This story was produced by Experian and reviewed and distributed by Stacker Media.

How many Americans have a perfect 850 credit score?

In many sports, it's possible to play a game that can be counted as "perfect." Knock down 120 pins with 12 bowls in 10-pin bowling and you've bowled a perfect game. Retire all 27 batters without anyone reaching base and you've pitched a perfect game. And when it comes to credit, 850 is the highest the FICO Score scale goes.

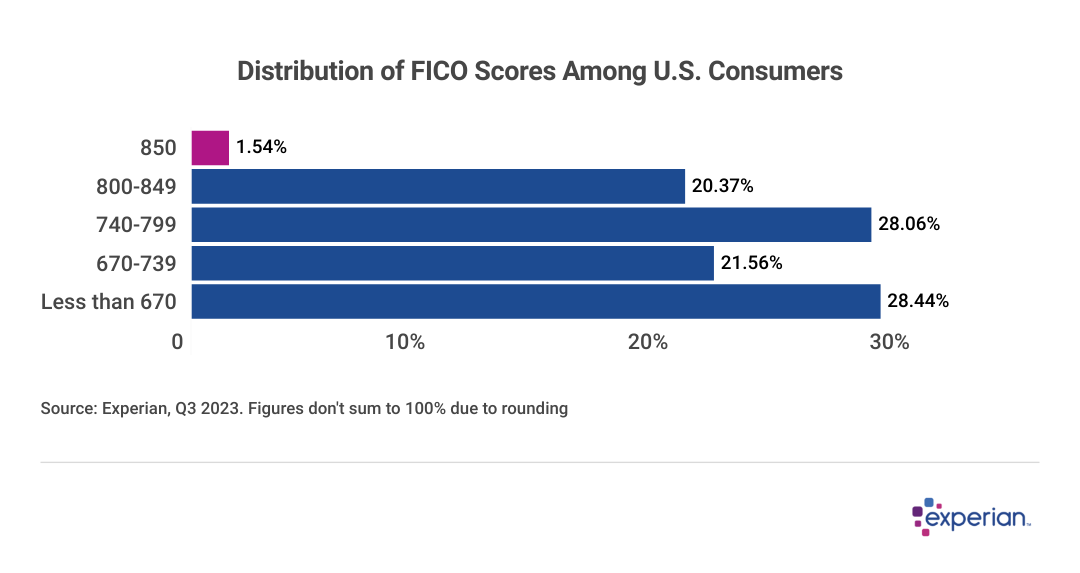

For more and more U.S. consumers, practice is making perfect. According to recent Experian data, 1.54% of consumers have a "perfect" FICO Score of 850. That's up from 1.31% two years earlier.

In this update, we'll discuss the who, where and why of perfect FICO Scores.

Characteristics of Consumers With Perfect Credit Scores

While it's perhaps self-evident that an 850 FICO Score reflects a history of responsible credit management, not everyone has ascended to those heights. Let's take a look at what generally sets these consumers apart.

