BNPL usage rises alongside late payments and regret

BNPL usage rises alongside late payments and regret

Just over one in four Americans say they’ve regretted using buy now, pay later (BNPL) after realizing how much they actually owed. Nearly 60% admit they’ve used BNPL to finance a purchase they couldn’t otherwise afford. Around 50% of young consumers prefer buy now, pay later over credit cards. According to Federal Reserve data, the share of BNPL users making late payments is increasing.

These trends, surfaced in Motley Fool Money’s 2025 Buy Now, Pay Later Trends Report, come as BNPL providers like Klarna and Affirm push further into the mainstream — Klarna with its 2025 IPO, and Affirm with plans to link its installment services directly to debit cards and banks.

Below are the latest buy now, pay later statistics and trends from Motley Fool Money.

15% of Americans used buy now, pay later in 2024

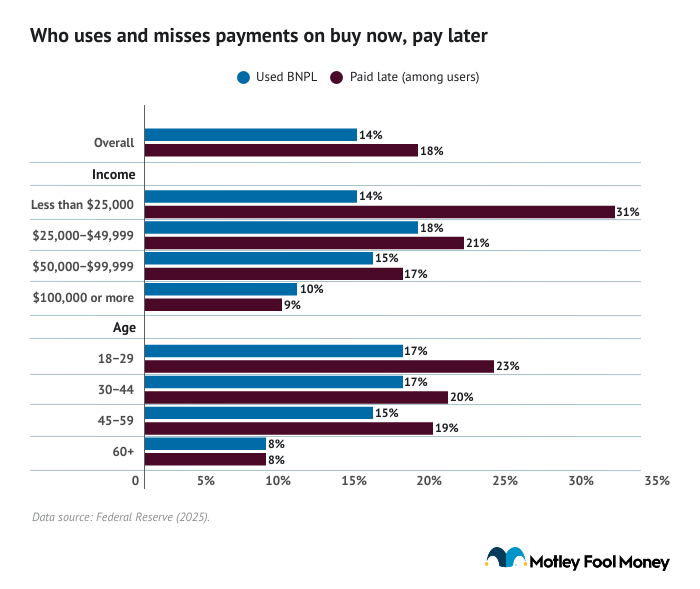

BNPL usage continues to grow: 15% of U.S. adults used it in 2024, up from 12% in 2022, according to the Federal Reserve.

Usage skews heavily toward younger consumers. Nearly one in five Americans under 45 has used BNPL, compared with just 8% of those 60 and older. Younger generations are more digitally savvy and may have less access to credit, pushing them towards BNPL at the register.

Late payments grow as BNPL users fall behind

Nearly one-quarter of BNPL users (24%) have made a late payment, up from 18% in 2023, according to the Federal Reserve. That comes as BNPL companies push into more stores and expand their offerings with banks and card issuers, reaching more consumers as economic conditions tighten.

Younger users are more likely to fall behind: 32% of 18- to 29-year-olds have missed a BNPL payment, compared with 12% of adults aged 60 and above. Late payments are also more common among lower-income and non-white Americans.

Lower-income Americans and younger Americans are more likely to have made a late payment, per the Federal Reserve.

That aligns with Motley Fool Money’s 2025 Buy Now, Pay Later Trends Report, which found that 29% of buy now, pay later users have made a late payment. The survey found that younger respondents were more likely to have fallen behind at least once.

The percentage of each generation that’s made a late BNPL payment is as follows:

- Gen Z: 39%

- Millennials: 35%

- Gen X: 17%

- Baby boomers: 11%

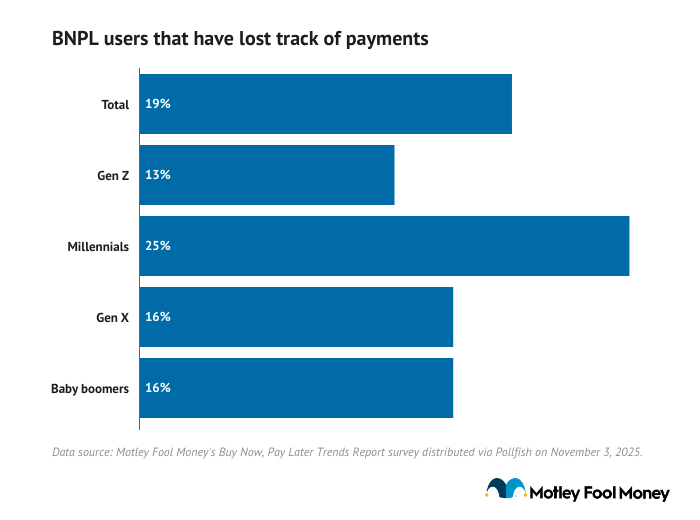

Nearly one in five users say they’ve lost track of BNPL bills

Nineteen percent of BNPL users say they’ve lost track of upcoming payments, according to Motley Fool Money’s 2025 Buy Now, Pay Later Trends Report. Millennials were the most likely to do so (25%), while Gen Z, despite having the highest late-payment rate, were least likely (13%).

