Publication 15-B outlines common fringe benefit exclusions, including:

- Accident and health benefits

- Dependent care assistance

- Educational assistance

- Employee discounts

- Retirement planning services

- Commuting benefits

- Tuition reduction

Clear communication helps avoid confusion. Let employees know which fringe benefits your company offers and whether those benefits create taxable income.

How to handle expense reimbursement through payroll

Whether a reimbursement should run through payroll depends on whether it’s taxable. Understanding this distinction helps ensure the correct withholding is applied and reduces year-end cleanup.

- Non-taxable reimbursements: Pay separately from payroll when reimbursements qualify under an accountable plan and are fully substantiated

- Taxable reimbursements: Process through payroll so income tax, Social Security, and Medicare taxes are withheld correctly

- Partial taxability: Split the payment when only part of a reimbursement is taxable, such as mileage paid above IRS limits

- Documentation: Retain receipts, expense reports, and approval records to support how each payment was classified

Handled correctly, reimbursements won’t create surprises for employees or issues during payroll and tax reporting.

This story was produced by Ramp and reviewed and distributed by Stacker.