Where social security benefits are highest and lowest relative to local housing costs

Where social security benefits are highest and lowest relative to local housing costs

Social Security plays a critical role in the retirement plans of millions of Americans each year. Average annual Social Security benefits reached $21,152 in 2021, according to the Census Bureau. While higher Social Security is good news for retirees on the surface, median housing costs also continued to climb, jumping 7.6%.

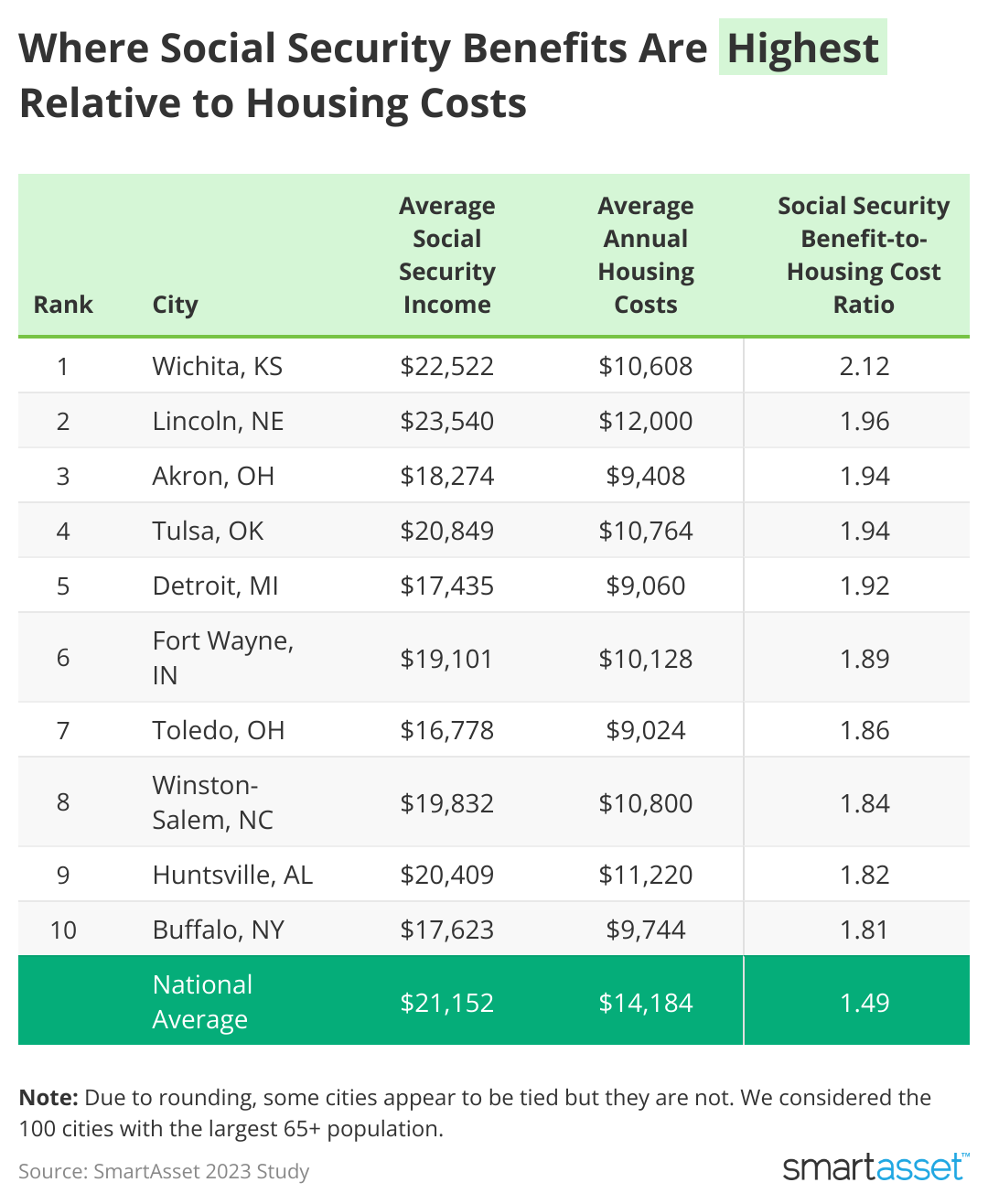

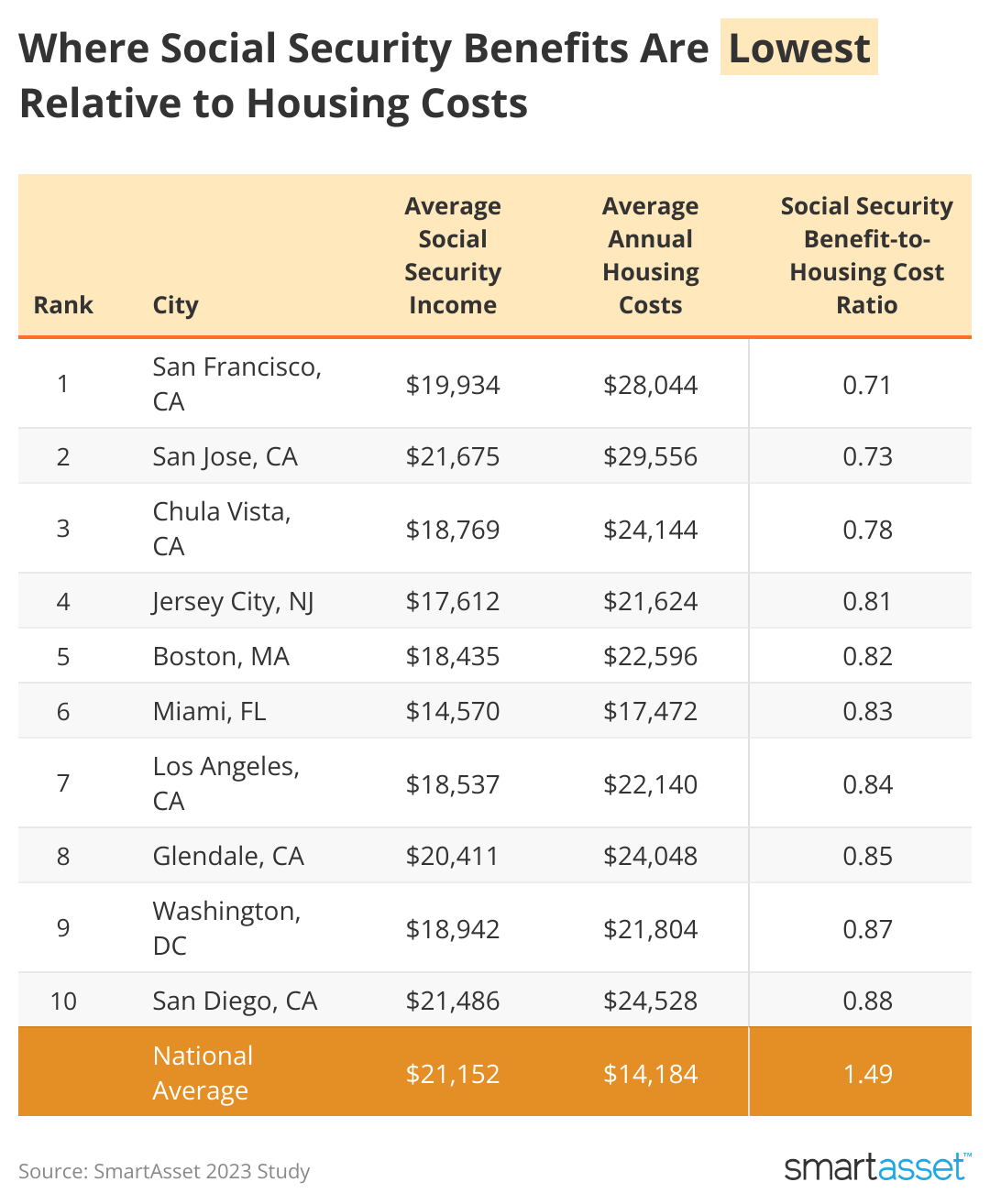

Keeping these figures in mind, SmartAsset set out to find where Social Security benefits are highest and lowest when compared with housing expenses. They analyzed data for 100 cities with the largest populations aged 65 and older and compared them across the following metrics: average annual Social Security income and median annual housing costs.

Key Findings

- The Midwest offers the best value for retirees. Six out of the top 10 cities where Social Security benefits are highest when compared with housing costs are located in the Midwest. Residents of these six cities spend an average of $10,038 on housing each year, while average retirees collect $19,608 in annual Social Security benefits.

- Housing costs are lowest in the No. 7-ranking Toledo, Ohio. This Midwest city has the lowest median annual housing costs ($9,024) out of all 100 cities the study examined. And it's also one out of just 36 cities in the study where median housing costs are below the national average ($14,184).