Taking out multiple BNPL loans can complicate tracking, as well as having to track an additional payment on top of existing bills.

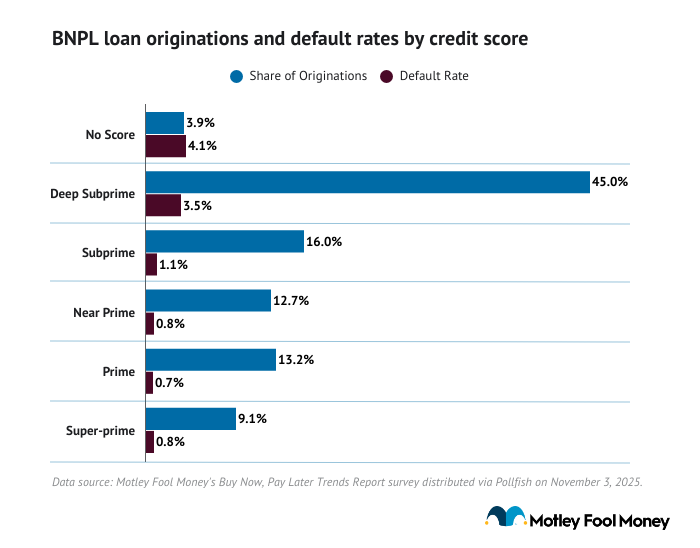

BNPL default rates remain low, but rise among young and low-credit users

In 2022, 1.9% of BNPL loans defaulted. Borrowers with deep-subprime credit scores (below 580) had a 3.5% default rate and accounted for nearly half of BNPL originations. By contrast, prime borrowers defaulted less than 1% of the time, according to the Consumer Financial Protection Bureau.

Default rates also drop sharply with age — 2.7% among borrowers under 25 versus below 2% for those aged 34 and older. That trend mirrors broader credit patterns in which younger borrowers are more likely to default or enter delinquency.

BNPL borrowers are less likely to default on their installment plans than on their credit cards. From 2019 to 2022, credit card default rates among BNPL users averaged roughly 10%, versus just 2% for BNPL loans.

Charge-off rates tell a similar story: 1.4% of BNPL loans were charged off in 2022, compared with 10.9% of credit card debt.

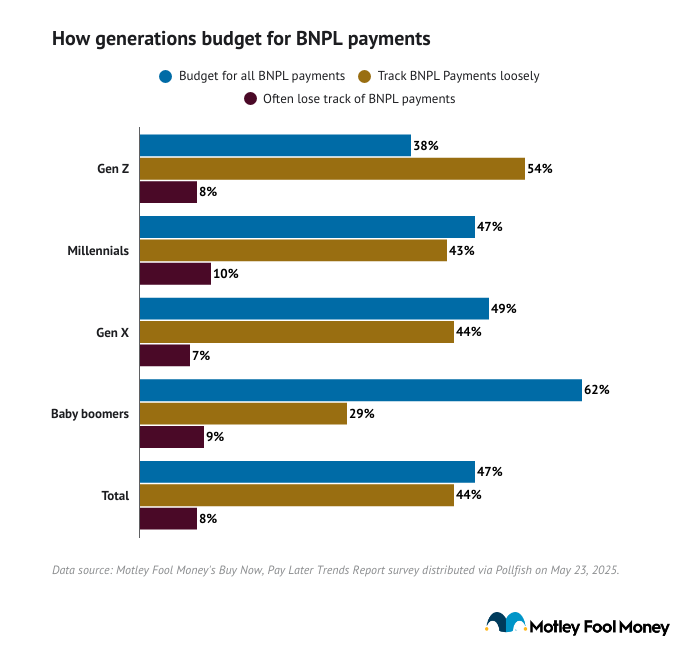

Less than half of BNPL users are budgeting before they buy

Just 47% of BNPL users plan their payments ahead of time; most either “track loosely” or lose track altogether, according to Motley Fool Money’s 2025 Buy Now, Pay Later Trends Report. However, budgeting discipline tends to wane among younger users.

Gen Z is least likely to plan (38%), while baby boomers are most disciplined — the only group where a majority (62%) budgets before buying.

