$695K bitcoin? $21K ether? Here’s where 21 experts think crypto is headed next

$695K bitcoin? $21K ether? Here’s where 21 experts think crypto is headed next

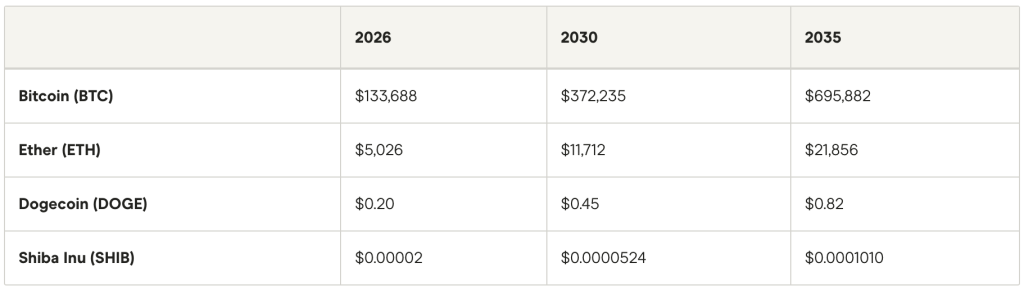

By 2035 — a mere nine years from now — Finder.com’s panel of crypto experts believes bitcoin (BTC) will reach an average high of $695,882. Ether (ETH)? $21,856. And what about dogecoin (DOGE) and shiba inu (SHIB)? $0.82 and $0.0001010, respectively.

For bitcoin alone, that’s an increase of 923% based on its current price of $68K, at the time of writing. But surprisingly, less than half of Finder’s panel believes these digital currencies are a buy right now.

So, what’s going on here?

Price forecast snapshot: 2026–2035

Every quarter, Finder asks a panel of crypto specialists where they see prices headed for year-end, 2030 and 2035. Here are the averages of those predictions across four digital currencies.

If these forecasts actually play out, bitcoin would gain more than half a million in value, ether would clear $20K and even shiba inu would drop a zero. Returns like these would be hundreds of times greater than the stock market’s historical average annual return of around 10%.

With potential increases like these, you’d think Finder’s panel would be screaming at everyone to buy crypto now — right?

Well, it’s not quite that straightforward.

What the experts say to do right now

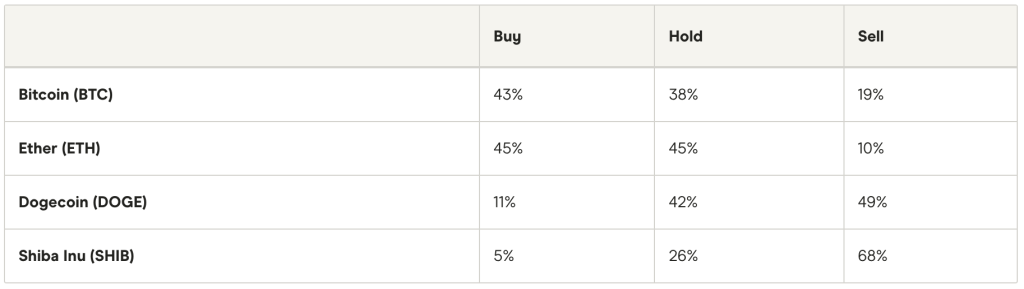

While surveying the panelists, Finder didn’t just ask about where crypto is headed. Here’s where the experts landed on whether to buy, hold or sell your crypto holdings.

That’s a shocking disconnect. Finder’s experts are predicting returns that astronomically outpace traditional investments, but fewer than half recommend investing in any of the coins they were asked about.

So, why is the panel predicting these absurd increases, but isn’t telling you to invest? Let’s start with bitcoin, where the disconnect is most dramatic.

Bitcoin (BTC)

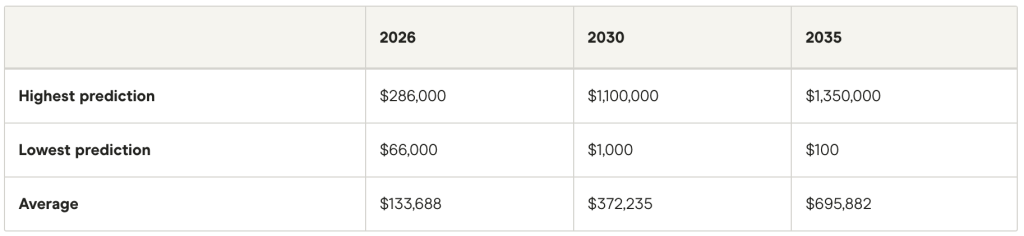

Finder’s panel average prediction for bitcoin by year-end is $133,688, but behind that average is a massive range of opinion. That divide only becomes more exaggerated the further we zoom out.

