This story originally appeared on CheapInsurance.com and was produced and distributed in partnership with Stacker Studio.

How gas prices have changed in Detroit since the 70s

It wasn't that long ago, 1999 in fact, that a gallon of regular gasoline cost less than $1. And that price was much more common through the 1980s.

More recently, of course, prices have been higher than $1. But when adjusted for inflation, the median price of gas when Jimmy Carter was president was just over $3 per gallon in 2023 dollars. Back then, in 1978, the price at the pump was about 65 cents—which equates to roughly $3.09 today.

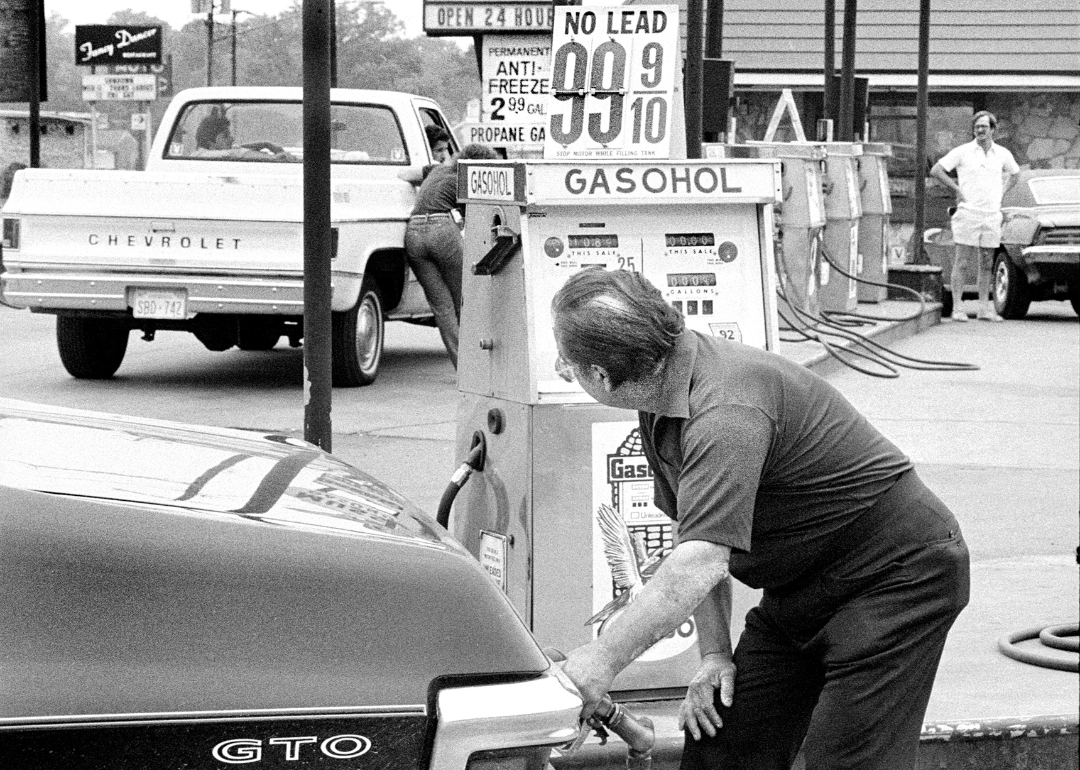

Gasoline has been the lifeblood of the nation's work and social lives since the automobile became widely adopted in the mid-1900s. It's an expense most Americans simply can't avoid, and one that is constantly at the forefront of political discussions when election time rolls around.

The cost of gas—and its fluctuations—can also vary widely depending on where in the country you are. Accessibility, tax rates, and other factors mean there can be dollars of difference in the per-gallon gas price at different corners of the U.S.

