With property values strong in 2023, many homeowners tapped home equity lines of credit, pushing total HELOC balances up 6.6%

This story was produced by Experian and reviewed and distributed by Stacker Media.

With property values strong in 2023, many homeowners tapped home equity lines of credit, pushing total HELOC balances up 6.6%

One thing that continues to work on behalf of many homeowners is the equity in their homes. Residential real estate has appreciated by $15 trillion, to more than $58 trillion, since 2020, according to the Federal Reserve. Meanwhile, homeowners steadily paying down their mortgages have been accumulating equity even faster than in previous years.

Many homeowners could use the win, as the cost of other goods and services continues to fluctuate and bigger-ticket items, like new cars, insurance premiums and renovation costs, are climbing nearly as fast as home prices.

As part of the continuing coverage of consumer credit and debt, Experian looked at anonymized credit data to observe recent trends in the home financing market, including home equity lines of credit, or HELOCs.

As home values increase, more homeowners are leveraging some of that newly won wealth in the form of HELOCs. By borrowing some of the value of a home, homeowners are able to make home improvements or consolidate, pay down or pay off higher-interest debts. In 2023, the average HELOC balance grew 2.7% to $42,139, and more than $20 billion was added to the total HELOC debt across all U.S. consumers.

Total HELOC Balances Increased 6.6% in 2023

Overall, HELOC debt nationwide increased by 6.6% in 2023, the second consecutive year that HELOC balances have grown. In the third quarter of 2021, HELOC debt was $295.5 billion; in the same quarter of 2022, it was $305.9 billion; and in 2023, it was up to $326.1 billion.

It wasn't always like this, however. The way homeowners have gone about tapping their home equity has evolved from the 2010s, when mortgage refinancing rates bumped along the 3% to 4% APR range. Then, the go-to move was to refinance an existing mortgage with a larger loan (often with a lower APR) and cash out any additional funds, which also get paid back through that shiny new mortgage.

Throughout the 2010s, interest in HELOCs waned as banks preferred to offer more lucrative mortgage refinances to homeowners. Refinancing proved to be a win-win situation for banks as well as their customers: Banks wrote lots of new fee-generating mortgages, and homeowners got either a low-interest loan through a cash-out refinance, a lower monthly payment or, in many cases, both.

But with mortgage rates these days moving between 6% to 7% instead of 3% to 4%, that math no longer works. Instead, more homeowners are using HELOCs to leverage their home equity.

The renewed interest in HELOCs now is evident, with consumer interest in mortgage refinancing largely disappearing as few homeowners with mortgages are able to refinance at lower rates. To borrow against existing equity without refinancing, homeowners must rely on either home equity loans or HELOCs.

Home equity loans are the lump-sum solution: Homeowners borrow a specific amount at a fixed interest rate and repay the loan just like an installment loan. HELOCs provide a line of credit that's there when you need it, and can be repaid over a number of years. HELOC balances increased by 2.7 % in 2023. They averaged $39,556 in 2021, $41,045 in 2022, and $42,139 in 2023.

What You'll Need for a HELOC (Besides Equity)

A HELOC is a line of credit secured by the equity a homeowner has in a property. HELOC lenders allow homeowners to tap up to a certain percentage of the paid-off portion of their mortgage. For example, someone who has a home valued at $400,000 with $100,000 remaining on their mortgage may be able to tap up to 80% of that equity—$240,000—in the form of a HELOC.

Most homeowners don't borrow all that they're eligible for. Across the U.S., average HELOC limits range from $75,000 to $175,000. But homeowners usually borrow roughly one-third of their HELOC limit from those lines of credit, an amount that roughly mirrors the cost of major home renovations—between $19,000 and $85,000, according to home services website Angi. In addition, according to Experian data, many homeowners (about half) have a home equity line of credit with a $0 balance but keep the HELOC in place for future financing needs.

Would-be HELOC borrowers need to meet certain requirements before their line of credit can be approved. Lenders want to see that the borrower's income is enough to cover their existing debts, including any borrowings from a HELOC. Lenders determine this by calculating the borrower's debt-to-income ratio (DTI). Most lenders are looking for a DTI under a certain level (often 43%). Also, one's credit history and credit score will also be considered, just as with a mortgage application.

