Retail card balances rise 6.5% to $118.9 billion in 2022

Retail card balances rise 6.5% to $118.9 billion in 2022

By all appearances, today's store cards resemble the ubiquitous credit cards that are commonplace in the wallets of many consumers. The key difference, however, is that many retail cards can only be used at a single retail store or group of stores. As retail traffic increased throughout the year in 2022, the total balance on store credit cards grew by $7.3 billion to $118.9 billion.

Experian looked at anonymized consumer credit data from the third quarter (Q3) of 2022 to observe recent trends in borrowing and spending with retail credit cards.

Total Retail Credit Card Debt Increased by 6.5% in 2022

Inflation played a role in growing balances for retail card holders as it did for all consumers. The increase in overall retail card debt, however, wasn't as sharp as it was for traditional credit cards. Overall debt for traditional credit cards grew by 16% to $910 billion from 2021 to 2022, while retail card debt grew 6.5% to reach $118.9 billion overall during the same period.

The relative size of their total debt and average balances—traditional credit card debt levels and average balances are eight times the size of retail store cards—illustrates the smaller role store credit cards are playing in today's economy. Not only are more consumers reaching for bank-issued credit cards for in-store purchases, but other payment types, like buy now, pay later, are also making inroads on the shrinking store card market.

Average Balances Increased

As supply chain shortages slowly became a thing of the past, durable goods including large appliances, electronic equipment and furniture—precisely the merchandise often purchased with store credit cards—returned to store shelves.

Similar to the change observed with overall store card debt, average balances for retail card holders increased from $1,046 in Q3 2021 to $1,109 in Q3 2022.

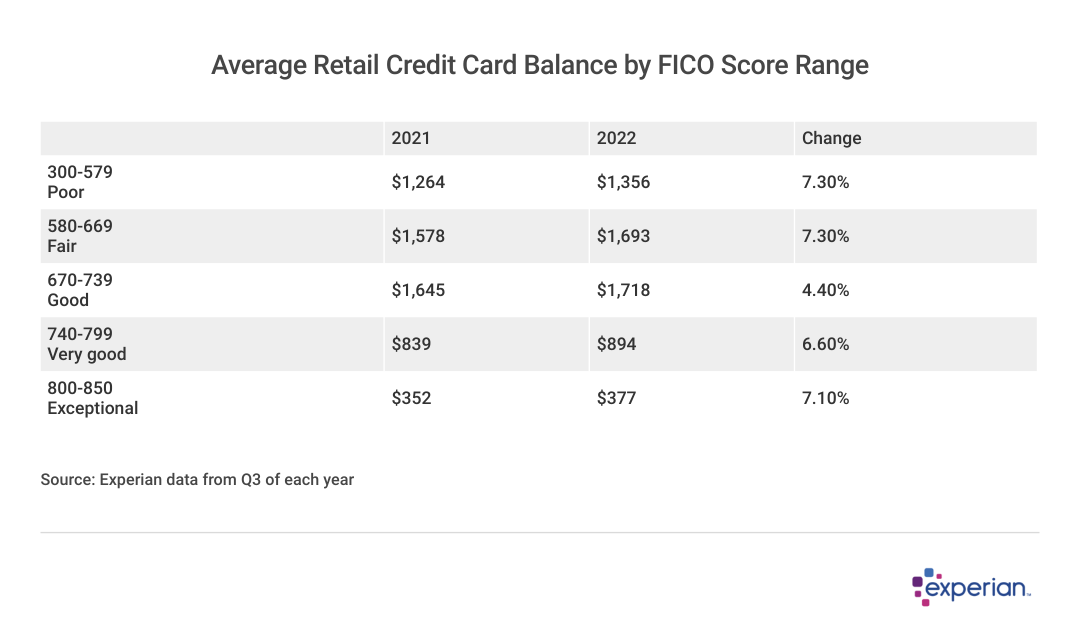

Balance Increases Similar Across Credit Scores in 2022

Balances increased at similar rates across retail cardholders regardless of FICO Score, according to Experian data. The increases ranged from 4.4% to 7.3%. Those increases were actually less than the rate of inflation over that same period, which was 8.2% as measured by the consumer price index.

