Business credit cards vs. corporate credit cards: Key differences explained

Business credit cards vs. corporate credit cards: Key differences explained

Business credit cards and corporate credit cards share many similarities, but they’re distinct products intended for different types of businesses. Corporate cards usually appeal to larger, more established businesses that value spend control, while business credit cards are primarily for small businesses, sole proprietors, and new LLCs looking for spending power and rewards.

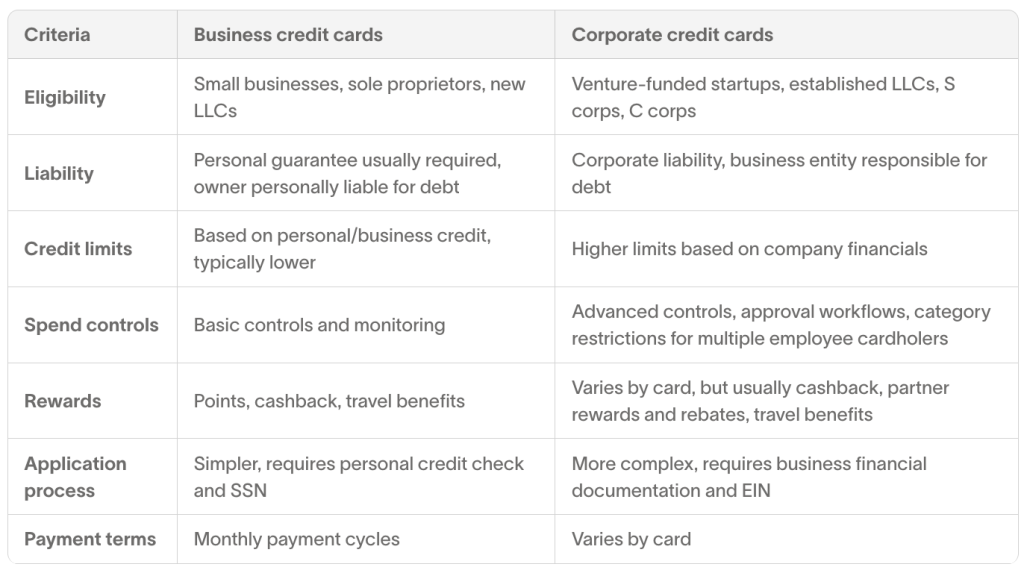

Key differences at a glance

Corporate credit cards differ from business credit cards in their eligibility requirements, liability structures, rewards, and financial controls. Ramp highlights these important factors to consider when deciding which card type to choose.

What is a business credit card?

Business credit cards are credit products designed for small to medium-sized businesses, sole proprietors, and startups managing day-to-day expenses. If you’re forming a limited liability company, exploring business credit cards for LLCs can help you find options that build credit and earn rewards early on. They function similarly to personal credit cards but offer higher credit limits and business-specific rewards categories.

Most business cards require a personal guarantee, which means your personal credit score plays a major role in approval and interest rates. It also makes you personally liable for your company’s debt if your business defaults.

You can typically qualify for a business card even as a sole proprietor with minimal revenue. These cards help you separate personal and business expenses while building business credit history, though they often still tie to your personal credit profile.

What is a corporate credit card?

A corporate credit card is a payment card issued to a company rather than an individual, used to manage employee and operational business expenses. Liability typically rests with the business, and it often includes expense management software and integrations with other financial software.

Corporate cards are built for scale. They give you control over how, where, and when employees can spend. You can set custom limits, restrict merchant categories, and monitor usage in real time. This reduces out-of-policy spending and keeps your books cleaner.

These cards require your company to meet specific revenue thresholds and demonstrate financial stability through audited statements. In return, you get advanced controls, detailed reporting, and the ability to issue cards to numerous employees without personal liability concerns.

Eligibility requirements and application process

Business cards are often marketed as an easy entry point for business owners looking to separate their personal and business expenses. Corporate cards are geared toward established organizations with more mature financial operations, and their eligibility requirements and application process reflect that.

Business credit cards

To qualify for a business credit card, you’ll need a business name, tax ID number (EIN or SSN), and your business contact information. Most issuers check your personal credit score since your personal creditworthiness matters most. Even new businesses can qualify if the owner has good personal credit.

