What a Trump proposal to ban institutional investors could really mean for homebuyers

What a Trump proposal to ban institutional investors could really mean for homebuyers

President Trump has teased a plan to ban large institutional investors from purchasing single-family homes. In a Truth Social post, he noted the American Dream is increasingly out of reach for many Americans. The policy is far from finalized, but the proposal raises important questions about market dynamics, affordability, and buyer opportunities.

“We know that investors of all sizes have been highly active in the entry-level segment. If this activity dries up, local demand could certainly soften,” says Ali Wolf, chief economist at Zonda and NewHomeSource, a new home listings site with customer reviews. “Conversely, we might see ‘missing’ traditional buyers, those who have been sidelined by competition, reenter the market once they feel they have a less crowded path to homeownership.”

An analysis by NewHomeSource parent company Zonda takes a look at which markets would be most impacted by a ban and what buyer segments could benefit the most from a ban.

How Large Is the Investor Footprint?

Investor activity ranges from 15% to 30% of home purchases in any given year. The larger institutional players are often most targeted in discussions like President Trump’s proposed ban, but these buyers represent just 1% to 5% of purchases. The overwhelming majority of investors’ transactions are “mom-and-pop” buyers, suggesting a blanket ban on large institutions may not unlock a significant increase in housing stock for sidelined buyers.

Is the Timing Right?

While the logic behind a ban on single-family purchases by investors is sound—fewer of these buyers increases opportunities for first-time buyers and sidelined buyers—the timing of the proposal seems misplaced.

There was a frenzy of investor purchases during and immediately after the COVID-19 pandemic due to cheap capital, low interest rates, and attractive returns. Institutional investors and smaller “mom-and-pop” operations capitalized on the market between 2020 and 2022 to purchase investment properties, Airbnbs, and second homes.

Today, the housing landscape and environment have shifted meaningfully. Higher borrowing costs, elevated prices, and alternative investment opportunities have reduced investor participation.

What Markets Could Be Most Affected?

Nationally, the impact on pricing and housing demand from the proposed demand is expected to be minimal. However, on a local market level, areas with strong investor activity—Tampa, Florida; Phoenix; and Las Vegas—could experience shifts in local market dynamics more significant than on the national level.

A caveat to note, though, is that investors typically purchase homes that struggle to attract traditional buyers, rehabilitating properties, and then reintroducing them to the market.

Who Could Stand to Benefit?

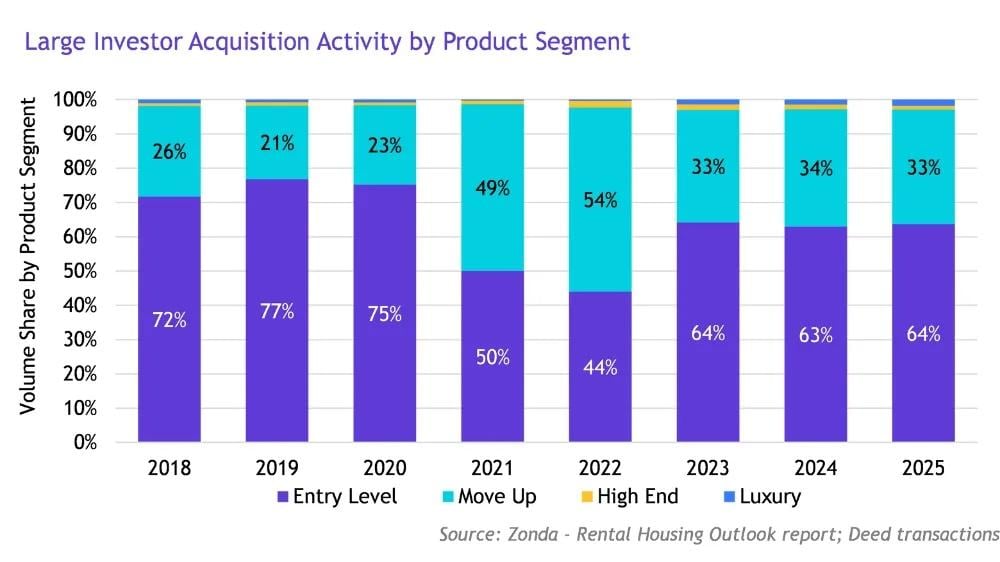

The buyer cohort that stands to benefit the most from sideling investors is first-time buyers. While the amount of capital allocated by investors has dipped in recent years, a disproportionate share of investor dollars remains focused on entry-level product. First-time buyers could benefit from less competition from investors who have more equity or cash than the typical first-time buyer.

Big Picture

While the proposed ban on investors may offer symbolic relief to the housing market, solving the affordability crisis will require solutions beyond addressing roughly 5% of the for-sale market. Additionally, home sales remain modest across the country, not just in areas that experience a higher volume of investor activity.

This story was produced by NewHomeSource and reviewed and distributed by Stacker.