Stock market analysis: Navigating momentum and managing expectations

Stock market analysis: Navigating momentum and managing expectations

After six months of remarkable market momentum through trade tensions and policy uncertainty, the fundamentals are signaling it may be time for a cautious reassessment. The S&P 500 defied historical norms this fall, shrugging off September seasonality to post a 3.5% return—its strongest September in 15 years. This rally continued through October, driving year-to-date (YTD) returns above 17% and an impressive 35%+ gain since the April market bottom.

Many investors are now eyeing the traditional year-end "Santa rally" as an easy win for continued momentum. The historical data is compelling: Over the past 50 years, the S&P 500 has risen nearly 80% of the time during November and December. In years where markets had already climbed more than 15% through October, that percentage of positive returns rises to 95%.

However, as tempting as it is to play the calendar game, it’s important to remember that seasonality is only a datapoint, not a long-term investment strategy.

What the Fundamentals Tell Us

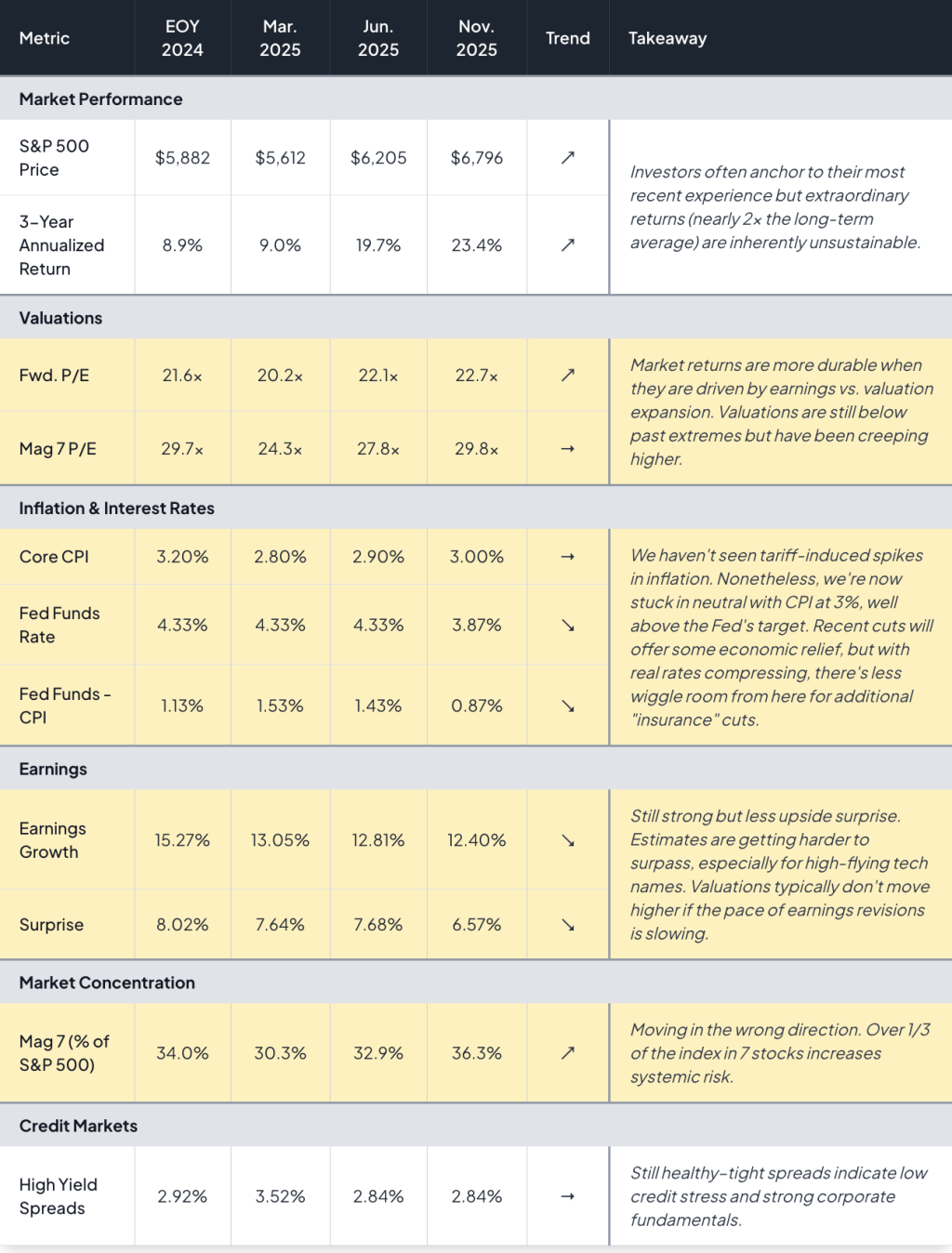

Looking at the fundamentals of the U.S. market, Range sees an increasingly mixed backdrop:

- Earnings: Remain strong, though the magnitude of upside surprises is moderating.

- Valuations: Well below past extremes, but have been creeping higher.

- Inflation and Rates: Inflation is stuck in neutral, and interest rates are closing in on the rate of inflation, leaving less room for future cuts.