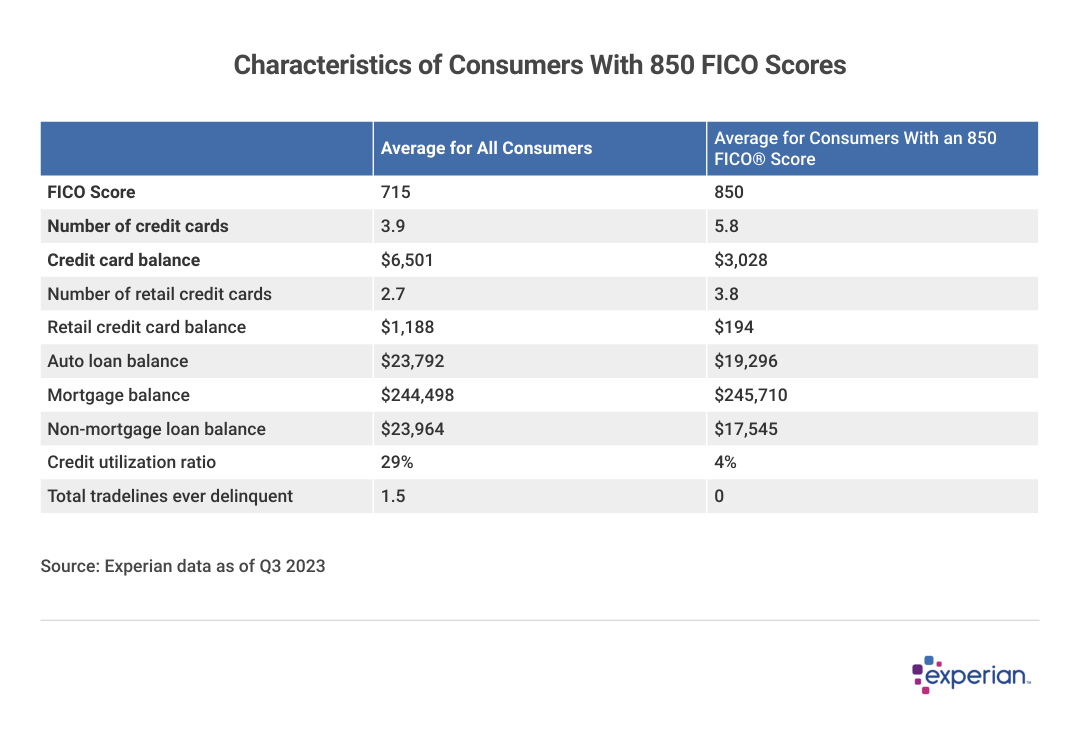

Higher Scores Usually Mean Lower Overall Debt

Consumers with perfect scores tend to have lower debt balances than the national average for all types of revolving credit, as well as overall non-mortgage debt levels. As for auto loans, lower balances for those with an 850 FICO Score may indicate that these consumers, when they do finance their vehicles, are able to do so with better financing terms than those with average credit scores.

Perfect-credit Consumers' Traits

- Lower debt balances nearly across the board: Balances are similar among all borrowers with mortgages—more people with 850 scores have mortgages than those who don't, and those who do are likely able to purchase "more" house due to their superior credit history.

- Credit utilization that's near zero: On average, consumers with perfect scores tend to carry more credit cards (both retail and otherwise), but their credit utilization rate is much lower. Credit utilization is one of the most important factors in credit score calculations, and those with the highest scores tend to keep it in the low single-digit percentages.

- Delinquencies are not a concern: With an average number of delinquencies sitting at zero, perfect-score consumers are paying their bills on time.

And while it's not shown in the above table, those with perfect credit scores also have lengthy credit histories. According to Experian data, baby boomers and other older consumers comprise 66% of the consumers with 850 FICO Scores, and Generation X another 26%. Millennials and younger consumers, so far anyway, account for less than 8%.

In brief: The summit isn't out of reach. Although the average FICO Score of 715 suggests most consumers have room to grow, many of those with even slightly above-average scores already exhibit at least some of the characteristics that go into a maxed-out FICO Score. Score improvement might just be a matter of time.