The application process is straightforward:

- Complete an online application with basic business information.

- Provide personal details for the primary cardholder.

- Agree to a personal guarantee, which makes you personally responsible for the debt.

- Submit to a personal credit check.

- Receive a decision, often within minutes to a few days.

Before you apply for a business credit card, gather your business tax ID, recent revenue figures, and personal financial information. Check your current credit score and address any issues first; the best business credit cards usually require a credit score of 670 and higher. Know your monthly business expenses to help select a card with the right rewards categories and credit limits.

Corporate credit cards

Corporate credit cards are designed for established companies, so the eligibility requirements are based more on your business’ financial health than your personal credit score. Providers look at factors like cash flow, bank balances, and revenue.

The application process for traditional corporate cards requires substantial documentation, including business financial statements, tax returns for the previous two to three years, bank account information, incorporation documents, and a list of authorized company representatives.

Traditional corporate credit cards typically require:

- Annual revenue of $4 million or more.

- At least two to three years of operating history.

- Established business credit profile.

- Good financial standing with healthy cash flow.

- Multiple employees who require purchasing capabilities.

Personal vs. corporate liability explained

Liability structure is one of the biggest differences between corporate cards and business credit cards, and it directly affects both your company and your personal finances.

Business credit cards require personal guarantees, making the business owner personally responsible for all charges. If your business can’t pay its credit card bills, the issuer can legally pursue your personal assets. Payment history on these cards often appears on your personal credit report, affecting your personal credit score.

Corporate credit cards work differently. The liability stays with the business entity, not with individual owners or employees. This corporate liability structure means the company alone is responsible for all charges, protecting personal assets and credit profiles. Payment history typically appears only on business credit reports. If you want similar protection without scaling to a full corporate program, consider business credit cards with no personal guarantee. Some modern providers now offer this flexibility.

Credit limits, spend controls, and policy enforcement

Credit limits are typically higher for corporate credit cards versus business credit cards, and they tend to offer stronger spend controls. Spend controls and policy enforcement refer to the tools you use to manage how, when, and where your team can use company funds.

Typical credit limits for business credit cards vs. corporate cards

Credit limits for business credit cards depend primarily on your personal credit history as the business owner. Issuers look at personal credit scores, income, and existing debt alongside basic business information. This typically results in credit limits between $5,000 and $50,000 for most small businesses.

Corporate credit card limits are based on company revenue, financial statements, and business credit history. These evaluations focus on your business’ financial health rather than individual creditworthiness. As a result, corporate cards frequently offer limits exceeding $100,000 that scale with company size.

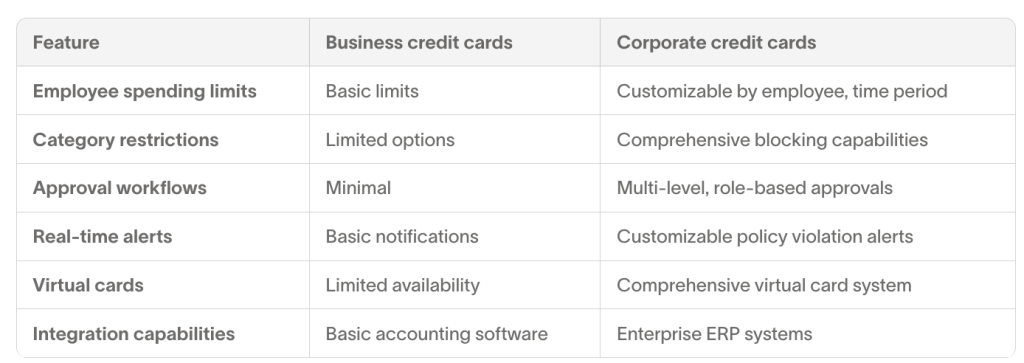

Spend control and expense policy enforcement features

Spend controls vary significantly between these card types. Business credit cards typically provide basic employee card limits, simple transaction monitoring, standard monthly statements, and limited category restrictions.

Corporate cards offer more sophisticated controls:

- Per-employee spending limits customizable by time period.

- Department and project budget allocations.