- California poses a challenge for retirees. California is home to six out of 10 cities where Social Security income is lowest when compared with housing expenses. On average, retirees in these six cities collect $20,135 per year in Social Security but face median annual housing costs of $25,410.

Where Social Security Benefits Are Highest Relative to Local Housing Costs

1. Wichita, KS

Known as the "Air Capital of the World," Wichita remains a hub for the aviation industry. Textron Aviation, Learjet and Spirit AeroSystems are all headquartered in this city of more than 395,000 people. The average Social Security income ($22,522) for a retiree in Wichita is 2.12 times the median annual housing costs ($10,608).

2. Lincoln, NE

Lincoln may be a college town (it's home to the University of Nebraska), but retirees enjoy Social Security benefits that average 1.96 times the median annual housing costs. While the average Social Security income in Lincoln is $23,540, residents spend just $12,000 per year on housing. However, Nebraska is also one of 11 states that tax Social Security benefits, which may lessen its appeal for retirees.

3. Akron, OH

Akron plays host to the All-American Soap Box Derby World Championships every summer, a weeklong event that draws approximately 10,000 spectators annually. Retirees in Akron not only have a front-row seat to the racing spectacle, they also benefit from relatively low housing costs when compared with their Social Security income. The average annual Social Security benefit ($18,274) is 1.94 times the median annual housing expenses ($9,408), a boon for nearly 34,000 residents who are over age 65.

4. Tulsa, OK

With a population of nearly 412,000 people, Tulsa is known for its high concentration of art deco buildings. Retirees who call Tulsa home collect an average Social Security income of $20,849 per year. That's 1.94 times as much as they pay in median annual housing costs ($10,764), making Tulsa one of the best-value cities in the study.

5. Detroit, MI

Detroit is home to the American automobile industry. And it is also known as an arts hub. Not only does the Detroit Institute of Art have one of the largest art collections in the world with over 65,000 pieces, but the city's theater district is the nation's second-largest after New York. The average Social Security income in Detroit ($17,435) is well below the national average. However, this city of nearly 633,000 residents is still 1.92 times greater than the median annual housing costs ($9,060).

Where Social Security Benefits Are Lowest Relative to Local Housing Costs

1. San Francisco, CA

It's no surprise that the average Social Security benefits are lowest in the uber-pricy city of San Francisco when compared with housing costs. While median annual housing expenses are $28,044, the average annual Social Security benefit is just $19,934. As a result, Social Security income covers just 71% of typical housing costs in San Francisco.

2. San Jose, CA

Retirees don't fare much better in San Jose, which is roughly 50 miles southwest of San Francisco. Housing is even more expensive in this technology hub, where the median housing costs are $29,556. With retirees collecting $21,675 per year on average, Social Security income is just 73% of median housing expenses in San Jose.

3. Chula Vista, CA

Chula Vista is a suburb of San Diego and has the third-lowest average Social Security benefits when compared with housing costs in our study. Retirees in this city of roughly 277,000 people average $18,769 per year in Social Security benefits, which is almost 22% less than median housing expenses ($24,144).

4. Jersey City, NJ

Jersey City is located directly across the Hudson River from Manhattan and has undergone a residential construction boom in recent years. But while gleaming high-rises dot the city's waterfront, housing expenses are significantly more than typical Social Security benefits. Median annual housing costs are $21,624, which is well above the average Social Security income ($17,612) that is collected in Jersey City.

5. Boston, MA

Boston is known for its rich history, vibrant culture and deep love for local sports teams. But it can also be expensive for retirees. Average annual Social Security income covers nearly 82% of median housing costs in Boston. While the average retiree in Beantown collects $18,435 in Social Security each year, median annual housing expenses in this city of roughly 654,000 people are $22,596.

Data and Methodology

To identify where Social Security are highest and lowest relative to local housing costs, the study looked at data for the 100 cities with the largest populations of residents ages 65 and older. Reseachers then compared them across these metrics:

- Average Social Security income. This is the average amount of Social Security benefits collected in a year. Data comes from the Census Bureau's 1-year American Community Survey from 2021.

- Median annual housing costs. These are the median annual housing costs for both homeowners and renters. We calculated this figure using median monthly housing costs from the Census Bureau's 1-Year American Community Survey from 2021.

To compile the rankings, they divided average annual Social Security benefits by median annual housing costs for each city. The resulting number is the ratio the rankings are based on.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.