From PPO to HMO, what's the difference between the 5 most common types of health insurance plans?

This story originally appeared on Doctors and Clinicians and was produced and distributed in partnership with Stacker Studio.

From PPO to HMO, what's the difference between the 5 most common types of health insurance plans?

For many Americans, early November not only signals Election Day but also means it's time to choose a health insurance plan for the upcoming year.

This year, open enrollment for public health insurance plans begins Nov. 1, 2024, and closes on Jan. 15, 2025. During the open enrollment period, Americans have the option to enroll, renew, or change health plans through the Health Insurance Marketplace for the coming year. The marketplace allows consumers to review numerous health care plans and consider factors such as coverage, affordability, and more.

Companies that have 50 or more full-time employees are required to offer employer-sponsored insurance. The window to purchase a plan for their staff lasts only two weeks. However, for both people independently seeking insurance and those who get it through their employer, the process remains expensive (with many seemingly hidden costs) and complex (with so many different types and levels of coverage).

For many Americans, the rising cost of health care has become an increasingly difficult financial burden. Some 41% of Americans have medical or dental debt, while nearly half of insured adults are worried about affording their monthly premiums, according to a 2024 KFF survey. Moreover, about half of those surveyed are concerned about the cost of medical care, and nearly 3 in 4 adults say that they are at least somewhat worried about the prospect of unexpected medical bills.

These concerns—and the mounting financial pressure of being uninsured—make selecting an appropriate plan during the open enrollment period an imperative for many Americans.

As consumers explore the Health Insurance Marketplace, some aspects of coverage tend to be more intuitive than others. Take, for instance, the metal plans: Bronze, Silver, Gold, and Platinum categories correspond to the percentage of out-of-pocket medical costs. Bronze plans usually have the lowest premiums but come with a high deductible—the amount consumers pay out of pocket before insurance kicks in. Bronze plans cover around 60% of medical bills, with users covering the remaining 40%. While Platinum plans tend to have the highest premiums, they come with a much lower deductible and cover 90% of medical expenses.

For independently insured people and those eligible for workplace-sponsored plans, selecting the type of insurance plan can be hard to navigate. For many, health care plan abbreviations like HMO, PPO, EPO, and PPS are just alphabet soup.

Doctors and Clinicians analyzed KFF data and resources from the Department of Health and Human Services to break down the common forms of insurance plans in the U.S. to help consumers navigate their options amid rising premiums.

