Credit card, car loans, and mortgage payments have all been rising in the US—and it's not just because of interest rate hikes

This story was produced by Experian and reviewed and distributed by Stacker Media.

Credit card, car loans, and mortgage payments have all been rising in the US—and it's not just because of interest rate hikes

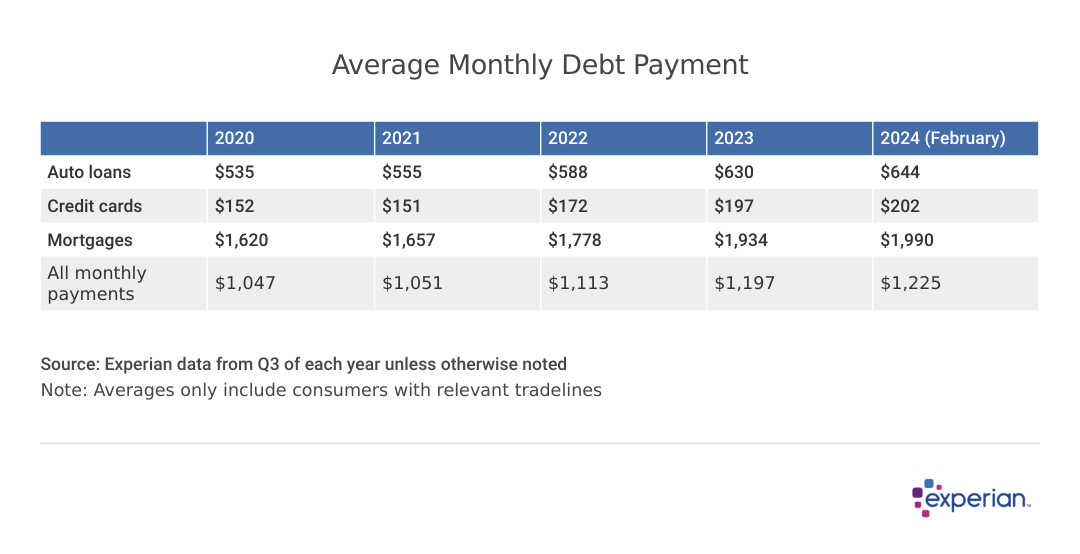

If you're like most borrowers, your monthly loan and credit card payments have increased, even from a few months ago, according to Experian data. As of February 2024, the average amount consumers needed to repay all of their monthly debt obligations climbed to $1,225.

