Top 5 areas where property taxes are exploding

Top 5 areas where property taxes are exploding

The post-COVID-19 pandemic real estate market has seen many changes, the most glaring of which is the rising cost of homeownership.

According to the latest Harvard University’s Joint Center for Housing Studies State of the Nation’s Housing report, released in 2025, house prices have increased by almost 30% nationwide. In addition to the rapid increase in property prices, which rose 60% in some markets from 2019 to 2025, average property tax rates also increased across almost all states.

However, some states and counties have historically been more expensive to invest in due to their high property taxes. The areas surrounding New York and many California counties typically rank among the highest for property taxes.

As a result, an investor seeking a property within a specific price range must factor in tax costs across two markets. For example, a $400,000 property in Illinois will be taxed at 1.83%, which is $7,320, while in Alabama, it’ll be taxed at 0.36%, which is $1,440.

Below, Property Reach takes a closer look at some of the areas investors will want to steer clear of due to their rapidly or significantly increasing average property tax rates.

Top 5 Areas Where Property Taxes Are Exploding

We combined data from the Joint Center for Housing Studies with additional research insights to track down five regions of the U.S. where property tax rates are booming. Here’s what we found:

1. Passaic County, NJ — $10,001 (2.28%)

The highest figure on the list, surpassing $10,000, is in Passaic County, at a whopping 2.28% tax rate. As a matter of fact, New Jersey has the highest number of counties with median tax figures over the $10,000 threshold, thanks to their proximity to New York.

However, rates vary across counties, with Bergen County having the most expensive properties, charging $10,000 at a 1.69% tax rate. The others are as follows:

- Union County — 2.05%

- Hunterdon County — 2.01%

- Somerset County — 1.91%

- Morris County — 1.79%

- Monmouth County — 1.77%

- Bergen County — 1.69%

2. Putnam County, NY — $10,001 (2.23%)

The Big Apple made it on this list, to no one’s surprise. Since New York is more of a rental-forward market with many commercial properties, it follows right behind New Jersey in the number of counties with median taxes over $10,000. Those counties include:

- Suffolk County — 1.85%

- Rockland County — 1.77%

- Westchester County — 1.57%

- Nassau County — 1.51%

- New York County — 0.90%

3. Falls Church City, VA — $10,001 (0.99%)

Why is a random city in Virginia on this list? Well, according to the Fall Church Pulse, the city’s mantra is “growth should pay for growth,” which stipulates that all the new development in the city is paid for through taxes, landing it right on this list.

4. Marin County, CA — $10,001 (0.72%)

Even though California has relatively low property tax rates, it has some of the most expensive properties in the country. At just 0.72%, Marin County concludes the list of counties surpassing $10,000 in median property taxes, thanks to its many luxury properties.

5. Santa Clara County, CA — $9,766 (0.71%)

The heart of Silicon Valley, Santa Clara County, inches very close to the $10,000 mark at $9,766 in median property taxes. This luxury market is also not so surprisingly one of the country’s most active, with properties selling in record times, or a median of 56 days after listing.