- Credit Markets: Still broadly healthy despite some signs of isolated stress.

- Market Concentration: Has intensified, and is moving in the wrong direction.

A friendly Fed has been a backstop for the markets, but after a cumulative 150 bps of rate cuts, the path towards further easing has become more uncertain. Meaningful additional help from the central bank will likely require lower inflation or economic deterioration—potentially removing a tailwind that has supported markets since last fall. Coupled with increased market concentration and decelerating earnings growth, the current rally has become fragile.

Signals of Speculative Froth

Wealth creation can be severely impaired by attempting to “time the market”. However, it’s important to be aware of the dynamics that can drive short-term market movements. Understanding the "why" behind these moves can prevent emotional reactions to market turbulence.

There are two signals of potential froth in the market that bear close monitoring:

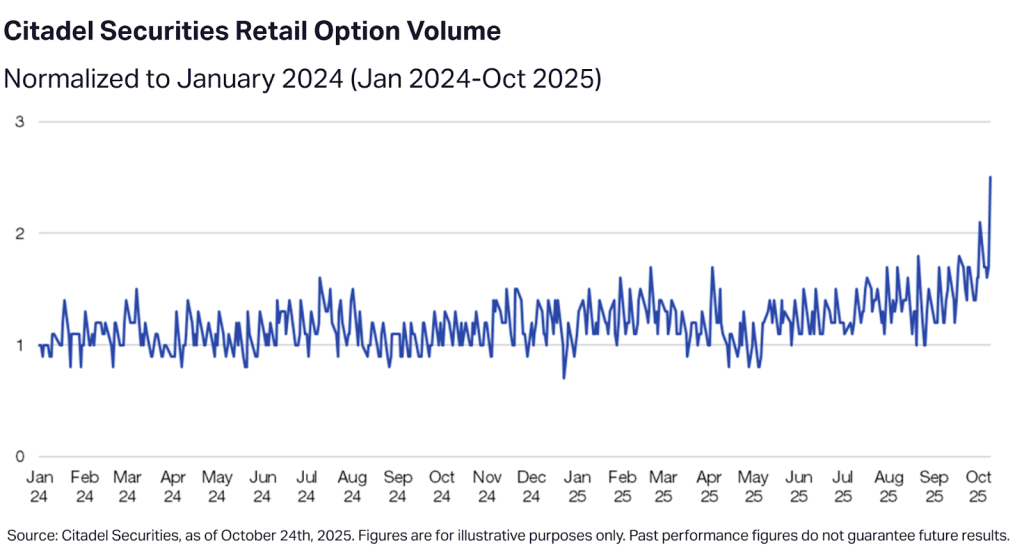

Record Retail Call Option Buying

We are seeing increasingly stretched investor positioning, especially amongst retail investors. Retail traders are buying call options at record levels, a sign of increasing speculation and leverage in the market.

This type of positioning can make markets more prone to volatility in the event of downside surprises. Just like in sports betting, when everyone expects the same team to win, that team needs to win by a wider margin to make money. When you have to take on more risk for less reward, any negative surprise can lead to larger losses.

Speculative Excess in Unprofitable Companies

Strong bull markets can breed speculative excess, where stocks rise regardless of fundamentals as FOMO drives investors to chase unrealistic returns. We’re seeing valuations in “non-profitable tech” companies (as defined by Goldman Sachs) begin to creep higher again. While not as extreme as valuations in 2021, this increase is a classic indicator of froth and can leave the overall market vulnerable to volatility.

Proceed with Caution

U.S. markets may produce strong gains over the medium term. Corporate earnings remain resilient, debt levels are contained, and productivity is accelerating on the heels of AI adoption.

That said, the 23% annualized return we’ve seen for the S&P 500 over the last three years won’t continue forever. Corrections are a normal part of market cycles, even in bull markets, and it’s possible we’ll see some volatility ahead. Even more likely is an eventual return to historical norms—a still-healthy 8% to 10% per year.

What Should Investors Do?

This environment doesn't call for selling out of equities or hoarding cash—secular tailwinds, particularly in AI, along with likely fiscal support in 2026, set a strong foundation for U.S. stocks. Instead, investors should focus on establishing a proactive investment strategy that accounts for market cycles and is designed to hedge against possible volatility.

For investors hoping to build resiliency, prioritize portfolio diversification:

- Broaden U.S. equity exposure. Companies outside the Magnificent 7 have seen earnings growth accelerate while trading at more reasonable valuations. Exposure to the broader U.S. market—not just megacaps—provides protection if we experience a tech or AI-specific sell-off.

- Think globally. Not all countries face the same inflation challenges or valuation hurdles as the U.S. does. Maintaining international exposure helps mitigate country-specific risks.

- Remember bonds and other asset classes. These investments can perform well during equity market stress. If the economy unexpectedly weakens, bonds can provide a portfolio cushion when you need it most.

The key is preparation, not prediction. Markets will always present uncertainty, but a well-structured portfolio positions you to weather volatility while capturing long-term growth.

This story was produced by Range and reviewed and distributed by Stacker.