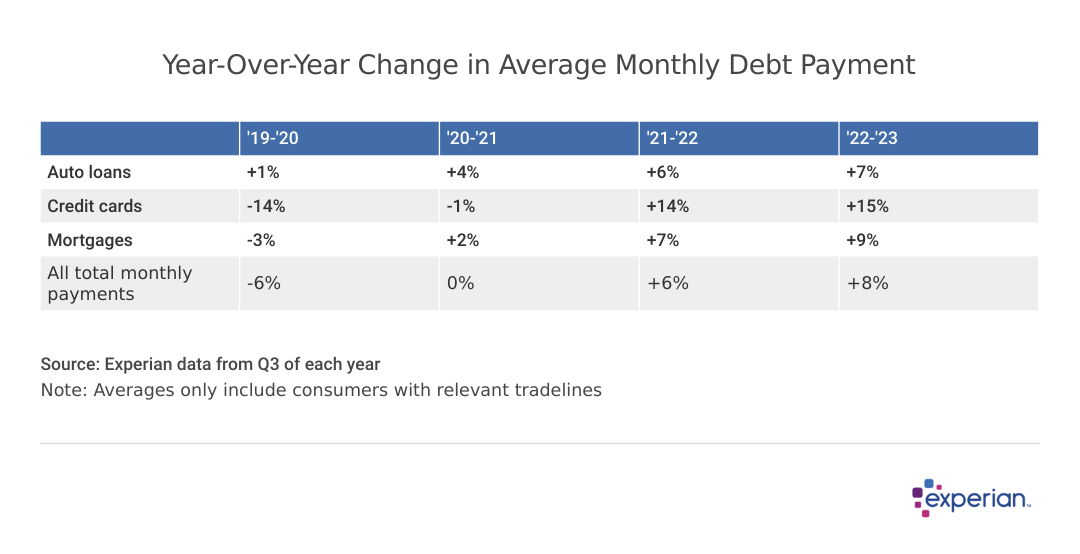

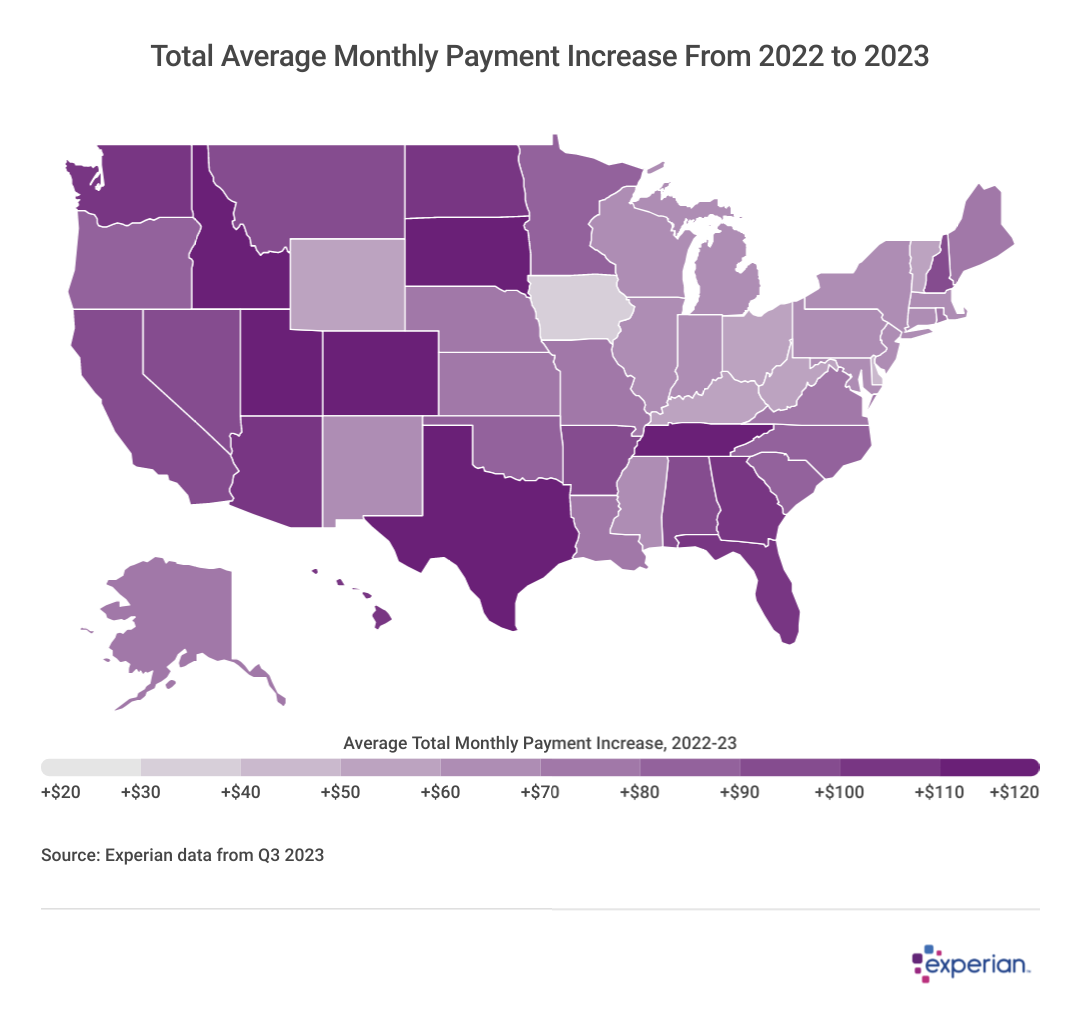

For each major type of loan—credit cards, auto loans and mortgages—payments have increased by at least 8% since 2022. Inflation and rising interest rates have played a big role in rising payments, but still are only part of the story. Depending on the type of loan, there are additional factors behind each of these types of debts.

Balances and Monthly Debt Payments Are Rising in Tandem

As Experian's consumer debt review revealed earlier this year, average balances are increasing for virtually every type of consumer debt. So, naturally, it follows that monthly debt payments have also increased. Since 2020, the average car loan payment has grown by more than $100 to $644, average monthly credit card payments due have increased $50 to $202 and average monthly mortgage payments have increased by $370 to nearly $2,000.

Newer Loans Are More Costly Than Older Loans

Consumers with newer car loans and mortgages are more likely to have above-average monthly loan payments, while those with loans originated before 2021 are more likely to pay less than the current monthly average. In recent years, a blend of both higher purchase prices, as well as higher interest rates, have resulted in higher-than-average monthly payments for more recent borrowers. One example: According to Experian Automotive, the average monthly payment for vehicle loans newly borrowed at the end of 2023 was $726—nearly $100 a month higher than the overall average monthly payment of $644.

Not all consumers carry every type of debt simultaneously, however, even if they use credit cards or own a home or vehicle. Roughly half of all credit card users carry an interest-bearing balance from month to month, according to the American Bankers Association. Not all homeowners have a mortgage, either. And although there are almost as many vehicles registered in the U.S. as there are people, just 62% of consumers have an auto loan in their credit file, according to Experian data.

Looking at average total monthly payments—the blend of payments varies for every consumer—the burden increased by 8% in 2023.

Interest Rate Increases Hit Credit Cards Hardest

Credit cards are the type of debt that's the most sensitive to interest rate increases. That partly explains why monthly payments in that category have increased the most (15%) over the past year as credit card interest rates have climbed to all-time highs. Average auto loan and mortgage payments, while also up, are somewhat tempered by fixed-rate lending—in most cases at least. But anyone who's shopped for a new car can attest to both fewer and more expensive choices in those markets since the pandemic.