For 2026 alone, the difference between the high end and low end is a $220K gap — and that’s on a one-year prediction. By 2035, the results are even more extreme: $100 versus $1.35 million.

Chances are, this isn’t just a difference in optimism. It’s a fundamentally different outlook on crypto and its future place in society. Either that, or even the experts are just guessing.

What the experts say

The bulls in Finder’s survey credit their outlook to a few key drivers. Josh Fraser, cofounder of Origin Protocol, bases his perspective on the world’s OG investment: gold.

“Bitcoin clearing $200,000 in 2026 and moving toward $1 million before 2035 comes down to simple math and macro reality: Bitcoin sits around a ~$2T market cap, while gold is closer to ~$30T, and even reaching a third of this market cap would bring BTC to a price of $500,000. Layer on accelerating institutional adoption through exchange-traded funds (ETFs), corporate treasuries and regulated custody, and bitcoin’s role as a global digital reserve asset continues to solidify over the next decade.”

However, not everyone’s convinced that BTC is digital gold. John Hawkins, head of the University of Canberra School of Government and the panel’s resident crypto skeptic, says bitcoin has no underlying value:

“BTC is still a speculative bubble as it has never achieved the initial goal of being a widespread payments mechanism. Even if electronic assets such as stablecoins, CBDCs (central bank digital currencies) or tokenized assets have a future, it does not mean that BTC has any fundamental value. Being supported by Trump will not keep prices up very long.”

The panel can’t even agree on the world’s most established cryptocurrency, so you can imagine how they feel about others.

Ether, DOGE and Shiba Inu

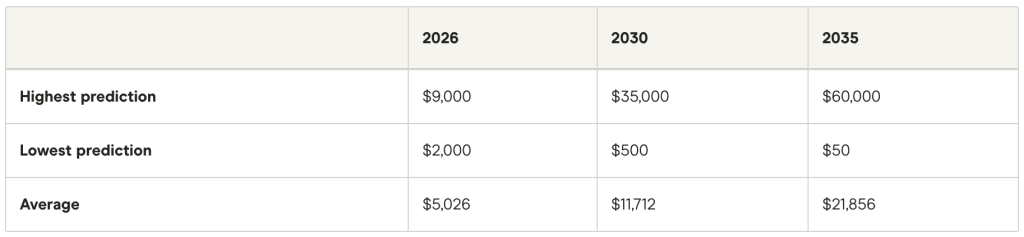

Arguably the most well-known altcoin, ether, shares a similar outlook to bitcoin, according to Finder’s panelists. While a few think it will crash and burn, others believe it will catapult into the stratosphere — rising over 30x in value by 2035.

Let’s look at the predictions:

As you probably guessed, the same pattern plays out for popular memecoins DOGE and SHIB. The most bullish panelist believes these doggy memes will increase by over 300% and 7,000%, respectively.

But collectively, the group isn’t advising you to put all your money into these internet jokes turned investable tokens. In fact, only 5% suggest buying shiba inu at all.

So, why aren’t they telling you to buy?

Here’s where it gets interesting. Let’s focus on bitcoin for a minute. Over half the panel (57%) says it is currently underpriced, and yet only 43% say BTC is a buy right now. How can a majority think it’s underpriced but not recommend investing?

The answer seems to come down to timing and uncertainty. Ben Ritchie, managing director of Alpha Node Global, explains:

“Bitcoin’s price outlook is shaped by delayed cycle dynamics and tightening supply, not hype. Macro uncertainty extended this cycle, but institutional demand is steadily building beneath the surface. A move toward $120,000 reflects bitcoin establishing a new valuation range rather than a speculative spike — though history suggests 2026 may reward discipline over exuberance.”

Ruslan Lienkha of YouHodler echoes that patience, recommending a hold:

“I believe bitcoin has strong long-term growth potential because it is decentralized and has a limited supply. However, as more institutions enter the market, liquidity increases and volatility decreases. This makes bitcoin more stable, but also means its growth is likely to be slower, more gradual and more closely linked to other risk assets and macroeconomic events.”

In other words: they see the upside, but they’re not rushing in. For many on the panel, the massive potential gains don’t outweigh the incredible uncertainty. If you could ask the average investor to sum up crypto’s history in one word, many would pick “volatile.”

Finder’s experts seem to agree on that, and possibly only that.

The takeaway? Crypto isn’t inherently a bad bet, but the old advice to “never invest more than you can afford to lose” may be more relevant than ever.

What this means for you

While there’s quite a bit of disagreement, Finder’s panel predicts some eye-popping growth for crypto in the coming years. But those potential returns are weighed against equally significant downsides. Many still question whether bitcoin and its digital siblings have any use in the real world, even after they’ve created countless millionaires.

The data here isn’t a green light or a red one: it’s flashing yellow. If you choose to invest, proceed with caution and HODL.

This story was produced by Finder.com and reviewed and distributed by Stacker.