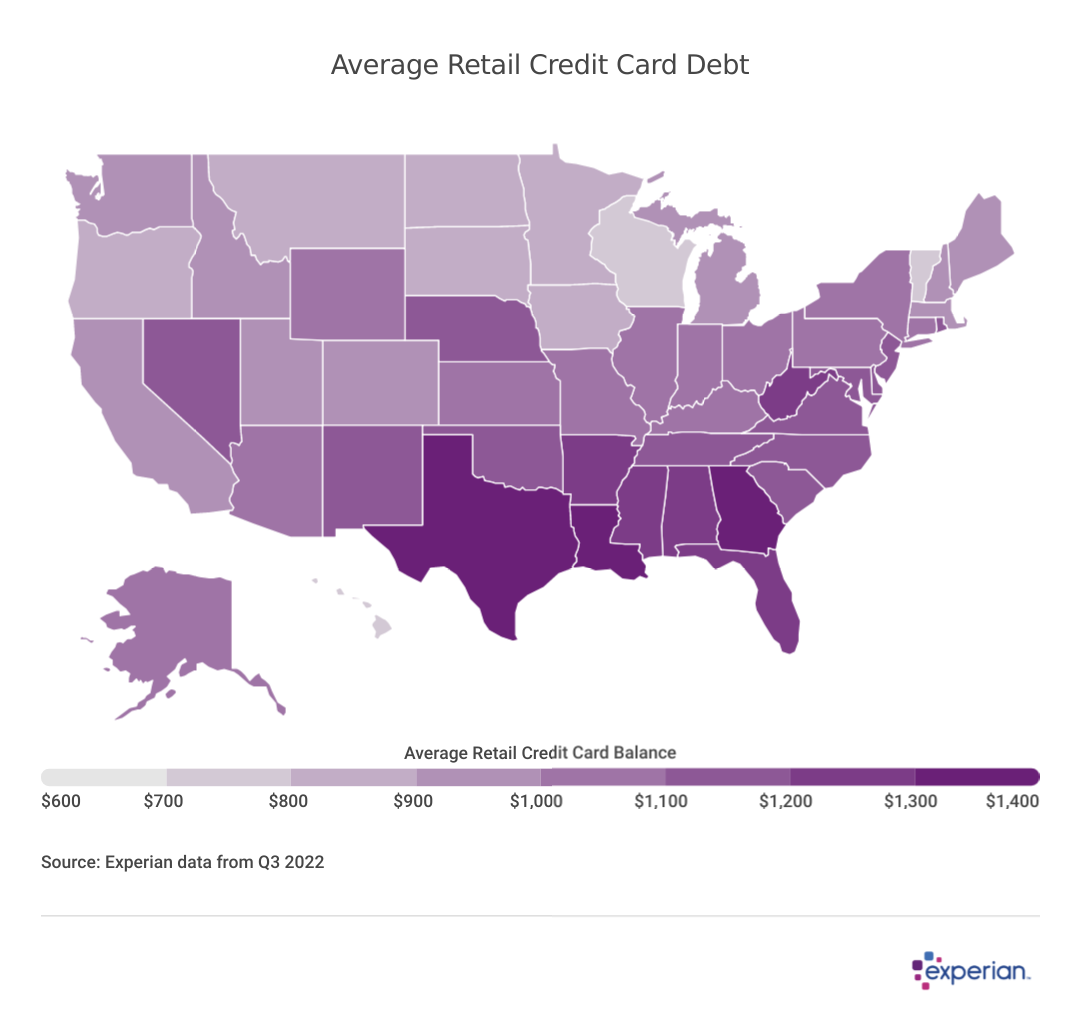

Average Retail Card Balances Increase Uniformly Across States

All 50 states and Washington, D.C., moved in the same direction in 2022, where average balances increased anywhere from 2.3% to 10.1% among them. Texas is the state with the largest retail card balance, at $1,443 in Q3 2022. Hawaii, a state with relatively few big box stores, has the lowest retail card balance of $761.

States where retail store card balances grew the most tended to be in the West in 2022, although the state with the largest increase was on the other side of the country, as Maine balances grew by 10.1% in 2022.

Mostly Southern states, meanwhile, were among the states with the smallest increases in 2022, relative to the rest of the nation. In most of these states, however, current average balances are above that of the nationwide average of $1,109.

