Most common financial conflicts between kids and parents and tips for getting ahead of them

This story originally appeared on GoHenry and was produced and distributed in partnership with Stacker Studio.

Most common financial conflicts between kids and parents and tips for getting ahead of them

Parenting children of any age has its ups and downs, and part of the job is navigating a variety of conflicts as children grow and mature. One of the most common conflicts are those related to money.

GoHenry analyzed the most common financial conflicts between kids and parents based on a study from LendingTree and further research. LendingTree, along with Qualtrics, surveyed 1,051 parents of children under 18 in January 2022. One in 4 parents who participated in this survey reported recently arguing about money with their child.

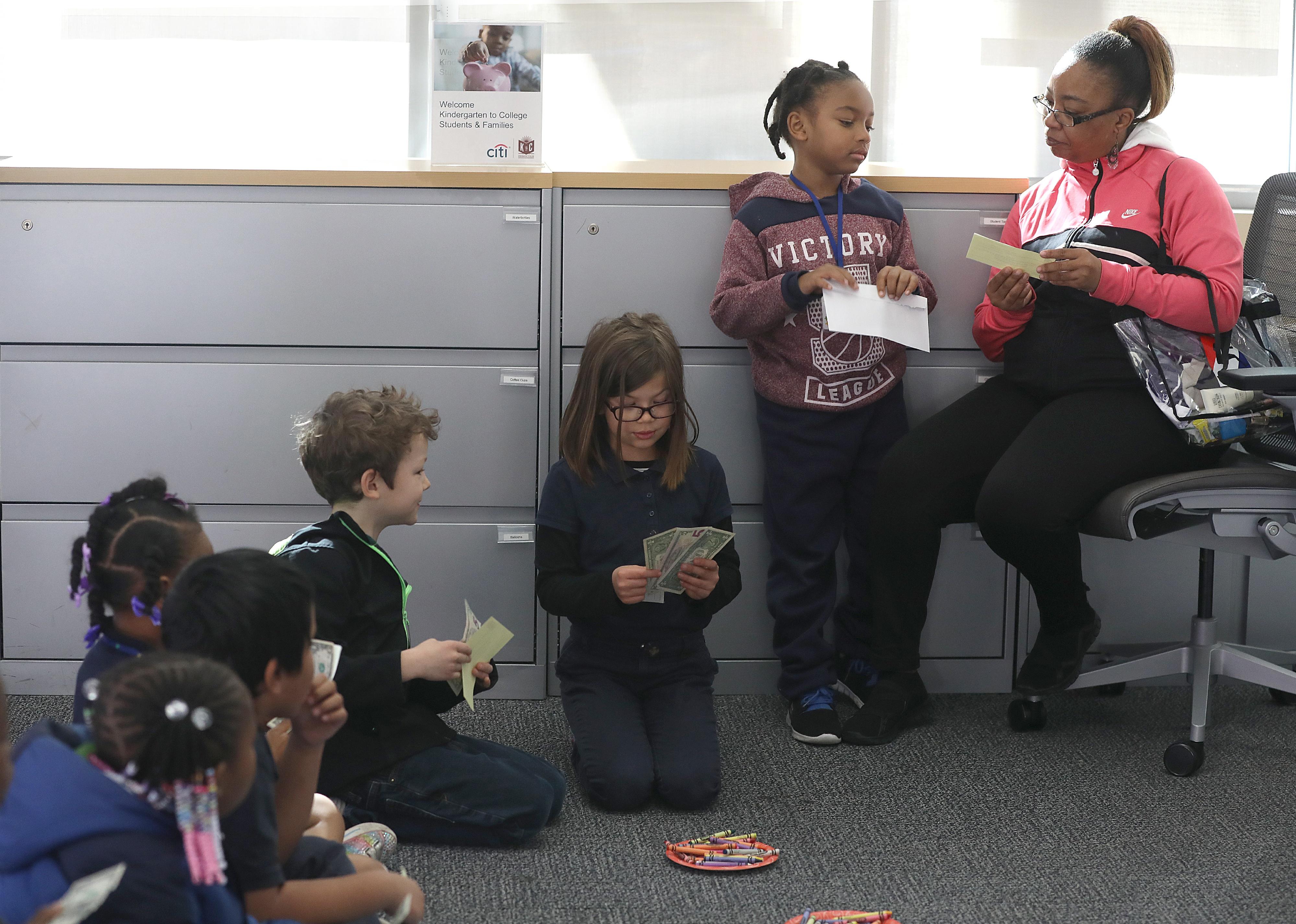

Money does not have to be an ongoing stressor in parent-child relationships, though. Parents can get ahead of potential conflict by starting to discuss finances with their kids at a young age. The earlier and more often these conversations come up, the more knowledgeable and prepared children will be for their financial futures.