States Where Perfect Credit Scores Are More Common

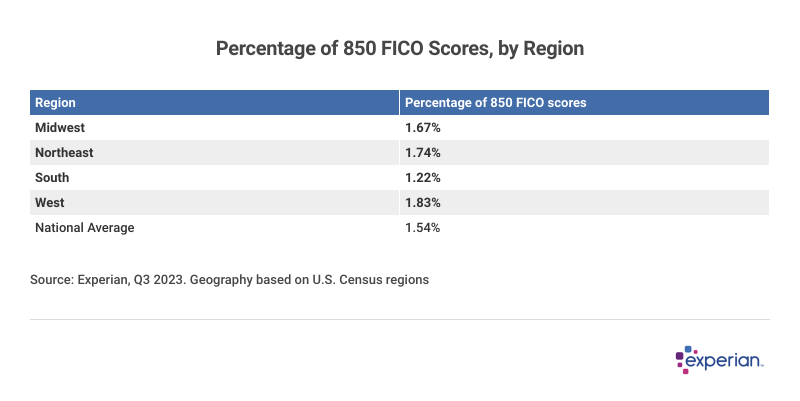

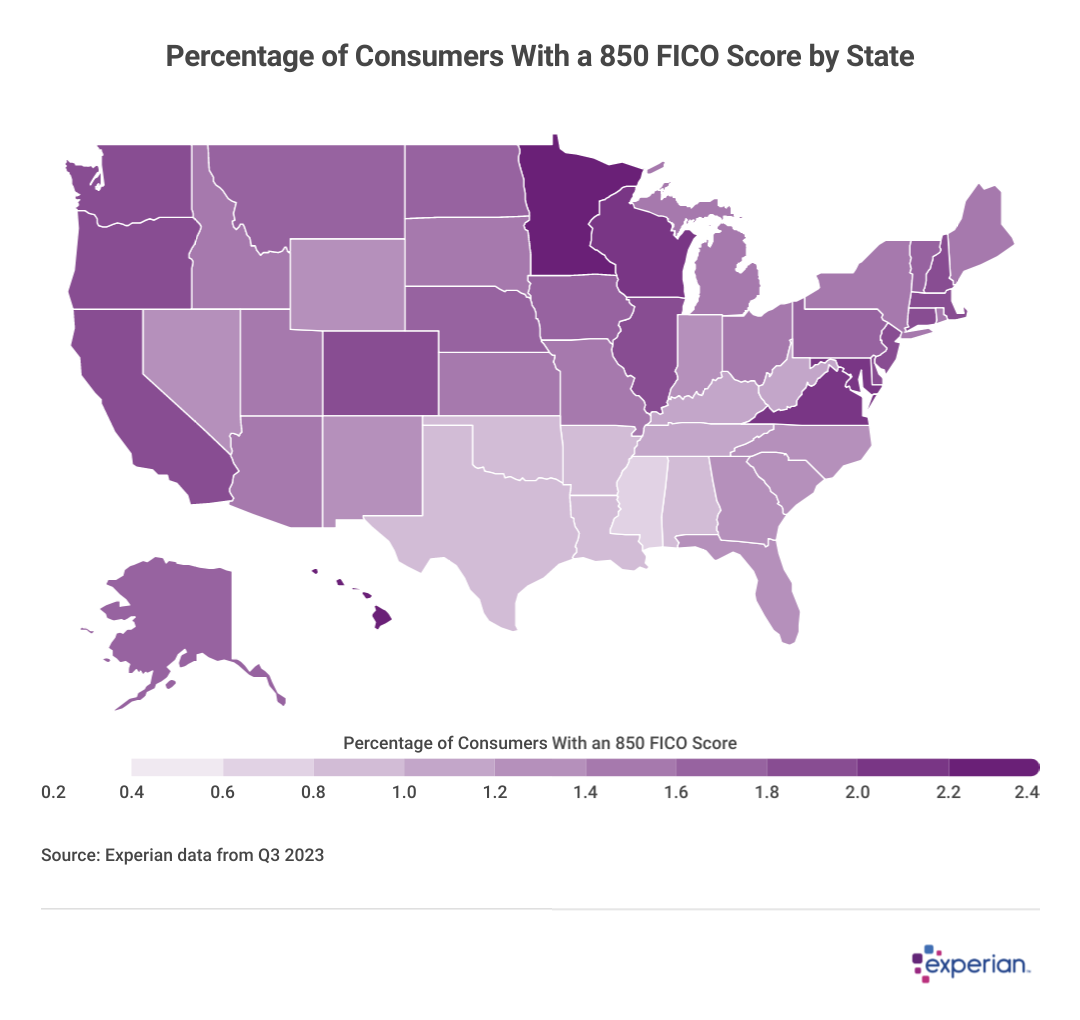

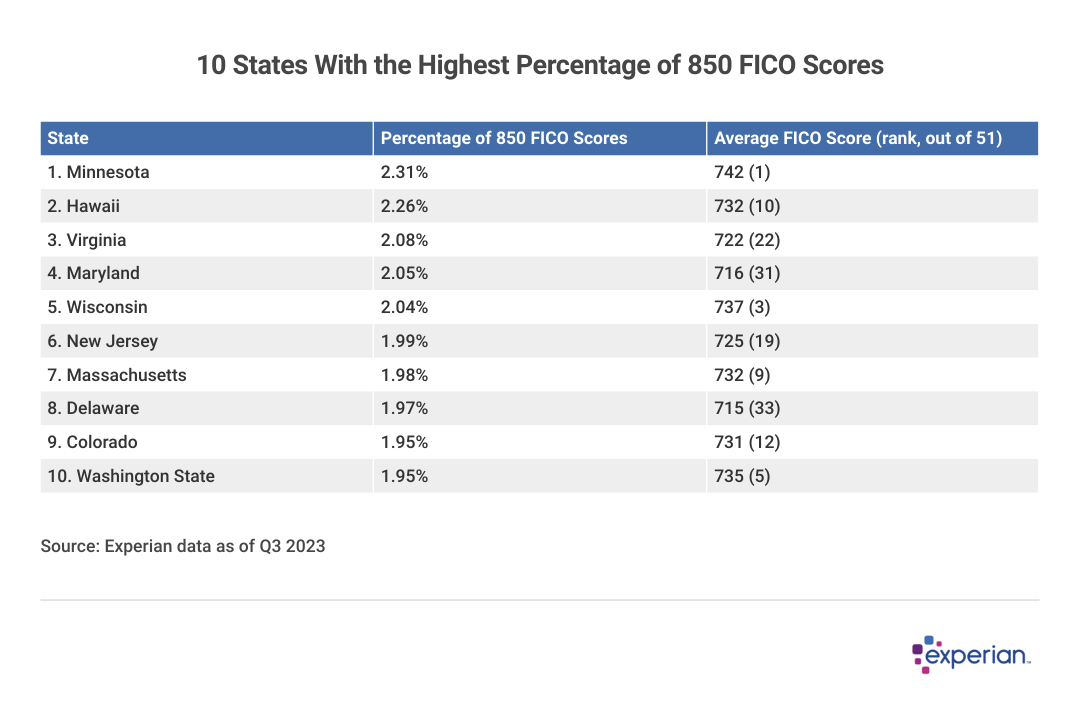

You'll find consumers with perfect credit scores everywhere in the U.S., although they're slightly more common in Western states than other regions of the country. When broken out by region, three regions have higher-than-average rates of perfection, while only 1.22% have a perfect score in the South.

A High Score Doesn't Always Mean Perfect

It's not surprising to see that states with higher average FICO Scores also have a higher percentage of consumers with an 850 credit score, but the relationship isn't lockstep. Once one reads past the top-ranked state of Minnesota, states with more than the typical number of perfectionists have average credit scores as low as the national average of 715 (in the case of Delaware).

Only four of the 10 states with the highest average FICO Score also have a high percentage of perfect scores.

Metro Areas Boost Perfect Score Percentages

The reason? Specific metropolitan areas within these states are responsible for most of the lift in their rankings. For instance, the Washington, D.C., metro—where 2.3% of consumers have a perfect 850 score—includes nearby Montgomery County, Maryland, and Fairfax County, Virginia, which lift the rankings of both states.

Conversely, states that don't rank in the top 10, such as California, have a number of top-ranking metros with perfect scores. Despite this, the Golden State ranks 12th overall, with only a 722 average FICO Score.

More Perfect Credit Scores in Midsize Metros

In 50 of the 374 metropolitan areas in the U.S., more than 2% of consumers have perfect scores—significantly higher than the 1.54% national average. There are three types of metros found in the top 10:

- Midsize metros in close proximity to larger metros; for instance, Boulder, Colorado, adjoins larger Denver, while Corvallis, Oregon, is down the road from larger Portland.

