Reduced interest rates affect mortgage costs—here's what to know

This story was produced by Experian and reviewed and distributed by Stacker Media.

Reduced interest rates affect mortgage costs—here's what to know

Rates on 30-year fixed-rate mortgages averaged 6.74% the week of March 14, 2023, according to Freddie Mac. The mark represents a 1.29% drop from the rate's 23-year high of 8.03% in October 2023. And while rates have cooled since that October peak, they remain elevated. Consequently, the cost of borrowing is higher than in recent years, making it more expensive for homebuyers to purchase homes and for existing homeowners to refinance their mortgages.

But good news could be on the horizon. The Federal Reserve has signaled it will cut its target rate three times in 2024. Experian looks closer at what that could mean for mortgage rates.

How do interest rates affect mortgage costs?

Mortgage interest rates have a direct impact on housing affordability. Not only do rates factor into the overall cost of a home loan, but lower rates also mean lower monthly payments (and vice versa).

Rate changes have no bearing on existing fixed-rate mortgages, which have the same interest rate and monthly payment for the entirety of the loan's term. However, mortgage rates do impact the overall cost and monthly payment amount of new fixed-rate mortgages and refinance loans. Adjustable-rate mortgages (ARMs) are also impacted by rate changes throughout the loan's term.

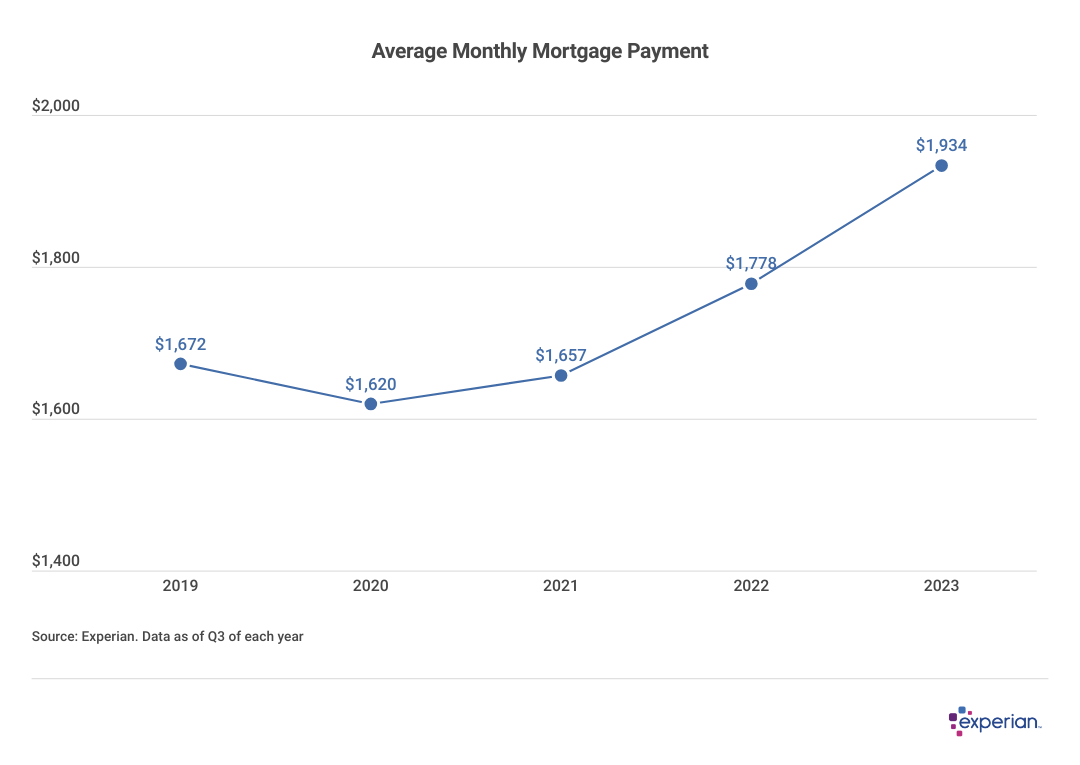

To illustrate, in September 2020, when average rates were down to 2.90%, the average monthly mortgage payment was $1,620, according to Experian data. Rates went on to hit a record low in January 2021, then began to climb in 2022. By September 2023, when average mortgage interest rates climbed to 7.31%, mortgage payments were an average of $1,934 a month.

Is the federal reserve expected to cut rates in 2024?

At its December meeting, the Fed signaled it would cut the federal funds rate three times in 2024—resulting in a 0.75% rate cut by year's end. Most economists anticipate any rate cuts won't happen until the second quarter, at the earliest.