HELOC Credit Limits Are Up in 2023

The average credit limit for HELOCs in 2023 was $117,598, which is 1.7% higher than the 2022 average limit of $115,650. Based on the 2023 average HELOC balance of $42,139, homeowners with HELOC balances are collectively using about 36% of their lines of credit.

Comparing states with higher and lower HELOC credit limits, limits are more than twice as high in California and Hawaii than lower-limit states like Indiana and West Virginia. This more or less mirrors the average home price differences among the states.

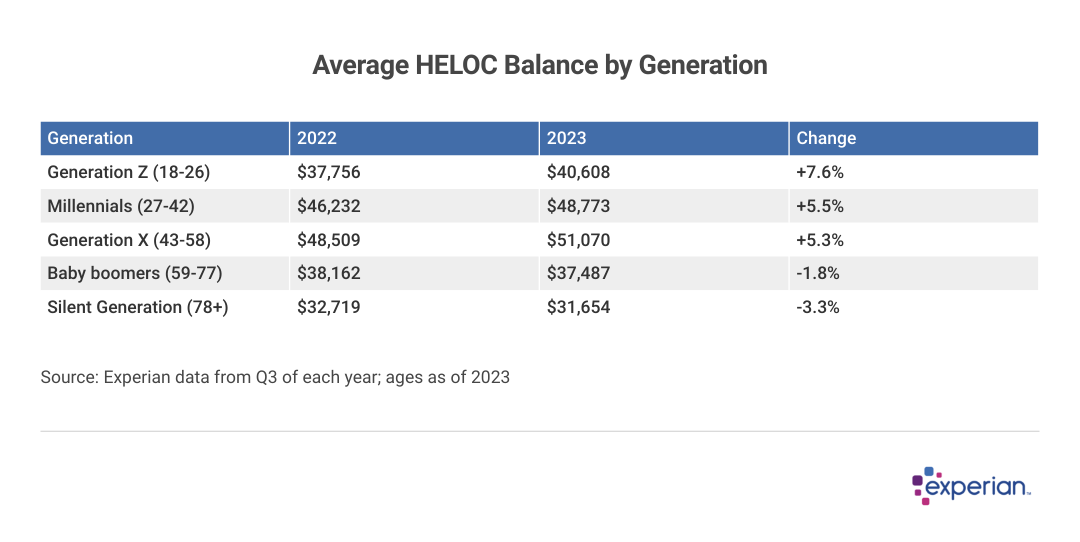

Generational Differences Seen in HELOC Balances

At first glance, it couldn't be more clear about which generations have been tapping home equity more. Homeowners born in 1965 or later have higher average balances than baby boomers or the Silent Generation, whose balances are lower than they were in 2022.

While household makeup explains much of the disparity in balances—younger homeowners who are building a family and updating their home to accommodate it versus older empty-nesters—there are other considerations. Reverse mortgages, for instance, are an alternative to HELOCs and other types of mortgage-based loans, but are only available to homeowners 62 or older who have paid off most or all of their mortgage.

While not all newer loans are for younger borrowers, there is some correlation between loan age and homeowner age.