A quarter of BNPL users feel regret when hit with their bill

Twenty-six percent of BNPL users say they’ve regretted using it once the full cost hit home, according to Motley Fool Money’s 2025 survey. Millennials (30%) and Gen Z (27%) report the most regret, consistent with their higher usage and late-payment rates.

Here’s how generational regret over BNPL purchases breaks down:

- Gen Z: 27%

- Millennials: 30%

- Gen X: 22%

- Baby boomers: 18%

More than half rely on BNPL for purchases they can’t afford upfront

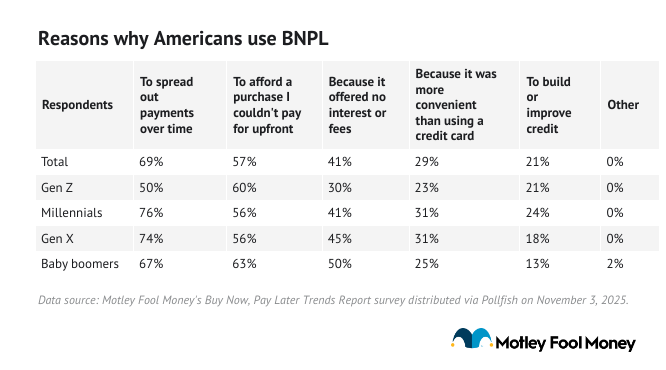

More than half of BNPL users rely on it to make purchases they otherwise couldn’t afford, according to Motley Fool Money's Buy Now, Pay Later Trends Report. Nearly 70% say they use it to spread out payments, and 41% do it to avoid interest.

Gen Z stands out for being most likely to use BNPL because they can’t pay up front rather than simply to space out payments.

Here's a full breakdown of why Americans use buy now, pay later:

Over half of all users (53%) also admit to using BNPL for purchases they know are outside their budget, a sign of how installment options can encourage overspending.

The generational breakdown for those who have used BNPL to buy something beyond their means is:

- Gen Z: 55%

- Millennials: 55%

- Gen X: 48%

- Baby boomers: 51%

Top categories for BNPL spending

BNPL has become a default checkout option, especially online. The most common categories:

- Online shopping: 63%

- Electronics: 54% (up from 49% in 2024)

- Clothing and fashion: 41%

- Furniture and appliances: 36%

- Groceries: 27%

- Food delivery: 27%

Rising BNPL use for essentials like groceries and delivery may reflect inflation pressures and tighter household budgets. Online shoppers may be more prone to impulse buys outside of their budget when BNPL becomes a seemingly attractive option. Electronics can be pricey, which may lead consumers to feel more comfortable about making a purchase if they can split it into smaller payments.

Holiday spending with BNPL hit a record $18.2 billion in the U.S. last year, accounting for about 7.5% of holiday purchases, according to Adobe Digital Insights. The total has risen steadily from $14.5 billion in 2022 to $16.6 billion in 2023.

Cyber Monday alone saw a record $991 million in BNPL transactions.

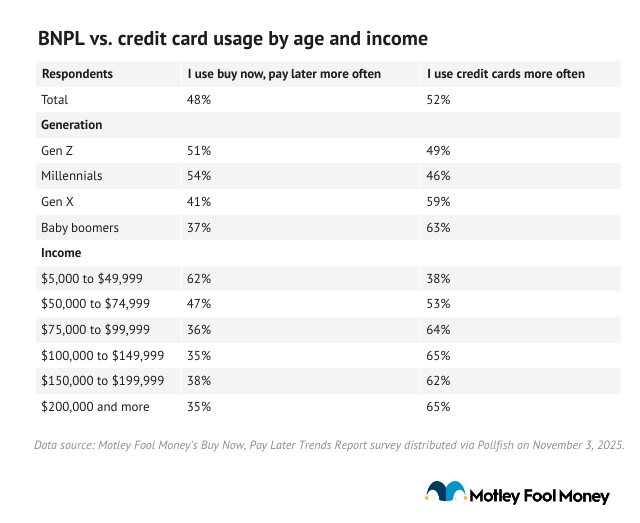

Gen Z and millennials use buy now, pay later more than credit cards

More than half of Gen Z (51%) and millennials (54%) say they use BNPL more often than credit cards, compared with 41% of Gen X and 37% of baby boomers.

The income divide is sharper: 62% of those earning under $50,000 rely on BNPL over credit cards, versus less than 40% of those making $75,000 or more.

That gap may reflect limited access to credit cards and lower credit limits among lower-income consumers — BNPL often offers instant, no-credit-check approval.

Most buy now, pay later users keep payments below $100 a month

Fifty-six percent of adults say their total monthly BNPL payments are $100 or less, including 27% who owe under $50. Another 28% pay $101 to $250 monthly, while only 4% pay over $500.

