Crypto all-time highs by year: When the market set new records

Crypto all-time highs by year: When the market set new records

In 2017, JPMorgan (JPM) CEO Jamie Dimon called bitcoin a “fraud.” Now, his company is building its own blockchain and believes the current crypto downturn will be short-lived. Bitcoin’s price history helps explain why. According to StatMuse, BTC has grown by over 20,000% since 2016 and set 11 new highs in 2025.

But raw percentage growth only tells part of the story. To better understand when crypto enters true price-discovery mode, Finder.com tracked how often the top five cryptocurrencies by market cap reach new price records. Let’s explore crypto all-time high (ATH) activity by year.

How often crypto hits new all-time highs

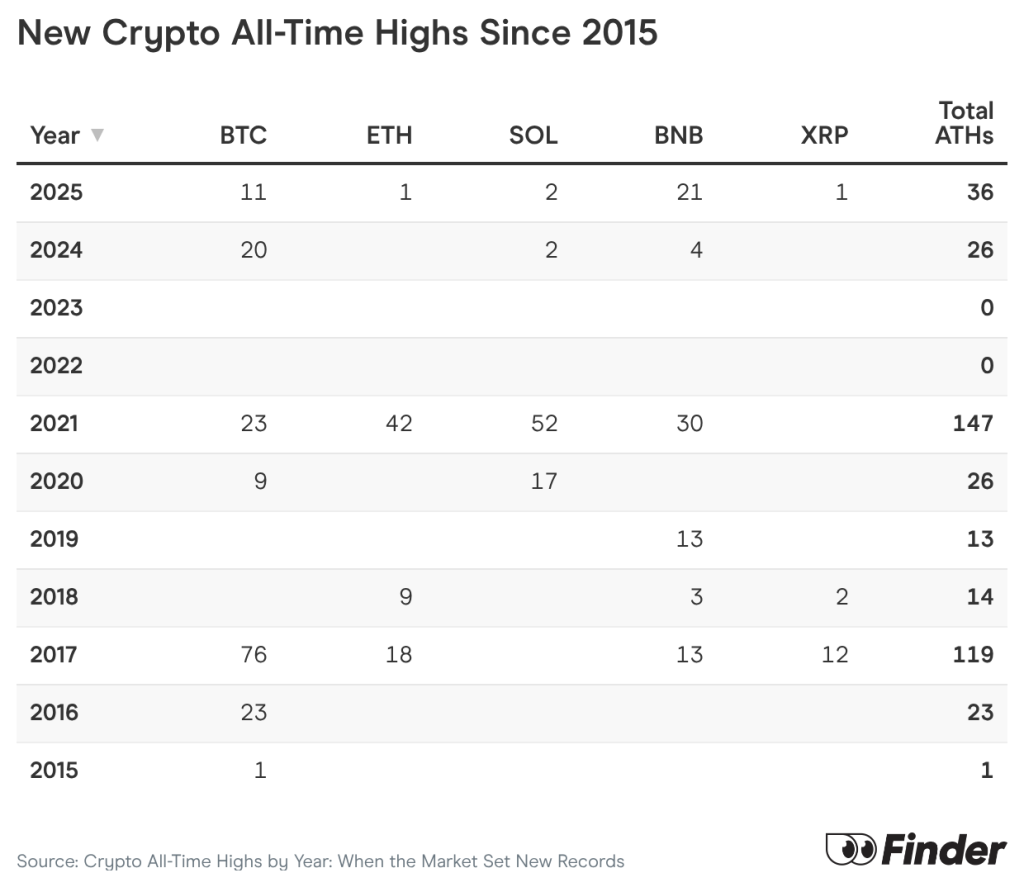

2021 reigns supreme as the year with the most all-time highs, coming in at a whopping 147. Another banner year was 2017, which hit just under 120 ATHs. Together, they account for more than half of the decade’s total all-time highs.

By contrast, 2022 and 2023 collectively saw no new records set at all, at least not by these top five coins. If you know crypto history, this lack of ATHs lines up with the crypto winter that followed a series of high-profile failures in the digital world — most notably, the collapse of crypto exchange FTX.

The periods between these peak markets and deep downturns featured moderate record-setting activity. The years 2016, 2020 and 2024 all had ATHs in the 20s, with 2018 and 2019 in the teens. These mid-cycle years usually represent growing momentum after a crash.

Which coins set the most all-time highs?

