It takes $5.8M to be part of the 1% in the US. Here's where in the world wealth is more achievable.

This story originally appeared on Spokeo and was produced and distributed in partnership with Stacker Studio.

It takes $5.8M to be part of the 1% in the US. Here's where in the world wealth is more achievable.

The world has witnessed a boom among ultra-wealthy people since the COVID-19 pandemic began, but cracking the top 1% of earners in the U.S. has become less attainable than ever.

Knight Frank's 2024 Wealth Report shows that the wealthiest 1% of individuals in the U.S. are each worth at least $5.8 million. Meanwhile, Federal Reserve economic data shows that, in 2022, the wealthiest households joined the ranks of the 1% with a minimum of $11.2 million. That's down slightly from 2019 when adjusted for inflation. Still, it takes $1.6 million more to be in the top 1% of households than it did a decade ago, and about $4 million more than it did at the turn of the century. About 1.2 million households are counted among the top 1% today, and they hold 30% of all wealth in the U.S.

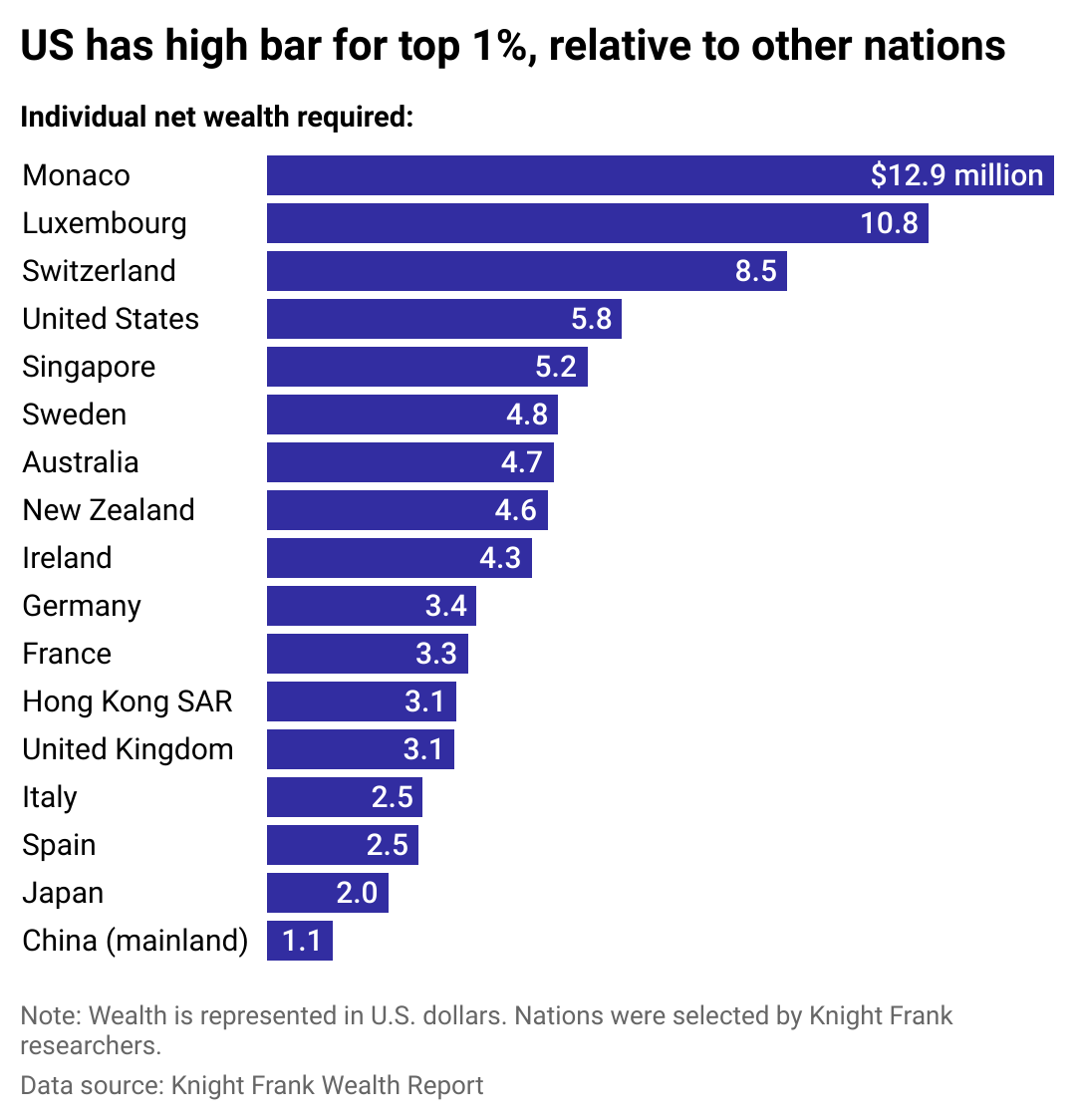

In other countries, however, the bar is often lower. Spokeo used Knight Frank data to visualize what it takes for individuals to be in the top 1% in select nations across the world.

"Wealth" carries many different meanings, particularly in the U.S. On average, Americans believe it takes $2.5 million to be considered wealthy, according to a 2024 survey by financial services provider Charles Schwab. That tracks relatively closely with the amount of wealth it takes to break into the top 10% of Americans, at around $2.2 million in 2022.

The wealth of some of America's most well-known rich people—such as Elon Musk, Jeff Bezos, and Mark Zuckerberg—goes well beyond the 1%, essentially creating their own bracket among billionaires (putting them within the top 0.1 and 0.01%). Instead, the top 1% comprises people like Sen. Elizabeth Warren (estimated $8 million net worth, according to latest available figures from 2018).

Most Americans hope to be rich one day—and believe they could be. About 3 in 5 Americans surveyed by The Harris Poll say they want to be billionaires one day, and over 2 in 5 believe they have the tools, such as cryptocurrency investment, to become one.

In fact, U.S. households did improve their wealth in recent years—but much more modestly than would be required to break into the top 1%. Median net worth of U.S. households grew by 37% from 2019 to 2022, which was by far the highest growth of any three-year span measured in the Federal Reserve Board's Survey of Consumer Finances.

Still, the family median rose to $192,900, which doesn't even scratch the surface of the $11.2 million threshold for the household 1%. COVID-era savings and monetary distributions from the government supported this surge, even as inflation hit record highs and the pandemic spurred a short-lived recession.