Kids want to have these conversations, too. In fact, half of children in a 2021 survey conducted by T. Rowe Price said they wanted their parents to talk to them about saving money, and 1 in 3 would like to discuss how to budget.

Read on to learn about the most common conflicts parents and children have about finances and tips on how to turn these conflicts into learning opportunities.

#5. Parent didn’t give child money to do something they wanted

Children often ask their parents for money to go out and do things. As the old saying goes, money doesn’t grow on trees, so parents must say “no” sometimes. These situations can be opportunities to teach kids about money and financial responsibility.

Differentiating between wants and needs can be a powerful lesson. Children also learn by watching their parents, so modeling financial responsibility is a great way to encourage children to make positive choices with their own money.

Teaching budgeting skills will follow children well into adulthood, while also helping them save money to do something they want. When budgeting for special events, there are simple steps and strategies parents can use—even with young children: setting a goal, planning the amount that needs to be saved, encouraging progress, and celebrating when the savings goal is achieved.

#4. Child’s spending habits

Sometimes, the things children want to spend their money on—not to mention the cost of these items—are not aligned with parental expectations for smart spending. Parents can work to prevent arguments about their children’s spending habits by teaching money-saving strategies from a young age.

Help kids be specific about their savings goals. It is important to not just set goals, but to break them down into smaller steps and clearly establish where the money will be saved—a piggy bank, a savings account, or even a debit card for kids.

Just having a plan to save money isn’t enough. Kids should learn to track their spending as well. Parents can encourage this behavior by providing opportunities for children to earn their own money via allowances.

#3. Child’s allowance amount

Allowances are an important way for parents to teach their kids not only how to manage their money but also the value of working to earn that money. Three in 4 parents pay an allowance to their children and about 1 in 3 set this payment somewhere between $11 to $20 per week, according to Investopedia.

However, setting the amount of the allowance can lead to arguments between parents and their kids. One way to mitigate this is to start paying allowances when children are as young as 5 or 6 years old. Establishing a clear amount in advance and explaining how this amount has been determined is another useful strategy to avoid conflict. For example, some parents pay children based on their age, while others assign a dollar amount to each chore or task the child completes.

#2. Child used credit card without permission

Nearly half of parents in the LendingTree survey said their child used their credit or debit card at least once without permission. With the average amount spent coming in at $534, it’s no surprise this is one of the top financial conflicts between kids and parents.

While the American Academy of Child and Adolescent Psychiatry acknowledges stealing as a “normal” behavior in very young children—who often take things they find interesting without understanding the repercussions—theft by older children can occur for many reasons that must be properly addressed. Older children may steal to show off for or feel more accepted by their friends, to give gifts to others, and even as a way to seek attention or express anger toward their parents.

So how should parents approach their kids when they steal? Child and adolescent psychiatrists recommend clearly labeling the behavior as unacceptable but not lecturing or condemning the child for their actions. Ensuring the child returns or pays back what they have taken is a powerful and effective learning lesson.

Teaching kids about properly using credit cards can also build good habits, such as establishing a prepaid card or authorizing a child to use a credit card—with features activated to track their spending.

#1. Parent didn’t buy something child wanted

Teaching children to regulate their emotions and respond appropriately when they don’t get their way is a common challenge for parents. Cleveland Clinic pediatrician Edward Gaydos recommends a number of strategies parents can use to help increase their children’s compliance and avoid unwanted behavioral issues.

Setting clear behavioral expectations and limits, then sticking to them, is crucial for kids. This includes being specific with those expectations and following through with discipline when needed. For example: A child should understand in advance what behavior is expected when out in public at a store. If the child throws a tantrum when their parent will not buy them an item they want, the child should understand the consequence for this behavior, and the parent must then follow through with implementing that consequence.

It is also important to keep in mind that managing children’s behavior shouldn’t be focused on punishment. Positive reinforcement, such as praising a child when they engage in desired behaviors, can be very effective.