The number of cost-burdened renters has hit an all-time high

This story originally appeared on Belong and was produced and distributed in partnership with Stacker Studio.

The number of cost-burdened renters has hit an all-time high

Half of all renters spend more than 30% of their incomes to cover the cost of housing, representing a record number of cost-burdened renters in the U.S.

The striking statistic comes from a new report from the Joint Center for Housing Studies of Harvard University, released in February 2024, that examined 2022 census data. Belong analyzed the report to better illustrate the issue. In this analysis, the term "cost burdened" refers to monthly housing costs exceeding a renter's 30% income threshold that was long used as a rule of thumb to protect lower-income households from extreme housing costs.

The uptick in cost-burdened renters comes after historic rental aid money disbursed during the COVID-19 pandemic years has all but run out nationwide and as prices for key goods and housing continue to rise. The typical rent in the U.S. has grown nearly 22% since 2020. And while wages have grown similarly at around 21% over that time period, other costs have also grown significantly compared to what consumers have been used to in recent history. These expenses increased differently from city to city, with some places seeing even more extreme growth.

Housing is more often than not the single largest expense Americans pay for, and it has slowed in terms of how quickly it's growing in cost for consumers. By the end of last year, the asking cost for rents came down to a nearly zero percent year-over-year change, down from highs of around 15% annual growth. Rental costs finally cooled off recently, plateauing at the end of 2023. At their hottest point in 2022, rents were increasing 15% annually on average across the country.

The slowdown is good news for consumers, even if it signals slower growth ahead for rental housing developers.

Rental costs began their meteoric rise as Americans emerged from pandemic lockdowns seeking more space and new opportunities in different cities. Young people who previously lived at home sought their own housing, while those who couldn't find or afford homes for sale in one of the most cutthroat housing markets in history added to higher rental-market demand.

Developers took advantage of the low-interest rate environment during the depths of the pandemic to fund the construction of a record number of multifamily apartment housing units, many of which opened and began leasing in the last year. The additional housing helped to alleviate some demand, per the Harvard report, cooling the trend of skyrocketing rent.

Yet even as rents grow at a slower rate, they command more of tenants' income than ever before. The trend is impacting the lowest-earning Americans the most.

Half of American renters are spending more than 30% of their income on rent, and half of that group spends more than 50%

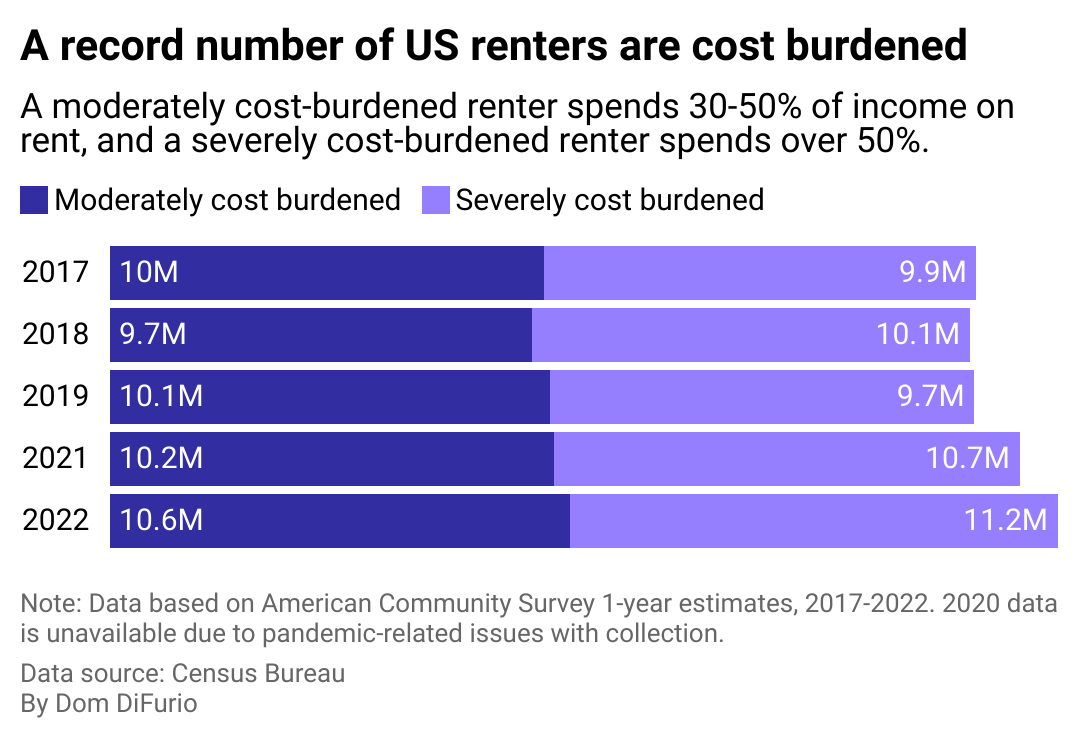

A record 21.8 million American renters were considered cost burdened in 2022, up 4% from the year before and representing about half of all American renters. Growth of cost-burdened renters began to grow quickly in 2021 as real estate values started to soar.

The journey to curb inflated housing costs with higher interest rates has thus far not tipped the country into a feared recession—but it's still brought pain for consumers. Americans are putting more expenses than ever on credit cards, which carry higher interest rates now than ever before. Rising interest rates also make it harder for the typical American who might want to purchase a home to afford it.

Cost-burdened renters are more likely to be economically vulnerable since they have no choice but to rent and have lower household incomes. Median renter household income in 2022 was $47,000, with about a third of renters reporting household incomes of less than $30,000. What's more, lower-income renters are often older, or over the age of 65, and tend to live alone. They're also more likely to belong to Black, Hispanic, and multiracial families. With longstanding racial discrimination across housing, education, and labor markets, Black heads of household have fewer housing options and a higher likelihood of bringing in less income than households of other races or ethnicities.

More than a third of renter households working 40-hour weeks are also cost burdened. These employees—with jobs in health care, education, sales, and construction—prove that full employment does not offer protection from unaffordable housing costs.

The growth of severely cost-burdened renters, or those spending more than 50% of their income on rent, is pushing consumers to live in inadequate or unsafe housing conditions and purchase fewer necessities like food and health care, Harvard's analysis of Bureau of Labor Statistics data found.

In its research, Harvard recommended reinvestment in aging housing stock and bolstering rental assistance for lower-income earners as higher interest rates are likely to persist, making it difficult for developers to turn a profit building anything besides higher-end housing.

Story editing by Nicole Caldwell. Copy editing by Tim Bruns.