Still, this growth did not occur equally. The bottom 25% of Americans grew their net worth by 900% between 2019 and 2022, but still only reached a median net worth of $3,500. During the same period, the top 10% increased their net worth by a median $782,000. Although Black families increased their median net worth by 60% (to $45,000) and Hispanic and Latino families by 47% (to $62,000), gaping racial and ethnic wealth inequality endured. U.S. one-percenters remain predominantly white, heterosexual, married couples, with the men of these households driving most of the income.

As wealth continues to consolidate and the cost of living continues to rise for many Americans, the highest ranks of American wealth are ever more elusive.

Few nations require more than US to break the top 1%

Though the U.S. has a high bar for its top 1%, it's not the highest. Among countries included in Knight Frank's report, three European nations led the U.S. for individual net wealth required to break the top 1%. The report found that smaller hubs of wealth typically have higher thresholds to reach this bar—perhaps because there is a smaller pool of wealthy people in consideration.

On the other hand, many other countries have lower bars to break into the 1%. In Japan and mainland China, the threshold for joining the top 1% is lower than the threshold for the top 10% in the U.S. They also have a relatively low gross domestic product per capita, compared to the other nations included in the wealth analysis.

In mainland China, $1.1 million in net wealth places you among the 1%. This relatively low threshold could be due in part to migration. More than 15,000 millionaires are expected to leave China in 2024, taking their financial assets with them, according to Henley & Partners, a global firm specializing in residence and citizenship by investment for wealthy individuals. The U.S., Canada, Singapore, and Japan are popular destinations for these expats.

Wealth migration is not exclusive to China. Millionaires across the globe are relocating at higher numbers than ever. Henley & Partners estimate that 128,000 high-net-worth individuals will relocate to new countries this year, seeking new investments, favorable taxation policies, and physical and economic security. That figure may rise to upwards of 135,000 next year.

These movements will continue to shift as more countries adjust policies regarding wealth accumulation, distribution, and taxation—whether to fill in government deficits or achieve "common prosperity." In turn, wealth distributions are likely to change across the world's 1%, including within the U.S.

Story editing by Natasja Sheriff Wells. Additional editing by Kelly Glass. Copy editing by Tim Bruns.