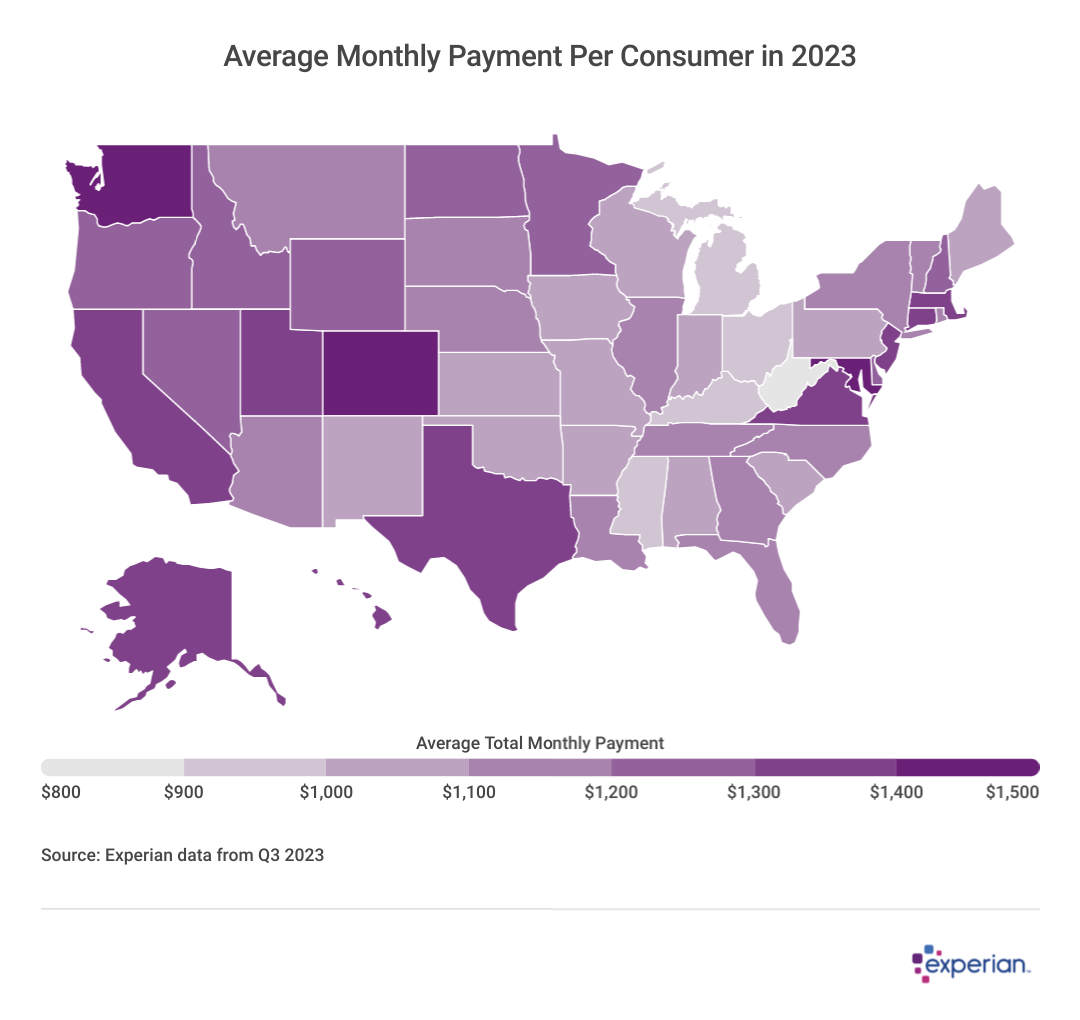

State-by-state Consumer Debt Payments Higher in Tech-driven States

A constellation of tech-heavy states including Colorado; Washington, D.C.; Washington; Maryland and Virginia have monthly debt payments of at least $1,400, well above the $1,197 national average. It's possibly a result of higher real estate as well as higher incomes relative to the rest of the nation.

Few States Have Average Monthly Debt Payments Under $1,000

Meanwhile, the average total monthly payment per month is under $1,000 a month in only a handful of midwestern states and Mississippi.

Student Loans, Rent and Other Monthly Payments Are Also Squeezing Consumers

Of course, there's additional financial pressure from monthly obligations such as student loans, rent and utilities, particularly for younger consumers. Zooming out, this growing stack of monthly payments may be beginning to slow consumer spending. Absent any increase in income, that means that U.S. consumers will have less for future consumer spending.

Nor will interest rate cuts, which are still expected sometime in 2024, immediately result in immediate relief for most consumers, although lower rates may help consumers with good credit to better negotiate lower rates on financing or refinancing loans.

Fortunately, for many, the labor market is still working to their advantage. Employment levels continue to increase, as well as average wage levels. Just as fewer vehicles and homes for sale meant rising prices in those markets, fewer workers in the coming years may mean higher wages as the market finds a new equilibrium.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.