If the Fed follows through on rate cuts, it'll mark a stark reversal from an aggressive cycle of rate hikes as the Fed sought to curb inflation. Beginning in March 2022, the Fed increased the federal funds rate 11 consecutive times—the most aggressive series of increases in four decades. The benchmark rate has remained in the 5.25% to 5.50% range since the most recent hike in July 2023.

If and when mortgage rates drop, borrowers will benefit from lower borrowing costs and monthly payments. For example, if mortgage rates drop 0.75%—in line with the projected federal funds rate cut—you could save $750 in interest annually for every $100,000 you borrow, or $22,500 in interest charges over a 30-year term.

How federal reserve rate cuts affect mortgages

Banks typically set their prime rate by adding 3% to the federal funds rate. As of March 2024, the federal funds target range was 5.25% to 5.50% and, accordingly, the prime rate was 8.50%. Keep in mind, the Federal Reserve doesn't set mortgage rates, but its actions do influence them. For example, mortgage rates climbed significantly during the Fed's rate hikes in 2022 and 2023.

Rate cuts could make mortgages more affordable

If the Federal Reserve lowers the federal funds rate, mortgage rates could follow suit. We've already begun to see evidence of this trend, with lenders adjusting rates in anticipation of the expected Fed actions. In December 2023, when the Fed first projected rate cuts in 2024, mortgage rates declined sharply, in part due to projected cuts.

Mortgage rates adjust daily in reaction to the dynamics of the U.S. and world economies. When the Fed ultimately decides to reduce the federal funds rate, the market may respond by lowering rates even further.

Lower mortgage rates would be welcome news for new homebuyers who've been sidelined by high mortgage interest rates. And homeowners with ARMs or home equity lines of credit (HELOCs) could see their rates and monthly payments drop.

Mortgage approval may get easier

Because reduced mortgage rates would result in lower monthly payments, borrowers may find it easier to qualify for a new home loan. That's because a lower payment decreases your debt-to-income ratio (DTI), a major factor home lenders consider when qualifying you for a new mortgage. Your DTI is the percentage of your monthly debt obligations compared to your gross monthly income. Lenders usually don't want your total monthly debt payments to exceed 36% of your monthly income, with 28% allocated for your housing payment.

Is It better to buy now or wait for rates to fall?

Buying a home now is a viable option if you can comfortably afford the monthly mortgage payment, maintenance costs and taxes at today's interest rates. After all, you can always refinance later to snag a lower mortgage rate and payment.

Additionally, if mortgage rates continue to fall, home prices could rise. Remember, many people have been unable to afford a home due to high interest rates. If rates drop, more homebuyers could purchase homes, and the increased demand could drive up home prices.

On the other hand, a rate decline could bring more homes to the market, easing competition. According to Zillow, 80% of existing mortgages have interest rates below 5%. That's because homeowners locked in these historically low rates in 2021 before rates escalated. If rates fall, more homeowners may be willing to sell if they can secure lower interest rates on their next house. More home listings could ease the current supply shortage and help curb rising prices.

Trying to time the market could be a feeble exercise since the housing market and the Fed's policy moves are often unpredictable. As such, consider the affordability of any home purchase and your willingness to refinance later for a lower rate as primary factors in your decision.

If you decide to pull the trigger on a new home, consider the following guidelines to make your home purchase more affordable.

- Take steps to improve your credit. Lenders tend to extend their best rates to borrowers with better credit. Reduce credit card balances, bring any late payments current and pay all your debts on time going forward to begin improving your credit scores.

- Save for a down payment. The larger your down payment, the lower your loan-to-value (LTV) ratio—the amount of money you need to borrow versus the home's current market value. Lenders typically view borrowers with lower LTVs as less risky, which could result in a lower interest rate. You could also eliminate private mortgage insurance on a conventional mortgage with a 20% down payment. PMI is usually added to your monthly mortgage payment and typically equals 0.5% to 2% of your total loan amount.

- Lower your DTI. Lenders take a close look at your DTI to gauge your ability to afford a new mortgage loan. Most lenders require DTI ratios below 36%, but some may allow up to 45%. Some Federal Housing Administration-backed home loans allow DTIs up to 50% if you have large cash reserves.

- Opt for a shorter loan term. The 30-year fixed-rate mortgage is the most popular type of mortgage but usually features higher interest rates than shorter loan terms for 15 or 20 years. If you can afford the higher payments of a shorter-term mortgage, you may save significantly on interest charges over the life of your loan.

Make sure your credit and finances are in good shape

If you're considering buying a home, make sure your financial situation and credit are squared away to take advantage of potentially lower mortgage rates. If possible, pay down debts to lower your DTI ratio and save for a larger down payment. Shore up your credit by reviewing your credit report and credit score. Address any issues you find and take proactive steps to improve your credit fast.