By comparison, the average monthly credit card payment was $363 in 2023, according to New York Life.

This is the average monthly BNPL payment that respondents to Motley Fool Money’s survey reported:

- $50 or less: 27%

- $51 to $100: 29%

- $101 to $250: 28%

- $251 to $500: 13%

- Over $500: 4%

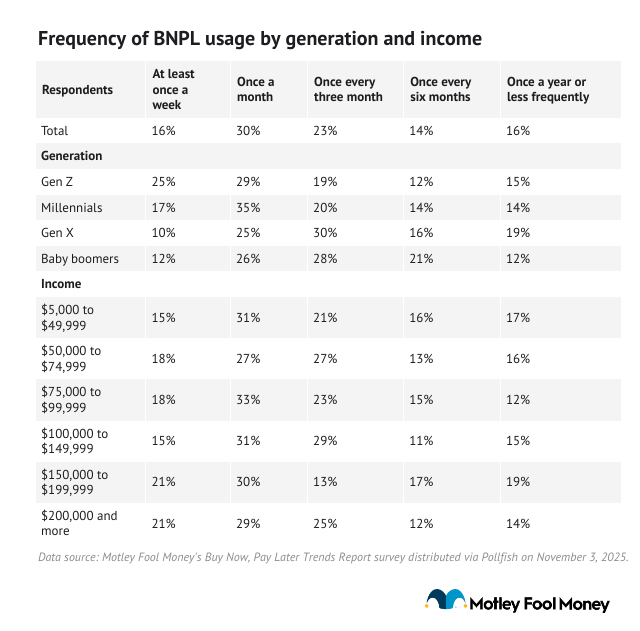

Monthly BNPL use is routine for three in 10 Americans

BNPL hasn’t reached the daily frequency of credit cards, but regular use is becoming common. Three in 10 Americans now use a BNPL service at least once a month, according to Motley Fool Money’s 2025 Buy Now, Pay Later Trends Report.

The frequency of purchases made with buy now, pay later has remained mostly stable over the past five years, with consumers turning to it more regularly, according to survey data from Motley Fool Money. Each year, between 30% and 40% of respondents who have used buy now, pay later do so once a month or more frequently, while between 30% and 40% use buy now, pay later once every six months or less frequently.

Understanding interest and late fees in buy now, pay later services

Most BNPL providers promote 0% interest, but that promise comes with caveats. Late or missed payments can trigger fees, and in some cases, financing charges that rival credit card interest rates.

The promise of making purchases with no interest makes it seem like buy now, pay later is the clear winner over traditional credit. But is buy now, pay later really better than a credit card?

The answer is complicated and largely depends on what consumers are looking for. For example, using a buy now, pay later service can't help credit scores, but it can hurt them.

If consumers are looking to improve their credit score or have more flexibility in their repayment period, a credit card with a 0% introductory APR may be a better option. Many credit cards provide perks like credit monitoring, purchase protection, and rewards programs that buy now, pay later providers don't yet offer, as well.

It's also worth noting that buy now, pay later programs lack the same level of regulatory oversight as credit cards. According to Consumer Reports, some buy now, pay later users have had trouble with disputes and returns, for example.

Has buy now, pay later usage plateaued?

Despite being available at most major retailers, the adoption of buy now, pay later has slowed. The share of Americans who used a BNPL service in the past year rose modestly from 12.1% in 2022 to 15% in 2024. But late payments have become more common, and many users now rely on BNPL to cover purchases they couldn’t otherwise afford.

BNPL providers face challenges beyond limited growth. Most users make small, infrequent purchases, suggesting the services haven’t yet replaced traditional credit for everyday spending. Still, companies continue to expand, integrate BNPL at checkout, partner with banks, and pursue IPOs to capture long-term market share.

BNPL can be convenient, especially for short-term, interest-free purchases, but it lacks many benefits of the best credit cards: competitive rewards, purchase protection, travel perks, and credit-building potential.

For consumers who are unable to qualify for a credit card, BNPL may be their only credit option; however, its flexibility can also encourage overspending or missed payments.

BNPL remains a growing part of the payments ecosystem, but its future depends on whether it can evolve from a niche financing tool into a true alternative to credit cards.

Methodology

Motley Fool Money surveyed 2,000 American adults via Pollfish on November 3, 2025. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool.

Separate surveys with the same methodology were carried out on May 23, 2025, July 8, 2024, July 19, 2023, June 29, 2022, March 10, 2021, and July 6, 2020.

This story was produced by Motley Fool Money and reviewed and distributed by Stacker.