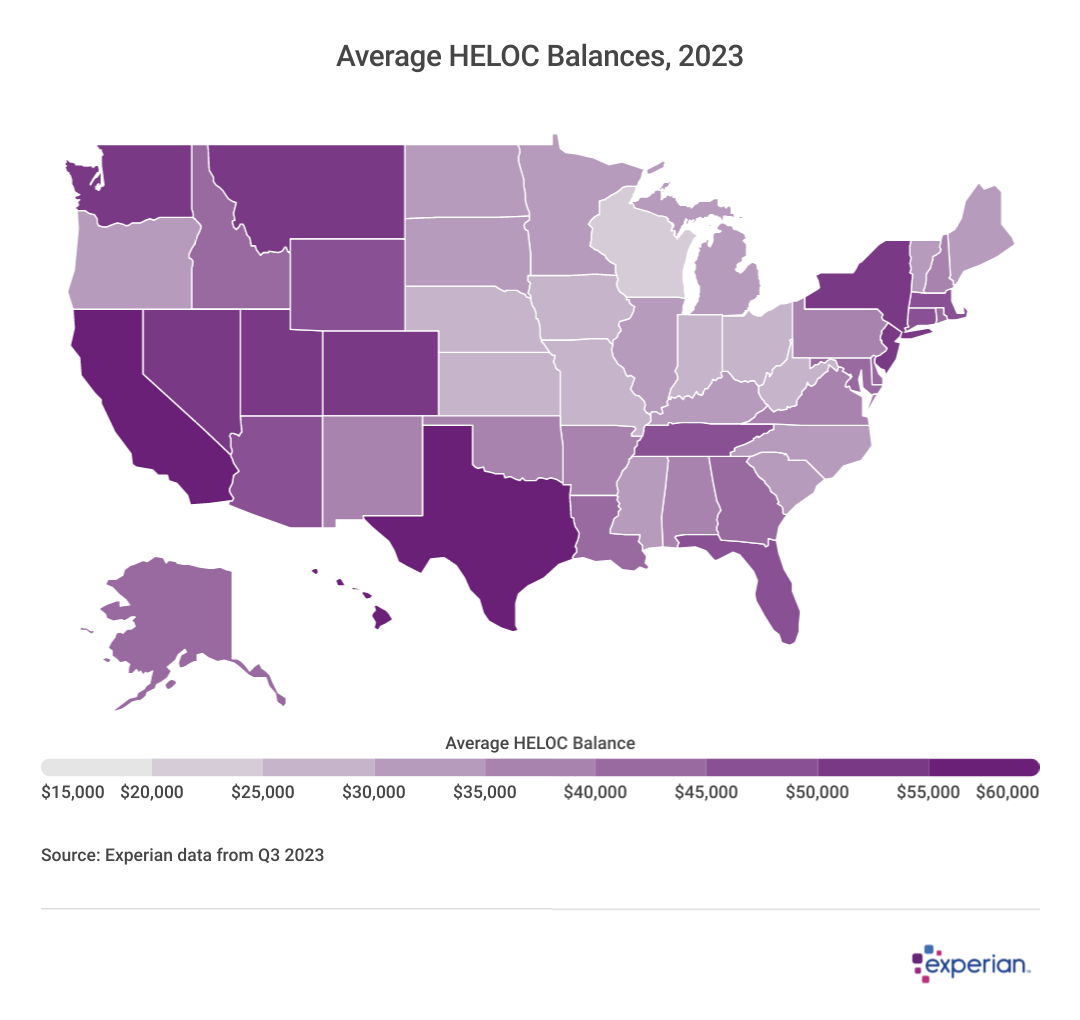

HELOC Average Balances Vary by State

Average outstanding HELOC balances are higher in 45 states and Washington D.C., in 2023.

HELOC balances climbed in most states, with the highest in Hawaii (+13.7%), Colorado (+10.5%), South Dakota (+8.9%), South Carolina (+8.2%) and Tennessee (+8.1%).

Where balances increased the most, there's no apparent throughline: Sparsely populated South Dakota, a pair of Southern states and Hawaii have little in common other than sharply increasing HELOC balances. As for Colorado, homeowners there increased average balances by more than 10% for the second consecutive year. It's a testament to the tight housing market in the state: There are fewer homes to choose from and homeowners are increasingly turning to renovation instead of trading up.

The states where average HELOC balances declined were among the largest urban centers in the nation: California, Illinois and the states that include the New York metropolitan area (Connecticut, New York, and New Jersey) saw HELOC balances decline in an otherwise up-balance year.

HELOCs in 2024: Almost Ready for Prime Time?

With consumer demand for credit not slowing down so far in 2024, why aren't HELOC offers seen everywhere?

Mortgage lenders have also been investing heavily in streamlining the HELOC application process, such as using AI-powered property valuations and employment verification.

However, due to the larger loan amounts and the lien recording involved, borrowers may need to be a bit more patient than they would for a smaller-sized unsecured loan. In exchange for their patience, they'll likely receive a loan rate significantly lower than they would for an unsecured loan. Once a HELOC is issued, homeowners should be intentional about HELOC utilization even as home prices continue to appreciate at historic rates.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.