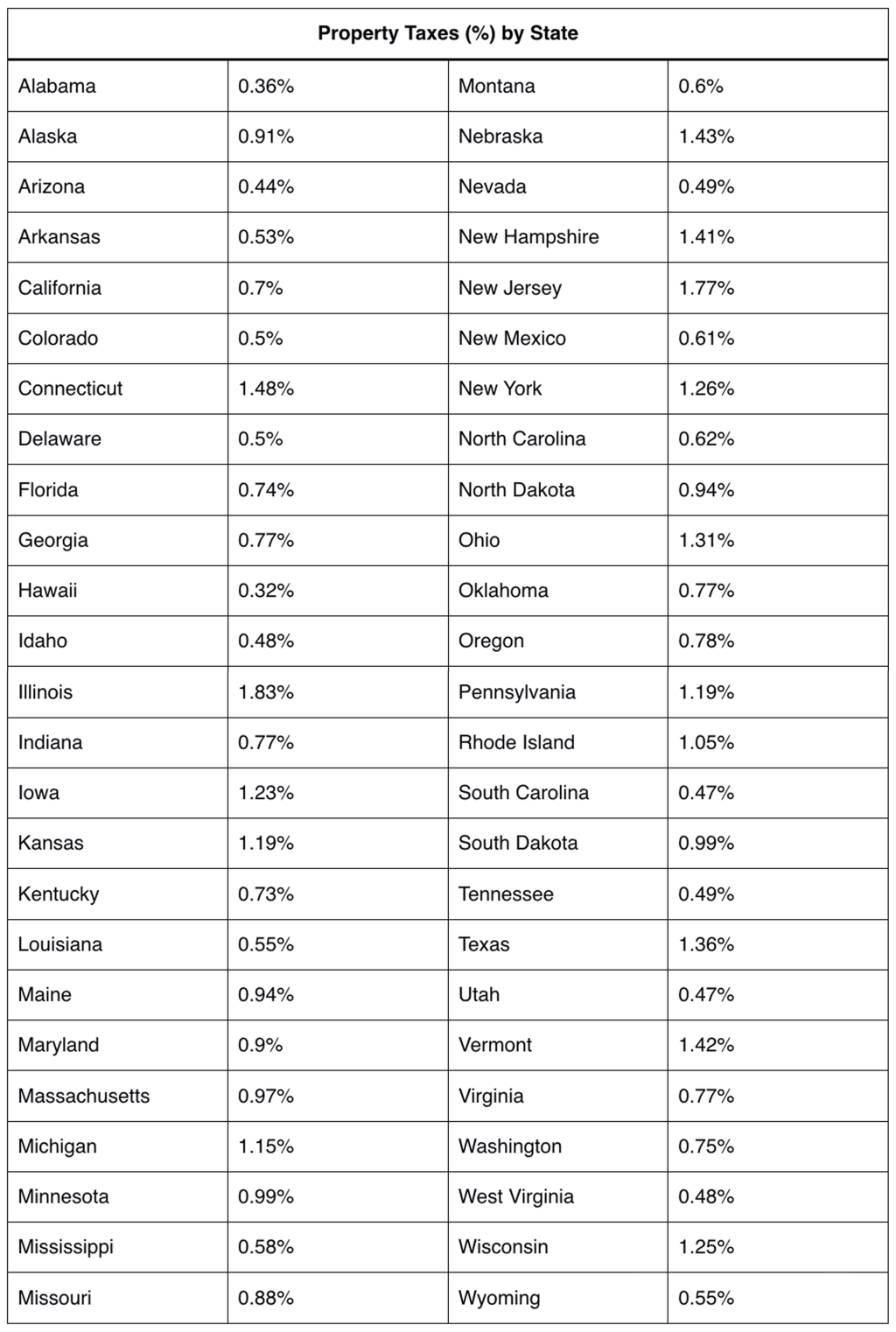

2025 Property Tax Rates by State

If you’re curious about your state’s tax rates, scroll through this table and find out.

Information provided by the Tax Foundation at taxfoundation.org.

What Factors Affect Property Tax Rates?

Final property tax figures are not only dependent on property price, but they’re also directly affected by local legislation, which determines tax rates and how they’re calculated.

Most people don’t know that the rates above apply to the assessed value of the property, which doesn’t always equal the market value. Some states consider the assessed price 100% of the market price of the property, while others value it as a percentage that can be as low as 10% of the market value for single-family homes (these include Louisiana and Mississippi, FYI).

You can dispute the assessed value of your property if you think it’s too high, and most local governments will look into it and adjust.

Just keep in mind that these taxes are how states pay for public amenities like schools, hospitals, and roads. So unless the state has another source of income, like tourism or oil production, property taxes can get pretty high.

Final Thoughts

After reviewing the highest property tax rates in the country, it’s clear that knowing where the right market is for a property investment is crucial in determining its feasibility.

Consider using a property search tool to compare units, locations, and property conditions among different counties in the same state to find out where to get the best mileage out of your investment dollar. It’ll most likely be away from New York and Silicon Valley, though.

This story was produced by Property Reach and reviewed and distributed by Stacker.