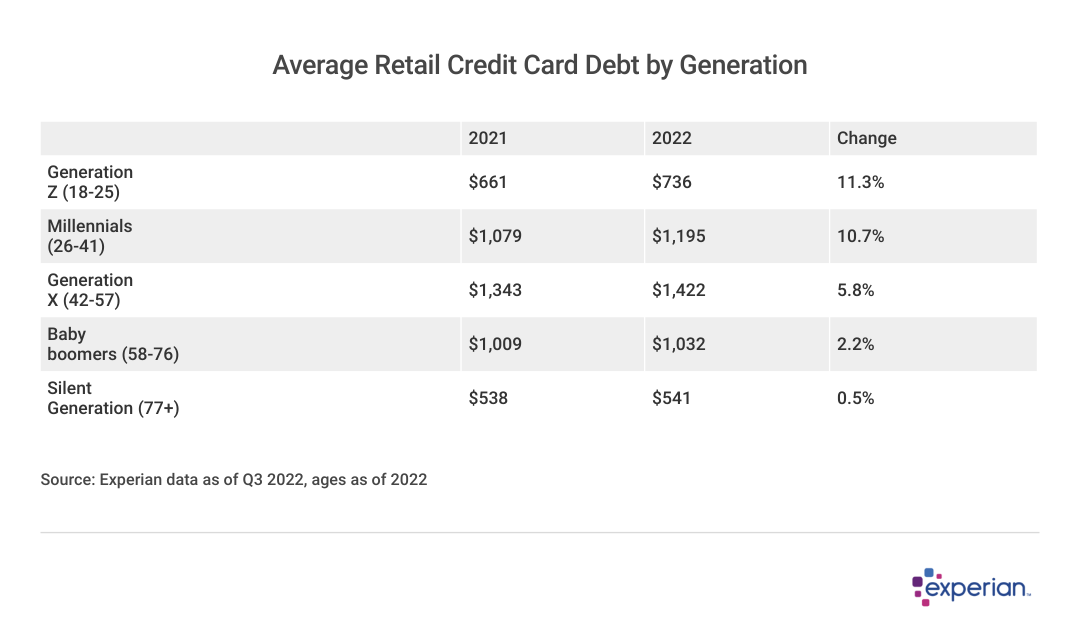

Younger Generations Add to Their Retail Card Balances, Despite Buy Now, Pay Later

Store spending increased the most among the younger generations in 2022, both sporting double-digit percentage gains. Average balances peak among Generation X, who have average balances of $1,422. Balances increased very little among older U.S. consumers.

Retail Cards Remain Relevant Despite Alternatives for Consumers

Retail cards have existed longer than bank-issued credit cards, as department stores offered certain customers a line of credit within the store long before the first credit cards were introduced in the 1950s. Since then, credit cards became more ubiquitous with each passing decade, with total balances outstanding climbing from only a few billion in the 1980s to more than $900 billion by the end of 2022.

Traditionally, the relationship between retailers and the card issuers managing the store cards (sometimes referred to as private label or co-branded credit cards) made both business parties happy: Not only did they increase store revenue, card issuers benefited from higher margins.

While that relationship still persists—retailers like Walmart and Target, as well as department stores like Macy's and Kohl's, still rely on retail cards for a portion of their in-store sales—other types of payments have been crowding out spending that's traditionally been paid for with retail cards.

One type of alternative payment making headlines is buy now, pay later, which often splits purchases up into four installment payments. Although considered primarily an online payment system, buy now, pay later is also being used increasingly at checkout, including at the four retailers above, which all offer both private label credit cards as well as buy now, pay later plans for purchases.

Two broad trends, often two sides of the same coin, explain in part the retail store credit card standstill in recent years:

- The rise of online shopping: Even absent the pandemic, consumers have been making fewer trips to retailers and making more online purchases. E-commerce—where the internet provides the storefront experience for the consumer—has added about a percentage point every year to its share of the entire retail market. Since 2000, E-commerce sales have grown from a 1% share of all sales, to comprise 15% of all retail sales today, according to data from the U.S. Department of Commerce.

- Alternative payment methods: The aforementioned buy now, pay later plans garner all the headlines today, but other payment methods, like mobile payments via Apple Pay and Samsung Pay, are also competing for a place in consumers' wallets.

Spoiled for choice, today's consumers are increasingly leaving their retail credit cards at home.

Methodology

The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of its consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.