- Large metros—such as Washington, D.C., and the Greater San Francisco Bay Area—where much of the regional economy are seats of well-compensated sectors such as information technology and defense.

- Metros in states that have a higher concentration of perfect scores, such as Minneapolis and Madison, Wisconsin.

- California metros have nabbed the top five spots of metros with the highest percentage of consumers with perfect credit scores. Close to 1 in 40 consumers in California have an 850 FICO Score.

Rounding out the other top 10 metros are Corvallis, Oregon; Boulder, Colorado; Minneapolis; Honolulu; and Ocean City, New Jersey.

Target, but Don't Obsess, Over an 850 FICO Score

Is hitting the credit bullseye even necessary? There's no commemoration of credit perfection: Those with an 850 FICO Score unfortunately won't receive a challenge coin in the mail—only bragging rights.

Perfect credit is a worthy goal to be sure, but a score in the ballpark of perfect will get you the same glory. An 850 FICO Score is hardly necessary to obtain the best rates for loans and credit. Those with exceptional credit, FICO scores of 800 and above, will likely receive the same terms as someone with a perfect score of 850—all else remaining equal. Even those with FICO Scores slightly below 800 may receive the same terms as those who have reached the top of the credit score scale.

While maxing out one's FICO Score may be satisfying to some, in essence it's reflective of consumers consistently maintaining good credit habits:

- Low revolving credit balances compared with credit limits (credit utilization ratio)

- A reasonably long credit history

- Few, if any, delinquencies reported on past and present credit accounts

Even if some of these habits aren't possible at the moment—one can't magically age 20 years overnight, after all—starting today will soon likely yield results. Even if it doesn't result in perfection, improved credit could make it easier to borrow when you need it most.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

FICO is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.