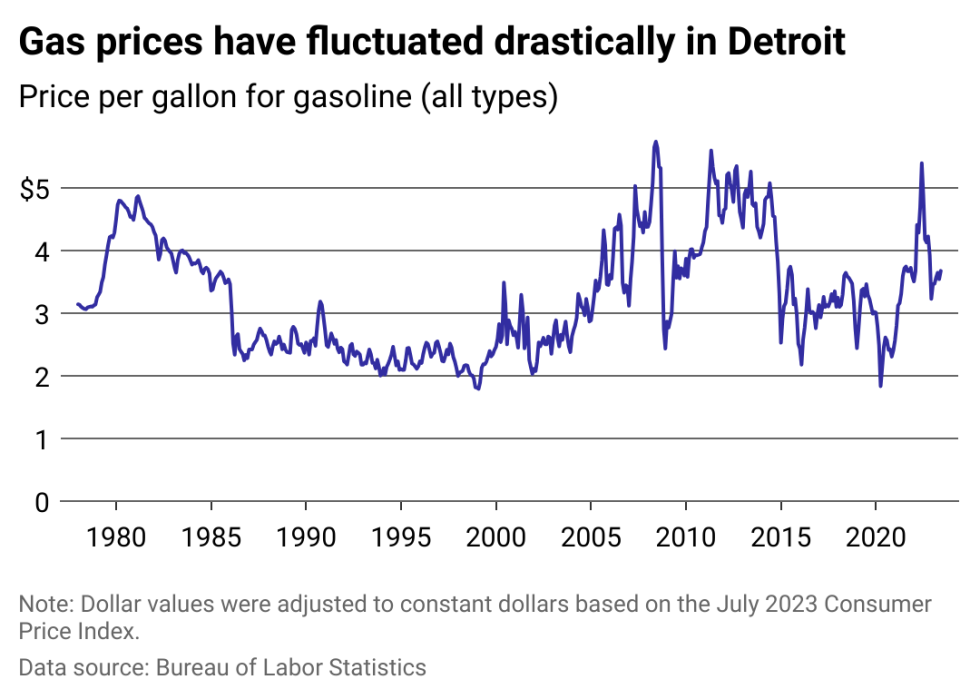

CheapInsurance.com used data from the Bureau of Labor Statistics to chart monthly changes in the price of Detroit gas over the past 45 years. Prices are converted to July 2023 dollars to account for inflation and represent the average price of all types of gas.

Gas prices in Detroit remain well above 45-year median

The median price of gas between 1978 and July 2023 in Detroit was $3.11 per gallon, adjusted to July 2023 dollars. Today, the price of gas is $0.57 above that median, and drivers' wallets are feeling it at the pump.

Nationally, the median price for gas in U.S. cities over that time span was $3.07 when adjusted for inflation. Compare that to the latest figures from July, when gas across the country was at $3.73 per gallon.

There have been several periods of large increases throughout history, typically driven by international conflicts, which almost always involve shifts in trade policies by some countries seeking to punish others. Global conflicts with oil-producing countries like those in the Middle East and Russia can be found throughout periods of high gas prices for Americans.

When the cost of gas increases, businesses raise the cost of their goods so they don't lose money. That means that gas prices are a piece of the economic puzzle that can not only directly push up transportation costs for travelers, but also the cost of nearly everything else, indirectly. Even the massage therapist who doesn't operate a fleet of delivery trucks needs to fill up their tank to get to the spa.

Gas prices are a commodity that can be highly volatile for consumers—so much so that governments have developed ways to control the swings.

In the U.S., the federal government operates a program known as the Strategic Petroleum Reserve. By geological happenstance, the North American continent contains plentiful fossil fuels locked beneath its surface. They're most abundant in regions like Texas, Louisiana, Pennsylvania, and Alaska. When prices are low, the U.S. government buys excess oil and stores it for the future. When prices go higher, the government can release stockpiled oil into the market to bring prices down. More supply than demand means lower prices for consumers.

America's ability to secure its own oil and keep prices low is a relatively novel turning point, made possible by technological advancements in oil extraction commonly known as fracking. Those practices have caused water pollution and potentially increased the frequency of earthquakes. It also kept gas prices low and the overall economy highly productive in the latter half of the 2010s.

Today the stockpile that serves as a buffer against gas price spikes is at the lowest level recorded since the early 1980s, according to the Energy Information Administration.

Stockpiles were drawn down in 2006 amid the U.S. invasion of Iraq and in 2011 as the country was gripped by a deep recession. But never in recent history have they been drawn down to the degree they have since 2021. That year Americans began driving again, demanding loads more gasoline after suppliers around the globe had backed off production in light of stay-at-home orders and reduced travel activity due to the COVID-19 pandemic.

In 2022, major international oil supplier Russia invaded Ukraine, throwing the global oil markets out of balance. The U.S. released stockpiled gasoline to prevent massive inflation but still was unable to avoid gas prices reaching a historic high of $5 per gallon on average that summer.

The price per gallon of gas has fallen more than a full dollar from the highs seen in the summer of 2022 but remains elevated over pre-pandemic levels. As the conflict in Eastern Europe shows no signs of stopping, experts and markets have expressed anxiety about how geopolitical tensions might affect gasoline costs in the coming years. Also facing the American consumer is a future in which there is a very real chance the transition to electric vehicles could create challenges for those still relying on gasoline. Fluctuations in demand and supply could result in temporary price spikes, according to experts.

This story features writing by Dom DiFurio and data reporting by Paxtyn Merten and is part of a series utilizing data automation across 10 metros.