This story was produced by SmartAsset and reviewed and distributed by Stacker Media.

Where high-earning households are moving most

When high earners move, they take their money with them. And because their budgets are much larger than most of the population, they can have an outsized effect on the local economy. Thus, states that attract high-earning households can gain an economic advantage over others. Many factors can drive high earners to move across state borders, including business opportunities, tax incentives and other conveniences.

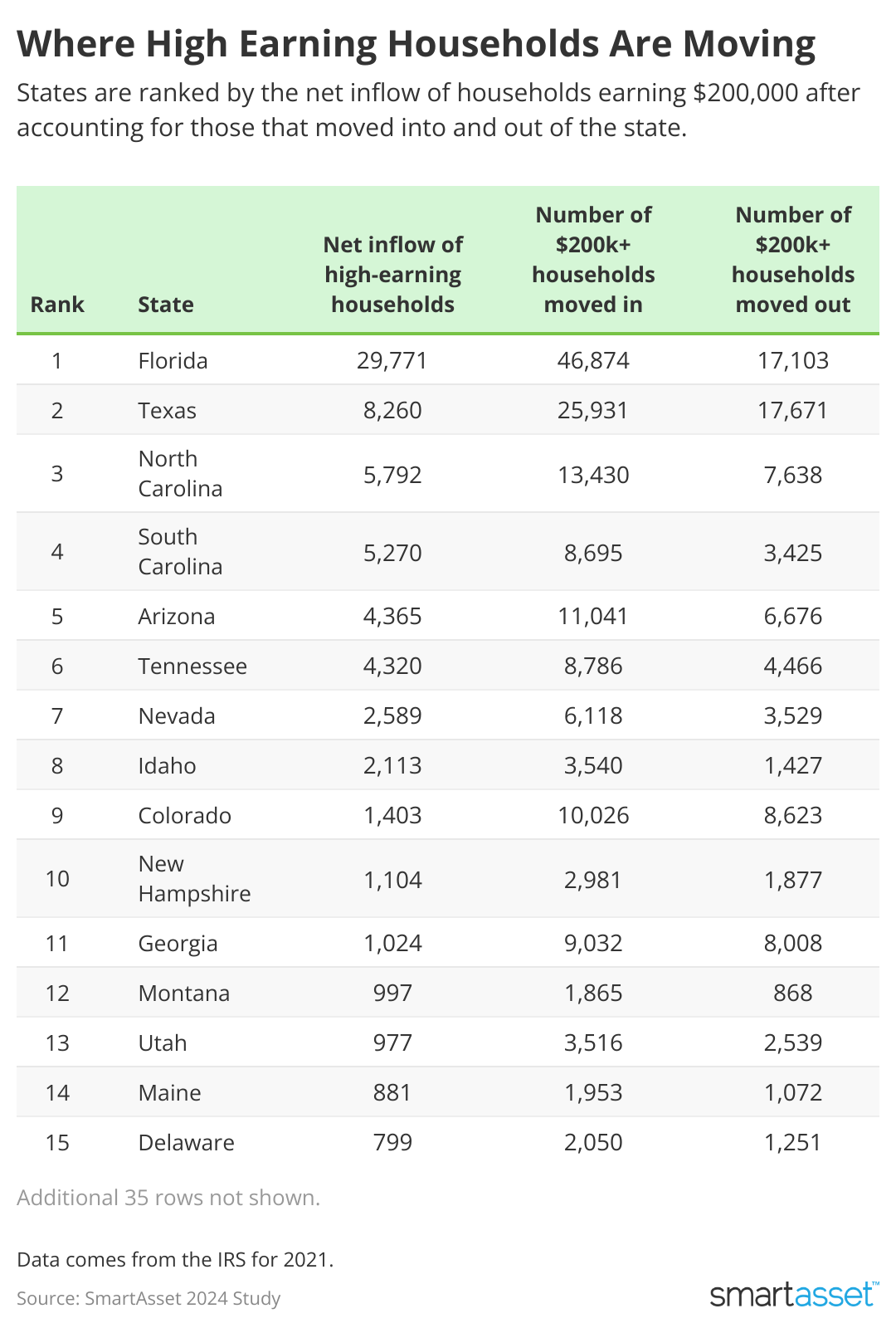

With this in mind, SmartAsset examined the latest IRS data to find where households earning $200,000 annually or more are moving.

Key Findings

- Florida gained nearly 30,000 high-income households. Florida is the top state where high-income households are moving to with 29,771 net new returns. Texas ranks second for this metric, with a net addition of 8,260 high-earning households.

- Money is moving to the Carolinas. North Carolina and South Carolina ranked third and fourth for most high-earning households moving in, with a net gain of 5,792 and 5,270 households, respectively. The average household income of high-earning households moving in is $456,000 for North Carolina and $501,000 for South Carolina.

- California and New York lost the most high earners. California ranked last for the net number of high earners moving into the state, with a total loss of 24,670 high income households. While New York lost the second-most high-earning households, its figure is less than half of California's loss, at -12,040 households. However, the high earners who did move into California and New York this time had a higher average adjusted gross income (AGI) than those who left.

- Fresh high-income transplants to Wyoming make nearly $1.6 million per year. The income of high-income households moving into Wyoming was just about triple that of those moving out ($535,000). The state ranked 21st overall with a net gain of 316 high-income households.