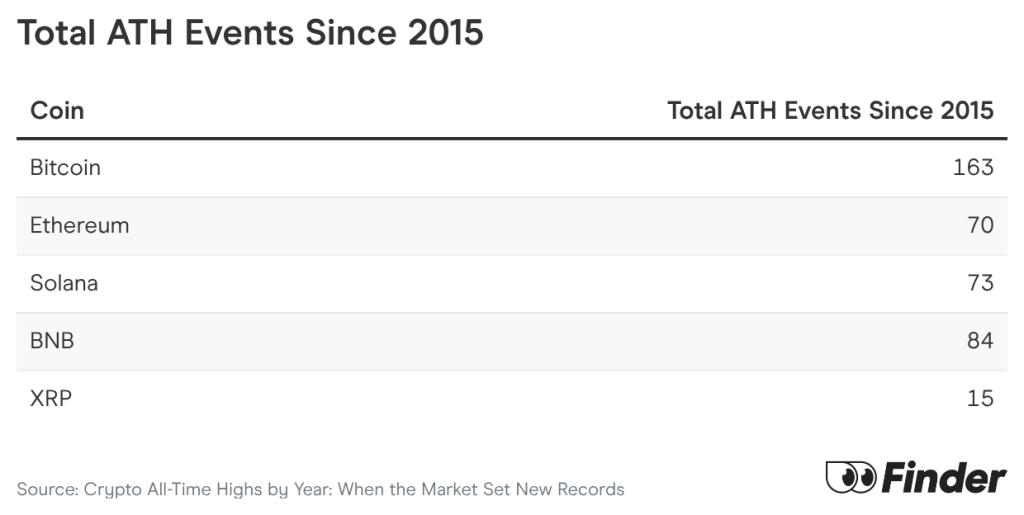

It’s probably no surprise that the OG crypto, bitcoin (BTC), takes top prize as the coin that set the most records over the last decade. Coming in at 163, it holds the lead with nearly double the ATHs of second place.

The next three — ether (ETH), solana (SOL), and BNB — fall into a clear middle band, each recording 70-84 all-time highs. While all three coins have seen strong growth, all were launched years after bitcoin, giving them less time to experience market cycles and growth.

While XRP lags behind at just 15 ATHs, it has only just replaced cardano (ADA) as the fifth-biggest coin by market cap (excluding stablecoins) in 2024.

What patterns emerge from the data?

It’s no secret that crypto runs on a four-year cycle. Consistent ATHs in 2017 and 2021 mark the typical upswings seen in crypto trends, while 2015, 2019 and 2022-2023 mark the lows.

However, 2025 — while still rising — did not break into the record-setting number of all-time highs we usually see at the height of a crypto cycle. Instead, 2025 recorded only 36 ATHs compared to 119 in 2017 and 143 in 2021.

So, what happened last year and why might 2025 differ from previous cycles?

Why 2025 may have diverged from the expected

Several factors may explain why 2025 failed to produce a similar peak in ATHs to those in 2017 and 2021, despite the growing crypto momentum over the last few years.

- Growing adoption and normalcy. Crypto is maturing into an established asset class, most recently evidenced by spot bitcoin ETFs and regulatory support. The volatility of its early years may be giving way to more stable price action.

- Rising market cap and scaling effects. Small-cap investments can double or triple in value much more easily than trillion-dollar companies. While the market cap for crypto has grown exponentially in the past, it’s only a matter of time before it cools. We could be seeing this effect right now.

- Macro headwinds tempered investment risk. Rising interest rates, concerns around inflation and global economic and political uncertainty may have turned investors toward more historically stable assets, like gold.

- The cycle is just late. Four years is a pattern, not a guarantee. While we did see some record-setting action in the latter half of this year, perhaps the real peak is around the corner in 2026.

Rather than signaling market weakness, 2025’s lukewarm record-setting activity may point more toward a transition for crypto. As it grows in size and acceptance, that explosive growth that sets a hundred or more ATHs in a single year may be a feature of its past.

Methodology

To analyze the frequency and patterns of all-time highs across crypto market cycles, Finder.com tracked the top five cryptocurrencies by market capitalization and counted each instance when they reached new price records. This methodology is outlined below.

- Coins selected. Researchers gathered information on the top five cryptocurrencies by total market capitalization based on data from CoinMarketCap.

- Exclusions. The study excluded stablecoins and wrapped assets from the top five coins.

- ATH definition. The research defined an all-time high as a new intraday price high relative to all prior trading history.

- Counting rules. Every new price record is counted as a separate “ATH event.”

- Data sources. Historical price was sourced from Yahoo Finance, and market cap data was sourced from CoinMarketCap.

Bottom Line

Crypto all-time highs tend to cluster in four-year cycles around major market momentum. However, 2025’s lower-than-expected ATH activity may represent growing maturity for an asset that was once dismissed by the traditional finance world.

Whether we see a surge in 2026 or more gradual growth, the market that emerges may look fundamentally different than that of its past. Understanding crypto’s changing patterns may help investors navigate an asset class that’s slowly gaining a place in people’s portfolios.

This story was produced by Finder.com and reviewed and distributed by Stacker.