- Category-specific restrictions (e.g., blocking entertainment expenses).

- Multilevel approval workflows for purchases above certain thresholds.

- Real-time alerts for policy violations.

The control mechanisms between these card types reflect their intended users’ complexity and scale. Business cards provide basic spending management, while corporate cards deliver sophisticated control systems.

Rewards, fees, and costs you should compare

Perks and rewards are the benefits you earn by using a business or company credit card. These can include cashback, discounts, travel rewards, loyalty points, or exclusive access to partner offers. The goal is to give you something in return for your spending.

Cashback and travel points

Business credit cards emphasize generous rewards programs to attract small business owners. Many cashback business credit cards let you earn a percentage of your spending back in categories like office supplies, shipping, and advertising.

Corporate cards may offer rewards and cardholder benefits, but card issuers tend to highlight how companies can use their cards to manage and track business expenses. While corporate cards can and often do provide cashback or points, they prioritize expense management features over maximizing rewards rates.

Annual and foreign transaction fees

Corporate cards usually require full payment at the end of each billing cycle, meaning interest rates aren’t a concern. Additionally, they typically come with higher annual fees because they include premium services and features. However, this isn’t always the case.

Business credit cards often have lower or no annual fees but charge interest on carried balances. Business credit cards usually carry higher interest rates and follow the same monthly billing cycle as a personal credit card. Average APR rates hover around 21.5% for business cards that allow balance carryover.

Foreign transaction fees vary between card types. Many corporate cards waive these fees to support international business operations, while business cards commonly charge a flat percentage on foreign purchases unless specifically marketed as travel cards.

Corporate card vs. business credit card: Which is right for you?

Your company’s size, structure, and financial position should guide your card choice.

Small businesses with fewer than 10 employees will benefit from business credit cards’ simplicity. Larger organizations with dozens or hundreds of employees need the advanced management features of corporate cards.

Financial maturity matters, too. Established businesses with years of financial history, formal accounting practices, and dedicated finance teams can make good use of corporate cards’ advanced features. Newer companies still developing these structures often find business cards more practical.

Ask yourself:

- Do you have multiple employees that need purchasing capabilities?

- Is your business established with at least $25,000 cash on hand?

- Do you need advanced spending controls and approval workflows?

- Are you comfortable with personal liability for business expenses?

- Do you need integration with enterprise accounting systems?

- How important is protecting personal credit from business activities?

Growing businesses face a tough decision. The right choice depends on growth trajectory, risk tolerance, and expense management needs.

Moving from business to corporate cards: Step-by-step switching checklist

Transitioning from business to corporate cards requires careful planning to avoid disrupting operations. Follow this approach to ensure a smooth migration.

Step 1: Audit current spend and limits

Review your existing card usage to identify patterns and pain points. Pull three months of statements and categorize spending by department, employee, and merchant type.

Document your current credit limits and how often you hit them. Note instances where employees couldn’t make necessary purchases due to limit constraints or had to request expense reimbursements after using personal funds for purchases.

Step 2: Compare card options

Research corporate card providers based on your specific needs rather than generic features. Focus on providers that address the pain points you identified in your audit.

Evaluate integration capabilities with your existing accounting software. Consider whether you need global spend capabilities, virtual cards, or specific spending controls. Request demos from top candidates to see their platforms in action.

Step 3: Draft a new expense policy

Create comprehensive spending guidelines before implementing corporate cards. Define approval thresholds, allowable expense categories, and documentation requirements for different employee levels.

Specify consequences for policy violations and establish review procedures. Include guidelines for travel expenses, client entertainment, and recurring subscriptions. Make your expense policy accessible and ensure all cardholders acknowledge their understanding.

Step 4: Migrate cards and integrate accounting software

Plan the transition timeline to minimize disruption. Start by issuing corporate cards to key employees while maintaining business cards temporarily for continuity.

Configure your accounting system integration before activating the new cards. Set up automated expense categorization rules and approval workflows, and train finance team members on the new platform's reporting features.

Cancel business cards only after confirming all recurring charges have transferred successfully. Archive historical business card data for tax and audit purposes.

This story was produced by Ramp and reviewed and distributed by Stacker.