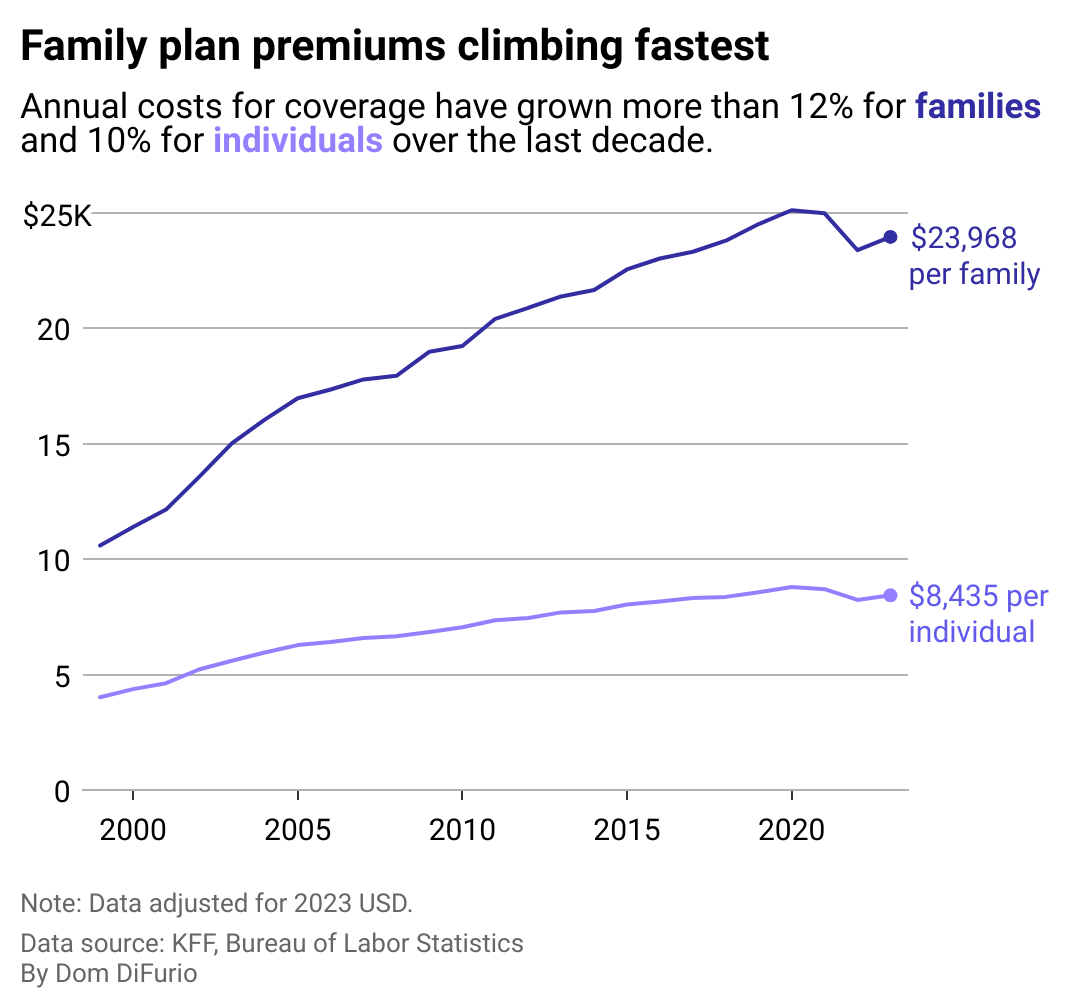

Premium costs outpace wage gains

Even for Americans with employer-sponsored coverage—considered lucky by those without the option—premium costs have risen faster than wages in most sectors. As insurance premiums have surged, families with employer-sponsored health care plans have paid nearly 5% of their total earnings over a 32-year period, according to a 2024 report investigating the link between earnings inequality and insurance premiums. Moreover, the investigation revealed that as a percentage of compensation, health care premiums were much higher for Black and Hispanic families.

Yet even as premium costs have skyrocketed over the last three decades, the share of worker contributions has remained mostly consistent since 1999. Workers with individual plans shoulder roughly 15-17% of premium costs, while those with family plans pay roughly a quarter of the cost.

Here's what four common types of plans cover, and what consumers should consider when navigating the marketplace.

HMO

Health Maintenance Organization plans are often considered the most affordable insurance option. With low deductibles and low copays for doctor visits and pharmaceuticals, HMOs are affordable because coverage remains in your primary network of doctors.

Notably, targeted care for mental health support, even in-network, requires a referral from a primary care physician—or patients risk footing the entire bill for their doctor's visit. The downside of HMO plans is that little extra is covered out of network, except for medical emergencies, and even those might not be covered in their entirety.

PPO

The Preferred Provider Organization plan is the most popular for those with employment-based insurance (currently 47% of them, in fact). PPOs allow the most flexibility in that people can choose their own in-network PCP and health facility while also providing partial coverage for some specialist care out of network.

However, they have higher annual deductibles and copays for doctor visits and medications than HMOs. Moreover, even though out-of-network expenses are partially covered, patients may be required to file claims for out-of-network care themselves, resulting in added paperwork.

POS

A Point of Service plan falls between HMOs and PPOs in terms of cost and combines features of both plans. POS plans allow you to choose what type of care you want at the beginning of every visit, giving users the most options, both in and out of network. They also have a larger number of in-network options than most HMOs.

However, this added flexibility comes at a cost. Patients are required to have a PCP, and referrals are needed to see a specialist. This plan comes with regular copays and an average higher deductible. Moreover, out-of-network costs not only require you to file claims but also often require you to pay up front, to be reimbursed months later after your claim is accepted.

EPO

An Exclusive Provider Organization plan, like a POS, combines different facets of basic HMO and PPO plans. Unlike POS and HMO plans, however, EPOs allow you to choose your own PCP and see specialists without a referral.

Although these plans do come with copays and deductibles, they are usually on the lower end. They promise a smaller, more intimate, and interconnected medical network that often comes with less need to file claims. However, a smaller network also means a more localized one, so care outside of your geographic region and for anything other than emergency care is not generally covered.

Story editing by Alizah Salario. Additional editing by Kelly Glass. Copy editing by Tim Bruns. Photo selection by Lacy Kerrick.