10 States That Gained the Most High-Income Households

- Florida

- Net inflow of high-earning households: 29,771

- Inflow of high earners (number of returns): 46,874

- Outflow of high earners (number of returns): 17,103

- Household income (AGI) for high earners moving in: $907,013

- Household income (AGI) for high earners moving out: $294,189

- Texas

- Net inflow of high-earning households: 8,260

- Inflow of high earners (number of returns): 25,931

- Outflow of high earners (number of returns): 17,671

- Household income (AGI) for high earners moving in: $579,207

- Household income (AGI) for high earners moving out: $370,986

- North Carolina

- Net inflow of high-earning households: 5,792

- Inflow of high earners (number of returns): 13,430

- Outflow of high earners (number of returns): 7,638

- Household income (AGI) for high earners moving in: $456,384

- Household income (AGI) for high earners moving out: $299,005

- South Carolina

- Net inflow of high-earning households: 5,270

- Inflow of high earners (number of returns): 8,695

- Outflow of high earners (number of returns): 3,425

- Household income (AGI) for high earners moving in: $501,205

- Household income (AGI) for high earners moving out: $197,386

- Arizona

- Net inflow of high-earning households: 4,365

- Inflow of high earners (number of returns): 11,041

- Outflow of high earners (number of returns): 6,676

- Household income (AGI) for high earners moving in: $561,112

- Household income (AGI) for high earners moving out: $328,474

- Tennessee

- Net inflow of high-earning households: 4,320

- Inflow of high earners (number of returns): 8,786

- Outflow of high earners (number of returns): 4,466

- Household income (AGI) for high earners moving in: $586,256

- Household income (AGI) for high earners moving out: $268,316

- Nevada

- Net inflow of high-earning households: 2,589

- Inflow of high earners (number of returns): 6,118

- Outflow of high earners (number of returns): 3,529

- Household income (AGI) for high earners moving in: $845,035

- Household income (AGI) for high earners moving out: $425,702

- Idaho

- Net inflow of high-earning households: 2,113

- Inflow of high earners (number of returns): 3,540

- Outflow of high earners (number of returns): 1,427

- Household income (AGI) for high earners moving in: $494,497

- Household income (AGI) for high earners moving out: $190,606

- Colorado

- Net inflow of high-earning households: 1,403

- Inflow of high earners (number of returns): 10,026

- Outflow of high earners (number of returns): 8,623

- Household income (AGI) for high earners moving in: $590,626

- Household income (AGI) for high earners moving out: $464,352

- New Hampshire

- Net inflow of high-earning households: 1,104

- Inflow of high earners (number of returns): 2,981

- Outflow of high earners (number of returns): 1,877

- Household income (AGI) for high earners moving in: $619,679

- Household income (AGI) for high earners moving out: $387,142

10 States That Lost the Most High-Incomes Households

- California

- Net outflow of high-earning households: -24,670

- Outflow of high earners (number of returns): 48,875

- Inflow of high earners (number of returns): 24,205

- Household income (AGI) for high earners moving out: $1,303,439

- Household income (AGI) for high earners moving in: $638,597

- New York

- Net outflow of high-earning households: -12,040

- Outflow of high earners (number of returns): 29,869

- Inflow of high earners (number of returns): 17,829

- Household income (AGI) for high earners moving out: $1,194,676

- Household income (AGI) for high earners moving in: $719,123

- Illinois

- Net outflow of high-earning households: -9,292

- Outflow of high earners (number of returns): 16,363

- Inflow of high earners (number of returns): 7,071

- Household income (AGI) for high earners moving out: $1,582,754

- Household income (AGI) for high earners moving in: $575,810

- Massachusetts

- Net outflow of high-earning households: -4,392

- Outflow of high earners (number of returns): 11,810

- Inflow of high earners (number of returns): 7,418

- Household income (AGI) for high earners moving out: $990,970

- Household income (AGI) for high earners moving in: $701,116

- New Jersey

- Net outflow of high-earning households: -3,863

- Outflow of high earners (number of returns): 15,661

- Inflow of high earners (number of returns): 11,798

- Household income (AGI) for high earners moving out: $892,971

- Household income (AGI) for high earners moving in: $533,027

- Pennsylvania

- Net outflow of high-earning households: -2,417

- Outflow of high earners (number of returns): 10,950

- Inflow of high earners (number of returns): 8,533

- Household income (AGI) for high earners moving out: $734,519

- Household income (AGI) for high earners moving in: $515,809

- Maryland

- Net outflow of high-earning households: -2,375

- Outflow of high earners (number of returns): 8,675

- Inflow of high earners (number of returns): 6,300

- Household income (AGI) for high earners moving out: $723,818

- Household income (AGI) for high earners moving in: $466,009

- Virginia

- Net outflow of high-earning households: -2,375

- Outflow of high earners (number of returns): 12,691

- Inflow of high earners (number of returns): 10,316

- Household income (AGI) for high earners moving out: $588,569

- Household income (AGI) for high earners moving in: $436,370

- Minnesota

- Net outflow of high-earning households: -1,784

- Outflow of high earners (number of returns): 4,929

- Inflow of high earners (number of returns): 3,145

- Household income (AGI) for high earners moving out: $950,019

- Household income (AGI) for high earners moving in: $450,349

- Washington

- Net outflow of high-earning households: -1,579

- Outflow of high earners (number of returns): 13,393

- Inflow of high earners (number of returns): 11,814

- Household income (AGI) for high earners moving out: $682,803

- Household income (AGI) for high earners moving in: $521,041

Data and Methodology

To determine where high-earning households are moving, SmartAsset reviewed the latest IRS data, which comes from the 2021-2022 tax year. High-earning households as those with adjusted gross incomes of $200,000 or more. The inflow of qualifying households in each state were compared to the outflows to determine net migration of high-earning households. The average AGI for high-earning households who moved during this tax year was also examined for each segment.